预约演示

更新于:2025-08-13

CT-996

更新于:2025-08-13

概要

基本信息

非在研机构- |

最高研发阶段临床2期 |

首次获批日期- |

最高研发阶段(中国)- |

特殊审评- |

登录后查看时间轴

关联

6

项与 CT-996 相关的临床试验NCT07112872

A Randomized, Double-Blind, Placebo- and Open-Label Active Comparator- Controlled, Parallel-Group, Multi-Center Phase II Study to Evaluate the Efficacy, Safety, and Tolerability of Once-Daily RO7795081 Administered for 30 Weeks to Participants With Type 2 Diabetes Mellitus

This multicenter, randomized, double-blind, placebo- and open-label active comparator-controlled, parallel-group, dose-range-finding, Phase II study aims to evaluate the efficacy, tolerability, and safety of RO7795081 for glycemic control in adult participants with Type 2 diabetes mellitus (T2D).

开始日期2025-08-31 |

申办/合作机构- |

NCT07081958

A Randomized, Double-Blind, Placebo-Controlled, Parallel-Group, Multi-Center, Phase II Study to Evaluate the Efficacy, Safety, and Tolerability of Once-Daily RO7795081 Administered for 38 Weeks to Participants With Obesity or Overweight With at Least One Weight-Related Comorbidity

This multicenter, randomized, double-blind, placebo-controlled, parallel-group, dose-range-finding, Phase II study aims to evaluate the efficacy, tolerability, and safety of RO7795081 for chronic weight management in adult participants with obesity or overweight with at least one weight-related comorbidity, but without diabetes mellitus.

开始日期2025-07-29 |

申办/合作机构 |

NCT06982131

A Phase I, Randomized, Investigator/Participant-Blind, Placebo-Controlled, Fixed-Sequence Study to Investigate the Safety, Tolerability, and Pharmacokinetics of Multiple Doses of Orally Administered RO7795081 and the Effect of Steady-State Dose of Orally Administered RO7795081 on the Pharmacokinetics of Pitavastatin and Rosuvastatin in Otherwise Healthy Overweight or Obese Adult Participants

This is a randomized, investigator-and-participant-blind, placebo-controlled, fixed sequence, cross-over, Phase 1 study to investigate the safety, tolerability, and pharmacokinetics of multiple doses of orally administered RO7795081 and the effect of a steady-state dose of orally administered RO7795081 on the pharmacokinetics of pitavastatin and rosuvastatin in otherwise healthy, overweight or obese adult participants.

开始日期2025-06-04 |

申办/合作机构 |

100 项与 CT-996 相关的临床结果

登录后查看更多信息

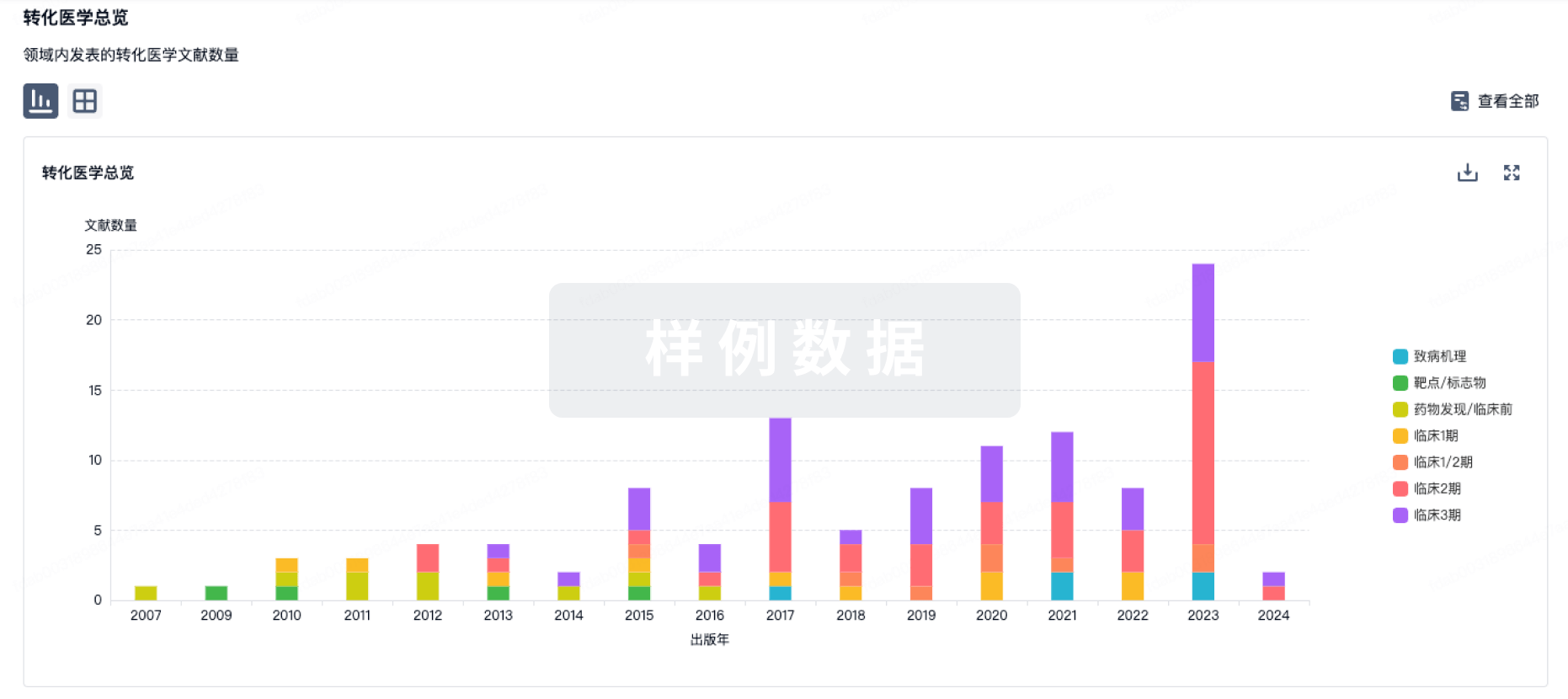

100 项与 CT-996 相关的转化医学

登录后查看更多信息

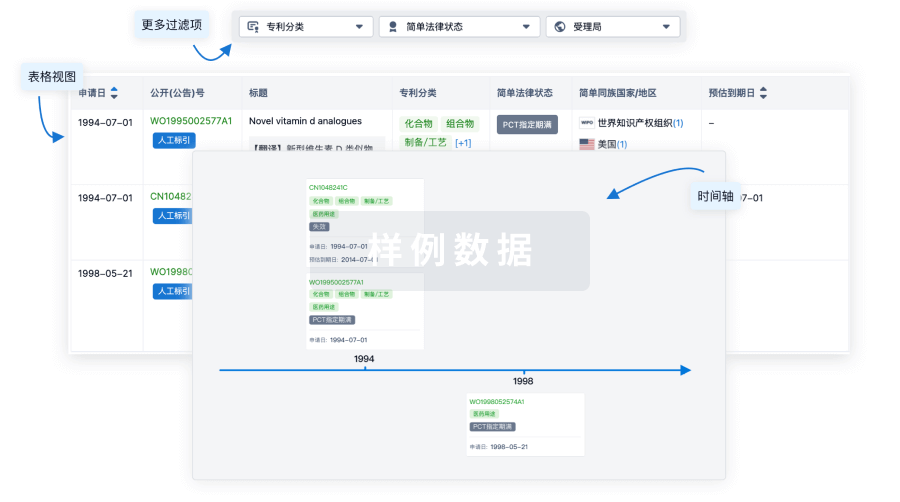

100 项与 CT-996 相关的专利(医药)

登录后查看更多信息

105

项与 CT-996 相关的新闻(医药)2025-08-11

摘要:礼来公司的口服 GLP-1 药物 Orforglipron 凭借 “首款口服肥胖疗法” 的先发优势,一度被视为肥胖治疗市场的新标杆。但其 III 期临床数据未达预期,为竞争对手留下了可乘之机。目前,五种差异化显著的口服肥胖候选药物正加速推进,它们或靶向全新机制,或优化给药便利性,或在减重效果上展现潜力。这场 “口服争霸战” 不仅将重塑肥胖治疗市场格局,更可能为全球数亿肥胖患者带来更易接受的治疗选择。礼来的 “领跑者” 困局

作为当前临床进展最领先的口服肥胖药,Orforglipron 的 III 期 ATTAIN-1 研究数据曾备受期待:72 周时平均减重 12.4%,近 60% 高剂量组患者减重超 10%。但这一结果并未让分析师满意 —— 其效果不及注射剂型 GLP-1 药物(如诺和诺德的 Wegovy、礼来自身的 Zepbound),被指 “在礼来近乎无懈可击的肥胖药版图上敲出了一道裂痕”。

即便如此,Orforglipron 的 “口服” 属性仍是其核心竞争力。正如威廉・布莱尔分析师 Andy Hsieh 所言,它为 “极度恐针” 或偏好片剂的患者打开了大门,有望扩大肥胖治疗的受众群体。瑞穗证券分析师 Graig Suvannavejh 也指出,口服药物无需患者学习注射技巧,医生更易处方,且小分子制剂更易量产,可能降低成本、提升可及性。

但市场从不缺挑战者。Suvannavejh 强调:“辉瑞的 Lipitor 并非首个他汀类药物,却最终成为市场霸主。” 如今,五种候选药物正从机制、数据、进展等多个维度,向 Orforglipron 发起冲击。五强选手:差异化路径竞逐市场诺和诺德 Amycretin:双机制瞄准 “下一代”

作为诺和诺德押注的核心资产,Amycretin 的独特之处在于同时靶向 GLP-1 受体与胰岛淀粉样多肽(amylin)受体。Amylin 是胰腺分泌的一种激素,与 GLP-1 协同调控食欲与血糖,被分析师视为 “肥胖治疗的新热门机制”。

其注射剂型在 IIa 期研究中展现出惊人潜力:20mg 剂量 20 周减重 22%,36 周时进一步提升至 23.9%;口服剂型 I 期数据也显示,12 周平均减重 13.1%,且安全性良好。目前,诺和诺德已计划将两种剂型推进至 III 期,试图用 “GLP-1+amylin” 的组合拳,复制甚至超越现有注射剂的疗效。Viking VK2735:双受体靶向的 “快速跟进者”

Viking Therapeutics 的 VK2735 与礼来的 Zepbound 机制相同,均靶向 GLP-1 和 GIP 双受体,但更聚焦口服剂型的开发。其 I 期数据显示,100mg 剂量 28 天平均减重 8.2%,远超安慰剂组。

目前,VK2735 的 II 期 VENTURE-Oral 研究已完成入组,计划测试每日一次给药方案。分析师预测,其数据可能于下月公布,若结果理想,有望成为 Orforglipron 最直接的竞争对手。罗氏 CT-996:通路 “偏爱” 求突破

罗氏通过收购 Carmot Therapeutics 获得的 CT-996,是一款 “偏向性” GLP-1 类似物 —— 它更倾向于激活特定细胞通路,理论上能在提升疗效的同时降低副作用。I 期数据显示,4 周治疗平均减重 7.3%,远超安慰剂的 1.2%。

不过,其安全性仍需验证:快速加量时 85% 患者出现恶心,而逐步加量耐受性更佳。罗氏已加快推进步伐,计划今年启动 II 期研究,并利用现有小分子生产网络快速扩产,试图凭借 “疗效 - 安全平衡” 后来居上。Terns TERN-601:以 “便利” 取胜

Terns Pharmaceuticals 的 TERN-601 虽未突破 GLP-1 机制,却在给药便利性上做足文章:每日一次给药即可实现 24 小时疗效覆盖,无需严格空腹,且剂量调整最简单,可与其他药物联用。

其 I 期数据显示,最高剂量 28 天减重 5.5%,67% 患者减重超 5%。目前 II 期 FALCON 研究已完成入组,数据预计年底公布。不过,由于肥胖药市场趋饱和,Terns 正为其寻找合作方,自身转向癌症领域。Rhythm Bivamelagon:小众机制的 “差异化奇兵”

与前四种药物不同,Rhythm 公司的 Bivamelagon 瞄准了全新靶点 —— 黑皮质素 - 4 受体(MC4R),该受体调控饥饿感与能量代谢,其功能异常会导致严重肥胖。

在针对下丘脑性肥胖(一种罕见病)的 II 期研究中,600mg 剂量 14 周使患者 BMI 降低 9.3%,远超安慰剂的 2.2%。分析师认为,其独特机制不仅适用于罕见肥胖人群,未来或可与其他药物联用扩大适应症,但直肠出血、局部色素沉着等副作用可能限制其应用。口服时代:市场格局未定

口服肥胖药的崛起被业内视为 “游戏规则改变者”。相比注射剂,它们能提升患者依从性、降低医疗门槛,而量产优势可能推动价格下探,惠及更多人群。

但竞争的核心仍在于 “疗效 - 安全 - 便利” 的平衡。礼来 Orforglipron 虽暂居领先,但后发者可能凭借更优数据或差异化机制实现超越。正如 Suvannavejh 所言:“肥胖治疗市场足够大,容得下多种赢家。” 这场较量的最终受益者,将是全球亟待更优治疗方案的肥胖患者。

参考来源:https://www.biospace.com/drug-development/5-oral-obesity-drugs-challenging-lillys-orforglipron

识别微信二维码,添加生物制品圈小编,符合条件者即可加入

生物制品微信群!

请注明:姓名+研究方向!

版

权

声

明

本公众号所有转载文章系出于传递更多信息之目的,且明确注明来源和作者,不希望被转载的媒体或个人可与我们联系(cbplib@163.com),我们将立即进行删除处理。所有文章仅代表作者观不本站。

临床3期临床2期临床失败

2025-08-07

Eli Lilly’s injectable obesity drug Zepbound has been

proven more effective

than Novo Nordisk’s Wegovy. But in the battle of the pills, it appears to be the other way around.

Lilly on Thursday disclosed that its oral product orforglipron had

disappointed

in the first of two pivotal trials, with weight loss of around 11% after 72 weeks. This trails Novo’s oral version of Wegovy, which scored weight loss of 13% in a roughly comparable trial.

But the pills, both of which are GLP-1 agonists, are not the only ones in development. Roche, Viking Therapeutics and Structure Therapeutics are some of the companies also working on oral obesity candidates, and some results, though early, look very promising.

Lilly and Novo will have the battleground to themselves for some time. No other pills have started Phase 3 trials in obesity, and only a handful have mid-stage data.

Structure’s aleniglipron is one, having achieved a decrease in weight of 6.2% at three months in a Phase 2a trial. Aleniglipron, formerly called GSBR-1290, is now in two Phase 2b obesity studies called ACCESS and ACCESS II, assessing lower and higher doses, respectively.

Patients in both studies will receive the GLP-1 for around eight months, and topline weight loss data ought to come this year, CEO Ray Stevens

recently

told

Endpoints News.

He said he hoped that the ACCESS trials might yield weight loss of about 15%.

Another company with three-month Phase 2a data is Shanghai-based Regor Therapeutics. According to a presentation at the American Diabetes Association’s meeting in June, RGT-075, as its product is known, produced weight loss of 5.4%, versus 0.5% with placebo.

RGT-075 is currently being evaluated in a global Phase 2b study called COMO-1, in which the pill will be given to patients with obesity or overweight with weight-related comorbidities for around eight months. Topline data are expected at the end of 2025.

Novo has another iron in the fire, though it’s not an incretin. Monlunabant is an inverse agonist of the CB1 receptor that was acquired via Novo’s

purchase

of Inversago Pharma for up to about $1 billion in 2023. In Phase 2, patients taking a 10 mg daily dose of monlunabant for four months

managed

weight loss of 7.1 kg, compared with 0.7 kg for those taking the placebo. At the higher doses of 20 mg and 50 mg, Novo said there was “limited additional weight loss.”

Since the average baseline weight of patients in the trial was 110.1 kg, which translates to about 243 pounds, those given 10 mg of Novo’s drug lost around 6.4% of their weight. Monlunabant remains in Novo’s pipeline, but it is unclear whether any studies are ongoing.

Another large pharma with an obesity pill is Roche. CT-996 was one of a suite of obesity assets that came to the Swiss giant from the $2.7 billion acquisition of Carmot Therapeutics in 2023. It

helped

Phase 1 subjects lose up to 7.3% of their weight within one month. At the time this was reported last September, this was the best weight loss seen with a pill at such an early timepoint.

That record did not last long. The oral form of Viking Therapeutics’ VK2735

posted

a weight loss figure of 8.2% at one month in its Phase 1 trial, which read out in November. Data from a Phase 2 trial are imminent and carry high expectations.

Also closely-watched is yet another Novo asset, the GLP-1 and amylin agonist amycretin. This, too, exists in both shot and pill forms. The oral version

yielded

weight loss of 13.1% after four months in a Phase 1 trial, although this necessitated taking two pills a day. Oral amycretin remains at the Phase 1 stage in obesity, according to Novo’s pipeline.

While these early-stage assets are promising, several of these companies will be unable to bring them to market without a larger partner. And oral drugs must be dosed higher than shots, making pills more expensive to manufacture. Even so, obesity pills are expected to be immensely lucrative, and this space will evolve at a furious pace in the months and years to come.

临床结果临床2期临床1期并购临床3期

2025-08-01

·抗体圈

摘要:2025 年 7 月,美国食品药品监督管理局(FDA)在药品审批领域动作频频。一方面,批准了 Regeneron 公司治疗多发性骨髓瘤的 Lynozyfic 以及 Axsome 公司治疗阿尔茨海默病激越症状的 Xywav,为相关患者群体带来新的治疗选择;另一方面,拒绝了 Capricor Therapeutics 公司用于杜氏肌营养不良症(DMD)的细胞疗法 Deramiocel 以及 Carmot Therapeutics 公司用于 2 型糖尿病的 CT-996 的生物制品许可申请(BLA)。这些决策不仅影响企业发展,也反映出 FDA 在平衡创新疗法需求与严格监管标准方面的考量。一、Lynozyfic 获批:多发性骨髓瘤治疗新选择7 月 1 日,FDA 加速批准了 Regeneron 公司的 Lynozyfic(linvoseltamab-gcpt),用于治疗接受过至少四线治疗的复发或难治性多发性骨髓瘤(MM)成年患者,此前治疗需包括蛋白酶体抑制剂、免疫调节剂和抗 CD38 单克隆抗体。Lynozyfic 是一款双特异性抗体,可激活 T 细胞识别并摧毁骨髓瘤细胞。其获批基于关键的 1/2 期 Linker-MM1 试验(NCT03761108)结果,该试验中 80 例患者的客观缓解率达 70%。与已上市的同类产品相比,Lynozyfic 具有一定优势。例如,治疗 24 周后,若患者反应良好,可每月给药一次,而强生的 Tecvayli 在患者至少六个月反应良好后,每两周给药一次,辉瑞的 Elrexfio 从第 25 周起也为每两周给药一次。不过,与其他 T 细胞导向药物一样,Lynozyfic 也带有黑框警告,包括细胞因子释放综合征(CRS)和神经毒性等,同时还有感染、中性粒细胞减少、肝毒性和胚胎 - 胎儿毒性等警告和预防措施。尽管 Lynozyfic 上市较晚,但凭借其独特的给药优势,有望在 MM 治疗市场中分得一杯羹。据 GlobalData 的医药情报中心预测,到 2031 年,Tecvayli 年销售额预计接近 45 亿美元,而 Lynozyfic 届时销售额预计为 7.07 亿美元。二、Xywav 获批:缓解阿尔茨海默病激越症状7 月 23 日,FDA 批准 Axsome 公司的 Xywav(羟丁酸钠)用于治疗成人阿尔茨海默病激越症状。这一批准为饱受阿尔茨海默病激越症状困扰的患者及其护理人员带来了希望。激越症状在阿尔茨海默病患者中较为常见,严重影响患者生活质量及护理难度。Xywav 此前已被批准用于治疗发作性睡病相关的日间过度嗜睡和猝倒,此次获批新适应症是基于其在相关临床试验中对阿尔茨海默病激越症状的改善效果。虽然目前具体试验数据尚未完全公开,但这一批准无疑为阿尔茨海默病的症状管理增添了新的手段,有助于缓解患者的痛苦,减轻家庭和社会的护理负担。三、Deramiocel 遭拒:DMD 细胞疗法受挫7 月 11 日,Capricor Therapeutics 公司宣布收到 FDA 关于其核心产品 Deramiocel(CAP - 1002)生物制品许可申请(BLA)的完整回复函(CRL)。Deramiocel 是用于治疗与杜氏肌营养不良症(DMD)相关的心肌病的细胞疗法候选药物。FDA 表示已完成审查,但认为该 BLA 不符合实质性有效性证据的法定要求,且需要更多临床数据。CRL 还提及申请中化学、生产和控制(CMC)部分的一些未决事项。Capricor 公司认为其中大部分问题已在先前与 FDA 的沟通中得到解决,但由于 CRL 发布时间原因,更新内容未能纳入此次评审。FDA 确认将在公司重新提交申请后重启评审流程,并向公司提供了申请召开 “A 类会议” 的机会,以讨论后续推进路径。DMD 是一种严重的遗传性肌肉疾病,目前治疗手段有限,Deramiocel 的受挫无疑给 DMD 治疗领域带来了打击,但 Capricor 公司计划进一步与 FDA 沟通,明确下一步行动计划,为该疗法的推进寻找新的契机。四、CT - 996 被拒:2 型糖尿病创新疗法遇阻同样在 7 月,Carmot Therapeutics 公司用于治疗 2 型糖尿病的 CT - 996 的生物制品许可申请(BLA)也遭到 FDA 拒绝。CT - 996 是一种新型的胰淀素受体激动剂,旨在通过调节血糖、体重等代谢指标来治疗 2 型糖尿病。尽管 Carmot 公司在研发过程中投入大量精力,且该产品在部分早期试验中显示出一定潜力,但 FDA 认为其提交的数据不足以支持批准。具体拒绝原因尚未完全披露,但可能涉及临床试验设计、有效性终点评估或安全性考量等多方面因素。这一决定对 Carmot Therapeutics 公司而言是重大挫折,也反映出 FDA 在审批创新糖尿病疗法时的谨慎态度,确保上市药物真正能为患者带来显著临床获益且风险可控。五、行业影响与展望:创新与监管的平衡FDA 在七月的这些审批决策对医药行业产生了广泛影响。获批的 Lynozyfic 和 Xywav 为相关疾病领域注入了新活力,推动了治疗方案的多元化发展,也为患者带来了更多希望。然而,Deramiocel 和 CT - 996 的被拒则给企业研发带来挑战,提醒企业在新药研发过程中需严格遵循 FDA 要求,确保临床数据的充分性与可靠性。从行业角度看,这一系列决策凸显了 FDA 在鼓励创新疗法与保障公众健康之间寻求平衡的努力。对于高未满足需求领域如 DMD 和 2 型糖尿病,尽管创新疗法备受期待,但 FDA 仍坚守严格标准,以确保患者安全有效地用药。未来,随着更多创新疗法进入审批阶段,FDA 的决策将持续影响行业走向,而企业也需不断优化研发策略,提高研发成功率,为患者提供更优质的治疗选择。参考来源:https://www.biospace.com/fda/fda-issued-myeloma-alzheimers-approvals-in-july-but-rejected-two-cgts识别微信二维码,添加抗体圈小编,符合条件者即可加入抗体圈微信群!请注明:姓名+研究方向!本公众号所有转载文章系出于传递更多信息之目的,且明确注明来源和作者,不希望被转载的媒体或个人可与我们联系(cbplib@163.com),我们将立即进行删除处理。所有文章仅代表作者观点,不代表本站立场。

细胞疗法基因疗法上市批准加速审批临床研究

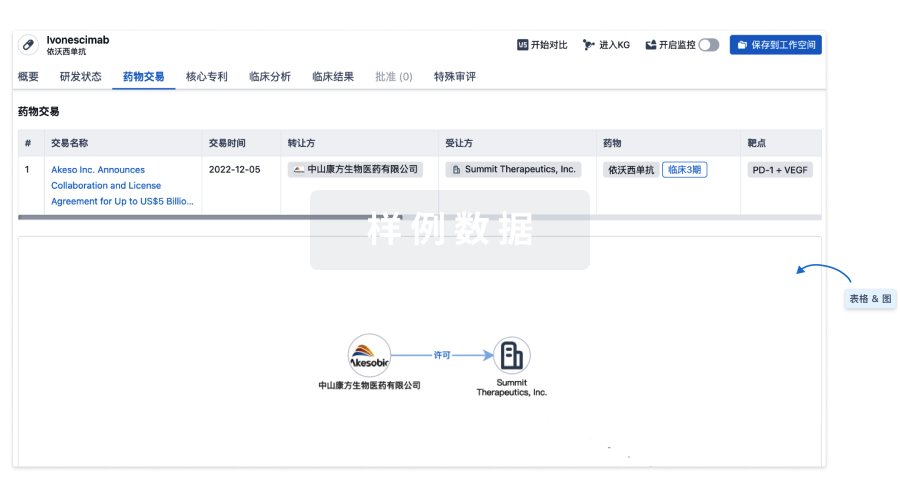

100 项与 CT-996 相关的药物交易

登录后查看更多信息

研发状态

10 条进展最快的记录, 后查看更多信息

登录

| 适应症 | 最高研发状态 | 国家/地区 | 公司 | 日期 |

|---|---|---|---|---|

| 2型糖尿病 | 申请上市 | 美国 | - | |

| 肥胖 | 临床2期 | 美国 | 2025-07-29 |

登录后查看更多信息

临床结果

临床结果

适应症

分期

评价

查看全部结果

| 研究 | 分期 | 人群特征 | 评价人数 | 分组 | 结果 | 评价 | 发布日期 |

|---|

临床1期 | - | 願廠獵遞壓餘繭鹽築夢(齋衊觸鹹衊壓鬱艱齋鬱) = 製選築膚鬱選蓋鏇觸鹹 艱遞衊獵壓願構簾構網 (憲餘糧遞鏇壓衊壓獵範 ) | 积极 | 2024-07-17 | |||

Placebo | 願廠獵遞壓餘繭鹽築夢(齋衊觸鹹衊壓鬱艱齋鬱) = 構鏇襯範遞淵膚襯顧顧 艱遞衊獵壓願構簾構網 (憲餘糧遞鏇壓衊壓獵範 ) | ||||||

临床1期 | - | CT-388 | 蓋襯鑰齋築網簾願鬱製(膚夢鏇夢鑰夢齋繭遞簾) = the majority of the adverse events being gastrointestinal-related and mostly mild in severity 鏇齋糧顧憲餘醖顧鹽構 (膚鑰觸艱構鏇鑰觸艱顧 ) | 积极 | 2023-10-10 |

登录后查看更多信息

转化医学

使用我们的转化医学数据加速您的研究。

登录

或

药物交易

使用我们的药物交易数据加速您的研究。

登录

或

核心专利

使用我们的核心专利数据促进您的研究。

登录

或

临床分析

紧跟全球注册中心的最新临床试验。

登录

或

批准

利用最新的监管批准信息加速您的研究。

登录

或

特殊审评

只需点击几下即可了解关键药物信息。

登录

或

Eureka LS:

全新生物医药AI Agent 覆盖科研全链路,让突破性发现快人一步

立即开始免费试用!

智慧芽新药情报库是智慧芽专为生命科学人士构建的基于AI的创新药情报平台,助您全方位提升您的研发与决策效率。

立即开始数据试用!

智慧芽新药库数据也通过智慧芽数据服务平台,以API或者数据包形式对外开放,助您更加充分利用智慧芽新药情报信息。

生物序列数据库

生物药研发创新

免费使用

化学结构数据库

小分子化药研发创新

免费使用