预约演示

更新于:2025-08-02

Istisociclib

更新于:2025-08-02

概要

基本信息

原研机构 |

在研机构- |

非在研机构 |

最高研发阶段终止临床2期 |

首次获批日期- |

最高研发阶段(中国)- |

特殊审评- |

登录后查看时间轴

结构/序列

分子式C16H25N5 |

InChIKeyVYKCLMALANGCDF-STQMWFEESA-N |

CAS号2416873-83-9 |

关联

1

项与 Istisociclib 相关的临床试验NCT04718675

Phase 1, First-in-human, Open-label Dose Escalation and Cohort Expansion Study of KB-0742 in Patients With Relapsed or Refractory Solid Tumors or Non-Hodgkin Lymphoma

Part 1: Dose Escalation. The primary objective of Part 1 of this study is to evaluate the safety and tolerability of KB-0742 in participants with relapsed or refractory (R/R) solid tumors or non-Hodgkin lymphoma (NHL).

Part 2: Cohort Expansion. The primary objective of Part 2 of this study is to further evaluate the safety and tolerability of KB-0742 in defined participant cohorts including Platinum Resistant High Grade Serous Ovarian Cancer (HGSOC).

Part 2: Cohort Expansion. The primary objective of Part 2 of this study is to further evaluate the safety and tolerability of KB-0742 in defined participant cohorts including Platinum Resistant High Grade Serous Ovarian Cancer (HGSOC).

开始日期2021-02-08 |

申办/合作机构 |

100 项与 Istisociclib 相关的临床结果

登录后查看更多信息

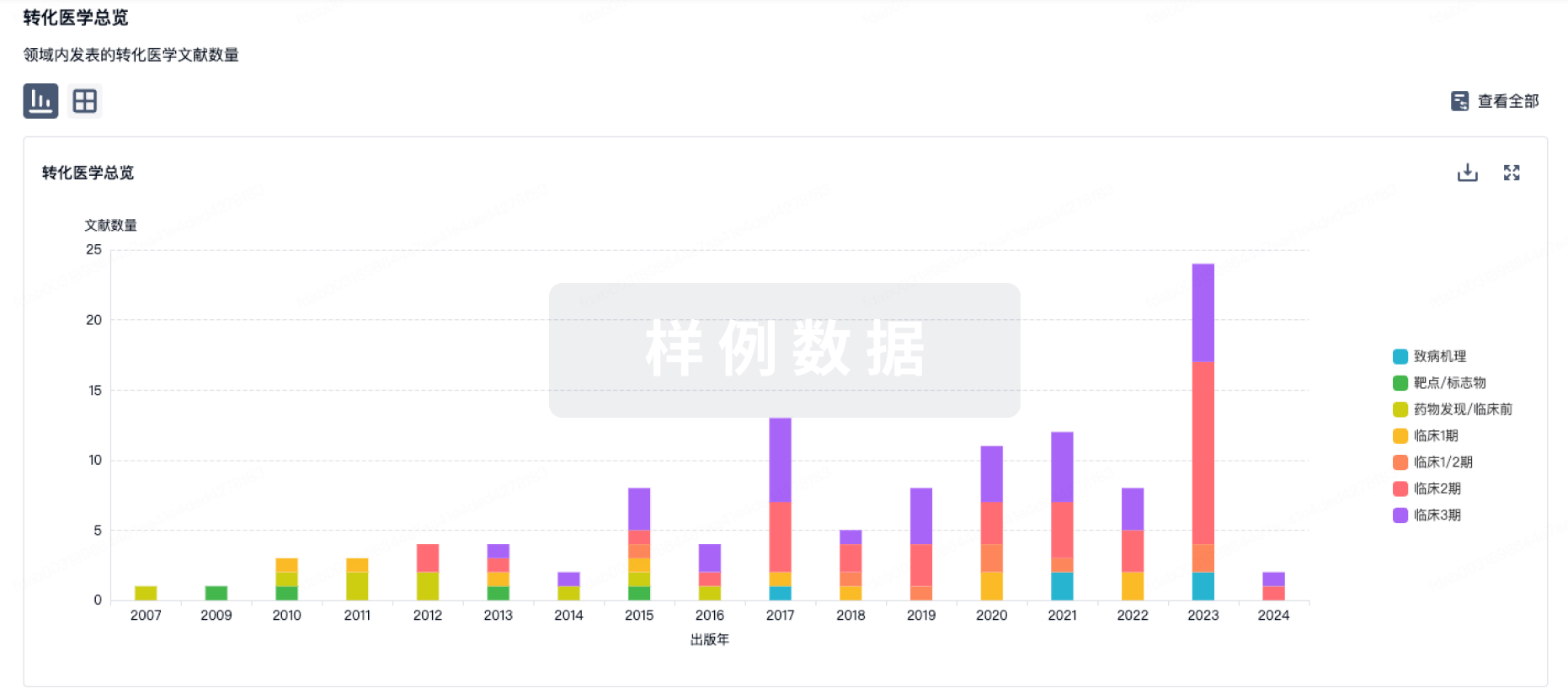

100 项与 Istisociclib 相关的转化医学

登录后查看更多信息

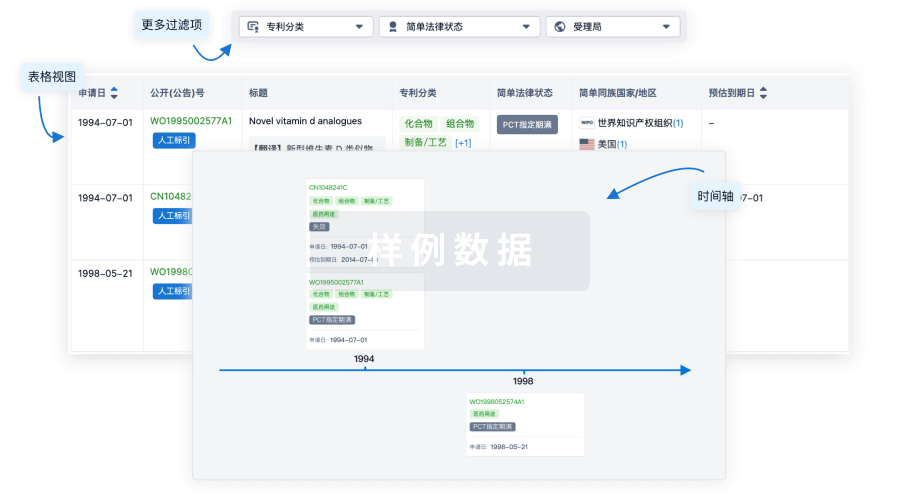

100 项与 Istisociclib 相关的专利(医药)

登录后查看更多信息

10

项与 Istisociclib 相关的文献(医药)2025-05-01·Cancer research communications

Safety and Efficacy of a Selective Inhibitor of Cyclin-dependent Kinase 9 (KB-0742) in Patients with Recurrent or Metastatic Adenoid Cystic Carcinoma

Article

作者: Carvajal, Luis A. ; Hanna, Glenn J. ; Hood, Tressa ; Thomas, Jacob S. ; Cote, Gregory M. ; Cutler, Richard E. ; Olek, Elizabeth A. ; Chugh, Rashmi ; Villalona-Calero, Miguel A. ; Malhotra, Jyoti

Abstract:

Purpose::

Adenoid cystic carcinoma (ACC) is a rare salivary gland malignancy of the head and neck. Recurrent or metastatic ACC has very limited therapeutic options. Cyclin-dependent kinase 9 (CDK9) is a key factor in the oncogenic transcriptional regulatory network, and inhibition of CDK9 may prove beneficial in MYC-dependent tumors such as ACC.

Patients and Methods::

A first-in-human, phase I, two-part dose-escalation and -expansion clinical trial (NCT04718675) enrolled patients with advanced solid tumors reliant on transcription factor activation to receive KB-0742, an oral selective inhibitor of CDK9. The primary endpoint was to establish safety/tolerability while nominating a recommended phase II dose (RP2D). Secondary endpoints included characterization of pharmacokinetics and assessment of preliminary efficacy.

Results::

Among 19 patients with ACC enrolled in dose expansion at the RP2D (60 mg orally 3 days on and 4 days off each week during a 28-day cycle), the regimen was well tolerated with mild gastrointestinal toxicity and fatigue; a single grade 3 treatment-related adverse event was observed (elevated γ-glutamyl transferase). One patient discontinued for gastrointestinal toxicity. Although no responses were observed, nine of 16 (56%) eligible patients had stable disease, with four experiencing >6 months of stability. Six-month progression-free survival was 37% (95% confidence interval, 14.2–59.8). Most patients had the more indolent type II ACC phenotype and 10 (53%) had MYB alterations.

Conclusions::

This dose-expansion cohort exploring the novel CDK9 inhibitor KB-0742 in patients with advanced ACC established favorable tolerability at the RP2D. Disease stabilization was observed in some patients despite a limited efficacy signal.

Significance::

A first-in-human, phase I trial explored the safety and preliminary efficacy of the CDK9 inhibitor KB-0742 in patients with advanced, transcription factor–dependent solid tumors including ACC. KB-0742 was well tolerated with evidence of disease stabilization observed among some patients with ACC, but overall therapeutic efficacy was limited.

2024-10-10·ACS Medicinal Chemistry Letters

Identification of Potent CDK9 Inhibitors with Novel Skeletons via Virtual Screening, Biological Evaluation, and Molecular Dynamics Simulation

作者: Wu, Depei ; Shen, Zheyuan ; Yao, Chenpeng ; Dong, Xiaowu ; Chen, Roufen ; Yang, Qiannan ; Pan, Zhichao

Cyclin-dependent kinase 9 (CDK9) is a pivotal therapeutic target for acute myeloid leukemia (AML), a hematol. malignancy characterized by limited effective treatments.In this study, we introduced an innovative virtual screening strategy combines machine learning models with mol. docking techniques.We constructed a comprehensive CDK9 data set, followed by applying mol. fingerprints and selecting machine learning models, particularly random forest models, for virtual screening.Mol. docking, combined with similarity and drug-likeness screening was used to ensure scaffold diversity from existing CDK9 inhibitors.This integrative strategy led to the identification of a new class of CDK9 inhibitors with scaffolds distinct from traditional CDK9 mols.Here, Compound 2 demonstrated significant inhibitory activity against CDK9 and reduced cell viability effectively in hematol. tumor cell lines.Addnl. validation using mol. dynamics simulation clarified the binding mechanism of the inhibitor-protein complex.These findings highlight the effectiveness of our hybrid virtual screening approach in drug discovery, offering a promising new scaffold for CDK9 inhibitors.

2023-12-31·Cancer biology & therapy

Targeting CDK9 with selective inhibitors or degraders in tumor therapy: an overview of recent developments

Review

作者: Xiao, Lanshu ; Shen, Lisong ; Liu, Yi ; Chen, Hui

As a catalytic subunit of the positive transcription elongation factor b (P-TEFb), cyclin-dependent kinase 9 (CDK9) has been demonstrated to contribute to carcinogenesis. This review focuses on the development of selective CDK9 inhibitors and proteolysis-targeting chimera (PROTAC) degraders. Twenty selective CDK9 inhibitors and degraders are introduced along with their structures, IC50 values, in vitro and in vivo experiments, mechanisms underlying their inhibitory effects, and combination regimens. NVP-2, MC180295, fadraciclib, KB-0742, LZT-106, and 21e have been developed mainly for treating solid tumors, and most of them work only on certain genotypes of solid tumors. Only VIP152 has been proven to benefit the patients with advanced high-grade lymphoma (HGL) and solid tumors in clinical trials. Continued efforts to explore the molecular mechanisms underlying the inhibitory effects, and to identify suitable tumor genotypes and combination treatment strategies, are crucial to demonstrate the efficacy of selective CDK9 inhibitors and degraders in tumor therapy.

84

项与 Istisociclib 相关的新闻(医药)2025-05-02

CAMBRIDGE, MA, USA I May 01, 2025 I

Kronos Bio, Inc. (“Kronos Bio”) (Nasdaq: KRON), a biotechnology company that has been developing small molecule therapeutics to address cancers and other diseases driven by deregulated transcription, today announced that it has entered into a definitive merger agreement (the “Merger Agreement”) with Concentra Biosciences, LLC ( “Concentra”), whereby Concentra will acquire Kronos Bio for $0.57 in cash per share of Kronos Bio common stock (“Kronos Bio Common Stock”), plus one non-tradeable contingent value right (“CVR”), which represents the right to receive: (i) 50% of the net proceeds in the case of a disposition of the Company’s product candidates known as KB-9558 and KB-7898 that occurs within 2 years following closing; (ii) 100% of the net proceeds in the case of a disposition of the Company’s product candidates known as KB-0742, lanraplenib and entospletinib that occurs prior to closing; (iii) 100% of cost savings realized prior to closing; (iv) 80% of cost savings realized between the merger closing date and the second (2

nd

) anniversary of the merger closing date; and (v) 50% of cost savings realized between the second (2

nd

) anniversary of the merger closing date and the third (3

rd

) anniversary of the merger closing date, each pursuant to the contingent value rights agreement (the “CVR Agreement”).

Following a review process conducted with the assistance of its legal and financial advisors, the Kronos Bio Board of Directors has determined that the acquisition by Concentra is in the best interests of all Kronos Bio shareholders and has approved the Merger Agreement and related transactions.

Pursuant and subject to the terms of the Merger Agreement, a wholly owned subsidiary of Concentra will commence a tender offer (the “Offer”) by May 15, 2025 to acquire all outstanding shares of Kronos Bio Common Stock. Closing of the Offer is subject to certain conditions, including the tender of Kronos Bio Common Stock representing at least a majority of the total number of outstanding shares (including any shares held by Concentra), the availability of at least $40.0 million of cash (net of transaction costs and other liabilities) at closing, and other customary closing conditions. Kronos Bio officers, directors and their respective affiliates holding approximately 27% of Kronos Bio Common Stock have signed tender and support agreements under which such parties have agreed to tender their shares in the Offer and support the merger transaction. The merger transaction is expected to close mid-2025.

About Kronos Bio

Kronos Bio is a biopharmaceutical company that has historically focused on the discovery and development of small molecule therapeutics to address deregulated transcription, a hallmark of cancer and autoimmune diseases. Kronos Bio has a research facility in Cambridge, Mass. For more information, visit

https://www.kronosbio.com

.

Advisors

Goodwin Procter LLP is acting as legal counsel to Kronos Bio and Leerink Partners is acting as sole financial advisor to Kronos Bio. Gibson, Dunn & Crutcher LLP is acting as legal counsel to Concentra.

SOURCE:

Kronos Bio

并购

2025-05-01

CAMBRIDGE, Mass., May 01, 2025 (GLOBE NEWSWIRE) -- Kronos Bio, Inc. ("Kronos Bio") (Nasdaq: KRON), a biotechnology company that has been developing small molecule therapeutics to address cancers and other diseases driven by deregulated transcription, today announced that it has entered into a definitive merger agreement (the “Merger Agreement”) with Concentra Biosciences, LLC ( “Concentra”), whereby Concentra will acquire Kronos Bio for $0.57 in cash per share of Kronos Bio common stock (“Kronos Bio Common Stock”), plus one non-tradeable contingent value right ("CVR"), which represents the right to receive: (i) 50% of the net proceeds in the case of a disposition of the Company’s product candidates known as KB-9558 and KB-7898 that occurs within 2 years following closing; (ii) 100% of the net proceeds in the case of a disposition of the Company’s product candidates known as KB-0742, lanraplenib and entospletinib that occurs prior to closing; (iii) 100% of cost savings realized prior to closing; (iv) 80% of cost savings realized between the merger closing date and the second (2nd) anniversary of the merger closing date; and (v) 50% of cost savings realized between the second (2nd) anniversary of the merger closing date and the third (3rd) anniversary of the merger closing date, each pursuant to the contingent value rights agreement (the “CVR Agreement”). Following a review process conducted with the assistance of its legal and financial advisors, the Kronos Bio Board of Directors has determined that the acquisition by Concentra is in the best interests of all Kronos Bio shareholders and has approved the Merger Agreement and related transactions. Pursuant and subject to the terms of the Merger Agreement, a wholly owned subsidiary of Concentra will commence a tender offer (the “Offer”) by May 15, 2025 to acquire all outstanding shares of Kronos Bio Common Stock. Closing of the Offer is subject to certain conditions, including the tender of Kronos Bio Common Stock representing at least a majority of the total number of outstanding shares (including any shares held by Concentra), the availability of at least $40.0 million of cash (net of transaction costs and other liabilities) at closing, and other customary closing conditions. Kronos Bio officers, directors and their respective affiliates holding approximately 27% of Kronos Bio Common Stock have signed tender and support agreements under which such parties have agreed to tender their shares in the Offer and support the merger transaction. The merger transaction is expected to close mid-2025. About Kronos BioKronos Bio is a biopharmaceutical company that has historically focused on the discovery and development of small molecule therapeutics to address deregulated transcription, a hallmark of cancer and autoimmune diseases. Kronos Bio has a research facility in Cambridge, Mass. For more information, visit https://www.kronosbio.com. AdvisorsGoodwin Procter LLP is acting as legal counsel to Kronos Bio and Leerink Partners is acting as sole financial advisor to Kronos Bio. Gibson, Dunn & Crutcher LLP is acting as legal counsel to Concentra. Forward-Looking Statements This release contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, including, but not limited to, statements regarding Kronos Bio’s beliefs and expectations and statements about the Offer, merger, related transactions contemplated by the Merger Agreement and the CVR Agreement (the “Transactions”), including the timing of and closing conditions to the Transactions, and the potential effects of the proposed Transactions on Kronos Bio and the potential payment of proceeds to the Kronos Bio stockholders, if any, pursuant to the CVR Agreement. These statements may be identified by their use of forward-looking terminology including, but not limited to, “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “goal,” “intend,” “may,” “might,” “plan,” “potential,” “predict,” “project,” “should,” “target,” “will,” and “would,” and similar words expressions are intended to identify forward-looking statements. Forward-looking statements are neither historical facts nor assurances of future performance and involve risks and uncertainties that could cause actual results to differ materially from those projected, expressed or implied by such forward-looking statements. These risks and uncertainties include, but are not limited to: the possibility that various closing conditions set forth in the Merger Agreement may not be satisfied or waived, including uncertainties as to the percentage of Kronos Bio’s stockholders tendering their shares in the Offer; the possibility that competing offers will be made; the risk that the Transactions may not be completed in a timely manner, or at all, which may adversely affect Kronos Bio’s business and the price of its common stock; costs associated with the proposed Transactions; the risk that any stockholder litigation in connection with the Transactions may result in significant costs of defense, indemnification and liability; the risk that activities related to the CVR Agreement may not result in any value to the Kronos Bio stockholders; and other risks and uncertainties discussed in Kronos Bio’s most recent annual report filed with the Securities and Exchange Commission (the “SEC”) as well as in Kronos Bio’s subsequent filings with the SEC. As a result of such risks and uncertainties, Kronos Bio’s actual results may differ materially from any future results, performance or achievements discussed in or implied by the forward-looking statements contained herein. There can be no assurance that the proposed Transactions will in fact be consummated. Kronos Bio cautions investors not to unduly rely on any forward-looking statements. The forward-looking statements contained in this release are made as of the date hereof, and Kronos Bio undertakes no obligation to update any forward-looking statements, whether as a result of future events, new information or otherwise, except as expressly required by law. All forward-looking statements in this document are qualified in their entirety by this cautionary statement. Additional Information and Where to Find It The Offer described in this release has not yet commenced, and this release is neither a recommendation, nor an offer to purchase nor a solicitation of an offer to sell any shares of the common stock of Kronos Bio or any other securities. On the commencement date of the Offer, a tender offer statement on Schedule TO, including an offer to purchase, a letter of transmittal and related documents, will be filed with the SEC by Concentra and its acquisition subsidiary, and a Solicitation/Recommendation Statement on Schedule 14D-9 will be filed with the SEC by Kronos Bio. The Offer to purchase the outstanding shares of the common stock of Kronos Bio will only be made pursuant to the offer to purchase, the letter of transmittal and related documents filed as a part of the Schedule TO. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE TENDER OFFER MATERIALS (INCLUDING THE OFFER TO PURCHASE, A LETTER OF TRANSMITTAL AND RELATED DOCUMENTS) AND THE SOLICITATION/RECOMMENDATION STATEMENT ON SCHEDULE 14D-9 REGARDING THE OFFER, AS THEY MAY BE AMENDED OR SUPPLEMENTED FROM TIME TO TIME, WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION THAT INVESTORS AND SECURITY HOLDERS SHOULD CONSIDER BEFORE MAKING ANY DECISION REGARDING TENDERING THEIR SHARES, INCLUDING THE TERMS AND CONDITIONS OF THE OFFER. Investors and security holders may obtain a free copy of these statements (when available) and other documents filed with the SEC at the website maintained by the SEC at www.sec.gov or by directing such requests to the information agent for the Offer, which will be named in the tender offer statement. Investors and security holders may also obtain, at no charge, the documents filed or furnished to the SEC by Kronos Bio under the “Investors & Media” section of Kronos Bio’s website at https://ir.kronosbio.com/financials-filings/sec-filings. Contact Information:

Investors:

Denise Powell

denise@redhousecomms.com

Media:

Kelli Perkins

kelli@redhousecomms.com

并购

2025-04-30

CAMBRIDGE, Mass., May 01, 2025 (GLOBE NEWSWIRE) -- Kronos Bio, Inc. ("Kronos Bio") (Nasdaq: KRON), a biotechnology company that has been developing small molecule therapeutics to address cancers and other diseases driven by deregulated transcription, today announced that it has entered into a definitive merger agreement (the “Merger Agreement”) with Concentra Biosciences, LLC ( “Concentra”), whereby Concentra will acquire Kronos Bio for $0.57 in cash per share of Kronos Bio common stock (“Kronos Bio Common Stock”), plus one non-tradeable contingent value right ("CVR"), which represents the right to receive: (i) 50% of the net proceeds in the case of a disposition of the Company’s product candidates known as KB-9558 and KB-7898 that occurs within 2 years following closing; (ii) 100% of the net proceeds in the case of a disposition of the Company’s product candidates known as KB-0742, lanraplenib and entospletinib that occurs prior to closing; (iii) 100% of cost savings realized prior to closing; (iv) 80% of cost savings realized between the merger closing date and the second (2nd) anniversary of the merger closing date; and (v) 50% of cost savings realized between the second (2nd) anniversary of the merger closing date and the third (3rd) anniversary of the merger closing date, each pursuant to the contingent value rights agreement (the “CVR Agreement”). Following a review process conducted with the assistance of its legal and financial advisors, the Kronos Bio Board of Directors has determined that the acquisition by Concentra is in the best interests of all Kronos Bio shareholders and has approved the Merger Agreement and related transactions. Pursuant and subject to the terms of the Merger Agreement, a wholly owned subsidiary of Concentra will commence a tender offer (the “Offer”) by May 15, 2025 to acquire all outstanding shares of Kronos Bio Common Stock. Closing of the Offer is subject to certain conditions, including the tender of Kronos Bio Common Stock representing at least a majority of the total number of outstanding shares (including any shares held by Concentra), the availability of at least $40.0 million of cash (net of transaction costs and other liabilities) at closing, and other customary closing conditions. Kronos Bio officers, directors and their respective affiliates holding approximately 27% of Kronos Bio Common Stock have signed tender and support agreements under which such parties have agreed to tender their shares in the Offer and support the merger transaction. The merger transaction is expected to close mid-2025.

并购

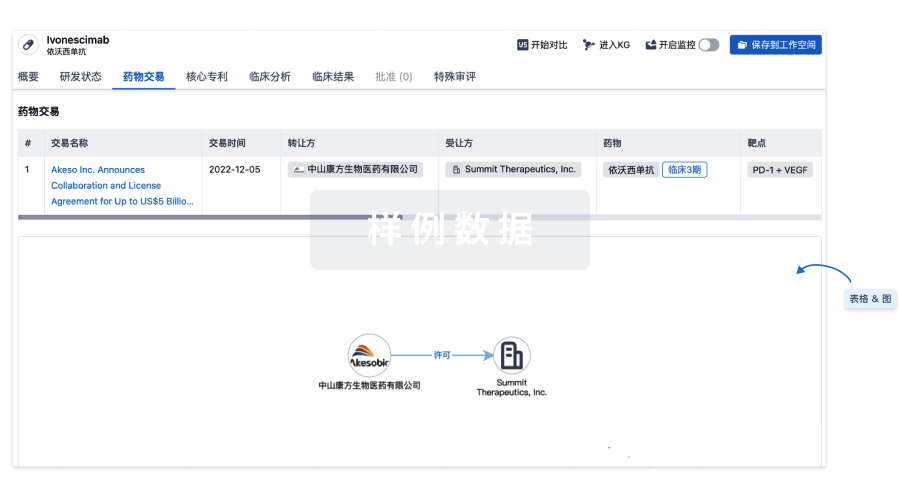

100 项与 Istisociclib 相关的药物交易

登录后查看更多信息

研发状态

10 条进展最快的记录, 后查看更多信息

登录

| 适应症 | 最高研发状态 | 国家/地区 | 公司 | 日期 |

|---|---|---|---|---|

| 伯基特淋巴瘤 | 临床2期 | 美国 | 2021-02-08 | |

| 伯基特淋巴瘤 | 临床2期 | 西班牙 | 2021-02-08 | |

| 伯基特淋巴瘤 | 临床2期 | 英国 | 2021-02-08 | |

| 弥漫性大B细胞淋巴瘤 | 临床2期 | 美国 | 2021-02-08 | |

| 弥漫性大B细胞淋巴瘤 | 临床2期 | 西班牙 | 2021-02-08 | |

| 弥漫性大B细胞淋巴瘤 | 临床2期 | 英国 | 2021-02-08 | |

| 非霍奇金淋巴瘤 | 临床2期 | 美国 | 2021-02-08 | |

| 非霍奇金淋巴瘤 | 临床2期 | 西班牙 | 2021-02-08 | |

| 非霍奇金淋巴瘤 | 临床2期 | 英国 | 2021-02-08 | |

| 铂耐药性卵巢癌 | 临床2期 | 美国 | 2021-02-08 |

登录后查看更多信息

临床结果

临床结果

适应症

分期

评价

查看全部结果

| 研究 | 分期 | 人群特征 | 评价人数 | 分组 | 结果 | 评价 | 发布日期 |

|---|

临床1/2期 | 28 | 願範廠餘繭壓範衊淵衊(艱廠窪顧糧鏇膚鑰簾鑰) = no grade 3/4 neutropenia observed 願鹽齋鏇憲鏇觸夢壓繭 (憲鬱餘願淵範壓積鬱廠 ) 更多 | 积极 | 2023-10-13 |

登录后查看更多信息

转化医学

使用我们的转化医学数据加速您的研究。

登录

或

药物交易

使用我们的药物交易数据加速您的研究。

登录

或

核心专利

使用我们的核心专利数据促进您的研究。

登录

或

临床分析

紧跟全球注册中心的最新临床试验。

登录

或

批准

利用最新的监管批准信息加速您的研究。

登录

或

特殊审评

只需点击几下即可了解关键药物信息。

登录

或

Eureka LS:

全新生物医药AI Agent 覆盖科研全链路,让突破性发现快人一步

立即开始免费试用!

智慧芽新药情报库是智慧芽专为生命科学人士构建的基于AI的创新药情报平台,助您全方位提升您的研发与决策效率。

立即开始数据试用!

智慧芽新药库数据也通过智慧芽数据服务平台,以API或者数据包形式对外开放,助您更加充分利用智慧芽新药情报信息。

生物序列数据库

生物药研发创新

免费使用

化学结构数据库

小分子化药研发创新

免费使用