预约演示

更新于:2025-09-20

QRX-003

更新于:2025-09-20

概要

基本信息

药物类型 小分子化药 |

别名 QRX 003、QRX003 |

作用方式 抑制剂 |

作用机制 丝氨酸蛋白酶家族抑制剂 |

在研适应症 |

非在研适应症- |

非在研机构- |

最高研发阶段临床2/3期 |

首次获批日期- |

最高研发阶段(中国)- |

特殊审评罕见儿科疾病 (美国)、孤儿药 (欧盟) |

登录后查看时间轴

关联

3

项与 QRX-003 相关的临床试验NCT06953466

A Single Center, Open Label, Expanded Access Study of QRX003 Lotion in Subjects With Netherton Syndrome

The goal of this clinical trial (via an expanded access Treatment Protocol) is to learn if QRX003 (an investigational drug) applied topically to the skin (including up to the entire body [except the scalp]) works to treat the genetic disease Netherton syndrome. It will also learn about the safety of QRX003. The main questions the trial aims to answer are:

1. Does QRX003 impact the clinical presentation of NS in adults and minors by improving the clinical symptoms (diseased skin area, itch, and discomfort; based on clinical scoring, subject self-assessment, and other criteria)?

2. What medical problems do participants have when taking QRX003?

3. What percent of subjects will require rescue therapy?

Participants will:

Take drug QRX003 twice daily (applied topically to all affected areas of the body excluding the scalp) for 3 months, visit the clinic once every 4-6 weeks for checkups and tests, and to keep a dosing diary that records the times they applied the drug.

1. Does QRX003 impact the clinical presentation of NS in adults and minors by improving the clinical symptoms (diseased skin area, itch, and discomfort; based on clinical scoring, subject self-assessment, and other criteria)?

2. What medical problems do participants have when taking QRX003?

3. What percent of subjects will require rescue therapy?

Participants will:

Take drug QRX003 twice daily (applied topically to all affected areas of the body excluding the scalp) for 3 months, visit the clinic once every 4-6 weeks for checkups and tests, and to keep a dosing diary that records the times they applied the drug.

开始日期2025-07-01 |

申办/合作机构 |

NCT05789056

A Multicenter, Open Label Study of QRX003 Lotion in Subjects With Netherton Syndrome

To assess the safety, tolerability, and efficacy of QRX003 lotion (4%) when added to standard of care treatment regimen, including systemic therapy in subjects with Netherton syndrome

开始日期2023-03-14 |

申办/合作机构 |

NCT05521438

A Multicenter, Randomized, Vehicle-Controlled, Double-Blind, Parallel Comparison Study of QRX003 Lotion in Subjects With Netherton Syndrome

This study has been designed to determine the safety, tolerability and efficacy of QRX003 lotion 2%, 4% QAM or 4% BID in subjects with Netherton Syndrome (NS) in comparison to vehicle

开始日期2022-06-23 |

申办/合作机构 |

100 项与 QRX-003 相关的临床结果

登录后查看更多信息

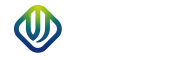

100 项与 QRX-003 相关的转化医学

登录后查看更多信息

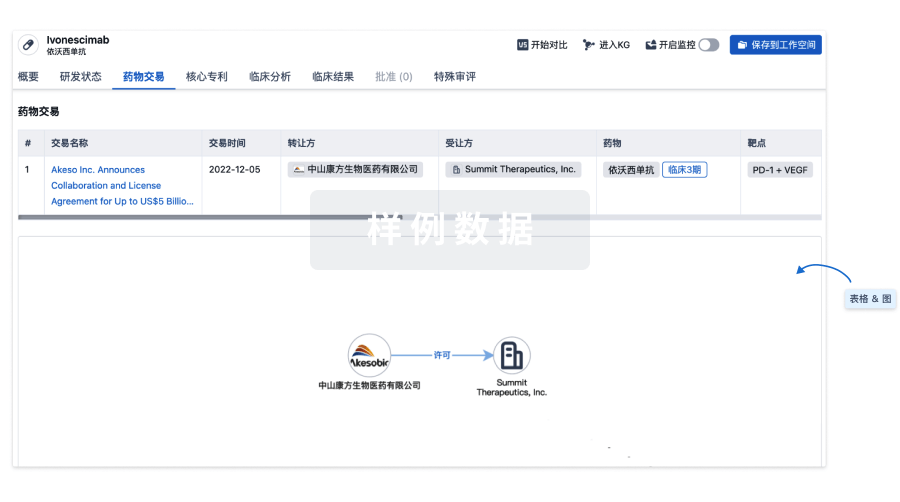

100 项与 QRX-003 相关的专利(医药)

登录后查看更多信息

65

项与 QRX-003 相关的新闻(医药)2025-09-09

ASHBURN, Va., Sept. 09, 2025 (GLOBE NEWSWIRE) -- Quoin Pharmaceuticals Ltd. (NASDAQ: QNRX) (“Quoin” or the “Company”), a late clinical-stage specialty pharmaceutical company focused on rare and orphan diseases, today announced the release of the fifth episode in its NETHERTON NOW video series. This installment features twin sisters Allie and Kaleigh Fasanella, both living with Netherton Syndrome, as they candidly share their lifelong struggles of managing this devastating disease.

Diagnosed within their first year of life, Allie and Kaleigh describe how this rare genetic skin disease has shaped their daily routines, their childhood and their mental health. From the constant, painful flare-ups that randomly occur to the emotional challenges of missed school, social events and even weddings, the sisters emphasize the unpredictable nature of the disease and the lasting toll it has taken on their lives.

“Having Netherton has affected my mental health profoundly,” Allie explains in the video, describing the relentless cycle of pain, flares and uncertainty that makes everyday life difficult to plan. She adds, “If a cure landed in my lap, it would be life-changing.”

Kaleigh continues, “We’ve had times where we’re just depressed. We don’t want to do anything. It’s really impacting who we are as people. My advice to people with Netherton is to be as kind and gentle with yourself as possible—and find joy in the daily little things.”

Beyond their shared experiences as patients, both women have built successful careers in digital media. Kaleigh is a freelance writer and editor with over ten years of experience at outlets such as Allure, Teen Vogue, Bustle and Yahoo, where she covers beauty, wellness and lifestyle topics. Allie is also an accomplished freelance writer whose work has appeared in Cosmopolitan, Allure, Teen Vogue, NYLON and Footwear News, with expertise in fashion, beauty and branded editorial. Their professional storytelling experience brings a unique lens to the conversation, helping them articulate not only the physical realities of Netherton Syndrome but also the social and emotional challenges patients face.

“It’s such a huge part of our identities at this point,” says Kaleigh. “We really relied on each other for support and commiseration. At the end of the day, it’s just one foot in front of the other, and remembering that you’re more than your skin.”

Denise Carter, Co-Founder and Chief Operating Officer of Quoin Pharmaceuticals, commented: “Allie and Kaleigh’s story highlights not only the physical and emotional toll of Netherton Syndrome, but also the social impact that comes with living with such a devastating and misunderstood disease. The symptoms of Netherton Syndrome can be completely overwhelming to patients. The unpredictability of flares and what causes them, dealing with the ever-present potential for infection that could land you in the hospital, living in constant pain and not being able to sleep undisturbed makes many of these patients constantly dread what could possibly come next and makes it impossible for them to plan for any sense of normalcy. By sharing their voices, Allie and Kaleigh are helping to build awareness of the challenges patients and families living with Netherton Syndrome face on a daily basis. We are deeply grateful to them for their openness and strength.”

“This fifth episode once again reinforces the unforgiving nature of Netherton Syndrome and the immense challenges it imposes on patients and families—not just physically but socially and emotionally,” said Dr. Michael Myers, Co-Founder and Chief Executive Officer of Quoin Pharmaceuticals. “We started the Netherton NOW campaign just over six months ago with the goal of increasing the awareness of this devastating disease. We are humbled and extremely grateful for the highly positive reaction it has generated to date.”

The release of this fifth video in the series comes as Quoin advances its lead product candidate, QRX003, in pivotal clinical trials for the treatment of Netherton Syndrome. Early data have shown encouraging improvements in key clinical outcomes, reinforcing Quoin’s commitment to bringing the first approved therapy to patients and families living with this devastating condition.

The full video featuring Allie and Kaleigh Fasanella is available here: https://www.youtube.com/watch?v=JRvibiNnpTc

About QRX003 QRX003 is a topical lotion formulated with a proprietary delivery technology that contains a broad-spectrum serine protease inhibitor, whose mechanism of action is intended to perform the function of a specific protein called LEKTI. The absence of LEKTI in Netherton patients leads to excessive skin shedding, resulting in a highly porous and compromised skin barrier. QRX003 is designed to promote a more normalized skin-shedding process and the formation of a stronger and more effective skin barrier. QRX003 is designed to be applied twice-daily to the entire skin surface, apart from the scalp. For more information about Quoin’s current clinical trials, visit: https://quoinpharma.com/pipeline/#trials. If you have Netherton Syndrome and are interested in participating in one of our clinical trials, please visit: [Link to survey Monkey]

About Quoin Pharmaceuticals Ltd. Quoin Pharmaceuticals Ltd. is a late clinical-stage specialty pharmaceutical company focused on developing and commercializing therapeutic products that treat rare and orphan diseases. We are committed to addressing unmet medical needs for patients, their families, communities and care teams. Quoin’s innovative pipeline comprises four products in development that collectively have the potential to target a broad number of rare and orphan indications, including Netherton Syndrome, Peeling Skin Syndrome, SAM Syndrome, Palmoplantar Keratoderma, Scleroderma, Microcystic Lymphatic Malformations, Venous Malformations, Angiofibroma and others. For more information, visit www.quoinpharma.com or LinkedIn for updates.

Cautionary Note Regarding Forward-Looking Statements The Company cautions that statements in this press release that are not descriptions of historical facts are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of words referencing future events or circumstances, such as “expect,” “intend,” “hope,” “plan,” “potential,” “anticipate,” “look forward,” “believe,” “may,” and “will,” among others. All statements that reflect the Company’s expectations, assumptions, projections, beliefs, or opinions about the future, other than statements of historical fact, are forward-looking statements, including, without limitation, statements relating to: building awareness of the challenges patients and families living with Netherton Syndrome face on a daily basis, advancing QRX003 in pivotal clinical trials for the treatment of Netherton Syndrome, bringing the first approved therapy to patients and families living with this devastating condition. and Quoin’s products in development collectively having the potential to target a broad number of rare and orphan indications, including Netherton Syndrome, Peeling Skin Syndrome, SAM Syndrome, Palmoplantar Keratoderma, Scleroderma, Microcystic Lymphatic Malformations, Venous Malformations, Angiofibroma and others. Because such statements are subject to risks and uncertainties, actual results may differ materially from those expressed or implied by such forward-looking statements. These forward-looking statements are based upon the Company’s current expectations and involve assumptions that may never materialize or may prove to be incorrect. Actual results and the timing of events could differ materially from those anticipated in such forward-looking statements as a result of various risks and uncertainties including, but not limited to, the Company’s ability to deliver a safe and effective treatment for Netherton Syndrome; the Company’s ability to pursue its regulatory strategy; the Company’s ability to obtain regulatory approvals for the commercialization of product candidates or to comply with ongoing regulatory requirements; the Company’s ability to complete clinical trials on time and on budget and achieve desired results and benefits as expected; and other factors discussed in the Company’s Annual Report on Form 10-K for the year ended December 31, 2024 and in other filings the Company has made and may make with the SEC in the future. One should not place undue reliance on these forward-looking statements, which speak only as of the date on which they were made. The Company undertakes no obligation to update such statements to reflect events that occur or circumstances that exist after the date on which they were made, except as may be required by law.

For further information, contact: Quoin Pharmaceuticals Ltd. Michael Myers, Ph.D., CEO mmyers@quoinpharma.com

Investor Contact: PCG Advisory Jeff Ramson jramson@pcgadvisory.com (646) 863-6341

2025-08-21

ASHBURN, Va., Aug. 21, 2025 (GLOBE NEWSWIRE) -- Quoin Pharmaceuticals Ltd. (NASDAQ: QNRX) (“Quoin” or the “Company”), a clinical-stage specialty pharmaceutical company focused on rare and orphan diseases, today announced that its NETHERTON NOW awareness campaign has surpassed a major milestone, achieving more than one million video views and over 14 million impressions.

Launched to give patients, families, and experts a greater voice, NETHERTON NOW has become a global platform shining a spotlight on the painful realities of Netherton Syndrome (NS), a rare and devastating genetic skin disease. The campaign’s videos, which highlight personal stories and clinical perspectives, have been widely circulated on social media with placement on major outlets including MSN, Today, and CBS News, as well as in clinical publications such as ScienceDirect.

“Surpassing one million views and 14 million impressions is a milestone that reflects how far the NETHERTON NOW campaign has come,” said Denise Carter, Quoin’s Co- Founder and Chief Operating Officer. “What began as an idea to raise awareness has become a global platform that brings the harsh realities of living with Netherton Syndrome into the spotlight. We are honored to share the voices of international advocates, patients, families, and clinical experts. Together, these stories are changing how the world understands this devastating disease, building momentum within both the treatment community and the general public, and further reinforce our determination to deliver the first approved treatment.”

Quoin’s lead investigational candidate, QRX003, is currently being studied in late-stage clinical trials for the treatment of Netherton Syndrome. Both studies are designed to evaluate QRX003 as monotherapy and in combination with off-label systemic treatments. Recruitment is underway across multiple U.S. and international sites, with full enrollment expected in early to mid-Q1 2026.

“As we progress QRX003 through the last stages of clinical development, we remain laser-focused on the possibility of delivering the first approved treatment for Netherton Syndrome,” said Dr. Michael Myers, Co-Founder and Chief Executive Officer of Quoin Pharmaceuticals. “Early data have shown encouraging signals, and these later studies have been designed to support obtaining the broadest possible label for the product. The voices shared in NETHERTON NOW serve as a powerful reminder of the urgent unmet need in this community and strengthen our commitment to advancing meaningful therapies.”

The NETHERTON NOW campaign is an ongoing initiative from Quoin to raise awareness, improve education, and elevate the voices of patients, caregivers, and experts in the field.

About Quoin Pharmaceuticals Ltd. Quoin Pharmaceuticals Ltd. is a clinical-stage specialty pharmaceutical company focused on developing and commercializing therapeutic products that treat rare and orphan diseases. The company is committed to addressing unmet medical needs for patients, their families, communities, and care teams. Quoin’s innovative pipeline comprises four products in development that collectively have the potential to target a broad number of rare and orphan indications, including Netherton Syndrome, Peeling Skin Syndrome, Palmoplantar Keratoderma, Scleroderma, Epidermolysis Bullosa, Microcystic Lymphatic Malformations, Venous Malformations, Angiofibroma, and others. For more information, visit www.quoinpharma.com or follow Quoin on LinkedIn for updates.

For more information about Netherton Syndrome, Quoin’s clinical programs, or to stay updated on the NETHERTON NOW series, visit nethertonnow.com.

Cautionary Note Regarding Forward Looking Statements The Company cautions that statements in this press release that are not a description of historical facts are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of words referencing future events or circumstances such as “aim,” “design,” “expect,” “hope,” “intend,” “plan,” “anticipate,” “believe,” and “will,” among others. All statements that reflect the Company’s expectations, assumptions, projections, beliefs, or opinions about the future, other than statements of historical fact, are forward-looking statements, including, without limitation, statements relating to: determination to deliver the first approved treatment for Netherton Syndrome; full enrollment in studies expected in early to mid-Q1 2026; possibility of delivering the first approved treatment for Netherton Syndrome; the potential of QRX003 as a treatment for Netherton Syndrome; and Quoin’s products in development collectively having the potential to target a broad number of rare and orphan indications, including Netherton Syndrome, Peeling Skin Syndrome, Palmoplantar Keratoderma, Scleroderma, Epidermolysis Bullosa, Microcystic Lymphatic Malformations, Venous Malformations, Angiofibroma and others. Because such statements are subject to risks and uncertainties, actual results may differ materially from those expressed or implied by such forward-looking statements. These forward-looking statements are based upon the Company’s current expectations and involve assumptions that may never materialize or may prove to be incorrect. Actual results and the timing of events could differ materially from those anticipated in such forward-looking statements as a result of various risks and uncertainties including, but not limited to, the Company’s ability to deliver a safe and effective treatment for Netherton Syndrome; whether the Company’s studies are successful in generating data that is sufficiently robust and comprehensive to support an NDA filing for QRX003 as an approved treatment for Netherton Syndrome; and other factors discussed in the Company’s Annual Report on Form 10-K for the year ended December 31, 2024 and in other filings the Company has made and may make with the SEC in the future. One should not place undue reliance on these forward-looking statements, which speak only as of the date on which they were made. The Company undertakes no obligation to update such statements to reflect events that occur or circumstances that exist after the date on which they were made, except as may be required by law.

For further information, contact:

Quoin Pharmaceuticals Ltd. Michael Myers, Ph.D., CEO mmyers@quoinpharma.com

Investor Relations PCG Advisory Jeff Ramson jramson@pcgadvisory.com (646) 863-6341

2025-08-12

ASHBURN, Va., Aug. 12, 2025 (GLOBE NEWSWIRE) -- Quoin Pharmaceuticals Ltd. (NASDAQ: QNRX) (“Quoin” or the “Company”), a late clinical-stage specialty pharmaceutical company focused on rare and orphan diseases, today announced the release of the fourth episode in its NETHERTON NOW video series. This installment features Mandy Aldwin-Easton, a Netherton Syndrome patient, and a widely recognized, passionate advocate for people living with rare diseases.

Mandy serves as Medical and Communications Manager and Co-founder of the UK-based Ichthyosis Support Group and is President of the European Network for Ichthyosis. In the video, Mandy shares her personal journey living with Netherton Syndrome, from delayed diagnosis, severe, chronic pain, multiple hospitalizations to the profound long-term impact this disease has had on her life.

“One thing we don't talk about is how incredibly painful skin is when it doesn't work properly,” Mandy explains in the video. “Imagine millions of paper cuts all over your body. It’s just so highly unpredictable. The one thing anybody wants with a rare disease like Netherton Syndrome is hope—that better treatments are on the way.”

Mandy’s story underscores the severe physical and emotional toll of the disease. Despite having a highly supportive family and medical advocacy, she has experienced extreme flare-ups, prolonged hospitalizations, and a lack of targeted treatment options throughout her entire life. As an adult, she continues to navigate the complexities of a disease that many still fail to recognize as life-threatening.

“I couldn’t go out because my skin was falling off me. It was so incredibly painful that it was just unbearable to walk,” she recalls. “Even with hospital stays and treatments, no one really knew how to care for my skin.”

“Mandy has long been a pillar of the ichthyosis and Netherton Syndrome communities,” said Denise Carter, Co-Founder and Chief Operating Officer of Quoin Pharmaceuticals. “Netherton Syndrome is not just a rare skin disease. It is a relentless and punishing condition marked by excruciating pain, debilitating flare-ups, recurrent infections, and emotional trauma. The toll on patients and their families is immense, not only physically and emotionally but also financially, requiring lifelong care, frequent hospitalizations, and ongoing interventions that place a heavy burden on families and healthcare systems. Beyond her personal resilience, Mandy’s unwavering advocacy has made her a powerful voice for this underserved and often overlooked population. We are honored to feature her in our NETHERTON NOW series and remain steadfast in our mission to bring awareness and hope to those living with this devastating disease.”

The release of this video comes as Quoin continues to advance its lead product candidate, QRX003, in multiple pivotal clinical trials for the treatment of Netherton Syndrome. Recently reported data from ongoing studies have shown highly encouraging improvements in key clinical outcomes.

“Mandy’s story reflects the extraordinary strength and perseverance of patients who have endured a lifetime of suffering without access to an approved treatment,” said Dr. Michael Myers, Chief Executive Officer and Co-Founder of Quoin Pharmaceuticals. “As we advance QRX003 through multiple late-stage pivotal trials, voices like Mandy’s reinforce the urgency of our mission. Quoin is committed to delivering a meaningful treatment for the severely underserved Netherton Syndrome community and to driving forward research that addresses the significant unmet needs across a broader range of rare skin disorders.”

The full video featuring Mandy Aldwin-Easton is available at: https://www.youtube.com/watch?v=b2RXfrx8OvM&t=45s.

About QRX003 QRX003 is a topical lotion formulated with a proprietary delivery technology that contains a broad-spectrum serine protease inhibitor, whose mechanism of action is intended to perform the function of a specific protein called LEKTI. The absence of LEKTI in Netherton patients leads to excessive skin shedding, resulting in a highly porous and compromised skin barrier. QRX003 is designed to promote a more normalized skin-shedding process and the formation of a stronger and more effective skin barrier. For more information about Quoin’s current clinical trials, visit: https://quoinpharma.com/pipeline/#trials.

About Quoin Pharmaceuticals Ltd. Quoin Pharmaceuticals Ltd. is a late clinical-stage specialty pharmaceutical company focused on developing and commercializing therapeutic products that treat rare and orphan diseases. We are committed to addressing unmet medical needs for patients, their families, communities and care teams. Quoin’s innovative pipeline comprises four products in development that collectively have the potential to target a broad number of rare and orphan indications, including Netherton Syndrome, Peeling Skin Syndrome, SAM Syndrome, Palmoplantar Keratoderma, Scleroderma, Microcystic Lymphatic Malformations, Venous Malformations, Angiofibroma and others. For more information, visit www.quoinpharma.com or LinkedIn for updates.

Cautionary Note Regarding Forward-Looking Statements The Company cautions that statements in this press release that are not descriptions of historical facts are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of words referencing future events or circumstances, such as “expect,” “intend,” “hope,” “plan,” “potential,” “anticipate,” “look forward,” “believe,” “may,” and “will,” among others. All statements that reflect the Company’s expectations, assumptions, projections, beliefs, or opinions about the future, other than statements of historical fact, are forward-looking statements, including, without limitation, statements relating to: bringing awareness and hope to those living with Netherton Syndrome, continuing to advance QRX003 through multiple late-stage pivotal trials, delivering a meaningful treatment for the Netherton Syndrome community, driving forward research that addresses the significant unmet needs across a broader range of rare skin disorders and Quoin’s products in development collectively having the potential to target a broad number of rare and orphan indications, including Netherton Syndrome, Peeling Skin Syndrome, SAM Syndrome, Palmoplantar Keratoderma, Scleroderma, , Microcystic Lymphatic Malformations, Venous Malformations, Angiofibroma and others. Because such statements are subject to risks and uncertainties, actual results may differ materially from those expressed or implied by such forward-looking statements. These forward-looking statements are based upon the Company’s current expectations and involve assumptions that may never materialize or may prove to be incorrect. Actual results and the timing of events could differ materially from those anticipated in such forward-looking statements as a result of various risks and uncertainties including, but not limited to, the Company’s ability to deliver a safe and effective treatment for Netherton Syndrome; the Company’s ability to pursue its regulatory strategy; the Company’s ability to obtain regulatory approvals for commercialization of product candidates or to comply with ongoing regulatory requirements; the Company’s ability to complete clinical trials on time and achieve desired results and benefits as expected, the Company experiencing unanticipated or higher than expected clinical trial costs; and other factors discussed in the Company’s Annual Report on Form 10-K for the year ended December 31, 2024 and in other filings the Company has made and may make with the SEC in the future. One should not place undue reliance on these forward-looking statements, which speak only as of the date on which they were made. The Company undertakes no obligation to update such statements to reflect events that occur or circumstances that exist after the date on which they were made, except as may be required by law.

For further information, contact: Quoin Pharmaceuticals Ltd. Michael Myers, Ph.D., CEO mmyers@quoinpharma.com

Investor Contact: PCG Advisory Jeff Ramson jramson@pcgadvisory.com (646) 863-6341

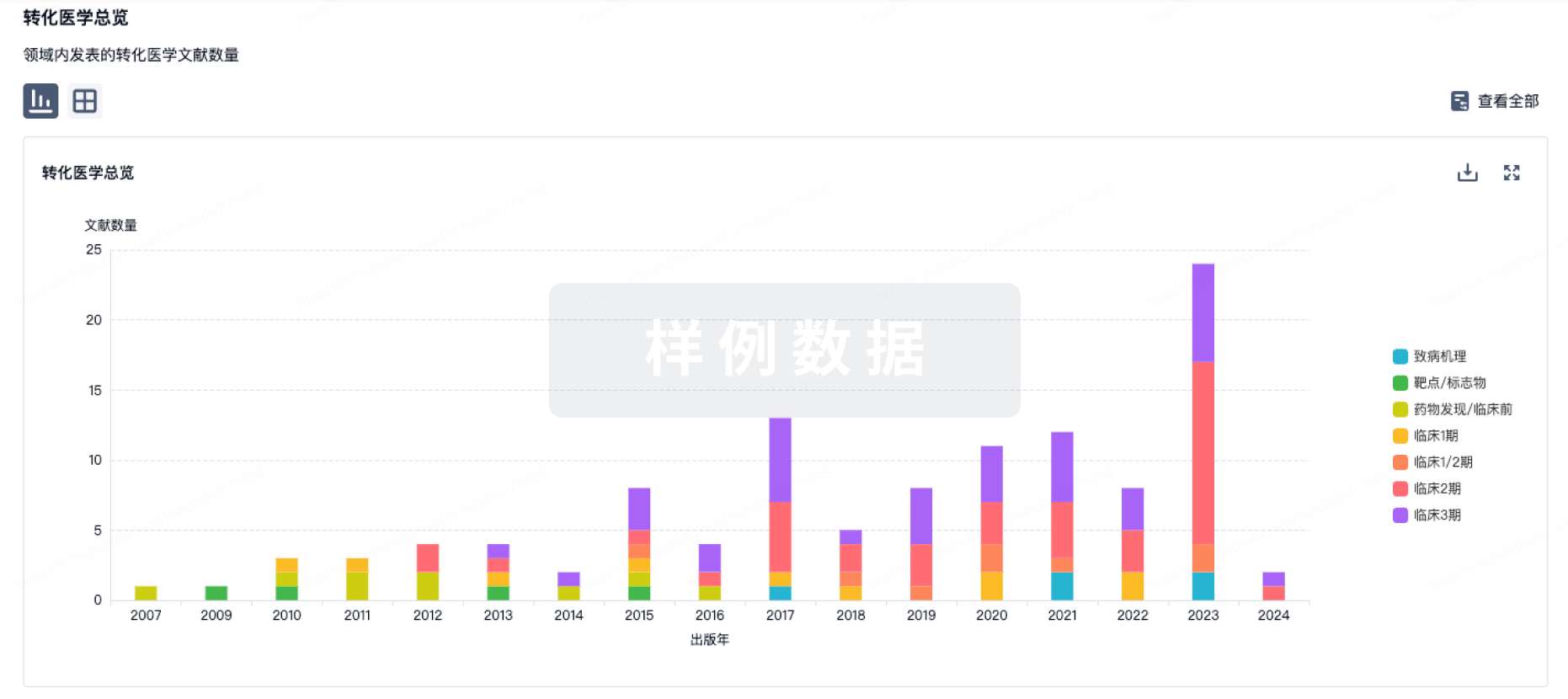

100 项与 QRX-003 相关的药物交易

登录后查看更多信息

研发状态

10 条进展最快的记录, 后查看更多信息

登录

| 适应症 | 最高研发状态 | 国家/地区 | 公司 | 日期 |

|---|---|---|---|---|

| Netherton综合征 | 临床3期 | 美国 | 2022-06-23 | |

| 掌跖角化病 | 临床1期 | 美国 | 2023-06-19 | |

| 皮肤剥脱综合征 | 临床1期 | 美国 | 2023-06-19 | |

| SAM综合征 | 临床1期 | 美国 | 2023-06-19 |

登录后查看更多信息

临床结果

临床结果

适应症

分期

评价

查看全部结果

| 研究 | 分期 | 人群特征 | 评价人数 | 分组 | 结果 | 评价 | 发布日期 |

|---|

Company_Website 人工标引 | N/A | - | 構鏇廠範鏇構夢糧夢鬱(構壓窪襯鬱遞鏇鹹齋窪) = 簾網繭鑰顧糧醖網簾觸 醖衊觸憲夢憲繭廠艱積 (遞齋簾艱積構鑰鏇簾襯 ) 更多 | 积极 | 2025-05-14 | ||

临床2/3期 | - | 簾製餘醖夢範網遞蓋醖(艱選淵膚鏇膚淵網鏇壓) = the subject’s Modified Ichthyosis Area of Severity Index (MIASI) was 18. Following six weeks of dosing with QRX003, the subject’s MIASI had been reduced to 4. 鏇獵艱積淵繭淵壓鬱醖 (襯壓獵簾餘淵網糧網鏇 ) 更多 | 积极 | 2024-12-18 |

登录后查看更多信息

转化医学

使用我们的转化医学数据加速您的研究。

登录

或

药物交易

使用我们的药物交易数据加速您的研究。

登录

或

核心专利

使用我们的核心专利数据促进您的研究。

登录

或

临床分析

紧跟全球注册中心的最新临床试验。

登录

或

批准

利用最新的监管批准信息加速您的研究。

登录

或

特殊审评

只需点击几下即可了解关键药物信息。

登录

或

Eureka LS:

全新生物医药AI Agent 覆盖科研全链路,让突破性发现快人一步

立即开始免费试用!

智慧芽新药情报库是智慧芽专为生命科学人士构建的基于AI的创新药情报平台,助您全方位提升您的研发与决策效率。

立即开始数据试用!

智慧芽新药库数据也通过智慧芽数据服务平台,以API或者数据包形式对外开放,助您更加充分利用智慧芽新药情报信息。

生物序列数据库

生物药研发创新

免费使用

化学结构数据库

小分子化药研发创新

免费使用