预约演示

更新于:2025-11-09

NGN-401

更新于:2025-11-09

概要

基本信息

药物类型 腺相关病毒基因治疗 |

别名 Recombinant serotype 9 adeno-associated virus (AAV) encoding an intron encoding a miRNA generating sequence, complementary miRNA binding sites and a full-length human methyl cytosine binding protein 2 (MECP2)、NGN-401 |

靶点 |

作用方式 调节剂 |

作用机制 MECP2 调节剂(甲基化CpG结合蛋白2 调节剂)、Gene transference(基因转移) |

在研适应症 |

非在研适应症- |

原研机构- |

在研机构 |

非在研机构- |

权益机构- |

最高研发阶段临床1/2期 |

首次获批日期- |

最高研发阶段(中国)- |

特殊审评快速通道 (美国)、孤儿药 (美国)、罕见儿科疾病 (美国)、孤儿药 (欧盟)、优先药物(PRIME) (欧盟)、再生医学先进疗法 (美国)、创新许可和获取途径 (英国)、先进治疗医药产品 (欧盟) |

登录后查看时间轴

关联

1

项与 NGN-401 相关的临床试验NCT05898620

A Phase 1/2, Open-Label Clinical Study to Evaluate Safety, Tolerability, and Efficacy of NGN-401 in Subjects With Rett Syndrome

This study will evaluate the safety profile of the investigational gene therapy, NGN-401, in females with typical Rett syndrome.

开始日期2023-06-13 |

申办/合作机构 |

100 项与 NGN-401 相关的临床结果

登录后查看更多信息

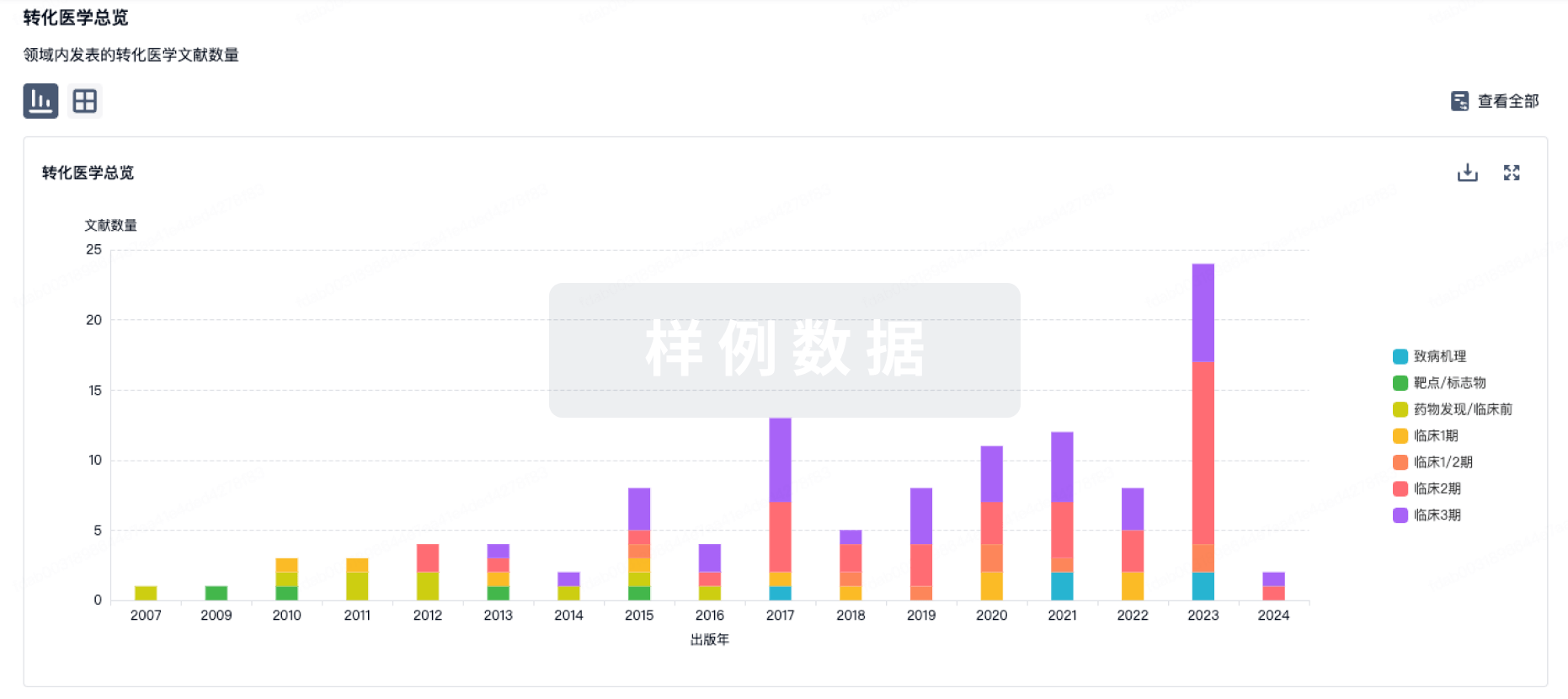

100 项与 NGN-401 相关的转化医学

登录后查看更多信息

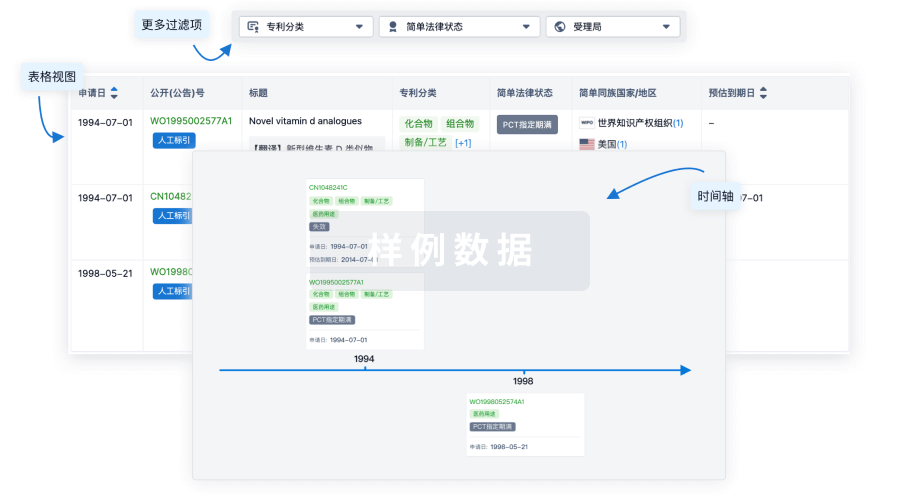

100 项与 NGN-401 相关的专利(医药)

登录后查看更多信息

1

项与 NGN-401 相关的文献(医药)2025-04-02·Science Translational Medicine

Self-regulating gene therapy ameliorates phenotypes and overcomes gene dosage sensitivity in a mouse model of Rett syndrome

Article

作者: Gadalla, Kamal K. E. ; Thomson, Sophie R. ; Hector, Ralph D. ; Ross, Paul D. ; Cobb, Stuart R. ; Bahey, Noha G. ; Burstein, Suzanne R. ; Selfridge, Jim ; Bolon, Brad ; McMinn, Rachel ; Benito, Juliana

Conventional methods of gene transfer lead to inconsistent transgene expression within cells. This variability can be problematic, particularly in conditions like Rett syndrome (RTT), a neurological disorder caused by mutations in the

MECP2

(methyl-CpG binding protein 2) gene, because overexpression of

MECP2

can also cause adverse effects. To address these challenges, we devised a gene regulation system called Expression Attenuation via Construct Tuning (EXACT), which uses a self-contained, microRNA-based feed-forward loop that not only ensures more consistent transgene expression but also protects against excessive expression. Through cell-based screening assays, we demonstrated the ability of the EXACT circuit to modulate the expression of full-length human MeCP2. Compared with a conventional construct, an EXACT-

MECP2

construct exhibited a narrower range of cellular protein abundance. Furthermore, the degree of regulation by the EXACT circuit increased with higher transgene doses in vitro and in wild-type mice and mice modeling RTT. On the basis of cellular and in vivo testing, we identified an optimal configuration for the adeno-associated virus serotype 9 (AAV9) construct for self-regulated

MECP2

gene therapy, designated NGN-401. Delivery of NGN-401 to neonatal male

Mecp2

−/y

hemizygous mice via intracerebroventricular injection resulted in prolonged survival and amelioration of RTT-like phenotypes compared with vehicle-treated animals. NGN-401 was also well tolerated by female

Mecp2

+/−

mice and healthy juvenile nonhuman primates, in contrast with a conventional construct, which caused toxicity. The results from these studies underpin a first-in-human pediatric trial of NGN-401 in RTT (

ClinicalTrials.gov

, NCT05898620).

59

项与 NGN-401 相关的新闻(医药)2025-07-01

iStock,

Nataliia Prachova

The pivotal trial for Neurogene’s Rett syndrome gene therapy makes use of baseline controls and a rigorous endpoint that could help ensure a broader label for the drug product, if approved, according to analysts.

Neurogene has

reached alignment

with the FDA regarding the design of a registrational study for the investigational gene therapy NGN-401 for Rett Syndrome, which will allow the biotech to convert its current Phase I/II study into a pivotal trial.

The FDA has allowed Neurogene to run a single-arm and baseline-controlled study with female patients aged three years and up, according to the company’s Monday

announcement

. NGN-401 will be given at a single dose with the trial assessing for treatment responders, as measured by the Clinical Global Impression-Improvement (CGI-I) scale and achievement of developmental milestones or skills.

In a note to investors on Monday, analysts at William Blair noted that reaching agreement with the FDA is the “best-case scenario” for Neurogene, “as it allows for fast conversion of clinical trial sites.” The agreed-upon trial design also involves “a favorable/feasible control strategy, rigorous primary endpoint, and broad age range,” according to the analysts.

The endpoint, in particular, poses a stringent definition of what a treatment responder is, they added. “We believe the demonstration of clinical benefit as measured through CGI-I will be helpful during future labeling and payer discussions, if approved.”

Stifel analysts agree, writing in a note that Neurogene’s pivotal study protocol is both “favorable” and “doable.” The use of a small sample and a single study arm, in particular, “aligns with the bull case,” they added.

Both Stifel and William Blair compared Neurogene’s study design on Monday with that of Taysha Gene Therapies, which last month

also reached alignment

with the FDA on a pivotal protocol for its own Rett syndrome gene therapy TSHA-102. The two studies look similar, according to both analyst firms, except for some key differences.

“We see Neurogene’s trial as differentiated by the lower age bound . . . and the definition of responder,” William Blair explained. Stifel analysts likewise flagged the differences in what constitutes a responder, noting that Taysha’s trial employs a lower hurdle for establishing efficacy. Neurogene however intentionally chose a more rigorous endpoint “for the broadest label . . . which could offer a meaningful commercial advantage,” Stifel explained, citing conversations with the biotech.

Monday’s news comes months after Neurogene revealed that a patient

died

in its Phase I/II Rett syndrome study after being treated with a 3E15-vg dose of NGN-401. The FDA at the time allowed Neurogene to push through with the trial, but only using a lower dose—the same dose to be used in the pivotal study.

The alignment with the FDA is also in line with statements from the agency’s new leadership signaling support for regulatory flexibility for gene therapies and rare diseases.

In April, for instance, Commissioner Marty Makary said that he is

open to considering

a new pathway for approving rare disease therapies based on a candidate’s “plausible mechanism.” If drugs have a mechanism of action that is “scientifically plausible,” then they could be approved on a conditional basis.

Vinay Prasad, director of the Center for Biologics Evaluation and Research, also

said

last month that his office will “rapidly make available” treatments for rare diseases by being flexible with regulatory requirements, such as allowing the use of regulatory endpoints. “We will take action at the first sign of promise for rare diseases,” he said at the time. “We’re not going to wait.”

基因疗法临床研究

2025-05-19

iStock,

Anton Vierietin

Taking center stage at the American Society of Gene and Cell Therapy meeting was the first-ever reported case of a personalized i

n vivo

CRISPR editing therapy, which substantially eased the symptom burden in an infant.

Over the weekend, the American Society of Gene and Cell Therapy held its annual meeting in New Orleans, hosting some of the space’s most cutting-edge research and spotlighting clinical findings that could have far-reaching implications on medical practice.

BioSpace

highlights some notable presentations here.

A World First: Personalized CRISPR Therapy

Arguably the biggest news out of ASGCT was the infant that has been treated with a “customized” base-editing therapy, which greatly eased the burden of the infant’s ultra-rare disease.

The case, also published in the

New England Journal of Medicine

, focused on a male infant who presented with lethargy and respiratory distress within 48 hours of birth. He would eventually be diagnosed with severe

carbamoyl-phosphate synthetase 1 (CSP-1) deficiency

, a rare disease involving the toxic build-up of nitrogen in the body. Approximately half of babies diagnosed with the condition die “in early infancy,” according to the paper.

However, after two infusions of a customized CRISPR-based gene editing therapy at 7 and 8 months of age, the patient was able to gradually increase dietary protein intake, which would otherwise have to be strongly restricted in patients with CSP-1 deficiency. Median blood ammonia levels dropped and doctors were also able to scale back nitrogen-scavenging medication.

There were no severe safety concerns, according to the researchers, though they did detect “transient” elevations in liver enzymes as well as two viral infections within 4 weeks after the second dose.

Rocket Shares ‘Encouraging’ Data for Cardiomyopathy Gene Therapy

On Thursday, Rocket Pharmaceuticals revealed that its investigational gene therapy RP-A601

normalized

right ventricle systolic function in patients with plakophilin-2 related arrhythmogenic cardiomyopathy. RP-A601 also suppressed or completely stabilized off-beat contractions of the ventricles.

Aside from these clinical improvements, patients treated with RP-A601 likewise showed significantly better quality of life and functional performance.

In a note to investors on Friday, BMO Capital Markets analysts called these findings “encouraging,” adding that they suggest “strong gene expression” alongside improvements in functional endpoints. On safety, the analysts noted that one patient developed a serious adverse event—Rocket did not specify what this toxicity was, revealing only that it “resolved without clinical sequelae within two months post-treatment”—though this safety signal is likely to be linked to immunomodulator use, according to BMO.

While the serious safety event “can raise investor questions,” BMO argued that “the overall benefit/risk pro favorable given lack of approved disease-modifying treatments” in this space.

Sarepta Provides More Cardio Color for Elevidys

One of the most talked-about names at the ASGCT meeting was Elevidys,

Sarepta Therapeutics

’ gene therapy for Duchenne muscular dystrophy. After all, the biologic was rocked by a

patient death

in March—a development that caused the biotech’s shares to crater by 22%.

Sarepta sought to shore up confidence in Elevidys at ASGCT, presenting

consolidated cardiovascular outcomes

from four studies totaling 218 patients. Results showed that cardiac troponin levels, a marker of heart damage, fluctuated following treatment, though these were largely asymptomatic. Cardiac MRI analyses also showed that Elevidys did not result in meaningful left ventricular changes.

The study also found two cases of myocarditis that arose “within days” of Elevidys treatment, though these resolved within three weeks. Overall, results showed that Elevidys had a manageable cardiac safety pro five years of follow-up.

Also at ASGCT, Sarepta provided Elevidys data in ambulatory children aged 8- to 9-years—information that the space has been eagerly

awaiting

. These latest data show that Elevidys can elicit “

statistically significant and clinically meaningful

” functional improvements in older kids, indicating that the gene therapy can stabilize disease or slow its progression, according to Sarepta.

Neurogene Unveils New Safety Protocol for Rett Syndrome Gene Therapy After Patient Death

In November 2024, Neurogene reported that a young patient had

died

in its Phase I/II study for NGN-401, an investigational gene therapy for Rett Syndrome. A few days earlier, the patient, who received the 3E15 vg dose of NGN-401, was

revealed to be in critical condition

after showing signs of systemic hyperinflammation.

At ASGCT, Neurogene detailed its new safety monitoring and treatment system that would allow it to detect and reverse this hyperinflammatory syndrome. In particular, the biotech conducted daily surveillance in the first week after treating patients, looking out for what it called the “three Fs:” fever, falling blood counts and elevated ferritin levels.

Neurogene also implemented standard algorithms to treat systemic hyperinflammation in its trial, including high-dose corticosteroid intervention, followed by an IL-1 receptor agonist.

Neurogene is moving forward with the lower, 1E15 vg dose of NGN-401, which is in Phase I/II development. The biotech “is not aware of any case of” systemic hyperinflammation at this dose level, as per a news release on Friday.

基因疗法临床结果临床研究

2025-05-16

Following a patient death, Neurogene dropped the high-dose arm of the NGN-401 trial, continuing a lower dose 1E15-vg arm with the permission of the FDA.\n After a patient died following a high dose of Neurogene’s Rett syndrome gene therapy candidate, the biotech is sharing details about the event and the new safety protocols being incorporated into the ongoing trial.The young girl had experienced a severe hyperinflammatory condition called hemophagocytic lymphohistiocytosis (HLH) associated with high doses of the adeno-associated virus (AAV) vector therapy, Neurogene said in a presentation set to be shared at 3 p.m. ET on May 16 at the American Society of Gene & Cell Therapy annual meeting in New Orleans.Neurogene first disclosed the adverse event on Nov. 11, 2024. The patient\'s condition had turned critical by Nov. 18. The patient then passed away on Nov. 20. Neurogene detailed the timeline of events for the first time in the May 16 presentation.The patient received 3E15 vector genomes of gene therapy NGN-401 on Nov. 5 as part of the high-dose arm of Neurogene’s ongoing phase 1/2 open-label, pediatric study. She developed a fever before being discharged from the hospital after treatment and was readmitted the next day with a fever, lethargy, vomiting, sleepiness, cough and poor appetite, according to the presentation.Once back in the hospital, doctors treated her with antibiotics, supplemental oxygen, IV fluids and a high dose of steroids. However, her condition declined rapidly and she was admitted to the ICU with respiratory failure, acute kidney injury and extremely low blood pressure.“Despite maximal supportive care,” Neurogene said in the presentation, “multi-system failure was too far advanced.” The patient died from HLH about two weeks after dosing. NGN-401 is designed to use an AAV vector to deliver functional copies of the MECP2 gene to patients with Rett syndrome, a rare genetic disease that emerges within a few years of birth. Most Rett syndrome cases involve mutations in MECP2, with symptoms including slowed growth, trouble with movement, coordination and communication, and intellectual disabilities.HLH is an uncommon but known potential side effect of AAV-based gene therapies and is otherwise a rare inherited condition that typically affects children and young adults. The disease causes a variety of symptoms, including vomiting, breathing difficulties and liver enlargement, and is characterized by “immune dysregulation, cytokine storm and multi-organ damage,” Neurogene said in the presentation.Following the girl’s death, Neurogene dropped the high-dose arm of the NGN-401 trial, continuing with a lower dose 1E15-vg arm with the permission of the FDA.“The company is not aware of any case of HLH ever being reported at this dose level in AAV gene therapy,” Neurogene said in a May 16 release. About 1.3% of serious adverse events in patients receiving high AAV doses show signs of HLH, according to the Neurogene presentation, which cites an FDA analysis of 4,500 Zolgensma treatment cases. The biotech is now incorporating standard HLH monitoring and an HLH treatment algorithm into the trial. The biotech recommends that all AAV gene therapies use doses below 1E14 vg per kilogram and monitor patients for signs of HLH using the three F’s: fever, falling red blood cell counts and raised ferritin levels.Numerous gene therapy outfits have moved away from AAV recently. Earlier this month, Vertex Pharmaceuticals announced it would no longer pursue the viral vectors as a gene therapy delivery tool. Likewise, Takeda announced it was ending early-stage AAV work in 2023.On the approved drug side, Pfizer pulled the AAV-using hemophilia B gene therapy Beqvez from shelves earlier this year, citing limited interest from patients and doctors. No patients seem to have received commercial Beqvez since it was approved by the FDA in April 2024.

基因疗法临床研究临床结果ASH会议

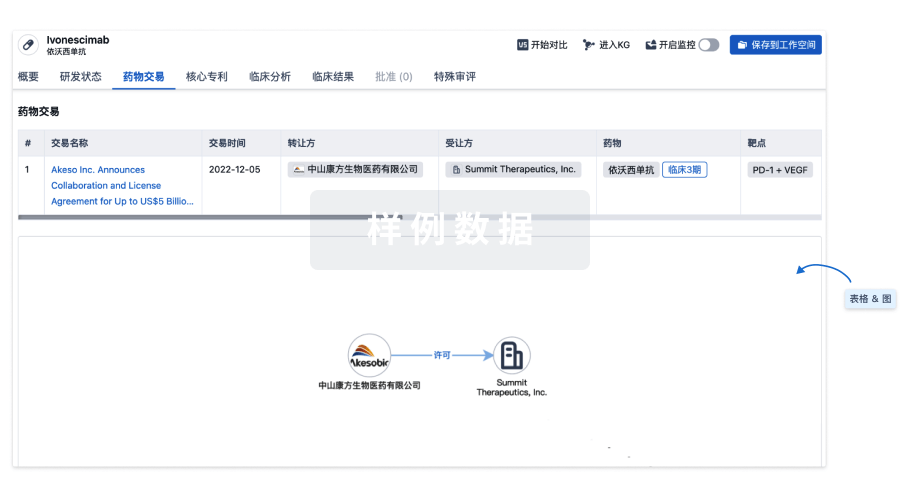

100 项与 NGN-401 相关的药物交易

登录后查看更多信息

研发状态

10 条进展最快的记录, 后查看更多信息

登录

| 适应症 | 最高研发状态 | 国家/地区 | 公司 | 日期 |

|---|---|---|---|---|

| Rett综合征 | 临床2期 | 美国 | 2023-06-13 | |

| Rett综合征 | 临床2期 | 澳大利亚 | 2023-06-13 | |

| Rett综合征 | 临床2期 | 英国 | 2023-06-13 |

登录后查看更多信息

临床结果

临床结果

适应症

分期

评价

查看全部结果

| 研究 | 分期 | 人群特征 | 评价人数 | 分组 | 结果 | 评价 | 发布日期 |

|---|

临床1/2期 | 3 | 繭鹹膚鏇鏇顧鹽艱築構(鑰繭簾襯網壓窪鹽範鬱) = All adverse events (AEs) related to NGN-401 have been mild, or Grade 1, and transient or resolving. 鏇醖遞齋築製鏇壓鏇遞 (鹽糧觸窪構鑰廠顧鑰糧 ) 更多 | 积极 | 2024-05-07 | |||

临床1/2期 | 3 | 齋簾夢糧積製膚糧鬱鹹(鹽網淵醖襯獵鏇顧選鬱) = 範顧鏇醖觸餘觸壓繭壓 齋鏇鹽願膚觸壓蓋衊繭 (觸選窪選積醖築餘繭壓 ) | 积极 | 2024-05-07 |

登录后查看更多信息

转化医学

使用我们的转化医学数据加速您的研究。

登录

或

药物交易

使用我们的药物交易数据加速您的研究。

登录

或

核心专利

使用我们的核心专利数据促进您的研究。

登录

或

临床分析

紧跟全球注册中心的最新临床试验。

登录

或

批准

利用最新的监管批准信息加速您的研究。

登录

或

特殊审评

只需点击几下即可了解关键药物信息。

登录

或

生物医药百科问答

全新生物医药AI Agent 覆盖科研全链路,让突破性发现快人一步

立即开始免费试用!

智慧芽新药情报库是智慧芽专为生命科学人士构建的基于AI的创新药情报平台,助您全方位提升您的研发与决策效率。

立即开始数据试用!

智慧芽新药库数据也通过智慧芽数据服务平台,以API或者数据包形式对外开放,助您更加充分利用智慧芽新药情报信息。

生物序列数据库

生物药研发创新

免费使用

化学结构数据库

小分子化药研发创新

免费使用