预约演示

更新于:2025-10-28

Salanersen

更新于:2025-10-28

概要

基本信息

非在研机构- |

最高研发阶段临床3期 |

首次获批日期- |

最高研发阶段(中国)- |

特殊审评孤儿药 (美国) |

登录后查看时间轴

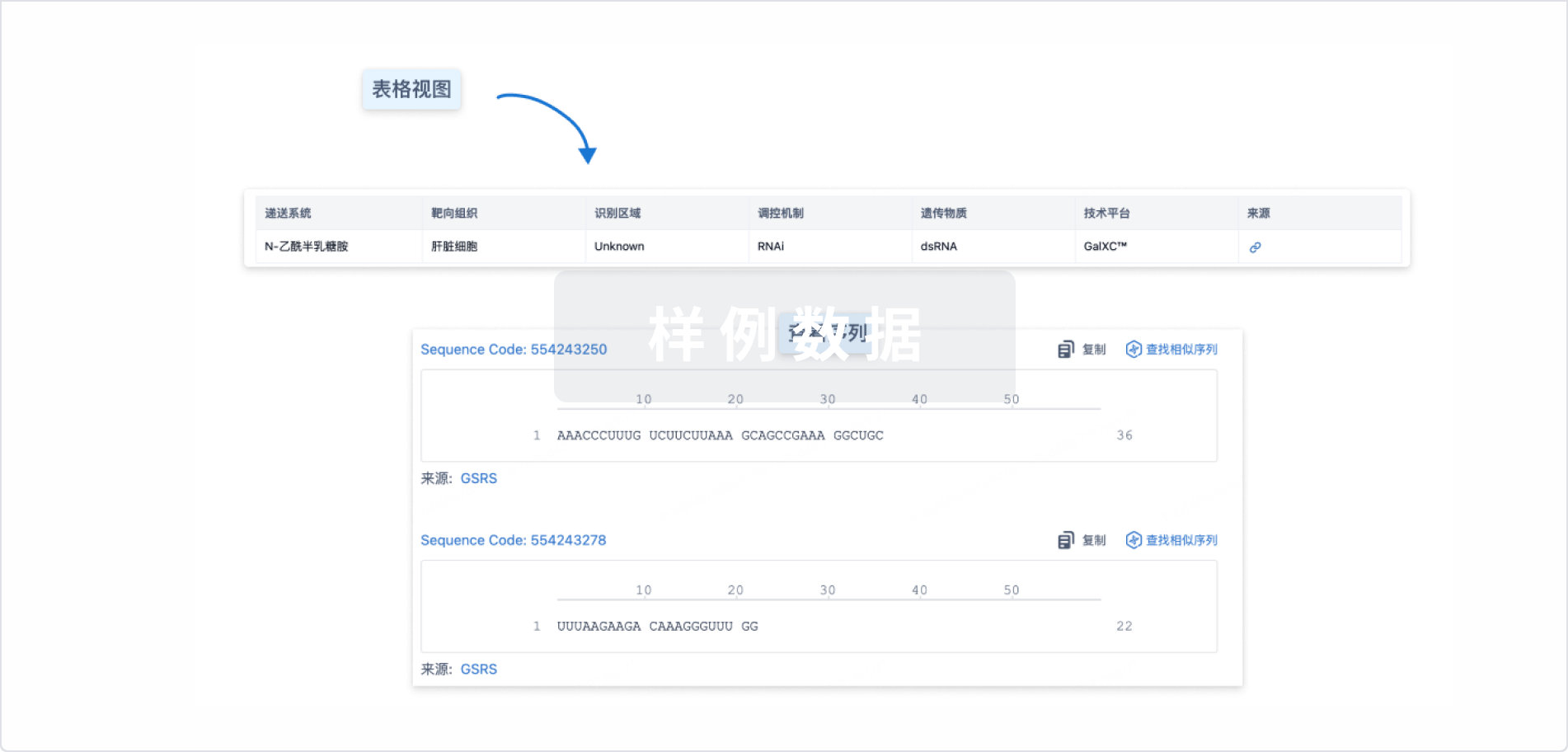

结构/序列

使用我们的RNA技术数据为新药研发加速。

登录

或

Sequence Code 32859106

来源: *****

关联

2

项与 Salanersen 相关的临床试验NCT07221669

An Open-Label Study to Assess the Efficacy and Safety of Multiple Doses of Salanersen (BIIB115) Delivered Intrathecally to Treatment-Naïve, Presymptomatic Infants With Genetically Diagnosed Spinal Muscular Atrophy

In this study, researchers will learn more about the effects and safety of BIIB115, also known as salanersen.

Specifically, researchers will learn more about how salanersen works in babies who have been diagnosed with SMA through genetic testing but have not yet started showing signs or symptoms. Most people with SMA have changes in a gene called survival motor neuron 1, also known as SMN1. These changes lower the amount of SMN protein in their bodies. Without enough of this protein, motor neurons and muscles cannot work properly. A similar gene called SMN2 can help replace some of the lost SMN protein in the body. Salanersen works by helping the SMN2 gene to make more SMN protein.

In this study, participants will have either 2 SMN2 copies or 3 SMN2 copies. The higher the copy number, the less severe the participant's SMA is.

The main goal of this study is to see if starting salanersen before signs or symptoms appear can prevent signs or symptoms of SMA or make them less severe. Researchers will use different tests to learn if motor symptoms are changing, including the World Health Organization (WHO) motor milestones.

The main questions researchers want to answer in this study are:

* How many participants with 2 copies of the SMN2 gene can sit without support at 12 months?

* How many participants with 3 copies of the SMN2 gene can walk alone at 18 months?

Researchers will also learn more about:

* The effects on participants' motor symptoms and how many new movement milestones participants achieve.

* How many participants stay free of SMA symptoms

* How much salanersen gets into the fluid surrounding the brain and spinal cord.

* How much salanersen gets into the blood.

* How many participants have adverse events or serious adverse events. Adverse events are health problems that may or may not be caused by the study drug.

This study will be done as follows:

* First, participants will be screened to check if they can join the study. The screening period will be up to 28 days.

* This is an "open label" study. This is a study in which the participants, study doctor, and site staff know which study drug participants are receiving. In this study, all participants will receive salanersen through an intrathecal injection, or one that is given into the fluid surrounding the brain and spinal cord.

* There will be 2 parts in this study. During Part 1, participants will receive 2 doses of salanersen, about 12 months apart from each other. Part 1 will last up to 25 months.

* During Part 2, participants will continue to receive salanersen. They will receive up to 3 doses, 12 months apart from each other. Part 2 will last up to 36 months.

* During Part 1, participants will have up to 11 clinic visits and up to 3 phone calls. During Part 2, participants will have up to 7 clinic visits and up to 12 phone calls.

Specifically, researchers will learn more about how salanersen works in babies who have been diagnosed with SMA through genetic testing but have not yet started showing signs or symptoms. Most people with SMA have changes in a gene called survival motor neuron 1, also known as SMN1. These changes lower the amount of SMN protein in their bodies. Without enough of this protein, motor neurons and muscles cannot work properly. A similar gene called SMN2 can help replace some of the lost SMN protein in the body. Salanersen works by helping the SMN2 gene to make more SMN protein.

In this study, participants will have either 2 SMN2 copies or 3 SMN2 copies. The higher the copy number, the less severe the participant's SMA is.

The main goal of this study is to see if starting salanersen before signs or symptoms appear can prevent signs or symptoms of SMA or make them less severe. Researchers will use different tests to learn if motor symptoms are changing, including the World Health Organization (WHO) motor milestones.

The main questions researchers want to answer in this study are:

* How many participants with 2 copies of the SMN2 gene can sit without support at 12 months?

* How many participants with 3 copies of the SMN2 gene can walk alone at 18 months?

Researchers will also learn more about:

* The effects on participants' motor symptoms and how many new movement milestones participants achieve.

* How many participants stay free of SMA symptoms

* How much salanersen gets into the fluid surrounding the brain and spinal cord.

* How much salanersen gets into the blood.

* How many participants have adverse events or serious adverse events. Adverse events are health problems that may or may not be caused by the study drug.

This study will be done as follows:

* First, participants will be screened to check if they can join the study. The screening period will be up to 28 days.

* This is an "open label" study. This is a study in which the participants, study doctor, and site staff know which study drug participants are receiving. In this study, all participants will receive salanersen through an intrathecal injection, or one that is given into the fluid surrounding the brain and spinal cord.

* There will be 2 parts in this study. During Part 1, participants will receive 2 doses of salanersen, about 12 months apart from each other. Part 1 will last up to 25 months.

* During Part 2, participants will continue to receive salanersen. They will receive up to 3 doses, 12 months apart from each other. Part 2 will last up to 36 months.

* During Part 1, participants will have up to 11 clinic visits and up to 3 phone calls. During Part 2, participants will have up to 7 clinic visits and up to 12 phone calls.

开始日期2026-01-30 |

申办/合作机构 |

NCT05575011

A Randomized, Blinded, Placebo-Controlled, Phase 1 Single Ascending Dose Study in Healthy Adult Male Volunteers and an Open-Label Multiple Ascending Dose Study With Long-Term Extension in Pediatric SMA Participants Previously Treated With Onasemnogene Abeparvovec (Zolgensma™) to Evaluate the Safety, Tolerability, and Pharmacokinetics of BIIB115

In this study, researchers will learn about a study drug called BIIB115 in healthy adult male volunteers and in participants with spinal muscular atrophy (SMA). This study will focus on children with SMA.

The main objective of the study is to learn about the safety of BIIB115 and how participants respond to different doses of BIIB115. The main question researchers want to answer is:

• How many participants have adverse events and serious adverse events during the study?

Adverse events are unwanted health problems that may or may not be caused by the study drug.

Researchers will also learn about how the body processes BIIB115. They will do this by measuring the levels of BIIB115 in both the blood and the cerebrospinal fluid, also known as the CSF. This is the fluid around the brain and spinal cord.

The study will be split into 2 parts - Part A and Part B.

During Part A:

* After screening, healthy volunteers will be randomly placed into 1 of 4 groups to receive either BIIB115 or a placebo. A placebo looks like the study drug but contains no real medicine.

* Participants will receive a single dose of either BIIB115 or the placebo as an injection directly into the spinal canal on Day 1.

* Neither the researchers nor the participants will know if the participants will receive BIIB115 or the placebo.

* The Part A treatment and follow-up period will last for 13 months.

* Participants will have up to 6 clinic visits and 4 phone calls.

During Part B:

* After screening, children with SMA will be placed into 1 of 2 groups to receive BIIB115.

* The doses of each group will be decided based on the results of Part A.

* Both researchers and participants will know they are receiving BIIB115.

* Participants will first receive 2 total doses of BIIB115 given at 2 different times.

* The Part B treatment and follow-up period will last for 24 months.

* Participants will have up to 14 clinic visits and 6 phone calls.

Part B Long-Term Extension:

* After completing the 25 months in Part B, participants may move onto the long-term extension (LTE).

* They will receive 5 more doses of BIIB115 at different times.

* The Part B LTE treatment and follow-up will last for 60 months.

* Participants will have up to 12 more clinic visits and 19 phone calls. In both Part A and Part B, participants will stay in the clinic for 24 hours after each dose so that researchers can check on their health. This 24-hour stay will not be required for the Part B LTE period.

The main objective of the study is to learn about the safety of BIIB115 and how participants respond to different doses of BIIB115. The main question researchers want to answer is:

• How many participants have adverse events and serious adverse events during the study?

Adverse events are unwanted health problems that may or may not be caused by the study drug.

Researchers will also learn about how the body processes BIIB115. They will do this by measuring the levels of BIIB115 in both the blood and the cerebrospinal fluid, also known as the CSF. This is the fluid around the brain and spinal cord.

The study will be split into 2 parts - Part A and Part B.

During Part A:

* After screening, healthy volunteers will be randomly placed into 1 of 4 groups to receive either BIIB115 or a placebo. A placebo looks like the study drug but contains no real medicine.

* Participants will receive a single dose of either BIIB115 or the placebo as an injection directly into the spinal canal on Day 1.

* Neither the researchers nor the participants will know if the participants will receive BIIB115 or the placebo.

* The Part A treatment and follow-up period will last for 13 months.

* Participants will have up to 6 clinic visits and 4 phone calls.

During Part B:

* After screening, children with SMA will be placed into 1 of 2 groups to receive BIIB115.

* The doses of each group will be decided based on the results of Part A.

* Both researchers and participants will know they are receiving BIIB115.

* Participants will first receive 2 total doses of BIIB115 given at 2 different times.

* The Part B treatment and follow-up period will last for 24 months.

* Participants will have up to 14 clinic visits and 6 phone calls.

Part B Long-Term Extension:

* After completing the 25 months in Part B, participants may move onto the long-term extension (LTE).

* They will receive 5 more doses of BIIB115 at different times.

* The Part B LTE treatment and follow-up will last for 60 months.

* Participants will have up to 12 more clinic visits and 19 phone calls. In both Part A and Part B, participants will stay in the clinic for 24 hours after each dose so that researchers can check on their health. This 24-hour stay will not be required for the Part B LTE period.

开始日期2022-10-10 |

申办/合作机构 |

100 项与 Salanersen 相关的临床结果

登录后查看更多信息

100 项与 Salanersen 相关的转化医学

登录后查看更多信息

100 项与 Salanersen 相关的专利(医药)

登录后查看更多信息

17

项与 Salanersen 相关的新闻(医药)2025-09-23

With competition heating up in the spinal muscular atrophy (SMA) space, Biogen has been hoping FDA approval of a new dosing regimen for Spinraza (nusinersen) could help refresh interest in the antisense oligonucleotide (ASO) — but its market plans have been put on pause after the US regulator declined to greenlight the supplemental application. Biogen said Tuesday that it received a complete response letter (CRL) for a high-dose Spinraza regimen that would lower the number of loading doses to two, rather than four, followed by higher maintenance doses every four months.The letter did not flag any problems with Spinraza's data package, Biogen said, which was based on results from the Phase II/III DEVOTE study, shared at last year's World Muscle Society (WMS) meeting. The trial met its primary endpoint in treatment-naïve, symptomatic infants, who achieved significantly greater improvements in motor function than untreated matched controls.Instead, the FDA is requesting a technical information update be included in the chemistry, manufacturing and controls (CMC) portion of the drug's application. Issues related to CMC are the most frequent reason for an FDA rejection, a recent FirstWord analysis found. The agency in July posted a batch of CRLs associated with more than 200 new drug applications, and deficiencies at manufacturing facilities or subpar quality of the manufactured drug product led to a combined 60% of all rejections (see – Vital Signs: What we learned from the FDA's CRL data dump).Luckily for Biogen, the fix appears to be easy — it said the FDA has shared options to resolve the application's issue, with a resubmission planned "promptly.""While this outcome was unexpected, we remain committed to bringing the high dose regimen to people living with SMA," said Priya Singhal, head of development at Biogen. The company noted that high-dose Spinraza was recently approved in Japan, and it's currently under review in the EU. High-dose Spinraza was one of two new SMA options expected to win FDA approval this week — and Scholar Rock's entrant, apitegromab, met a similar fate to Biogen's ASO (see – Spotlight On: How will newcomers reshape the SMA market?).Separately on Tuesday, the US regulator issued a CRL to Scholar Rock's application for apitegromab, citing CMC issues. The letter identified problems with Catalent's Indiana fill-finish facility, and were not specific to the antibody. Once the issues at the facility have been addressed, Scholar Rock said it will resubmit its application for apitegromab with the hope that the FDA "will be able to act expeditiously" on the re-filing.If Biogen and Scholar Rock are successful with their resubmissions, their products will compete with Roche's oral small molecule Evrysdi (risdiplam), which has charted a steep growth trajectory since its launch in mid-2020. Last year, the more conveniently-dosed oral drug posted higher revenue figures than both the standard dosing regimen of Spinraza and Novartis' gene therapy Zolgensma (onasemnogene abeparvovec) (see – Vital Signs: Roche outmanoeuvres another gene therapy).Biogen and partner Ionis Pharmaceuticals also have another SMA shot-on-goal in the works. Registrational studies are being prepped for salanersen after Phase I data for the ASO — administered intrathecally once per year — demonstrated that it can slow neurodegeneration in patients previously treated with Zolgensma.

基因疗法临床1期上市批准寡核苷酸

2025-08-19

·医药观澜

编者按:每年8月是国际SMA关爱月。脊髓性肌萎缩症(SMA)是一种遗传性神经肌肉病,以肌无力和肌萎缩为主要临床特征。该病致残、致死率高,一度“无药可治”。随着产业界的不懈努力,近年多款新药接连问世,为患者带来“新生”。为了实现更高的治疗甚至治愈目标,科学界还在探索更多的创新疗法。作为全球医药及生命科学行业创新的赋能者,药明康德多年来也一直在支持包括SMA在内的各类罕见病新药的开发,以一体化、端到端的CRDMO服务平台,助力全球合作伙伴加速新药问世、造福病患。

脊髓性肌萎缩症(SMA)是一种遗传性神经肌肉病,病症表现为进行性肌肉萎缩、无力和瘫痪。根据今年3月份的文献报道,全球SMA发病率约为每12万人中10例。根据严重程度或发病年龄、基因型等可将SMA分为四种亚型(SMA1-4),最严重的SMA1型为宫内发病,历史数据显示该群体预期寿命不足两年。其他基因型的患者则分别在不同年龄发病。

SMA是由于运动神经元存活基因1(SMN1)基因中出现基因变异,导致无法生成足够的运动神经元生存(SMN)蛋白,而SMN蛋白对维持运动神经元的存活至关重要。得益于疾病机制的确定,SMA新药研发领域在过去10年里不断取得重大突破。目前美国FDA已经批准了3款针对SMA的创新疗法,包括反义寡核苷酸疗法Spinraza、基因疗法Zolgensma、小分子药物Evrysdi。这些疾病修饰疗法改变了以往SMA只能采取姑息治疗的格局,为患者及其家庭带来重生希望。同时为实现更好的治疗效果,当下全球范围内还有数十款SMA新药在研。

今年上半年,SMA新药研发领域也迎来多项重要进展,多款新药冲刺或获批上市:

图片来源:123RF

2月,罗氏(Roche)宣布FDA已批准其Evrysdi(risdiplam)片剂的新药申请,用于治疗SMA患者。Evrysdi是一种靶向SMN2基因的小分子mRNA剪接调节剂,可提高全身多系统SMN蛋白水平, 缓解SMA患者的症状。该产品的口服液剂型已经于2020年8月获FDA批准治疗2个月以上婴幼儿和成人SMA患者,本次获批的口服药片剂型则为患者用药提供了更多用药便利。《新英格兰医学杂志》还于今年2月发表了一项研究,介绍了全球首例在SMA患儿出生之前,在母体子宫内使用Evrysdi治疗的案例。这名患儿在出生两年多后,尚未观察到任何可识别的SMA病征。研究人员表示,这一研究结果显示了产前治疗SMA的可行性。

3月,Scholar Rock公司宣布其在研SMA抗体疗法apitegromab的生物制品许可申请(BLA)已经获得FDA受理并授予优先审评资格,预计在今年9月22日之前完成审评。Apitegromab通过选择性结合骨骼肌中肌生成抑制蛋白(myostatin)的前体及潜在形式抑制其激活,代表了一种创新的肌肉靶向疗法。myostatin是调节骨骼肌生长和强度的关键负调节因子。

同样在3月,诺华(Novartis)宣布其采用鞘内注射的onasemnogene abeparvovec(OAV101 IT),在针对2岁至<18岁SMA患者群体的3期临床研究中显示出积极的安全性和疗效结果。诺华已经在美国和欧盟递交该产品的监管申请。该疗法利用腺相关病毒载体将SMN1转基因递送到运动神经元中,可直接针对疾病的遗传根本原因。此前,采用一次性静脉注射的OAV101(即Zolgensma)已经于2019年5月获FDA批准上市,治疗2岁以下的SMN1双等位基因突变的SMA患者。

6月,渤健(Biogen)公布了反义寡核苷酸(ASO)疗法salanersen治疗SMA的1期临床研究中期分析结果,研究对象为一组既往接受过基因治疗但临床状态仍不理想的SMA患儿。结果显示,该产品可显著降低神经退行性标志物神经丝轻链(NfL)的水平,治疗6个月后基线NfL浓度较高的患者平均NfL下降幅度达70%,且这一效果可持续维持至一年。渤健正与计划推进该产品进入注册性临床研究阶段。

这些进展提示SMA治疗有望在近期迎来新突破,患者将有望迎来更多治疗选择。

图片来源:123RF

治疗SMA,寡核苷酸疗法率先突破

在SMA治疗领域,寡核苷酸药物是率先获批的药物类型。2016年底,SMA治疗迎来重要里程碑:Spinraza获批上市,成为FDA批准的首款治疗SMA的创新疗法。这款由渤健和Ionis Pharmaceuticals联合开发的靶向SMN2基因的ASO类疾病修饰治疗药物,通过鞘内注射直接作用于脊髓运动神经元,通过与SMN2基因转录形成的mRNA相结合,改变RNA的剪接过程,从而增加正常SMN蛋白的表达量。该疗法于2018年获得了国际盖伦奖(Prix Galien USA Awards)最佳生物技术产品奖。于2019年公布的长期疗效数据显示,经过长达45.1个月的随访和数据分析,Spinraza能够帮助婴儿达到疾病自然发展历史上无法达到的运动能力里程碑,其中包括100%的儿童能够不需协助坐起来,88%的儿童能够自主行走。

除了Spinraza,全球范围内还有一些寡核苷酸疗法正在被探索治疗SMA,靶点主要包括SMN,还有一些近年来被发现为SMA调控基因的靶点(比如NCALD)。

公开资料显示,对于包括SMA在内的神经退行性疾病,治疗困难的主要原因之一在于难以直接靶向引发疾病的遗传因素。ASO疗法通过与编码蛋白的mRNA或mRNA前体结合,促使mRNA降解或调控其前体的剪接过程,为精准靶向神经退行性疾病的遗传根源提供了有效途径。迄今为止,FDA批准的11款ASO疗法中,有4款用于治疗神经退行性疾病,显示出ASO疗法在延缓甚至逆转神经疾病病程方面的巨大潜力。

需要提到的是,天然的寡核苷酸极易被人体内的酶降解,因此在临床应用中面临较大挑战。近年来,研发界对ASO的化学修饰显著提高了药物的亲和力、效力和稳定性。然而,这些复杂的修饰工艺也为ASO药物的合成带来了新的技术难题。作为医药创新的赋能者,药明康德旗下WuXi TIDES的寡核苷酸平台针对性地提供从药物发现到商业化生产的一体化CRDMO服务。药物发现阶段的合成服务支持高通量库合成和定制合成,涵盖多种类型的寡核苷酸及其单体、连接子、配体和偶联物,助力合作伙伴快速推进临床前研究。同时,可无缝衔接到工艺开发阶段,放大到任何规模(mmol到mol),充分满足从临床前、临床到商业化阶段的需求。

在某项目中,WuXi TIDES各团队高效协作,帮助合作伙伴在12个月内完成了先导化合物的优化、工艺开发及GMP生产,同时帮助合作伙伴基于数据进行快速决策,选出综合效力、稳定性和开发潜力俱佳的ASO候选化合物,为后续临床研究奠定了坚实基础。随着越来越多的ASO药物进入临床开发,这种产业协同模式将成为加快研发步伐的重要推动力。

数十款SMA新药在研,多类创新疗法受关注

除了ASO寡核苷酸药物,全球范围内还有数十款SMA在研新药,其中少数几款已经进入后期临床研究阶段。这些药物的类型主要涵盖小分子、抗体和基因治疗药物等。

在小分子药物领域,有一些新靶点正在被探索SMA治疗潜力。比如NMD Pharma在研的氯离子通道(ClC-1)抑制剂NMD670正在针对SMA开展2期临床研究,临床前研究表明,抑制ClC-1可以增强神经肌肉传递,最终增强骨骼肌功能。

在抗体药物领域,肌肉靶向疗法正在被广泛关注。Biohaven公司开发的肌生成抑制蛋白(myostatin)拮抗剂和激活素1型受体抑制剂taldefgrobep alfa目前已进入3期临床研究阶段;罗氏在研的抗myostatin单抗GYM329(RG-70240)联合利司扑兰治疗SMA的3期临床试验正在进行中。此外,来凯医药在研的Act RIIA / IIB双靶点单克隆抗体LAE123也在临床前研究中显示治疗SMA的潜力,研究表明ActRIIA是肌肉增长和脂肪减少的主要调控靶点。

突破罕见病新药研发困局,一体化CRDMO平台提供赋能支持

SMA是少数幸运的、已拥有针对性疗法的罕见病类型之一。而放眼更广泛的罕见病新药开发领域,挑战依然存在。根据世界卫生组织统计,全球约有6000多种罕见病,患者总数超3亿人,目前仅不到5%的罕见病有治疗方法。罕见病药物的研发面临患者群体小、研发成本高、技术难度大等诸多挑战,需要创新生物医药生态圈的共同努力。

作为创新的推动者、客户信赖的合作伙伴以及全球健康产业的贡献者,药明康德多年来通过其一体化、端到端的CRDMO新药研发平台,通过技术创新、高效协同和全链条服务,为合作伙伴的罕见病新药研发提供强有力的支持。

罕见病药物的研发往往始于对疾病机制的深入理解。公开信息显示,药明康德生物学业务早在2016年就上线了罕见病平台,专注于罕见病药物研发的早期阶段。该平台覆盖了罕见病药物研发的全路线,提供包括罕见病体内外模型构建,以及体内、外的药理药效研究一站式服务,涵盖了血液疾病、代谢类疾病、免疫类疾病和精神类疾病等研发领域,助力各类罕见病药物的早期研发。

图片来源:123RF

药明康德测试事业部也持续赋能客户开展罕见病新药研发IND工作和非临床研究工作。以神经系统类罕见病疗法“穿透血脑屏障”这一行业挑战为例,在这一领域,药明康德DMPK自2009年起开始进行中枢神经系统相关研究,拥有超过15年的临床前中枢神经系统药物研发经验,建立了针对这类药物体外血脑屏障通透性评价的特色且准确性较高的“漏斗”模型。通过完善的体外、体内测试平台,药明康德DMPK能够快速、准确、高效地对中枢神经系统药物进行全方位药代动力学相关评价,筛选出具有良好的脑通透性及稳定性的中枢神经系统候选药物。根据早前公开信息,该平台已完成包括常规小分子、治疗性蛋白、寡核苷酸等新分子实体类型项目百余项,成功助力全球客户多个中枢神经系统药物进入临床阶段。

罕见病药物的研发不仅需要科学突破,还需要高效的工艺开发能力,以应对临床阶段的复杂挑战。药明康德子公司合全药业在这一领域展现了强大的赋能能力。基于质量源于设计(QbD)的理念,合全药业的研发团队能够快速推进药物工艺的开发和安全放大,在保障产品质量的同时,显著降低成本。

这些平台共同构成了药明康德在罕见病药物研发领域的强大引擎,助力合作伙伴加速新药研发进程,为全球罕见病患者带来更多的治疗选择。药明康德的赋能不仅限于技术支持,还体现在其全球化的合作网络中。通过与全球药企、生物技术公司和研究机构的紧密合作,药明康德持续助力罕见病新药走向世界。

在人类与疾病的漫长斗争中,科学创新始终是照亮希望的火炬。SMA从无药可用到多款突破性疗法相继问世的十年历程,生动诠释了新药研发如何重塑罕见病患者的生命轨迹。我们期待更多罕见病将迎来治疗曙光,更多的罕见病不再“罕治”!

参考资料:

[1]Nikunja Kishor Mishra.(2025) Spinal Muscular Atrophy (SMA): Treatment strategies, challenges and future prospects.Pharmacological Research - Reports.Doi:https://doi-org.libproxy1.nus.edu.sg/10.1016/j.prerep.2025.100031

版权说明:本文欢迎个人转发至朋友圈,谢绝媒体或机构未经授权以任何形式转载至其他平台。转载授权或其他合作需求,请联系wuxi_media@wuxiapptec.com。

免责声明:本文仅作信息交流之目的,文中观点不代表药明康德立场,亦不代表药明康德支持或反对文中观点。本文也不是治疗方案推荐。如需获得治疗方案指导,请前往正规医院就诊。

优先审批寡核苷酸上市批准信使RNA基因疗法

2025-08-05

·药事纵横

8月2日,中国国家药监局药品审评中心(CDE)官网公示显示,诺华公司Onasemnogene abeparvovec鞘内注射液(商品名:Zolgensma)的上市申请已获正式受理。这款革命性基因疗法此前已被纳入优先审评,拟用于治疗6月龄及以上5q型脊髓性肌萎缩症(SMA)患者。

Zolgensma是全球首个获批治疗SMA的一次性基因疗法,2019年5月在美国上市时曾因212.5万美元的定价引发全球关注,此次在华申报意味着中国SMA患者将有机会获得这种“一针治愈”的创新治疗选择。

致命遗传病杀手

脊髓性肌萎缩症(SMA)被称为“2岁以下婴幼儿头号遗传病杀手”。这是一种由体内的SMN1基因和SMN2基因突变引起的遗传性神经肌肉疾病。患者主要表现为全身肌肉萎缩无力,身体逐渐丧失各种运动功能,包括呼吸和吞咽能力,严重情况下会导致死亡。

5q型SMA是该疾病最常见的形式,约占所有SMA病例的95%。作为一种在患儿出生之前就可能受累的进行性神经退行性疾病,SMA给无数家庭带来了沉重的经济与精神负担。

基因治疗的突破

Zolgensma代表了一种全新的治疗模式——基因替代疗法。其作用机制是通过病毒载体将外源性基因导入宿主体内,使外源性基因在宿主细胞内表达目的蛋白,从而治疗疾病。

该药物采用腺相关病毒载体(AAV),这是一种小型非致病性病毒,可靶向运动神经元和星形胶质细胞,有效感染整个中枢神经系统。其中使用的自身互补型腺相关病毒9(scAAV9)亚型具有突破血脑屏障的能力,可通过静脉注射导入宿主体内,且不整合至宿主基因组,安全性较高。

Zolgensma的核心优势在于其“一次性治疗,终身受益”的特点。它将正常拷贝的SMN1基因传递到肌肉细胞,使得基因改造后的肌肉细胞能够持续产生全长SMN蛋白,从而恢复患者的正常肌肉功能。

Zolgensma的鞘内注射剂型通过下背部直接注射到脑脊液中给药,这一创新给药方式突破了传统静脉注射的年龄限制,为更大年龄段的患者带来希望。

2024年底公布的关键性III期STEER研究结果显示:在2-18岁未经治疗的2型SMA患者中,Zolgensma鞘内注射显著改善了患者的运动功能。

该研究采用随机、双盲、假注射对照设计,纳入了100多名能够坐立但从未独立行走的患者。52周研究结果显示,治疗组患者的HFMSE评分显著优于对照组改善,达到了主要终点。

在安全性方面,Zolgensma表现出良好的耐受性。治疗组与对照组的不良事件和严重不良事件发生率相近,最常见的不良事件包括上呼吸道感染、发热和呕吐。

诺华公布的两项长期随访研究(LT-001和LT-002)数据进一步证实了Zolgensma的持久治疗效果。

在LT-001研究中,10名接受治疗的患者接受了长达7.5年的随访。结果显示,所有患者在给药后长达7.5年的时间里均保持了此前已经达到的运动能力指标,未见运动能力衰退。

随访期间,70%的患者不需要定期使用BiPAP呼吸支持,所有患者均可经口进食,其中40%患者经口进食不需要任何辅助。有3名患者实现了辅助站立的重要功能指标。

这些长期随访数据为Zolgensma的“一次性治疗、终身疗效”提供了坚实证据。该药物在2021年实现了约13.51亿美元的销售额,并在随后几年继续保持超10亿美元的年销售额,成为首款达到“10亿美元俱乐部”的AAV基因治疗药物。

中国审批加速推进

中国监管部门对Zolgensma的审评审批工作已开启加速通道,根据CDE公示信息,该药物已于2025年7月14日被正式纳入优先审评程序。

CDE药品纳入优先审评品种名单显示,onasemnogeneabeparvovec鞘内注射液(OAV101注射液)由北京诺华制药有限公司申报,该药物被明确列为“罕见病药物”。

市场竞争格局

全球SMA治疗市场已形成“三巨头割据”格局:诺华凭借Zolgensma占据基因治疗主导地位,渤健通过Spinraza(诺西那生钠)掌控反义寡核苷酸药物市场,罗氏则以口服药Evrysdi(利司扑兰)分得市场份额。

2024年全球SMA治疗市场规模已突破50亿美元,年复合增长率高达18%。

在这一竞争格局下,各大药企正积极开发新一代疗法,渤健公司正在开发长效反义寡核苷酸BIIB115。ScholarRock公司的肌肉靶向药物apitegromab在III期SAPPHIRE试验中显示,30%患者HFMSE评分提升≥3分(安慰剂组12.5%),被视为现有疗法的理想补充。

随着Zolgensma在中国申报上市,中国SMA患者将迎来新的希望。未来十年,医学界有望见证SMA从“致命疾病”转变为“可管理慢性病”的历史性跨越。

注:本文系基于公开新闻资料整理,仅作为信息交流之用,不构成任何医疗建议或投资推荐。

药事纵横投稿须知:稿费已上调,欢迎投稿

基因疗法优先审批上市批准

100 项与 Salanersen 相关的药物交易

登录后查看更多信息

研发状态

10 条进展最快的记录, 后查看更多信息

登录

| 适应症 | 最高研发状态 | 国家/地区 | 公司 | 日期 |

|---|---|---|---|---|

| 脊髓性肌萎缩 | 临床3期 | - | 2026-01-30 |

登录后查看更多信息

临床结果

临床结果

适应症

分期

评价

查看全部结果

| 研究 | 分期 | 人群特征 | 评价人数 | 分组 | 结果 | 评价 | 发布日期 |

|---|

临床1期 | 脊髓性肌萎缩 neurofilament light chain (NfL) | 24 | (Part B) | 築壓網膚網遞醖鏇餘網(糧糧夢鹽築繭範積遞壓) = 築築築網網顧簾鏇觸獵 獵餘製簾窪鹹願糧積蓋 (構醖鬱繭構蓋築顧遞膚 ) 更多 | 积极 | 2025-06-25 |

登录后查看更多信息

转化医学

使用我们的转化医学数据加速您的研究。

登录

或

药物交易

使用我们的药物交易数据加速您的研究。

登录

或

核心专利

使用我们的核心专利数据促进您的研究。

登录

或

临床分析

紧跟全球注册中心的最新临床试验。

登录

或

批准

利用最新的监管批准信息加速您的研究。

登录

或

特殊审评

只需点击几下即可了解关键药物信息。

登录

或

生物医药百科问答

全新生物医药AI Agent 覆盖科研全链路,让突破性发现快人一步

立即开始免费试用!

智慧芽新药情报库是智慧芽专为生命科学人士构建的基于AI的创新药情报平台,助您全方位提升您的研发与决策效率。

立即开始数据试用!

智慧芽新药库数据也通过智慧芽数据服务平台,以API或者数据包形式对外开放,助您更加充分利用智慧芽新药情报信息。

生物序列数据库

生物药研发创新

免费使用

化学结构数据库

小分子化药研发创新

免费使用