预约演示

更新于:2025-08-23

MEDI-1814

更新于:2025-08-23

概要

基本信息

原研机构 |

在研机构 |

非在研机构 |

最高研发阶段临床1期 |

首次获批日期- |

最高研发阶段(中国)- |

特殊审评- |

登录后查看时间轴

结构/序列

Sequence Code 14216578CDR2-L

Sequence Code 24551760CDR1-L

Sequence Code 24551768CDR3-H

Sequence Code 24551794CDR3-L

Sequence Code 24551958CDR2-H

Sequence Code 24552035VL

Sequence Code 24552095VH

Sequence Code 24552096CDR1-H

关联

1

项与 MEDI-1814 相关的临床试验NCT02036645

A Randomised, Double-Blind, Placebo Controlled, Single and Multiple Ascending Dose Study to Assess the Safety, Tolerability, Pharmacokinetics and Pharmacodynamics of MEDI1814 in Subjects With Mild to Moderate Alzheimer's Disease.

The purpose of this study is to assess the safety, drug levels and effects on the body of 1 or 3 injections of MEDI1814, in people with mild to moderate Alzhiemer's Disease or healthy elderly people.

开始日期2014-02-04 |

申办/合作机构 |

100 项与 MEDI-1814 相关的临床结果

登录后查看更多信息

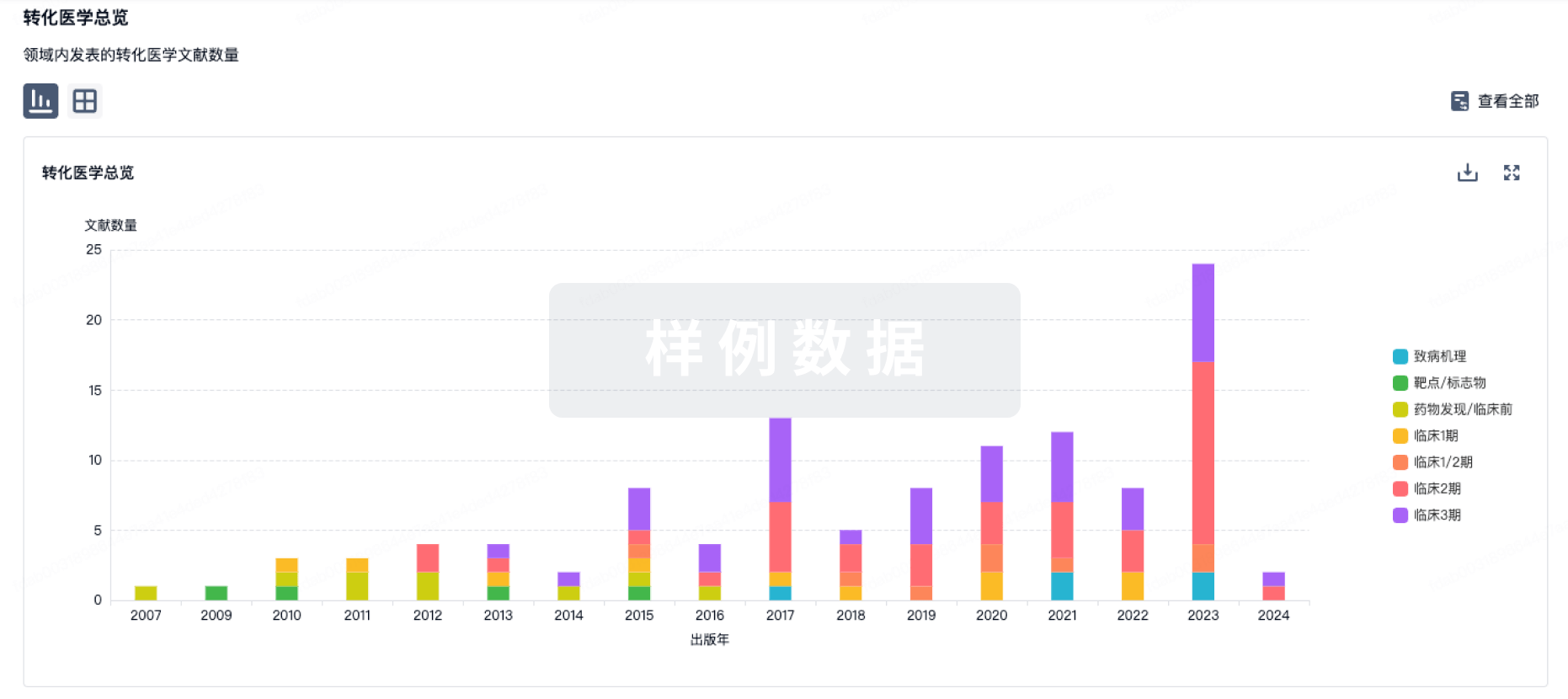

100 项与 MEDI-1814 相关的转化医学

登录后查看更多信息

100 项与 MEDI-1814 相关的专利(医药)

登录后查看更多信息

37

项与 MEDI-1814 相关的文献(医药)2025-05-31·Alzheimers Research & Therapy

Associations between platelet indices and cerebrospinal fluid biomarkers of Alzheimer's disease pathology in cognitively intact adults: the CABLE study.

Article

作者: Wang, Lan-Yang ; Li, Qiong-Yao ; Xiong, Shi-Yin ; Zhang, Dan-Dan ; Hao, Quan ; Zhao, Yong-Li ; Zhang, Zi-Qi ; Wang, Yong-Chang ; Yin, Shan ; Liu, Min ; Tan, Lan ; Fu, Yan ; Qiu, Shu-Dong

INTRODUCTION:

Although previous studies have shown that specific platelet indices had correlations with cognitive impairment, the associations between platelet indices and cerebrospinal fluid (CSF) biomarkers of Alzheimer's disease (AD) pathology remain unclear.

METHODS:

Our study included 1,047 cognitively normal participants from the Chinese Alzheimer's Biomarker and LifestylE (CABLE) study. The total participants had an average age of 58.33 years, a female proportion of 41.5% and average educational attainment of 9.58 years. Multiple linear regression models were used to analyze the associations of five platelet indices (plateletcrit [PCT], platelet count [PLT], mean platelet volume [MPV], platelet distribution width [PDW], and platelet large cell ratio [PLCR]) with CSF AD biomarkers after adjusting for age, gender, education and APOE ε4 allele status. Furthermore, the interactive, stratified and sensitivity analyses were further conducted to verify their relationships.

RESULTS:

In the total participants, we found higher PCT levels were significantly correlated with higher CSF P-tau/Aβ42 (β = 0.102, P = 0.008) and T-tau/Aβ42 (β = 0.102, P = 0.008), as well as lower CSF Aβ42 (β = -0.089, P = 0.018) and Aβ42/Aβ40 (β = -0.093, P = 0.018). Moreover, other four platelet indices (PLT, MPV, PDW, PLCR) demonstrated moderate correlations with CSF AD biomarkers. The interaction analyses revealed that age affected the correlations between PCT and PLT with CSF Aβ42. Importantly, the associations between PCT and the aforementioned CSF AD biomarkers became more significant in the late-life group, but turned non-significant in the mid-life group. Besides, sensitivity analyses confirmed the robustness of our findings.

CONCLUSIONS:

Our study provided preliminary evidence suggesting potential associations between platelet indices (especially PCT) and CSF AD biomarkers in cognitively intact adults. Nonetheless, more studies are needed to further validate these findings.

2025-04-01·Alzheimer's & Dementia: Diagnosis, Assessment & Disease Monitoring

Clinical utility of CSF Aβ38 in Japanese research and clinical cohorts

Article

作者: Kikuchi, Masataka ; Ikeuchi, Takeshi ; Onodera, Osamu ; Iwatsubo, Takeshi ; Miyashita, Akinori ; Kasuga, Kensaku ; Tsukie, Tamao ; Ishiguro, Takanobu

Abstract:

INTRODUCTION:

Previous studies have reported that cerebrospinal fluid (CSF) amyloid beta (Aβ42/Aβ38) performs comparably to Aβ42/Aβ40 in predicting amyloid positron emission tomography (PET) positivity in White cohorts. However, this finding has not been validated in diverse populations. Moreover, the utility of CSF Aβ38 in diagnosing various neurological diseases has not been fully understood.

METHODS:

We analyzed CSF Aβ38, Aβ40, Aβ42, phosphorylated tau181, and neurofilament light chain in Japanese research and clinical cohorts with Alzheimer's clinical syndrome (ACS) or non‐ACS.

RESULTS:

CSF Aβ42/Aβ38 predicted amyloid PET positivity comparably to Aβ42/Aβ40. The levels of CSF Aβ38 were significantly lower in patients with progressive supranuclear palsy (PSP) and idiopathic normal pressure hydrocephalus (iNPH) than in those with other diseases.

DISCUSSION:

We validated the high diagnostic performance of CSF Aβ42/Aβ38 in Japanese patients with AD. CSF Aβ38 reduction may be a characteristic feature of PSP and iNPH.

Highlights:

The diagnostic value of cerebrospinal fluid (CSF) amyloid beta (Aβ)38 was examined in Japanese research and clinical cohorts.CSF Aβ42/Aβ38 and Aβ42/Aβ40 showed comparable performance to detect brain Aβ deposition.CSF Aβ42/Aβ38 and Aβ42/Aβ40 discordant group showed a characteristic profile.CSF Aβ38 and Aβ40 were prominently decreased in progressive supranuclear palsy and idiopathic normal pressure hydrocephalus.

2025-01-01·Alzheimer's & Dementia: Diagnosis, Assessment & Disease Monitoring

sTREM2 in discordant CSF Aβ42 and p‐tau181

Article

作者: Jain, Ishika ; Men, Lu ; Glittenberg, Matthew ; An, Binchong ; Li, Ling ; Li, Danni ; Zhang, Lin ; Mantyh, William G.

Abstract:

INTRODUCTION:

Little is known about the factors underpinning discordant cerebrospinal fluid (CSF) amyloid beta (Aβ)42 versus p‐tau181/Aβ42 or CSF Aβ42 versus Aβ positron emission tomography (PET).

METHODS:

We stratified 570 non‐demented Alzheimer's Disease Neuroimaging Initiative (ADNI) participants by Aβ PET and further by CSF Aβ42 or p‐tau181/Aβ42. We used analysis of covariance testing adjusting for covariates, followed by Tukey post hoc pairwise comparisons, to compare CSF soluble triggering receptor expressed on myeloid cells‐2 (sTREM2) across four participant groups: CSF+ Aβ42 with CSF− p‐tau/Aβ42, CSF− Aβ42 with CSF+ p‐tau/Aβ42, and concordant CSFAβ42/CSFp‐tau/Aβ42. We also compared sTREM2 across discordant and concordant CSFAβ42/PET.

RESULTS:

Regardless of Aβ PET status, CSF+Aβ42 with CSF−p‐tau/Aβ42 had lower sTREM2 than CSF−Aβ42 with CSF+p‐tau/Aβ42. CSF sTREM2 was similarly also associated with discordant CSF Aβ42 /PET.

DISCUSSION:

Our study suggests the potential roles of sTREM2 in discordant CSF Aβ42 and p‐tau181/Aβ42 and discordant CSFAβ42/PET. Low‐ and high‐CSF sTREM2 may affect the accuracy of p‐tau181/Aβ42 during the clinical work‐up of AD.

Highlights:

17% of non‐demented older adults had discordant CSF Aβ42 versus p‐tau181/Aβ42.sTREM2 differed between discordant cases of CSF Aβ42 versus p‐tau181/Aβ42.20% of non‐demented older adults had discordant CSF Aβ42 versus Aβ PET.sTREM2 also differed between discordant cases of CSF Aβ42 versus Aβ PET.p‐tau181/Aβ42 may miss 6.7% of PET+ non‐demented older adults with low sTREM2.

13

项与 MEDI-1814 相关的新闻(医药)2025-07-28

·深蓝观

李昀 | 撰文王晨 | 编辑当全球生物制药“低垂的果实”已被摘光时,下一个药王将在哪个领域出现?2025年,对于中枢神经系统(CNS)药物而言,充满了选择和选择的后果。所谓的CNS药物,粗暴一点说就是“为大脑设计的药”。其中包括精神心理科疾病用药,例如:抑郁症、焦虑症、双向情感障碍等;也包括神经科疾病用药,例如:阿尔兹海默症、帕金森病、渐冻症等。一名投资人表示,从整个全球市场的角度来看,CNS类药物都存在巨大的未满足的临床需求。但是从去年开始,相关企业的投资才在中国备受关注。“最重要的原因可能是因为肿瘤、ADC、CAR-T的赛道过热,一级资本需寻找长期回报但技术壁垒高的赛道,CNS完美符合。”他说到。截至 2025 年 6 月,中国在 CNS 治疗领域已有至少 24 家创新药企完成融资,融资总额累计超过 110 亿元人民币。企业涵盖小分子、新基因治疗等多个方向。但与此同时,CNS药物研发也极具风险。上半年,阿斯利康就宣布终止其所有 CNS 在研项目,包括与礼来合作的 AD 药 MEDI1814 和处于II 期的偏头痛单抗 MEDI0618 等——这表明部分大型跨国药企正在退出 CNS 赛道,转投更确定性的治疗领域。而在国内,CNS相关开发本身起步较晚,近几年一些先行者虽然进入了商业验证阶段,但坏消息还是比好消息更多。其中最典型的代表就是绿谷971。这款用以治疗阿尔兹海默症的药物从去年到今年,进入了断货、裁员、被药监部门“卡关”等风波中。这款药物的研发花去了公司40亿元,但截至停产都未能利润打平。上述投资人也坦言,相较于其它领域,自己所在机构对CNS企业的投资额度一般不高。这名已经入行十几年的从业者说,投资CNS领域“让他找到了一种刚开始职业生涯时的感觉”:学习越多,越能发现这条路上遍布坑洞,工作时焦虑感很严重。“虽然说CNS的讨论度很高,但不是所有机构都会去碰。”他说到,“相对来说,只有美元基金和成长型创投的兴趣会高一些。”更重要的是,在CNS这一领域,中国创新药企业暴露了一些先天劣势:比如业内常提的和美国相比中国“产学研“之间的脱节、药物评审机制的弹性不足、市场对于疾病的认知程度较低等。现今的百亿投资,在十年后究竟能结出怎样的果子,在很大程度上也依赖于以上方面会在未来如何改变。-01-什么样的机构在投?从这两年的CNS企业投融资事件来看,参与其中的玩家不少,但类型很有限。其中就包括偏爱前沿领域的美元专业基金。包括礼来亚洲:曾经投资相关赛神医药,A 轮融资约 1 亿美元;龙磐资本:领投核酸递送类CNS企业大睿生物, A+ 轮融资约3500 万美元;幂方健康:投资过专注神经炎症的CNS企业高光制药。而在人民币基金方面,投融资主力军都是一些成长型、孵化型基金。比如启明创投、高瓴创投,就参与了CNS类企业如宁丹新药、泽安生物等企业的融资。但这种投资选择,并不能代表如今医药投资圈的大方向。“现在的投资环境,其实比以前更偏好快进快出的模式。”上述投资人说到。“BD模式之所以这么火,就是因为能更快落地。对于肿瘤药,只要能拿到早期数据就能BD,但是CNS药的数据解读难,很多管线即使都到了Phase 2,大药企还是不敢买。”总体而言,CNS药物的研发周期长、失败率高,从立项到上市少说8–10年,和大部分基金的投资期限(5年左右)严重不匹配。而这个预期期限因为资本环境原因还在不断被缩短。除此以外,CNS新药模式还和一些具有中国本土特色的投资模式之间,存在一些天然的距离。比如这两年存在感越来越明显的政府主导产业母基金,背后是一套当地医药制造升级、完善产业链和生态圈的叙事。但大部分CNS公司还停留在理论验证的早期阶段,和产业上下游之间勾连不深,本地化生产、带动就业的价值不明显,因此不在这一投资逻辑内。再比如:由于大多数CNS类biotech管线较少、靶点较冷,产品线看上去不够“丰满性感”,对于如今主流的“平台型+爆款药”类型投资也缺乏吸引力。在大多数情况下,CNS药物的高度个性化并不适合通过平台被放大和复制。-02-什么样的公司被偏爱?在搞清楚不同资本类型的口味后,CNS类企业如何在拉投资时讲故事就显得尤为重要。这一领域企业所面临的挑战其实是:如何在一个小众的领域,讲出一个能被大众接受的故事。一些企业选择在做充满风险的早期药物研发之余,还增加一些传统的服务类业务。比如先声系企业宁丹新药,就是既做急性缺血性脑卒中、阿尔兹海默症、神经病理性疼痛等适应症的新药,又做CXO服务,为药物的临床研究提供技术服务和专业指导。除此之外,拓宽技术路径本身的辐射范围,或是利用好其它领域的技术验证成果,也是讲好故事的一个思路。一名就职于CNS类biotech企业的从业者提到,他在找工作时对市场上同类型企业观察后发现:目前市场上很多CNS类初创在某些关键研发环节上还处于推论阶段。但资本认为谁的推论成功可能性更大,其实和产业对特定方向的信心相关。关键环节之一就是如何穿越血脑屏障。由于血脑屏障对大多数分子阻挡极强,如今许多递送平台,仍停留在动物实验或模型阶段;人体临床验证尚非常稀少,因此很多平台的有效性只是合理推论。然而在近些年的中国biotech行业,递送技术其实获得了大量的开发经验。尽管其中的靶点特异性和穿透方式并不适用于CNS类药物,但是中国biotech产业在ADC、核酸类药物“如何进入目标细胞”上的解决经验,都能为CNS药物开发提供必要的知识和借鉴。“曾经面试过的一家公司老板,就有过在偶联抗体上开发的成功经验,对linker的理解尤其深入。他们公司比起其它同类型公司在融资上就更加顺利。”上述从业者说到。因此,如今赢得资本青睐的CNS企业,一般都不是只做CNS这一适应症的。依靠某一突破关键研发环节的技术,管线往往可以覆盖很多治疗领域——这也是投资者愿意承担风险的原因所在。比如大睿生物主打的肝外核酸递送技术,就可以在CNS以外的心血管代谢以及减重领域有所发挥;比如睿健医药主打的干细胞治疗,已经开发了诱导多能干细胞来源的眼科产品,未来也希望将其运用在帕金森病的治疗上。-03-中国可能弯道超车么?据艾昆玮报告,截至2025年,全球CNS 疾病领域试验总数接近 3400 项,中国在全球 CNS临床试验中占比由2015–2019年的6% 提升到2020–2024年的13%。但毕竟2024年中国在新启动临床试验总数中占比已经达到了30%。尽管有所提升,但和欧美的热度相比,中国对CNS的投入仍显不足。一些海外投资机构的报告也指出,从中国与海外的交易数据来看,中国biotech在CNS领域参与很少。机构由此判断:尽管中国biotech近年势头很猛,但其在CNS等关键领域的滞后会让未来的创新能力面临风险。事实上,尽管一些MNC选择放弃阵地,但依然有许多公司在围绕CNS进行持续交易。比如,武田曾与AC Immune就针对Aβ的疫苗产品达成了一项高达22亿美元的BD;同一天,艾伯维和Gilgamesh宣布达成一项超20亿美元的合作和许可选择协议,以开发下一代精神疾病疗法。而中国在这一领域的出海上,一直保持沉寂。如上所述,中国的优势在于一些关键开发环节的举一反三;但劣势同样明显。其中之一就在于监管部门的严格,以及这一因素导致的投资犹豫和开发犹豫。比如,导致阿尔茨海默症药物开发者绿谷停摆的一个重要原因就在于药监方面对971有严格的专业标准,要求重复三期安慰剂双盲对照临床试验。相对而言,FDA对CNS类药物的口子放得更开。比如2019年首发适应症为精神分裂症、2021年获批用于双相抑郁的药物Caplyta,它的三项临床试验只有两项是阳性结果,但综合整体证据FDA还是盖章通过。这一药物在上市后引发了较为常见的内分泌紊乱等副作用,也证明了有关部门的把关问题;但毫无疑问的是,这种较为宽松的上市环境,极大刺激了资本的热情和动力。去年9月,对于CNS领域的一个大事件就是BMS公司精神分裂药物Cobenfy在美上市,这是数十年来首个获批的全新机制的精神分裂症治疗药物。再鼎医药拥有这款药物在大中华区的开发、生产和商业化权益,但至今还没有在中国获得上市批准。FDA在CNS类药物审批上的高效和开放,来自于美国公共卫生机构对这一领域的长期关注。据统计,NIH在21世纪投入80多亿美元进行神经学研究,是90年代的近10倍。因此,监管部门对于CNS的临床需求和难点都有更深入的认识,也形成了较为灵活的应对方法。比如,CNS 疾病主观性强,临床评分存在干扰因素;对照组效应强,安慰剂反应率高;药物效应窗口小,易因样本、设计或入组标准变化造成失败。针对这些特点,FDA往往会在主要临床效益证据之外评估其它辅助证据,从而增加了药物上市可能性。要回答是否“弯道超车”这一问题,关键并不取决于起点——中国biotech已经在多个领域证实了这一点;而取决于是否能找到与自身药物特点匹配的可商业化路径。路径选得对,加速度必然也会在未来得到释放。......欢迎添加作者交流:李昀:liyun940820

细胞疗法抗体药物偶联物免疫疗法

2025-05-23

药械追踪No.1 / 加科思/艾力斯KRAS G12C抑制剂艾瑞凯在华获批,触发5000万元里程碑款2025年5月23日,加科思(1167.HK)宣布,其自主研发的KRAS G12C抑制剂艾瑞凯(通用名:戈来雷塞)已获中国国家药监局(NMPA)批准上市,适应证为至少经历过一种系统性治疗的KRAS G12C突变的非小细胞肺癌(NSCLC)。戈来雷塞(研发代号:JAB-21822)是加科思自主研发的KRAS G12C抑制剂,其的中国(包括中国大陆及港澳台)权益已授予上海艾力斯医药科技股份有限公司(艾力斯,688578.SH)。此次获批触发里程碑付款条件,加科思将收到来自合作伙伴艾力斯的5000万元里程碑付款。戈来雷塞此次获批是基于一项在中国开展的II期注册性临床研究。该研究显示,戈来雷塞单药治疗二线及以上NSCLC患者,客观缓解率(ORR)为49.6%,疾病控制率(DCR)达86.3%,中位无进展生存期(PFS)达8.2个月,中位总生存期(OS)达17.5个月。戈来雷塞安全可耐受,和其他KRAS G12C抑制剂相比具有良好的消化道安全性。->点击文末阅读原文,解锁完整双语新闻No.2 / 罗氏Susvimo在美获批新适应证,治疗糖尿病视网膜病变2025年5月22日,罗氏(OTCMKTS: RHHBY)宣布其产品Susvimo(雷珠单抗,100 mg/mL)获美国FDA批准用于治疗糖尿病视网膜病变(DR),成为该药在美国的第三个适应证,前两个为湿性年龄相关性黄斑变性(nAMD)和糖尿病性黄斑水肿(DME)。Susvimo是一种可重复填充的眼部植入物,可持续释放雷珠单抗,仅需每9个月重复填充一次。此次批准基于Pavilion Ⅲ期研究结果,数据显示,每9个月接受一次Susvimo补充治疗可显著改善患者的视网膜病变严重程度,受试者在一年后无需补充治疗;Susvimo安全性与既往报道一致。该治疗方案适用于此前对至少两次抗VEGF注射有应答的DR患者,有望为需长期管理的视网膜病变提供更持久、依从性更高的治疗选择。->点击文末阅读原文,解锁完整双语新闻No.3 / 恒瑞医药瑞格列汀二甲双胍片获批上市2025年5月22日,恒瑞医药(600276.SH)宣布,其子公司盛迪医药自主研发的1类创新药瑞格列汀二甲双胍片(Ⅰ)/(Ⅱ)已获中国国家药监局(NMPA)批准上市,适用于配合饮食与运动,改善2型糖尿病成人患者的血糖控制。该产品为中国首个自主研发的二肽基肽酶IV抑制剂(DPP-4)抑制剂磷酸瑞格列汀与盐酸二甲双胍固定剂量复方制剂,通过双重机制实现降糖协同作用。同类复方产品在全球范围内已有多款上市,如默沙东的捷诺达、诺华的宜合瑞和武田的KAZANO等。据悉,2024年全球相关产品年销售额合计约11.55亿美元。恒瑞本项目累计研发投入约7660万元。->点击文末阅读原文,解锁完整双语新闻No.4 / 葛兰素史克美泊利珠单抗在美获批用于COPD附加维持治疗2025年5月22日,葛兰素史克(LSE/NYSE:GSK)宣布,美国食品药品监督管理局(FDA)已批准Nucala(美泊利珠单抗)作为成人慢性阻塞性肺疾病(COPD)患者(其病情未能通过吸入三联疗法得到充分控制且具有嗜酸性粒细增多表型)的附加维持治疗药物。此次批准基于MATINEE和METREX三期临床试验的积极数据。在这些试验中,美泊利珠单抗在具有嗜酸性粒细增多表型的广泛COPD人群中显示出具有临床意义且统计学上显著降低中度/重度急性加重的年化率的效果。预防急性加重是COPD管理的关键目标。急性加重对患者极为不利,已知会导致不可逆的肺部损伤、症状加重和死亡率增加。在安慰剂组和美泊利珠单抗组之间,不良事件的发生率相似。->点击文末阅读原文,解锁完整双语新闻企业动态No.1 / 阿斯利康宣布全面退出神经科学领域在阿斯利康2025年第一季度财报会议上,阿斯利康宣布全面退出神经科学领域,生物制药研发执行副总裁Sharon Barr表示,“我们已关闭神经科学项目,并为部分项目寻找合作伙伴,这意味着阿斯利康神经科学团队的解散。”阿斯利康终止的项目包括与礼来合作多年的阿尔茨海默病药物MEDI1814、用于治疗偏头痛的MEDI0618以及针对骨关节炎疼痛和糖尿病神经痛的MEDI7352。至此,阿斯利康神经科学在研管线全部清零。->点击文末阅读原文,解锁完整双语新闻No.2 / 7.96亿港元!荣昌生物拟配售1900万股2025年5月22日,荣昌生物(9995.HK)发布公告称,拟配售已发行H股股份的10.2%(面值1900万元人民币),配售所得款项总额预计为8.06亿港元,而配售所得款项净额(扣除佣金及估计开支后)预计约为7.96亿港元。本集团拟将配售所得款项净额用于投资核心产品泰它西普(RC18)的核心适应证拓展,如重症肌无力、膜性肾病及其他一般企业用途。于本公告日期,公司已发行股份总数为544,608,243股股份,包括355,027,004股A股及189,581,239股H股。->点击文末阅读原文,解锁完整双语新闻全球医疗情报领导者解锁隐藏在数据中的商业潜力 关于 G B I”自从2002年成立以来,GBI始终以技术为驱动,为药企、器械及行业相关服务商提供贯穿生命周期的全球药品市场竞争数据、全球行业资讯、HCPs洞察、全国医疗器械数据等商业信息与洞察,助力企业在进行战略布局和决策时,脱颖而出。历经20余年的深耕细作GBI已成为95%以上跨国药企、国内头部药企、咨询与投资机构等医疗圈灯塔用户值得信赖的长期合作伙伴。联系我们投稿 | 发稿 | 媒体合作▶ olivia.xu@generalbiologic.com数据库 | 咨询服务 | 资讯追踪▶ 点击左下“阅读原文”完成表单填写点击阅读原文,解锁完整双语新闻

引进/卖出上市批准临床3期临床2期

2025-05-22

·深蓝观

李昀 | 撰文高翼 | 编辑近日,阿斯利康宣布退出CNS(中枢神经系统)类药物的开发,引发业界热议。4月29日,公司在投资者电话会议上宣布了这一消息。同时发布的2025年一季度财报显示,公司已经终止了多项相关管线,包括与礼来合作开发治疗阿尔茨海默症的MEDI1814、处于2期临床的偏头痛单抗MEDI0618、治疗糖尿病神经痛的双抗MEDI7352,至此公司神经科学在研管线全部清零。对这一结果,业内其实早已有预料。CNS的开发从来都泥泞不堪,去年许多MNC也都折戟:比如强生连续终止了3个相关临床项目,艾伯维则在去年 11 月宣布其收购 Cerevel 的核心药物、一款用于治疗精神病症状急性加重的精神分裂症新药的两项临床试验失败。然而,像阿斯利康这样公开表示不再碰CNS的情况比较罕见。一名投资人分析称:公司之所以会做这种声明,大概率表示转型并不是由于项目失败,而是战略收缩和优化配置。也是在引导市场从更加积极的角度进行解读。从二级市场表现来看,公司的业务调整得到了投资者的认可:消息宣布当日,公司股价不跌反涨:涨 2.55%,报 71.71 美元。不过,其中一部分原因在于财务情况:阿斯利康当天发布的2025Q1财报给出了一个交代:2025 年 Q1 总营收 135.88 亿美元,同比增长 10%。净利润增长更明显,同比增长33.99%。“他们的新产品在美国市场推广得不错,”上述投资人提到,“尤其是R&I业务,这几年都在加大投入。”而R&I也确实贡献了Q1季报中最亮眼新药:哮喘药特泽利尤单抗增长明显,报告期内收入 2.17 亿美元,增长 85%。阿斯利康的相关高层也表示:放弃神经科学领域将使公司能够专注于核心治疗重点,资助“高价值项目”。并提到了“核心治疗”的几大领域:体重管理、血脂异常、呼吸系统疾病和免疫学适应症。公司的目标是到 2030 年实现年收入 800 亿美元以及推出 20 种新药。上述投资人分析称,这两个目标几乎不太可能同时实现。“从目前的增长速度来看,破800亿美元依然需要一到两款新的重磅炸弹。但是20款新药不是一个小数字,加上市场推广费用,非常牵拽资源。”因此,砍掉CNS业务,其实算是砍掉了一些阻碍前行的重量,让阿斯利康在奔向短期目标的道路上跑得更快。一名关注过CNS投资的业内人士也提到:尽管从未满足的临床需求来说,CNS潜力巨大,但五年内诞生重磅炸弹的概率相对其他领域更小。“能不能成功看的还是新的机制和技术手段,比如基因治疗。但同样的技术,在其它应用领域起步更早、基础更深,收获期应该会更早到来。“-01-业绩支撑点对于阿斯利康而言,其实已经从去年几年的战略调整上吃到了甜头。2024 年,阿斯利康全年营收同比增长 21% ,达到 540.73 亿美元,在全球制药企业营收 TOP10 排名中跃升至第 5 位,这是阿斯利康近几年来的最好成绩。复盘来看,公司其实从一些调整中收获颇丰。继续加大肿瘤领域的投资力度,其对ADC领域的投资,即使在掷金如土的新药领域也算得上激进:和第一三共的三笔交易总值超150亿美元,并且为该领域专门打造高级管理团队。同时,公司也在其他领域精简资源:比如2020年,公司将心血管及糖尿病代谢业务合并重组,心血管与糖尿病两大治疗领域正式合并为心血管糖尿病代谢业务部。这种调整在2024财年取得了不错的效果:ADC Enhertu不负众望成为新王牌,销售增长速度最快,全年销售额增长 58%,达到19.82亿美元。肿瘤业务依然是阿斯利康表现最强劲的板块,实现营收223.53亿美元,同比增长24%,占总营收的41%。其余三大业务板块:疫苗与免疫、罕见病和心血管、肾脏及代谢疾病 2024 年分别实现营收14.62亿美元、87.68亿美元、125.17亿美元;分别同比增长 8%、16%、20%。上述投资人称,阿斯利康能有如今的表现,和公司CEO帕斯卡离不开关系。“尽管这个人争议比较大。但是有一点是公认的:他是MNC高管中比较难得的战略家,扭转了之前公司的颓势,主要靠的就是做减法+大并购。”这种战略的实行,必须依赖成本控制和业务之间的重组与平衡。从目前公司的布局和市场趋势来看,阿斯利康已经为自己的研发日程表排得满满当当:体重管理代谢类药物、ADC 、放射性药物、下一代 IO 双特异性抗体、细胞治疗和 T 细胞接合剂、基因治疗和基因编辑等方面,阿斯利康都处在研究的白热化阶段。如果其中一两个能够进展顺利,未来几年公司并不缺增长驱动力。显然,在阿斯利康的战略规划中,CNS 业务难以在资源分配上与这些具有高增长潜力的核心业务竞争,成为一张弃牌的结果也就不难理解了。-02-CNS的命运2024年,精神分裂症药市场迎来了35年以来的首款新药:KarXT。这是一种选择性毒蕈碱 M1/M4 受体激动剂,为该病症的治疗打开了新的思路。然而,独木难支。一款新药的成功上市解决不了该领域的底层问题。上述相关领域投资人认为,该药的临床成功有运气成分。“整个大环境都还处于试错阶段,偶尔一次试对了并不能代表什么。但总归是个开始。”CNS的底层问题在于研发缺乏机制基础。精神疾病常常缺乏生物标志物,诊断依赖症状描述,异质性很强,被形容为“在黑屋子里找黑猫”。同时,大部分的化合物无法有效穿透进入脑组织。这就导致,很多在动物实验有效的新药进入临床后往往失效。由于可应用的产品有限,加上其疗效一直饱受争议,因此新药即使上市,显性或隐性的限制也会比较多。比如治疗阿尔茨海默症的Lecanemab、Aduhelm虽获批,因高昂价格受限于医保政策,商业化进展缓慢。卫材公司设定的目标是在 2024 财年前让 10000 名患者接受Lecanemab治疗,但截至次年1月 ,美国只有 2000 名患者接受了这种淀粉样蛋白抗体治疗。由于学界对该药疗效并具有普遍信任,根据Spherix Global Insights的一项调查:少于一半的美国神经科医生会向患者推荐Lecanemab。因此,过去数间,辉瑞、安进、默沙东等 家药企相继缩减CNS 投入,就连一直专注该领域的渤健也在拓展其他领域。这种集体性的战略调整,凸显出CNS在药物研发方面的艰难处境。2024年也是CNS“事故”频发的一年。除了上文提到的强生和艾伯维以外,被终止的比较重要的临床管线还包括:Neurocrine的精神分裂症药物 luvadaxistat ,Neumora的靶向毒蕈碱受体 M4 的高度选择性正变构调节剂NMRA - 266 ,Sage 的新药Dalzanemdor阿尔茨海默症和帕金森病相关认知障碍这两项适应症的临床研究。 而终止原因,要么是被FDA叫停,要么则是临床研究未达到主要终点。“虽然退出CNS对阿斯利康这家公司没有太大影响,甚至好处大于坏处。但对专注于这个领域的biotech来说,算得上是一个噩耗,因为又少了一家可以买单的MNC。”上述相关领域的投资人说。在他看来,对于这些biotech来说,未来并不一定是死局。还有一些留存业务的MNC,如BMS、罗氏、诺华等,可能会因为阿斯利康的退出加大研发投入、加快推进相关管线进程,争取在新的竞争格局中占据有利地位。但从投资角度来看,MNC依然是投资风向标:尽管业内依然存在对CNS抱有好感和期待的MNC,但是整体的退出趋势对高风险做出了提示。尤其是在现在的寒冬环境下,未来对该领域的投资会变得更加谨慎。“未来的投资主流看的可能还是公司有没有前沿的技术平台。比如基于人工智能的研发技术,平台对靶点的精准筛选和设计能力。这是一个对创新度要求、复合研究能力要求非常高的领域,投资策略也会更激进。”投资人说到。-03-MNC的顾虑在过去几年里,MNC普遍体验到一种危机四伏感:专利悬崖的阴影始终盘旋,但同时研发难度曲线不断攀升,成本高涨,每个新药上市的平均成本已超过25亿美元;而医保支付压力加大,尤其是在欧美国家,药价谈判趋严。整体而言,MNC的困境可以被总结成“研发风险上升”和“增长速度放缓”的双面夹击,也就是成本端和收入端的失衡。在这种情况下,大部分MNC都选择收缩战线、聚焦核心。MNC有几条道路可以走,视其实力和已有管线矩阵而定:可以选择“高风险/高利润”路线,比如诺华,虽然外围业务都砍得一个不剩了,但依然保留了一些高风险业务线,在CGT、AI驱动靶点发现等方面持续大投入;当然,企业也可以选择“低风险/中高利润”路线,比如赛诺菲就是稳健地将K药开发一条路走到底。对RNA、细胞治疗等领域投资较少,未来虽然可能错过风口,但靠着已有的围绕K药展开的研发管线,也不会过得太差。但显然,从上述的分析来看:CNS目前还处于“高风险/低利润”的区间里,因此很多MNC都会选择将其进行冷处理。此外,监管环境的日益严格也促使 MNC 更加谨慎地对待研发项目。在 CNS 等复杂领域,新药获批难度加大,使得 MNC 在权衡风险与收益时更加保守。而在自身具有优势的核心领域,MNC 凭借已有的技术积累和临床经验,更容易满足监管要求,提高新药获批的成功率。总的来说,最近几年MNC的研发选择已经不如过去急速上升期那样具有多元化的趋向。随着市场的扩容,“多元化”的角色被越来越多地交给biotech和风投基金。那些如CNS一般被MNC“放弃”的领域,还需要后者的继续哺育,才能最终回到巨头们的餐桌上。 ......欢迎添加作者交流:李昀:liyun940820

财报基因疗法并购临床2期

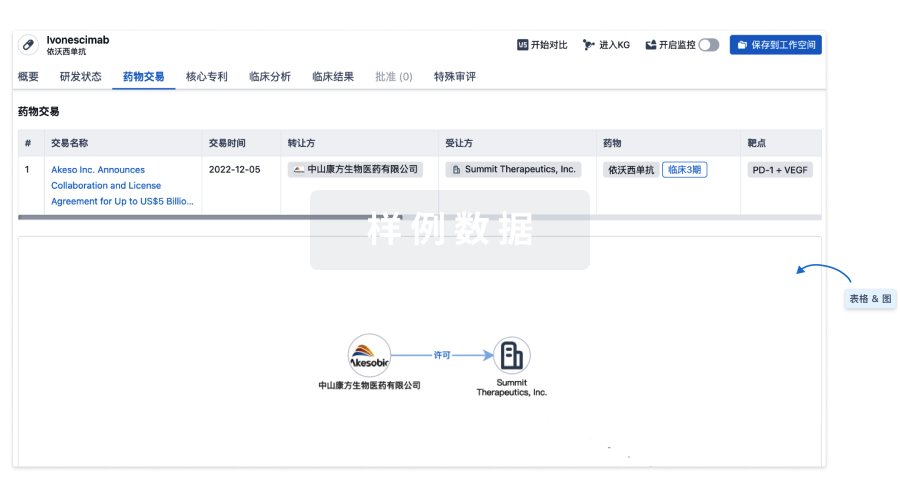

100 项与 MEDI-1814 相关的药物交易

登录后查看更多信息

研发状态

10 条进展最快的记录, 后查看更多信息

登录

| 适应症 | 最高研发状态 | 国家/地区 | 公司 | 日期 |

|---|---|---|---|---|

| 阿尔茨海默症 | 临床1期 | 美国 | 2014-02-04 |

登录后查看更多信息

临床结果

临床结果

适应症

分期

评价

查看全部结果

| 研究 | 分期 | 人群特征 | 评价人数 | 分组 | 结果 | 评价 | 发布日期 |

|---|

No Data | |||||||

登录后查看更多信息

转化医学

使用我们的转化医学数据加速您的研究。

登录

或

药物交易

使用我们的药物交易数据加速您的研究。

登录

或

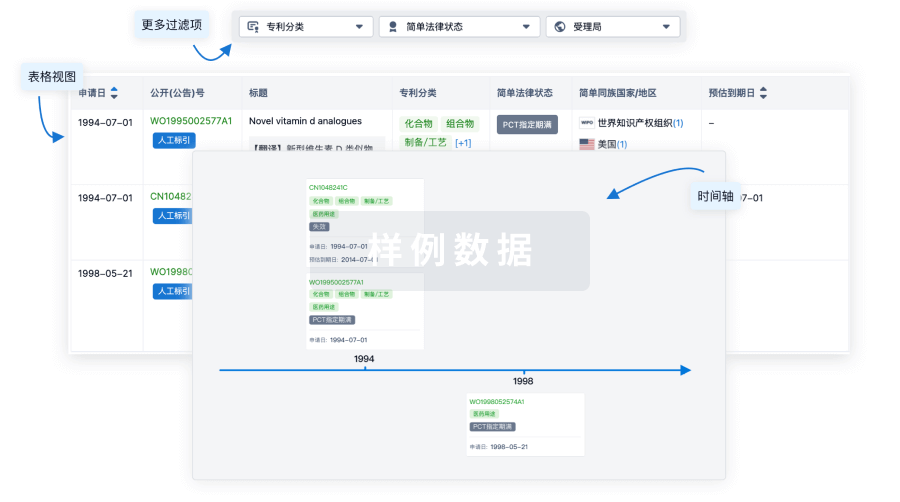

核心专利

使用我们的核心专利数据促进您的研究。

登录

或

临床分析

紧跟全球注册中心的最新临床试验。

登录

或

批准

利用最新的监管批准信息加速您的研究。

登录

或

生物类似药

生物类似药在不同国家/地区的竞争态势。请注意临床1/2期并入临床2期,临床2/3期并入临床3期

登录

或

特殊审评

只需点击几下即可了解关键药物信息。

登录

或

Eureka LS:

全新生物医药AI Agent 覆盖科研全链路,让突破性发现快人一步

立即开始免费试用!

智慧芽新药情报库是智慧芽专为生命科学人士构建的基于AI的创新药情报平台,助您全方位提升您的研发与决策效率。

立即开始数据试用!

智慧芽新药库数据也通过智慧芽数据服务平台,以API或者数据包形式对外开放,助您更加充分利用智慧芽新药情报信息。

生物序列数据库

生物药研发创新

免费使用

化学结构数据库

小分子化药研发创新

免费使用