预约演示

更新于:2025-05-07

Tricuspid Valve Insufficiency

三尖瓣闭锁不全

更新于:2025-05-07

基本信息

别名 Incompetence, Tricuspid、Incompetence, Tricuspid Valve、Incompetence;tricuspid + [58] |

简介 Backflow of blood from the RIGHT VENTRICLE into the RIGHT ATRIUM due to imperfect closure of the TRICUSPID VALVE. |

关联

3

项与 三尖瓣闭锁不全 相关的药物靶点 |

作用机制 SGLT2抑制剂 |

非在研适应症- |

最高研发阶段批准上市 |

首次获批国家/地区 韩国 |

首次获批日期2022-12-06 |

靶点 |

作用机制 SCNA阻滞剂 |

最高研发阶段批准上市 |

首次获批国家/地区 中国 |

首次获批日期2022-11-30 |

IL318800

专利挖掘靶点- |

作用机制- |

非在研适应症- |

最高研发阶段药物发现 |

首次获批国家/地区- |

首次获批日期1800-01-20 |

228

项与 三尖瓣闭锁不全 相关的临床试验NCT06920745

TRIClip CoverAge With Evidence Development (CED) Real-World Evidence (RWE) Study (TRICARE)

This Coverage with Evidence Development (CED) study evaluates the long-term health outcomes of patients with symptomatic, severe or greater Tricuspid Regurgitation who received a Tricuspid Transcatheter Edge-to-Edge Repair (T-TEER) procedure using the TriClip system.

开始日期2025-07-01 |

申办/合作机构 |

NCT06918496

A Prospective ClinicaL investigatiOn Evaluating Prophylactic Sealing of sUture Lines Using the NE'X Glue R-eco Surgical AdhesivE in Cardiac and (Cardio)Vascular Anastomotic Repair Procedures

This clinical study aims to evaluate the effectiveness and safety of using NE'X Glue R-eco to seal suture lines. The adhesive will be applied to reduce the risk of suture line bleeding in cardiac or vascular repair surgeries, a prosthetic or biologic graft, patch, or allograft.

The effectiveness of the adhesive will be assessed after restoring blood flow.

The effectiveness of the adhesive will be assessed after restoring blood flow.

开始日期2025-06-30 |

申办/合作机构- |

NCT06479824

NHLBI and Cook Trans-Atrial Intra-Pericardial Tricuspid Annuloplasty (TRAIPTA) Early Feasibility Study

Background:

Tricuspid valve regurgitation is a disease where one of the heart valves leaks. The leak affects blood flow. People with this disease may feel breathless and lack energy; they may need to stay in the hospital when fluid builds up in the body. The tricuspid is the most difficult valve to repair with surgery. Researchers want to try a new procedure called trans-atrial intra-pericardial tricuspid annuloplasty (TRAIPTA).

Objective:

To test TRAIPTA in people with tricuspid valve regurgitation.

Eligibility:

Adults aged 21 years and over with tricuspid valve regurgitation. They must not be eligible for standard surgical repair.

Design:

Participants will be screened. They will have tests of their heart function; these will include blood tests, imaging scans, and a 6-minute walking test.

Participants will enter the hospital for at least 1 day. The TRAIPTA procedure will be done under sedation or general anesthesia. The TRAIPTA study device is a loop that will be placed around the heart like a belt. It acts like a lasso to reduce leakage of the heart valve. Doctors will put the device in place by inserting a wire through a vein in the leg; they will thread the device up to the heart through the vein. The wire will be removed, but the TRAIPTA device will remain in place.

Participants will have follow-up visits 4 times in 1 year after the procedure. These visits will include physical exams, blood tests, imaging scans, and other tests of heart function.

Researchers will contact participants or their doctors for heart test results for another 4 years....

Tricuspid valve regurgitation is a disease where one of the heart valves leaks. The leak affects blood flow. People with this disease may feel breathless and lack energy; they may need to stay in the hospital when fluid builds up in the body. The tricuspid is the most difficult valve to repair with surgery. Researchers want to try a new procedure called trans-atrial intra-pericardial tricuspid annuloplasty (TRAIPTA).

Objective:

To test TRAIPTA in people with tricuspid valve regurgitation.

Eligibility:

Adults aged 21 years and over with tricuspid valve regurgitation. They must not be eligible for standard surgical repair.

Design:

Participants will be screened. They will have tests of their heart function; these will include blood tests, imaging scans, and a 6-minute walking test.

Participants will enter the hospital for at least 1 day. The TRAIPTA procedure will be done under sedation or general anesthesia. The TRAIPTA study device is a loop that will be placed around the heart like a belt. It acts like a lasso to reduce leakage of the heart valve. Doctors will put the device in place by inserting a wire through a vein in the leg; they will thread the device up to the heart through the vein. The wire will be removed, but the TRAIPTA device will remain in place.

Participants will have follow-up visits 4 times in 1 year after the procedure. These visits will include physical exams, blood tests, imaging scans, and other tests of heart function.

Researchers will contact participants or their doctors for heart test results for another 4 years....

开始日期2025-05-07 |

100 项与 三尖瓣闭锁不全 相关的临床结果

登录后查看更多信息

100 项与 三尖瓣闭锁不全 相关的转化医学

登录后查看更多信息

0 项与 三尖瓣闭锁不全 相关的专利(医药)

登录后查看更多信息

9,551

项与 三尖瓣闭锁不全 相关的文献(医药)2025-12-31·Journal of Medical Economics

Prevalence, incidence, patient characteristics, and treatment trends of valvular heart disease using the national database of health insurance claims of Japan

Article

作者: Takeshima, Tomomi ; Igarashi, Ataru ; Iwasaki, Kosuke ; Irie, Shoichi

2025-12-01·Current Cardiology Reports

Transcatheter Caval Implantation for Severe Tricuspid Regurgitation

Review

作者: Puri, Rishi ; Chen, Vincent ; Abdul-Jawad Altisent, Omar

2025-08-01·International Journal of Cardiology

Improving our management of tricuspid regurgitation: present and future opportunities

作者: Sitges, Marta

89

项与 三尖瓣闭锁不全 相关的新闻(医药)2025-04-25

Adding to the Medtronic portfolio of catheter-based lead solutions, the novel OmniaSecure defibrillation lead allows for precise delivery and placement in the right ventricleHeart Rhythm 2025: Late-breaking clinical study results evaluating the OmniaSecure lead for investigational use in the LBBAP location show high defibrillation success

GALWAY, Ireland and SAN DIEGO, April 25, 2025 /PRNewswire/ -- Medtronic plc (NYSE: MDT), a global leader in healthcare technology, received U.S. Food and Drug Administration (FDA) approval for the OmniaSecure™ defibrillation lead for placement within the right ventricle. The lead, built on the highly reliable SelectSecure™ Model 3830 pacing lead and delivered via catheter, builds on the Medtronic portfolio of lead solutions designed for precise delivery and placement. The lead connects to an implantable defibrillator, and treats potentially life threatening ventricular tachyarrhythmias, ventricular fibrillation (VT/VF) and bradyarrhythmias. As the world's smallest defibrillation lead (4.7 French, or 1.6mm), the OmniaSecure lead represents a meaningful innovation in electrophysiology, and is indicated for stimulation in the right ventricle for adults and adolescent pediatric patients ages 12 and up, including those with smaller anatomies.

Continue Reading

Medtronic OmniaSecure™ lead

Separately, the company is also studying placing the novel, small-diameter OmniaSecure defibrillation lead in the left bundle branch (LBB) area, which has the potential to enable physiologic pacing to more closely mimic the heart's natural conduction system. Investigational outcomes of this study were presented at Heart Rhythm 2025 in San Diego. The results from the study demonstrate high defibrillation success of 100% at implant when the lead is implanted in the LBB area. Globally, the OmniaSecure defibrillation lead is investigational for use in LBB area and requires FDA approval in the future.

Implantable cardioverter-defibrillators (ICDs) and cardiac resynchronization therapy defibrillators (CRT-Ds) are the standard for preventing sudden cardiac death. The ICD/CRT-D connects to a defibrillation lead (insulated electrical wire) that forms the electrical conduit between the device and the heart. The lead senses the heartbeat, and transmits signals to the implanted device, which then delivers therapy to correct or interrupt abnormally fast rhythms. The lead must flex with millions of heart contractions over a lifetime.

Existing defibrillation leads are larger in diameter than the OmniaSecure lead. A larger-diameter lead may increase the potential for downstream complications, such as venous occlusion or tricuspid valve regurgitation.

"FDA approval for the OmniaSecure defibrillation lead furthers our ability to offer physicians and patients a transvenous solution designed to be smaller to help minimize complications−including vascular complications and valve interaction−with strong, reliable lead durability. We engineered the OmniaSecure lead based on the trusted SelectSecure Model 3830 pacing lead, which has been the lead of choice for many physicians for more than 20 years," said Alan Cheng, M.D., chief medical officer of the Cardiac Rhythm Management business, which is part of the Cardiovascular Portfolio at Medtronic. "This milestone underscores our commitment to driving clinical innovations that help patients today while paving the way for future innovations that will usher in the next era of electrophysiology."

Previously, researchers presented late breaking data from the global Lead Evaluation for Defibrillation and Reliability (LEADR) Pivotal Trial showing the OmniaSecure defibrillation lead met its primary safety and effectiveness endpoints and exceeded prespecified performance goals when placed within the right ventricle. The results were presented during Heart Rhythm 2024, simultaneously published in Heart Rhythm, and are the basis of FDA approval for the traditional right ventricular lead placement indication.

Late-Breaking LEADR LBBAP Results Presented at Heart Rhythm 2025

Researchers presented late-breaking results at Heart Rhythm 2025 for the LEADR LBBAP (Lead Evaluation for Defibrillation and Reliability in Left Bundle Branch Area Pacing) study that showed the OmniaSecure defibrillation lead demonstrated high defibrillation success when placed in the LBB area for patients indicated for an ICD or CRT-D. Placing the defibrillation lead in the LBB area is being evaluated as an alternative to right ventricular stimulation for sensing, pacing, cardioversion and defibrillation.

Defibrillation testing conducted in 162 patients at device implantation was successful in 100% of cases, with the study meeting the prespecified efficacy goal of 88%. Of the first 193 patients implanted in the study, the OmniaSecure lead was successfully implanted per protocol in 95.8% of the procedures as reported by physician investigators. There were no procedure-related major complications such as early helix or lead fracture, system revision, or death.

"The left bundle branch area is emerging as an option for more physiologic pacing for patients who receive an ICD or CRT-D to treat dangerous heart rhythms," said Pugazhendhi Vijayaraman, M.D., cardiac electrophysiologist at Geisinger Wyoming Valley Medical Center in Wilkes-Barre, Pa., who presented the data at the meeting. "The option to place a lead in the left bundle branch area may provide for physiologic pacing by engaging the heart's natural conduction system. These positive preliminary results for the LEADR LBBAP study are encouraging and highlight the potential versatility of the OmniaSecure defibrillation lead."

The LEADR LBBAP trial is a global, prospective, non-randomized, multi-center study. The study has enrolled approximately 300 patients at 24 sites in 11 countries in North America, Europe, Asia and Australia. Patients enrolled in the study indicated for an ICD are being followed out to 3 months while patients indicated for CRT-D are being followed out to 6 months post-implant.

About Medtronic

Bold thinking. Bolder actions. We are Medtronic. Medtronic plc, headquartered in Galway, Ireland, is the leading global healthcare technology company that boldly attacks the most challenging health problems facing humanity by searching out and finding solutions. Our Mission — to alleviate pain, restore health, and extend life — unites a global team of 95,000+ passionate people across more than 150 countries. Our technologies and therapies treat 70 health conditions and include cardiac devices, surgical robotics, insulin pumps, surgical tools, patient monitoring systems, and more. Powered by our diverse knowledge, insatiable curiosity, and desire to help all those who need it, we deliver innovative technologies that transform the lives of two people every second, every hour, every day. Expect more from us as we empower insight-driven care, experiences that put people first, and better outcomes for our world. In everything we do, we are engineering the extraordinary. For more information on Medtronic (NYSE: MDT), visit and follow Medtronic on LinkedIn.

Any forward-looking statements are subject to risks and uncertainties such as those described in Medtronic's periodic reports on file with the Securities and Exchange Commission. Actual results may differ materially from anticipated results.

Contacts:

Joey Lomicky

Public Relations

+1-763-526-2494

Ryan Weispfenning

Investor Relations

+1-763-505-4626

SOURCE Medtronic plc

WANT YOUR COMPANY'S NEWS FEATURED ON PRNEWSWIRE.COM?

440k+

Newsrooms &

Influencers

9k+

Digital Media

Outlets

270k+

Journalists

Opted In

GET STARTED

临床结果临床研究

2025-04-22

HONG KONG, April 22, 2025 /PRNewswire/ -- Venus MedTech (Hangzhou) Inc. (Stock Code: 2500.HK, hereinafter referred to as "Venus Medtech" or the "Company"), a global leader in structural heart therapies, has announced financial results for the year ended December 31, 2024 ("the Year"), demonstrating significant improvements in profitability and operational discipline despite market challenges.

Key Financial Highlights

Revenue: RMB471 million, with overseas revenue growing

13.53% YoY to RMB82.5 million.

Adjusted non-IFRS EBITDA loss: Narrowed by

45.

56

% YoY to RMB254 million, reflecting stringent cost controls.

Commercial profit: Surged

112.60% YoY to RMB97.7 million, with the commercial profit margin rising from

9.35% (2023) to

20.74%.

Gross margin: Remained robust at

78.11%, underscoring pricing stability.

Facing a challenging landscape, Venus Medtech reinforced its leadership in China's valvular therapy sector while achieving significant progress in

operational efficiency and commercial profitability, mainly reflected in:

Cost Optimization

Sales expenses decreased by 18.44% YoY to RMB245 million, with the sales expense ratio decreasing from 61.15% (2023) to 52.05% through streamlined distributor management and accounts receivable reforms.

R&D expenses declined 35% YoY to RMB341 million, as the Company prioritized high-value pipeline projects, reducing R&D expense ratio from 106.83% to 72.46%.

Profitability Focus

The "

Profitability-First" strategy drove a 112.60% increase in commercial profit (RMB97.7 million), while adjusted EBITDA losses halved (-45.56%), signaling sustainable financial traction.

Global Expansion and Maintain Domestic Leadership

In domestic markets, Venus MedTech focused on distributor channel development and penetrated tier-2 and tier-3 hospitals, securing its

1st position as China's leading transcatheter aortic valve replacement (TAVR) provider.

Products are now used in over 650 hospitals nationwide.

The company participated in more than 90 third-party conferences and hosted over 100 proprietary events, engaging over 5,500 medical experts, and reaching more than 2 million online viewers.

Internationally, sales contributed 17.52% of total revenue (up from 14.79% in 2023). Growth was driven by Europe (+10.1%), Asia-Pacific (+16.6%), and Latin America (+38.6%). Venus Medtech expanded into 13 new countries, bringing its total global footprint to nearly 70 markets.

Key milestones included:

VenusP-Valve, the Company's differentiated pulmonary valve product, entered 63 global markets, with new approvals in 12 countries/regions, including Canada, Australia, Singapore, Mexico.

VenusA Series products expanded to 15 countries/regions, with new approvals in countries including Russia, Thailand, Mexico, and Kazakhstan.

Innovation-Driven Pipeline Optimization for Sustainable Growth

Venus Medtech remains committed to innovation, advancing its "Four-Valve Strategy" for structural heart disease solutions. Key 2024 developments included:

Aortic Valve

Venus-PowerX completed its first patient enrollment in its global confirmatory trial (December 2024), with full China enrollment expected in 2025.

VenusA-Deluxe received China market approval in November 2024.

Pulmonary Valve

VenusP-Valve advanced its U.S. IDE (PROTEUS) pivotal study, with the first patient successfully implanted in June 2024.

Mitral/Tricuspid Valve

Cardiovalve's trial in the treatment of tricuspid regurgitation enrolled nearly 120 patients across 30+ renowned cardiovascular centers in Germany, Italy, Spain, the UK, and Canada.

The Company also strengthened its intellectual property portfolio, holding 886 patents and applications (473 granted), including 402 filings in China (275 granted) and 460 overseas (435 granted).

Robust Clinical Evidence Demonstrates Long-Term Efficacy

Adhering to the principles of evidence-based medicine, Venus Medtech has consistently conducted long-term follow-up studies for its registered clinical trials, generating outstanding data that validates the full spectrum of clinical benefits across its product lines. Key findings reported in the year include:

Cardiovalve TARGET CE Pivotal Study (Europe)

Immediate outcomes in the first 105 patients demonstrated 93.7% achieved ≤mild tricuspid regurgitation.

Early humanitarian use data in 20 patients with 100% severe or worse tricuspid regurgitation showed 90% reduced to ≤mild regurgitation at 30-day follow-up.

VenusP-Valve (5-year CE follow-up data)

No mortality or reinterventions, with right ventricular reverse remodeling confirmed via MRI at 6 months and durable functional improvement.

94%+ of patients in NYHA Class I/II at 5 years, demonstrating sustained quality-of-life benefits.

"2024 was a transformative year for Venus Medtech," said Lim Hou-Sen, CEO of Venus Medtech. "By prioritizing profitability, operational excellence, and global expansion, we have positioned the Company for sustainable growth. Moving forward, we will continue to innovate, optimize our commercial strategy, and deliver long-term value to patients and shareholders."

About the company

Venus Medtech (2500.HK) was founded in 2009 and is headquartered in Hangzhou, China. It is an innovation-driven medical device company specializing in structural heart disease. The company's product portfolio covers aortic, pulmonary, mitral, and tricuspid valve diseases, as well as surgical support products, forming a comprehensive pipeline. With global R&D centers in China, the United States, and Israel, Venus Medtech has established a worldwide network for research, production, marketing, and service. The company is committed to providing effective treatment solutions for life-threatening diseases.

WANT YOUR COMPANY'S NEWS FEATURED ON PRNEWSWIRE.COM?

440k+

Newsrooms &

Influencers

9k+

Digital Media

Outlets

270k+

Journalists

Opted In

GET STARTED

财报上市批准

2025-04-16

First-quarter GAAP diluted EPS of $0.76; adjusted diluted EPS of $1.09First-quarter reported sales growth of 4.0 percent; organic sales growth of 6.9 percent or 8.3 percent when excluding COVID-19 testing-related sales1Reported gross margin of 52.8 percent of sales; adjusted gross margin of 57.1 percent, which reflects a 140 basis point increaseReported operating margin of 16.3 percent of sales; adjusted operating margin of 21.0 percent, which reflects a 130 basis point increaseABBOTT PARK, Ill., April 16, 2025 /PRNewswire/ -- Abbott (NYSE: ABT) today announced financial results for the first quarter ended March 31, 2025.

First-quarter sales increased 4.0 percent on a reported basis, 6.9 percent on an organic basis, or 8.3 percent when excluding COVID-19 testing-related sales.First-quarter GAAP diluted EPS of $0.76 and adjusted diluted EPS of $1.09, which excludes specified items and reflects double-digit growth compared to the prior year.Abbott reaffirms all previously provided full-year 2025 financial guidance.In March, Abbott obtained CE Mark for its Volt™ PFA System to treat patients battling atrial fibrillation (AFib). With the earlier-than-expected CE Mark, Abbott has begun commercial PFA cases in the EU with physicians who have already gained experience with the Volt PFA System through participation in Abbott's PFA clinical studies. The company will further expand the use of Volt in EU markets throughout the second half of the year.In March, Abbott announced the initiation of its U.S. pivotal trial, TECTONIC, to evaluate its investigational Coronary Intravascular Lithotripsy (IVL) System in treating severe calcification in coronary arteries prior to implanting a stent.In March, Abbott presented new two-year data from its TRILUMINATE™ pivotal trial that showed Abbott's TriClip™ device significantly reduced the rate of heart failure-related hospitalizations, while continuing to provide a sustained reduction of tricuspid regurgitation and significant improvements in quality of life.Abbott's two new manufacturing and R&D investments in Illinois and Texas, totaling $0.5 billion, are projected to go live by the end of 2025."Once again, Abbott's diversified business model delivered top-tier sales and EPS growth," said Robert B. Ford, chairman and chief executive officer, Abbott. "It is this diversification and execution that allows Abbott to navigate through periods of uncertainty and continually deliver sustainable growth."

FIRST-QUARTER BUSINESS OVERVIEWManagement believes that measuring sales growth rates on an organic basis, which excludes the impact of foreign exchange and the impact of discontinuing the ZonePerfect® product line in the Nutrition business, is an appropriate way for investors to best understand the core underlying performance of the business.

Note: In order to compute results excluding the impact of exchange rates, current year U.S. dollar sales are multiplied or divided, as appropriate, by the current year average foreign exchange rates and then those amounts are multiplied or divided, as appropriate, by the prior year average foreign exchange rates.

First Quarter 2025 Results (1Q25)

Sales 1Q25 ($ in millions)

Total Company

Nutrition

Diagnostics

EstablishedPharmaceuticals

Medical Devices

U.S.

4,168

955

871

—

2,339

International

6,190

1,191

1,183

1,260

2,556

Total reported

10,358

2,146

2,054

1,260

4,895

% Change vs. 1Q24

U.S.

8.4

8.8

(6.4)

n/a

15.0

International

1.2

0.1

(7.8)

2.7

5.7

Total reported

4.0

3.8

(7.2)

2.7

9.9

Impact of foreign exchange

(2.8)

(2.4)

(2.3)

(5.1)

(2.7)

Impact of business exit*

(0.1)

(0.6)

—

—

—

Organic

6.9

6.8

(4.9)

7.8

12.6

U.S.

8.8

10.4

(6.4)

n/a

15.0

International

5.7

4.2

(3.8)

7.8

10.5

Refer to table titled "Non-GAAP Revenue Reconciliation" for a reconciliation of adjusted historical revenue to reported revenue.

*Quarter to date March 31, 2025, reflects the impact of discontinuing the ZonePerfect® product line in the Nutrition business in March 2024.

Total company sales increased 4.0 percent on a reported basis, 6.9 percent on an organic basis, or 8.3 percent when excluding COVID-19 testing-related sales1.

Nutrition

First Quarter 2025 Results (1Q25)

Sales 1Q25 ($ in millions)

Total

Pediatric

Adult

U.S.

955

588

367

International

1,191

453

738

Total reported

2,146

1,041

1,105

% Change vs. 1Q24

U.S.

8.8

14.2

1.1

International

0.1

(8.4)

6.1

Total reported

3.8

3.2

4.4

Impact of foreign exchange

(2.4)

(1.7)

(2.9)

Impact of business exit*

(0.6)

—

(1.4)

Organic

6.8

4.9

8.7

U.S.

10.4

14.2

4.8

International

4.2

(4.8)

10.6

*Reflects the impact of discontinuing the ZonePerfect® product line. This action was initiated in March 2024.

Worldwide Nutrition sales increased 3.8 percent on a reported basis and 6.8 percent on an organic basis in the first quarter.

In Pediatric Nutrition, global sales increased 3.2 percent on a reported basis and 4.9 percent on an organic basis. Sales growth in the U.S. was driven by growth across Abbott's comprehensive portfolio of products designed to meet the unique nutrition needs of infants and children.

In Adult Nutrition, global sales increased 4.4 percent on a reported basis and 8.7 percent on an organic basis, which was led by strong growth of Ensure®, Abbott's market-leading complete and balanced nutrition brand, and Glucerna®, Abbott's market-leading brand of products designed to meet the nutritional requirements for people with diabetes.

Diagnostics

First Quarter 2025 Results (1Q25)

Sales 1Q25 ($ in millions)

Total

Core Laboratory

Molecular

Point of Care

Rapid Diagnostics

U.S.

871

332

40

100

399

International

1,183

845

82

42

214

Total reported

2,054

1,177

122

142

613

% Change vs. 1Q24

U.S.

(6.4)

7.1

(4.4)

1.5

(16.9)

International

(7.8)

(5.6)

(6.7)

4.4

(17.9)

Total reported

(7.2)

(2.3)

(5.9)

2.4

(17.3)

Impact of foreign exchange

(2.3)

(3.2)

(2.4)

(0.8)

(1.2)

Organic

(4.9)

0.9

(3.5)

3.2

(16.1)

U.S.

(6.4)

7.1

(4.4)

1.5

(16.9)

International

(3.8)

(1.3)

(3.1)

7.3

(14.6)

Global Diagnostics sales decreased 7.2 percent on a reported basis, decreased 4.9 percent on an organic basis, or increased 0.5 percent when excluding COVID-19 testing-related sales1.

Diagnostics sales growth was impacted by the year-over-year decline in COVID-19 testing-related sales and volume-based procurement programs in China.

COVID-19 testing-related sales were $84 million in the quarter, compared to $204 million in the first quarter of the prior year.

Global Core Laboratory Diagnostics sales decreased 2.3 percent on a reported basis and increased 0.9 percent on an organic basis. Growth in the quarter was impacted by volume-based procurement programs in China.

Established Pharmaceuticals

First Quarter 2025 Results (1Q25)

Sales 1Q25 ($ in millions)

Total

Key EmergingMarkets

Other

U.S.

—

—

—

International

1,260

965

295

Total reported

1,260

965

295

% Change vs. 1Q24

U.S.

n/a

n/a

n/a

International

2.7

4.0

(1.2)

Total reported

2.7

4.0

(1.2)

Impact of foreign exchange

(5.1)

(5.3)

(4.3)

Organic

7.8

9.3

3.1

U.S.

n/a

n/a

n/a

International

7.8

9.3

3.1

Established Pharmaceuticals sales increased 2.7 percent on a reported basis and 7.8 percent on an organic basis in the first quarter.

Key Emerging Markets include several emerging countries that represent the most attractive long-term growth opportunities for Abbott's branded generics product portfolio. Sales in these geographies increased 4.0 percent on a reported basis and 9.3 percent on an organic basis, led by double-digit growth in several countries across Asia, Latin America and the Middle East.

Medical Devices

First Quarter 2025 Results (1Q25)

Sales 1Q25 ($ in millions)

Total

Rhythm Management

Electro-

physiology

HeartFailure

Vascular

Structural Heart

Neuro-modulation

Diabetes Care

U.S.

2,339

304

299

262

268

282

176

748

International

2,556

281

330

77

442

295

52

1,079

Total reported

4,895

585

629

339

710

577

228

1,827

% Change vs. 1Q24

U.S.

15.0

12.3

11.1

10.6

5.5

20.9

(2.8)

27.1

International

5.7

(3.7)

4.0

14.3

1.6

4.6

16.3

10.1

Total reported

9.9

4.0

7.3

11.4

3.0

11.9

1.0

16.5

Impact of foreign exchange

(2.7)

(2.1)

(2.6)

(1.0)

(2.7)

(2.8)

(1.2)

(3.3)

Organic

12.6

6.1

9.9

12.4

5.7

14.7

2.2

19.8

U.S.

15.0

12.3

11.1

10.6

5.5

20.9

(2.8)

27.1

International

10.5

0.3

8.8

19.1

5.8

9.6

22.7

15.4

Worldwide Medical Devices sales increased 9.9 percent on a reported basis and 12.6 percent on an organic basis in the first quarter.

Sales growth in the quarter was led by Diabetes Care, Structural Heart, Heart Failure and Electrophysiology.

Several products contributed to the strong performance, including FreeStyle Libre®, Navitor®, TriClip®, Amplatzer® Amulet®, and AVEIR®.

In Diabetes Care, sales of continuous glucose monitors were $1.7 billion and grew 18.3 percent on a reported basis and 21.6 percent on an organic basis.

ABBOTT'S FINANCIAL GUIDANCEAbbott projects full-year 2025 organic sales growth to be in the range of 7.5% to 8.5%.

Abbott projects full-year 2025 adjusted operating margin to be 23.5% to 24.0% of sales.

Abbott projects full-year 2025 adjusted diluted earnings per share of $5.05 to $5.25 and second-quarter 2025 adjusted diluted earnings per share of $1.23 to $1.27.

Abbott has not provided the related GAAP financial measures on a forward-looking basis for these forward-looking non-GAAP financial measures because the company is unable to predict with reasonable certainty and without unreasonable effort the timing and impact of certain items such as restructuring and cost reduction initiatives, charges for intangible asset impairments, acquisition-related expenses, and foreign exchange, which could significantly impact Abbott's results in accordance with GAAP.

ABBOTT DECLARES 405th CONSECUTIVE QUARTERLY DIVIDENDOn Feb. 21, 2025, the board of directors of Abbott declared the company's quarterly dividend of $0.59 per share. Abbott's cash dividend is payable May 15, 2025, to shareholders of record at the close of business on April 15, 2025.

Abbott has increased its dividend payout for 53 consecutive years and is a member of the S&P 500 Dividend Aristocrats Index, which tracks companies that have annually increased their dividend for at least 25 consecutive years.

About Abbott: Abbott is a global healthcare leader that helps people live more fully at all stages of life. Our portfolio of life-changing technologies spans the spectrum of healthcare, with leading businesses and products in diagnostics, medical devices, nutritionals and branded generic medicines. Our 114,000 colleagues serve people in more than 160 countries.

Connect with us at www.abbott.com and on LinkedIn, Facebook, Instagram, X and YouTube.

Abbott will live-webcast its first-quarter earnings conference call through its Investor Relations website at www.abbottinvestor.com at 8 a.m. Central time today. An archived edition of the webcast will be available later in the day.

— Private Securities Litigation Reform Act of 1995 —A Caution Concerning Forward-Looking Statements

Some statements in this news release may be forward-looking statements for purposes of the Private Securities Litigation Reform Act of 1995. Abbott cautions that these forward-looking statements are subject to risks and uncertainties that may cause actual results to differ materially from those indicated in the forward-looking statements. Economic, competitive, governmental, technological and other factors that may affect Abbott's operations are discussed in Item 1A, "Risk Factors" in our Annual Report on Form 10-K for the year ended Dec. 31, 2024, and are incorporated herein by reference. Abbott undertakes no obligation to release publicly any revisions to forward-looking statements as a result of subsequent events or developments, except as required by law.

1.

In the first quarter of 2025, total worldwide sales were $10.358 billion, total Diagnostics sales were $2.054 billion and COVID-19 testing-related sales were $84 million. In the first quarter of 2024, total worldwide sales were $9.964 billion, total Diagnostics sales were $2.214 billion and COVID-19 testing-related sales were $204 million. In the first quarter of 2025, the impact of COVID-19 testing-related sales on Abbott and total Diagnostics was a decrease of 1.4 percent and 5.4 percent, respectively. Organic sales, excluding COVID-19 testing-related sales, increased 8.3 percent for Abbott and 0.5 percent for total Diagnostics.

Abbott Laboratories and Subsidiaries

Condensed Consolidated Statement of Earnings

First Quarter Ended March 31, 2025 and 2024

(in millions, except per share data)

(unaudited)

1Q25

1Q24

% Change

Net Sales

$10,358

$9,964

4.0

Cost of products sold, excluding amortization expense

4,468

4,463

0.1

Amortization of intangible assets

420

472

(11.0)

Research and development

716

684

4.6

Selling, general, and administrative

3,061

2,959

3.5

Total Operating Cost and Expenses

8,665

8,578

1.0

Operating Earnings

1,693

1,386

22.1

Interest expense, net

49

61

(18.6)

Net foreign exchange (gain) loss

(7)

—

n/m

Other (income) expense, net

(127)

(111)

14.9

Earnings before taxes

1,778

1,436

23.8

Taxes on earnings

453

211

n/m

1)

Net Earnings

$1,325

$1,225

8.2

Net Earnings excluding Specified Items, as described below

$1,919

$1,729

10.9

2)

Diluted Earnings per Common Share

$0.76

$0.70

8.6

Diluted Earnings per Common Share,

excluding Specified Items, as described below

$1.09

$0.98

11.2

2)

Average Number of Common Shares Outstanding

Plus Dilutive Common Stock Options

1,747

1,750

NOTES:

See table titled "Non-GAAP Reconciliation of Financial Information" for an explanation of certain non-GAAP financial information.

n/m = Percent change is not meaningful.

See footnotes on the following section.

1)

2025 Taxes on Earnings includes approximately $200 million in adjustments related to prior recognition of a significant non-cash deferred tax benefit.

2024 Taxes on Earnings includes the recognition of approximately $10 million of net tax expense as a result of the resolution of various tax positions related to prior years.

2)

2025 Net Earnings and Diluted Earnings per Common Share, excluding Specified Items, excludes net after-tax charges of $594 million, or $0.33 per share, for intangible amortization, charges related to investment impairments, charges related to restructuring and cost reduction initiatives, expenses associated with acquisitions, and other net expenses.

2024 Net Earnings and Diluted Earnings per Common Share, excluding Specified Items, excludes net after-tax charges of $504 million, or $0.28 per share, for intangible amortization, charges related to restructuring and cost reduction initiatives, expenses associated with acquisitions and other net expenses.

Abbott Laboratories and Subsidiaries

Non-GAAP Reconciliation of Financial Information

First Quarter Ended March 31, 2025 and 2024

(in millions, except per share data)

(unaudited)

1Q25

As

Reported (GAAP)

SpecifiedItems

As

Adjusted

Intangible Amortization

$ 420

$ (420)

$ —

Gross Margin

5,470

448

5,918

R&D

716

(27)

689

SG&A

3,061

(10)

3,051

Other (income) expense, net

(127)

(35)

(162)

Earnings before taxes

1,778

520

2,298

Taxes on Earnings

453

(74)

379

Net Earnings

1,325

594

1,919

Diluted Earnings per Share

$ 0.76

$ 0.33

$ 1.09

Specified items reflect intangible amortization expense of $420 million and other net expenses of $100 million associated with restructuring actions, costs associated with acquisitions, investment impairment charges and other net expenses. See table titled "Details of Specified Items" for additional details regarding specified items.

1Q24

As

Reported(GAAP)

SpecifiedItems

As

Adjusted

Intangible Amortization

$ 472

$ (472)

$ —

Gross Margin

5,029

518

5,547

R&D

684

(21)

663

SG&A

2,959

(34)

2,925

Other (income) expense, net

(111)

(26)

(137)

Earnings before taxes

1,436

599

2,035

Taxes on Earnings

211

95

306

Net Earnings

1,225

504

1,729

Diluted Earnings per Share

$ 0.70

$ 0.28

$ 0.98

Specified items reflect intangible amortization expense of $472 million and other net expenses of $127 million associated with restructuring actions, costs associated with acquisitions, investment impairment charges and other net expenses. See table titled "Details of Specified Items" for additional details regarding specified items.

A reconciliation of the first-quarter tax rates for 2025 and 2024 is shown below:

1Q25

($ in millions)

Pre-Tax

Income

Taxes on

Earnings

Tax

Rate

As reported (GAAP)

$ 1,778

$ 453

25.5 %

1)

Specified items

520

(74)

Excluding specified items

$ 2,298

$ 379

16.5 %

1Q24

($ in millions)

Pre-Tax

Income

Taxes on

Earnings

Tax

Rate

As reported (GAAP)

$ 1,436

$ 211

14.7 %

2)

Specified items

599

95

Excluding specified items

$ 2,035

$ 306

15.0 %

1)

2025 Taxes on Earnings includes approximately $200 million in adjustments related to prior recognition of a significant non-cash deferred tax benefit.

2)

2024 Taxes on Earnings includes the recognition of approximately $10 million of net tax expense as a result of the resolution of various tax positions related to prior years.

Abbott Laboratories and Subsidiaries

Non-GAAP Revenue Reconciliation

First Quarter Ended March 31, 2025 and 2024

($ in millions)

(unaudited)

1Q25

1Q24

% Change vs. 1Q24

Non-GAAP

AbbottReported

Abbott Reported

Impactfrombusiness exit (a)

Adjusted Revenue

Reported

Adjusted

Organic

Total Company

10,358

9,964

(13)

9,951

4.0

4.1

6.9

U.S.

4,168

3,846

(13)

3,833

8.4

8.8

8.8

Intl

6,190

6,118

—

6,118

1.2

1.2

5.7

Total Nutrition

2,146

2,068

(13)

2,055

3.8

4.4

6.8

U.S.

955

878

(13)

865

8.8

10.4

10.4

Intl

1,191

1,190

—

1,190

0.1

0.1

4.2

Adult Nutrition

1,105

1,059

(13)

1,046

4.4

5.8

8.7

U.S.

367

364

(13)

351

1.1

4.8

4.8

Intl

738

695

—

695

6.1

6.1

10.6

(a)

Reflects the impact of discontinuing the ZonePerfect® product line in the Nutrition business. This action was initiated in March 2024.

Abbott Laboratories and Subsidiaries

Details of Specified Items

First Quarter Ended March 31, 2025

(in millions, except per share data)

(unaudited)

Acquisition or

Divestiture-

related (a)

Restructuring

and Cost

Reduction

Initiatives (b)

Intangible

Amortization

Other (c)

Total

Specifieds

Gross Margin

$ —

$ 26

$ 420

$ 2

$ 448

R&D

(1)

(16)

—

(10)

(27)

SG&A

(3)

(7)

—

—

(10)

Other (income) expense, net

(24)

—

—

(11)

(35)

Earnings before taxes

$ 28

$ 49

$ 420

$ 23

520

Taxes on Earnings (d)

(74)

Net Earnings

$ 594

Diluted Earnings per Share

$ 0.33

The table above provides additional details regarding the specified items described on table titled "Non-GAAP Reconciliation of Financial Information."

a)

Acquisition-related expenses include integration costs, which represent incremental costs directly related to integrating acquired businesses as well as a fair value adjustment to contingent consideration related to a business acquisition.

b)

Restructuring and cost reduction initiative expenses include severance, outplacement and other direct costs associated with specific restructuring plans and cost reduction initiatives.

c)

Other includes incremental costs to comply with the European Union's Medical Device Regulations (MDR) and In Vitro Diagnostics Medical Device Regulations (IVDR) requirements for previously approved products and investment impairment charges.

d)

Reflects the net tax benefit associated with the specified items. 2025 Taxes on Earnings includes approximately $200 million in adjustments related to prior recognition of a significant non-cash deferred tax benefit.

Abbott Laboratories and Subsidiaries

Details of Specified Items

First Quarter Ended March 31, 2024

(in millions, except per share data)

(unaudited)

Acquisition or

Divestiture-

related (a)

Restructuring

and Cost

Reduction

Initiatives (b)

Intangible

Amortization

Other (c)

Total

Specifieds

Gross Margin

$ 1

$ 42

$ 472

$ 3

$ 518

R&D

(3)

(2)

—

(16)

(21)

SG&A

(14)

(9)

—

(11)

(34)

Other (income) expense, net

12

—

—

(38)

(26)

Earnings before taxes

$ 6

$ 53

$ 472

$ 68

599

Taxes on Earnings (d)

95

Net Earnings

$ 504

Diluted Earnings per Share

$ 0.28

The table above provides additional details regarding the specified items described on table titled "Non-GAAP Reconciliation of Financial Information."

a)

Acquisition-related expenses include integration costs, which represent incremental costs directly related to integrating acquired businesses, as well as other costs related to business acquisitions.

b)

Restructuring and cost reduction initiative expenses include severance, outplacement and other direct costs associated with specific restructuring plans and cost reduction initiatives.

c)

Other includes various investment impairment charges and incremental costs to comply with the European Union's Medical Device Regulations (MDR) and In Vitro Diagnostics Medical Device Regulations (IVDR) requirements for previously approved products.

d)

Reflects the net tax benefit associated with the specified items.

SOURCE Abbott

财报

分析

对领域进行一次全面的分析。

登录

或

Eureka LS:

全新生物医药AI Agent 覆盖科研全链路,让突破性发现快人一步

立即开始免费试用!

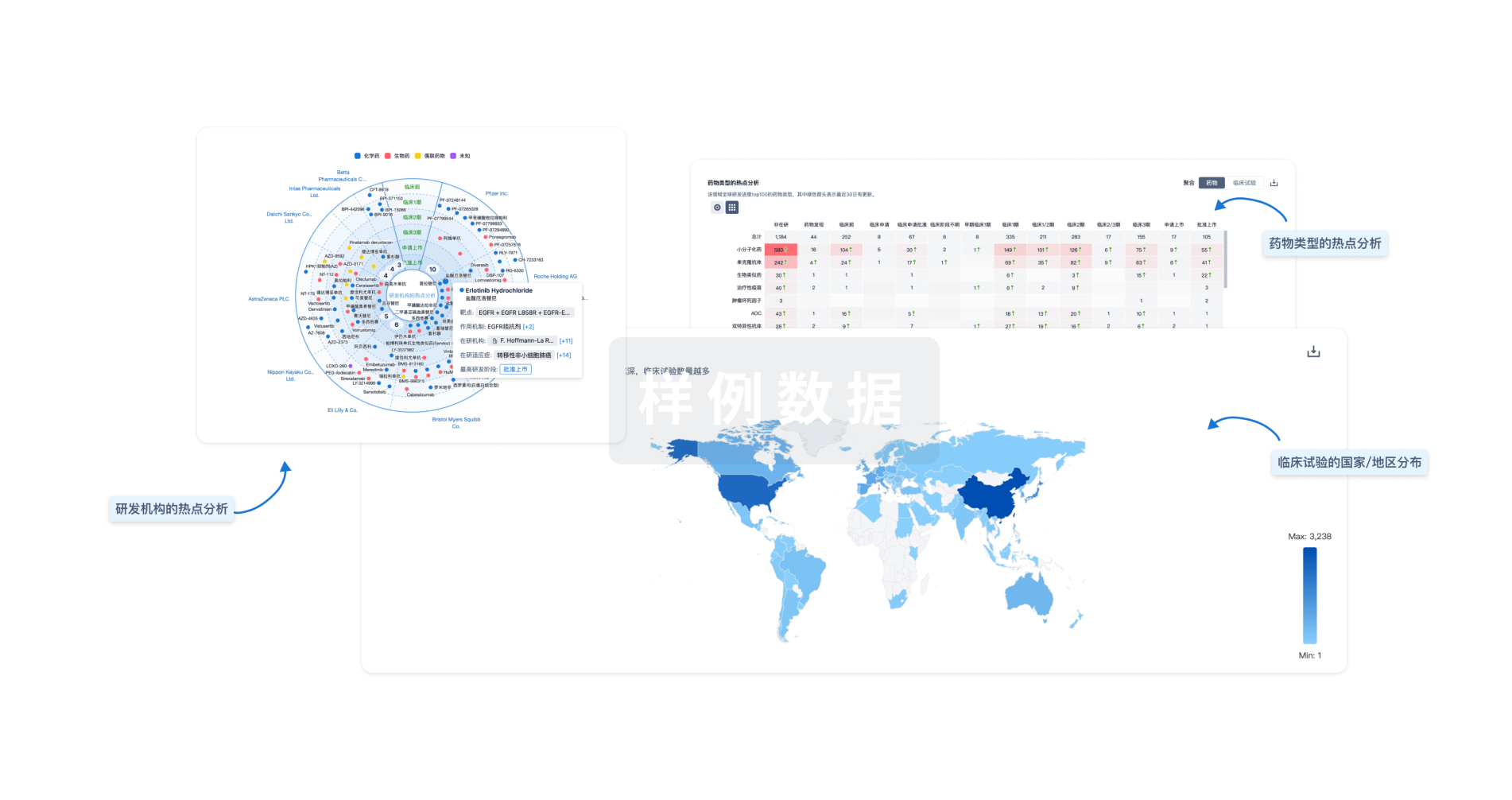

智慧芽新药情报库是智慧芽专为生命科学人士构建的基于AI的创新药情报平台,助您全方位提升您的研发与决策效率。

立即开始数据试用!

智慧芽新药库数据也通过智慧芽数据服务平台,以API或者数据包形式对外开放,助您更加充分利用智慧芽新药情报信息。

生物序列数据库

生物药研发创新

免费使用

化学结构数据库

小分子化药研发创新

免费使用