预约演示

更新于:2025-08-11

West Therapeutic Development LLC

更新于:2025-08-11

概览

关联

100 项与 West Therapeutic Development LLC 相关的临床结果

登录后查看更多信息

0 项与 West Therapeutic Development LLC 相关的专利(医药)

登录后查看更多信息

3

项与 West Therapeutic Development LLC 相关的新闻(医药)2019-10-22

Businessman showing thumbs down.

Tero Vesalainen/Getty Images/iStockphoto

Shares of Assertio Therapeutics plunged more than 28% Monday after the company announced the U.S. Food and Drug Administration rejected an injectable formulation of long-acting cosyntropin.

Shares of Illinois-based

Assertio Therapeutics

plunged more than 28% Monday after the company announced the U.S.

Food and Drug Administration (FDA)

rejected an injectable formulation of long-acting cosyntropin.

Assertio, which was formerly known as Depomed, and its development partner West Therapeutic Development

received a Complete Response Letter

from the regulatory agency over the synthetic adrenocorticotropic hormone, or ACTH. The companies are seeking approval of the injectable for use as a diagnostic drug in the screening of patients presumed to have adrenocortical insufficiency. The New Drug Application for cosyntropin was accepted by the FDA in February of this year and given a PDUFA date of Oct. 19.

In its brief announcement, Assertio said the FDA informed the companies that “certain pharmacodynamic parameters” were not adequately achieved and that was the primary reason for the rejection. Arthur Higgins, president and chief executive officer of Assertio, said the company, along with West, will work together to “determine how best to address the CRL.” In the meantime, Higgins said the company will continue to focus on generating a strong cash flow for the company.

Long-acting cosyntropin is an alcohol-free formulation of a synthetic analog of ACTH, a hormone secreted from the pituitary gland that is responsible for the stimulation of the adrenal cortex. Cosyntropin is composed of the first 24 of 39 amino acids of natural ACTH and retains the full steroidogenic activity of natural ACTH, the company said.

Adrenal insufficiency occurs when the adrenal glands don’t produce enough hormones, including cortisol. The insufficiency is linked to

Addison’s disease

. The most common symptoms of the insufficiency are fatigue, muscle weakness, loss of appetite, weight loss, and abdominal pain, according to the Mayo Clinic.

For Assertio, the rejection from the FDA comes weeks after the small company tapped AstraZeneca veteran

David Wheadon

for its board of directors. Wheadon recently retired from the U.K. pharma giant after serving as head of global regulatory affairs, patient safety and quality assurance.

In addition to cosyntropin, Assertio also has another drug under regulatory review, diclofenac potassium for treatment of mild to moderate acute pain in juvenile patients ages 12 to 17 years. The company also has a

migraine treatment

in Phase I/II development. The drug is aimed at acute migraine attacks, according to information on the company website.

After the CROL was announced, shares of Assertio fell from $1.17 to 81 cents per share. This morning, the stock saw a slight gain in premarket trading to 84 cents per share.

hbspt.forms.create({

portalId: "4413123",

formId: "c4dda430-e2b0-4083-86f3-ccce0c1d4479"

});

高管变更申请上市

2019-05-09

Assertio Therapeutics, Inc. reported financial results for the quarter ended March 31, 2019, and provided an update on its business performance and strategic initiatives.

Reports Neurology Franchise Net Sales of $26.3 million

Commercialization Agreement Revenues of $30.9 million

Raises 2019 Earnings Guidance Range and Confirms Neurology Franchise Net Sales Guidance

Significant Debt Reduction

LAKE FOREST, Ill., May 08, 2019 (GLOBE NEWSWIRE) --

Assertio Therapeutics, Inc.

(NASDAQ: ASRT) today reported financial results for the quarter ended March 31, 2019, and provided an update on its business performance and strategic initiatives.

First-Quarter Financial Highlights:

(unaudited)

First-Quarter 2019

(in millions, except earnings per share)

GAAP

Non-GAAP

(1)

Total Revenues

$57.9

$59.7

Net Income/(Loss)

$(14.3)

$17.6

Earnings/(Loss) Per Share

$(0.22)

$0.23

Adjusted EBITDA

-

$36.4

(1)

All non-GAAP measures included in this earnings release are reconciled to the corresponding GAAP measures in the schedules attached.

“We’re off to a strong start to the year,” said Arthur Higgins, President and CEO of Assertio. “We continue to drive better performance from our business as we remain focused on operating efficiencies and improving momentum in our Neurology Franchise net sales. As a result of our strong start, today we are raising our adjusted EBITDA guidance range.”

Business Highlights:

Favorable NUCYNTA

®

Patent Ruling:

On March 28, 2019, the Company announced that the United States Court of Appeals for the Federal Circuit ruled in favor of Assertio with respect to the Company’s patent litigation against three of Abbreviated New Drug Applications (ANDAs) for the NUCYNTA franchise. The Federal Circuit’s ruling affirms the decision of the United States District Court (D.N.J.), which found U.S. patent No. 7,994,364 (the ’364 Patent) to be valid and infringed by the defendants. The ’364 Patent covers the entire NUCYNTA franchise until December 2025.

*

The NUCYNTA franchise is commercialized by Collegium Pharmaceutical, Inc.(Collegium). The Company receives royalties from Collegium based on net sales of the franchise.

*Patent expiration dates reflect the addition of six months of pediatric patent term extension Assertio anticipates securing from the United States Food and Drug Administration.

FDA Accepted Filing of 505(b)(2) NDA Filing for Cosyntropin:

On February 19, 2019, the Company received notification of acceptance for filing from the U.S. Food and Drug Administration for its 505(b)(2) New Drug Application for its injectable formulation of long-acting cosyntropin (synthetic adrenocorticotropic hormone, or ACTH). The Company, together with its partner, West Therapeutic Development, LLC, seeks approval for the use of long-acting cosyntropin as a diagnostic drug in the screening of patients presumed to have adrenocortical insufficiency.

Amended Senior Secured Credit Facility:

On January 8, 2019, the Company amended its Senior Secured Credit Facility, replacing the previous fixed adjusted EBITDA covenant with a trailing 12-month debt-to adjusted EBITDA ratio that declines over time as we make scheduled principal payments. The amendment gives the Company greater flexibility to continue to pay down debt and invest in the core business, including potential business development transactions.

Debt Reduction and Cash Position:

On January 15 and April 15, 2019, the Company made scheduled principal repayments of $25.0 million and $55.0 million, respectively, reducing the Company’s secured debt to $202.5 million as of today’s date. On January 30, 2019, the Company received $32.0 million, the balance of a $62.0 million patent litigation settlement announced in the third quarter of 2018. As of March 31, 2019, the Company had cash and cash equivalents of $109.7 million.

Revenue Summary:

(in thousands, unaudited)

Three Months Ended March 31,

2019

2018

Product sales, net:

Gralise

$

13,278

$

14,827

CAMBIA

8,808

6,416

Zipsor

4,231

4,746

Total neurology product sales, net

26,317

25,989

Nucynta products

62

18,145

Lazanda

71

220

Total product sales, net

26,450

44,354

Commercialization agreement:

Commercialization rights and facilitation services, net

30,856

28,095

Revenue from transfer of inventory

—

55,705

Royalties and milestone revenue

623

250

Total revenues

$

57,929

$

128,404

2019 Financial Guidance:

The Company is raising its previous 2019 earnings guidance range and confirming its previous Neurology Franchise net sales guidance:

Prior 2019 Guidance

Current 2019 Guidance

Neurology Franchise Net Sales

Low to Mid-Single Digit Growth

Low to Mid-Single Digit Growth

GAAP Net Loss

(1)(2)

($71) to ($61) million

($68) to ($58) million

Non-GAAP Adjusted EBITDA

(1)(2)

$115 to $125 million

$118 to $128 million

(1) Guidance includes $2.8 million of non-cash Collegium warrant related income.

(2) Guidance excludes any future mark-to-market adjustments, which cannot be estimated.

Conference Call and Webcast:

Assertio will host a conference call today, Wednesday, May 8, 2019 beginning at 4:30 p.m. ET to discuss its results. This event can be accessed in three ways:

From the Assertio website:

. Please access the website 15 minutes prior to the start of the call to download and install any necessary audio software.

By telephone: Participants can access the call by dialing (877) 550-3745 (United States) or (281) 973-6277 (International) referencing Conference ID 5347358.

By replay: A replay of the webcast will be located under the Investor Relations section of Assertio’s website approximately two hours after the conclusion of the live call.

About Assertio Therapeutics, Inc.

Assertio Therapeutics is committed to providing responsible solutions to advance patient care in the Company’s core areas of neurology, orphan and specialty medicines. Assertio currently markets three FDA-approved products and continues to identify, license and develop new products that offer enhanced options for patients that may be under served by existing therapies. To learn more about Assertio, visit

.

“Safe Harbor” Statement under the Private Securities Litigation Reform Act of 1995

This news release contains forward-looking statements. These statements involve inherent risks and uncertainties that could cause actual results to differ materially from those projected or anticipated, including risks related to regulatory approval and clinical development of long-acting cosyntropin, expectations regarding royalties to be received based on sales of NUCYNTA and NUCYNTA ER, expectations regarding potential business opportunities and other risks outlined in the Company’s public filings with the Securities and Exchange Commission, including the Company’s most recent annual report on Form 10-K and subsequent Quarterly Reports on Form 10-Q. All information provided in this news release speaks as of the date hereof. Except as otherwise required by law, the Company undertakes no obligation to update or revise its forward-looking statements.

Investor and Media Contact:

John B. Thomas

Senior Vice President, Investor Relations and Corporate Communications

jthomas@assertiotx.com

Non-GAAP Financial Measures

To supplement the Company’s financial results presented on a U.S. generally accepted accounting principles (GAAP) basis, the Company has included information about non-GAAP revenue, non-GAAP adjusted earnings, non-GAAP adjusted diluted earnings per share, non-GAAP adjusted EBITDA and other non-GAAP financial measures as useful operating metrics. The Company believes that the presentation of these non-GAAP financial measures, when viewed with results under GAAP and the accompanying reconciliation, provides supplementary information to analysts, investors, lenders, and the Company’s management in assessing the Company’s performance and results from period to period. The Company uses these non-GAAP measures internally to understand, manage and evaluate the Company’s performance, and in part, in the determination of bonuses for executive officers and employees. These non-GAAP financial measures should be considered in addition to, and not a substitute for, or superior to, net income or other financial measures calculated in accordance with GAAP. Non-GAAP financial measures used by us may be calculated differently from, and therefore may not be comparable to, non-GAAP measures used by other companies.

Specified Items

Non-GAAP measures presented within this release exclude specified items. The Company considers specified Items to be significant income/expense items not indicative of current operations, including the related tax effect. Specified items include non-cash adjustment to Collegium agreement revenue and cost of sales, release of NUCYNTA and Lazanda sales reserves for products the Company is no longer selling, interest income, interest expense, amortization, acquired in-process research and development and non-cash adjustments related to product acquisitions, stock-based compensation expense, non-cash interest expense related to debt, depreciation, taxes, transaction costs, CEO transition, restructuring costs, adjustments to net sales related to reserves recorded prior to the Company’s exit of opioid commercialization activities, legal costs and expenses incurred in connection with opioid-related litigation, investigations and regulations pertaining to the company’s historical commercialization of opioid products, certain types of legal settlements, disputes, fees and costs, and to adjust for the tax effect related to each of the non-GAAP adjustments.

RECONCILIATION OF GAAP NET INCOME (LOSS) TO NON-GAAP ADJUSTED EBITDA

ROLLING TWELVE MONTHS

(unaudited)

The below reconciliation is presented to disclose the calculation of Adjusted EBITDA (as defined in our Senior Notes) on a rolling 12 month basis to support covenant compliance for our Senior Notes.

Twelve Month Period

Ended March 31, 2019

(unaudited)

GAAP net (loss)/income

$

(11,217

)

Commercialization agreement revenues (1)

29,252

Nucynta and Lazanda revenue reserves (2)

(1,695

)

Expenses for opioid-related litigation, investigations and regulations (3)

9,321

Intangible amortization related to product acquisitions

101,774

Contingent consideration related to product acquisitions

(313

)

Stock-based compensation

11,165

Purdue Litigation

(62,000

)

Interest and other income

(1,604

)

Interest expense

67,420

Depreciation

793

Income taxes (expense) benefit

1,602

Restructuring and related costs (4)

12,934

Other costs

(239

)

Fair value for warrants

1,629

Adjusted EBITDA

$

158,822

(1) For the period from January 8, 2018 through November 8, 2018, the adjustment relates to the non-cash value assigned to inventory transferred to Collegium. As of the date of the amendment, on November 8, 2018, the Company ceased recognition of fixed revenues and began the recognition of variable revenues when they become due beginning in January 2019. The adjustment for the three months ended March 31, 2019 relates to non-cash expense for third-party royalties, which are expected to have no net impact for the full year period, as well as the amortization of the contract asset.

(2) Removal of the impact of revenue adjustment estimates related to products that we are no longer commercializing.

(3) Legal costs/expenses related to opioid-related litigation, investigations and regulations pertaining to the Company’s historical commercialization of opioid products.

(4) Restructuring and other costs represents non-recurring costs associated with the Company’s restructuring, reincorporation, headquarters relocation and CEO transition.

FIRST-QUARTER RECONCILIATION OF GAAP to NON-GAAP REVENUES

(in thousands)

(unaudited)

Three Months Ended March31,

2019

2018

(1)

Total revenues (GAAP basis)

$

57.9

$

128.4

Non-cash adjustment to commercialization

agreement revenues

(2)

1.8

(52.5

)

Release of NUCYNTA sales reserves

(3)

—

(12.5

)

Total revenues (non-GAAP basis)

$

59.7

$

63.5

(1) First quarter 2018 total GAAP revenues include one-time items described in our quarterly report on Form 10-Q for the fiscal period ended March 31, 2018.

(2) The adjustment for the three months ended March 31, 2019 relates to non-cash adjustments for third-party royalties, which were an expense in Q1 2019 but are expected to have no net impact for the full year period, the amortization of the contract asset, and the impact of revenue adjustment estimates related to products that we are no longer commercializing. For the three months ended March 31, 2018the adjustment relates to the non-cash value assigned to inventory transferred to Collegium.

(3) $12.5 million benefit from the release of sales reserves for which the Company is no longer financially responsible.

FULL-YEAR 2019 NON-GAAP GUIDANCE RECONCILATION

(in millions)

(unaudited)

Earnings

(1)

Low End

High End

GAAP

$

(68

)

$

(58

)

Specified Items

(2)

$

186

$

186

Non-GAAP

$

118

$

128

(1) GAAP net income guidance refers to GAAP net income and non-GAAP earnings guidance refers to non-GAAP adjusted EBITDA.

(2) For purposes of this forward-looking reconciliation, a description of the categories of specified items included in this reconciliation are detailed in the tables above.

Source: Assertio Therapeutics, Inc.

财报申请上市

2019-03-07

Reports Neurology Franchise Annual Net Sales of $110.3 million, at the High End of Guidance Range

-- Reports Neurology Franchise Annual Net Sales of $110.3 million, at the High End of Guidance Range --

-- Files NDA for Long-Acting Cosyntropin and Receives FDA Notification of Acceptance --

-- Issues Full-Year 2019 Guidance for Earnings and Neurology Franchise Net Sales --

LAKE FOREST, Ill., March 06, 2019 (GLOBE NEWSWIRE) --

Assertio Therapeutics, Inc.

(NASDAQ: ASRT) today reported financial results for the fourth quarter and year ended December 31, 2018, and provided an update on its business performance and strategic initiatives.

Financial Highlights:

(unaudited)

Fourth-Quarter 2018

Full-Year 2018

(in millions, except earnings per share)

GAAP

Non-GAAP

(3)

GAAP

Non-GAAP

(3)

Total Revenues

(1) (2)

42.6

62.8

311.8

278.0

Net Income/(Loss)

(24.1)

23.1

36.9

93.2

Earnings/(Loss) Per Share

$(0.38)

$0.30

$0.57

$1.22

Adjusted EBITDA

—

41.0

—

155.3

(1) Fourth-quarter 2018 includes a $21.3 million adjustment reversal for the non-cash value assigned to inventory transferred to Collegium.

(2) Full-year 2018 includes a ($25.2) million adjustment reversal for the non-cash value assigned to inventory transferred to Collegium.

(3) All non-GAAP measures included in this earnings news release are reconciled to the corresponding GAAP measures in the schedules attached.

“Assertio’s 2018 financial performance met, or exceeded, our goals for the full year,” said Arthur Higgins, President and CEO of Assertio. “We delivered adjusted EBITDA at the high end of our current guidance range, and ahead of our original target, as well as neurology franchise sales at the high end of our current guidance range. In addition, we made significant progress throughout the year advancing our strategic, financial and operational goals, including the NDA filing of our long-acting cosyntropin. We look forward to another productive year ahead as we continue the transformation of Assertio into a biopharma company with sustainable growth and a promising pipeline.”

Business Highlights:

FDA Accepted Filing of 505(b)(2) NDA Filing for Cosyntropin:

On February 19, 2019, the Company received notification of acceptance for filing from the U.S. Food and Drug Administration for its 505(b)(2) New Drug Application for its injectable formulation of long-acting cosyntropin (synthetic adrenocorticotropic hormone, or ACTH). The Company, together with its partner West Therapeutic Development, LLC, seeks approval for the use of long-acting cosyntropin as a diagnostic drug in the screening of patients presumed to have adrenocortical insufficiency. The PDUFA date is October 19, 2019.

Strong Cash Generation and Debt Reduction:

In 2018, the Company secured $97.0 million in non-dilutive cash through strategic transactions, of which approximately $65.0 million was received in 2018; the balance of $32 million was received on January 30, 2019. These cash inflows, as well as the Company’s own cash-flow generation, reduced total secured debt by $82.5 million from $365.0 million as of December 31, 2017 to $282.5 million as of December 31, 2018. As of December 31, 2018, the Company had cash and cash equivalents of $110.9 million.

Amended Senior Secured Credit Facility:

On January 8, 2019, the Company amended its Senior Secured Credit Facility, replacing the previous fixed adjusted EBITDA covenant with a trailing 12-month debt-to-adjusted EBITDA ratio that declines over time. The amendment gives the Company greater flexibility to continue to pay down debt and invest in the core business, including potential business development transactions.

Strengthened NUCYNTA Collaboration with Collegium - Extends Minimum Term; Annual Royalty Payments Through 2021

: On November 8, 2018, the Company announced an amendment to the Commercialization Agreement with Collegium Pharmaceutical, Inc. relating to the NUCYNTA

®

franchise. The amendment strengthens the collaboration and further aligns the parties’ mutual interest in growing the franchise. The amendment secures a minimum term of the Commercialization Agreement through at least December 31, 2021, prior to which Collegium may not terminate.

Completed Previously Announced Corporate Restructuring and HQ Relocation:

In 2018, the Company completed its reincorporation from California to Delaware and changed its name from “Depomed, Inc.” to “Assertio Therapeutics, Inc.” In connection with the reincorporation and name change, the Company’s common stock began trading under a new ticker symbol “ASRT” and a new CUSIP number, 04545L 107, on August 15, 2018.

On August 15, 2018, the Company completed the relocation of its corporate headquarters from Newark, CA, to Lake Forest, IL. The relocation is consistent with the Company’s strategy to attract new pharmaceutical talent based in the Chicagoland area.

Additionally, the Company has sublet the entirety of its Newark facility.

Revenue Summary

(in thousands, unaudited)

Three Months Ended

December 31,

Twelve Months Ended

December 31,

2018

2017

2018

2017

Product sales, net:

Gralise

$

14,805

$

20,208

$

58,077

$

77,034

CAMBIA

10,933

7,749

35,803

31,597

Zipsor

3,212

4,415

16,387

16,700

Total neurology product sales, net

28,950

32,372

110,267

125,331

Nucynta products

(1)

162

60,018

18,944

239,539

Lazanda

(2)

227

1,770

755

15,010

Total product sales, net

29,339

94,160

129,966

379,880

Commercialization agreement:

(3)

Commercialization rights and facilitation services, net

12,983

—

100,038

—

Revenue from transfer of inventory

—

—

55,705

—

Royalties and milestone revenue

277

248

26,061

844

Total revenues

$

42,599

$

94,408

$

311,770

$

380,724

___________________

(1) The Company transitioned the commercial rights to sell NUCYNTA to Collegium on January 9, 2018. NUCYNTA product sales for the three months ended December 31, 2018 relate to sales reserve estimate adjustments. NUCYNTA product sales for the twelve months ended December 31, 2018 reflect the Company’s sales of NUCYNTA during a stub period between January 1st and January 8th, and also includes a $12.5 million benefit related to the release of sales reserves for which the Company is no longer financially responsible.

(2) The Company divested Lazanda in November 2017. Product sales for the three and twelve months ended December 31, 2018 relate to sales reserve estimate adjustments.

(3) The Commercialization Agreement revenues for the twelve months ended December 31, 2018 includes $100.0 million related to the commercialization rights and facilitation services provided to Collegium and $55.7 million related to the fair value of inventory transferred to Collegium. During the fourth quarter of 2018, the Company amended the Commercialization Agreement and agreed upon a variable revenue stream to take the place of the existing fixed revenue stream. As such, as of the date of the amendment, on November 8, 2018, the Company ceased recognition of fixed revenues and will begin recognition of variable revenues when they become due beginning in January 2019. Cash collected during the fourth quarter remained in-line with the pre-modification agreement amount of $33.8 million.

2019 Financial Guidance

The Company is providing the following 2019 financial guidance:

2019 Guidance

Neurology Franchise Net Sales

Low-to Mid-Single Digit Growth

GAAP Net (Loss)/Income

(1)

($71) to ($61) million

Non-GAAP Adjusted EBITDA

(1)

$115 to $125 million

(1) Guidance includes: (a) $2.8 million of non-cash Collegium warrant-related income and excludes (b) any future mark-to-market adjustments related to those warrants, which cannot be estimated at this time.

Conference Call and Webcast

Assertio will host a conference call today, Wednesday, March 6, 2019 beginning at 4:30 p.m. ET to discuss its results. This event can be accessed in three ways:

From the Assertio website:

. Please access the website 15 minutes prior to the start of the call to download and install any necessary audio software.

By telephone: Participants can access the call by dialing (877) 550-3745 (United States) or (281) 973-6277 (International) referencing Conference ID 3784827.

By replay: A replay of the webcast will be located under the Investor Relations section of Assertio’s website approximately two hours after the conclusion of the live call.

About Assertio Therapeutics, Inc.

Assertio Therapeutics is committed to providing responsible solutions to advance patient care in the Company’s core areas of neurology, orphan and specialty medicines. Assertio currently markets three FDA-approved products and continues to identify, license and develop new products that offer enhanced options for patients that may be under served by existing therapies. To learn more about Assertio, visit

.

“Safe Harbor” Statement under the Private Securities Litigation Reform Act of 1995

The statements that are not historical facts contained in this release are forward-looking statements that involve risks and uncertainties including, but not limited to, the commercialization of Gralise, CAMBIA, and Zipsor, royalties associated with Collegium’s commercialization of NUCYNTA and NUCYNTA ER, regulatory approval and clinical development of long-acting cosyntropin, loan agreements, including our senior secured debt facility, Assertio’s financial outlook for 2019 and expectations regarding financial results and potential business opportunities and other risks detailed in the Company’s Securities and Exchange Commission filings, including the Company’s most recent Annual Report on Form 10-K and most recent Quarterly Report on Form 10-Q. The inclusion of forward-looking statements should not be regarded as a representation that any of the Company’s plans or objectives will be achieved. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. The Company undertakes no obligation to publicly release the result of any revisions to these forward-looking statements that may be made to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events.

Investor and Media Contact:

John B. Thomas

Senior Vice President, Investor Relations and Corporate Communications

jthomas@assertiotx.com

Non-GAAP Financial Measures

To supplement the Company’s financial results presented on a U.S. generally accepted accounting principles (GAAP) basis, the Company has included information about non-GAAP revenue, non-GAAP adjusted earnings, non-GAAP adjusted diluted earnings per share, non-GAAP adjusted EBITDA and other non-GAAP financial measures as useful operating metrics. The Company believes that the presentation of these non-GAAP financial measures, when viewed with results under GAAP and the accompanying reconciliation, provides supplementary information to analysts, investors, lenders, and the Company’s management in assessing the Company’s performance and results from period to period. The Company uses these non-GAAP measures internally to understand, manage and evaluate the Company’s performance, and in part, in the determination of bonuses for executive officers and employees. These non-GAAP financial measures should be considered in addition to, and not a substitute for, or superior to, net income or other financial measures calculated in accordance with GAAP. Non-GAAP financial measures used by us may be calculated differently from, and therefore may not be comparable to, non-GAAP measures used by other companies.

Specified Items

Non-GAAP measures presented within this release exclude specified items. The Company considers specified Items to be significant income/expense items not indicative of current operations, including the related tax effect. Specified items include non-cash adjustment to Collegium agreement revenue and cost of sales, release of NUCYNTA and Lazanda sales reserves for products the Company is no longer selling, interest income, interest expense, amortization, acquired in-process research and development and non-cash adjustments related to product acquisitions, stock-based compensation expense, non-cash interest expense related to debt, depreciation, taxes, transaction costs, CEO transition, restructuring costs, adjustments to net sales related to reserves recorded prior to the Company’s exit of opioid commercialization activities, legal costs and expenses incurred in connection with opioid-related litigation, investigations and regulations pertaining to the company’s historical commercialization of opioid products, certain types of legal settlements, disputes, fees and costs, and to adjust for the tax effect related to each of the non-GAAP adjustments.

CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except per share amounts)

(unaudited)

Three Months Ended December 31,

Twelve Months Ended December 31,

2018

2017

2018

2017

(unaudited)

(unaudited)

Revenues:

Product sales, net

$

29,339

$

94,160

$

129,966

$

379,880

Commercialization agreement, net

12,983

—

155,743

—

Royalties and milestones

277

248

26,061

844

Total revenues

42,599

94,408

311,770

380,724

Costs and expenses:

Cost of sales (excluding amortization of intangible assets)

704

17,704

18,476

72,598

Research and development expenses

2,207

1,259

8,042

13,718

Acquired in-process research and development

—

24,900

—

24,900

Selling, general and administrative expenses

25,468

48,318

119,218

195,696

Amortization of intangible assets

25,443

25,541

101,774

102,745

Restructuring charges

1,859

9,372

20,601

13,247

Total costs and expenses

55,681

127,094

268,111

422,904

Income/(loss) from operations

(13,082

)

(32,685

)

43,659

(42,180

)

Litigation settlement

—

—

62,000

—

Gain on divestiture of Lazanda

—

17,064

—

17,064

Interest and other income

224

77

1,197

681

Loss on prepayment of Senior Notes

—

(573

)

—

(5,938

)

Interest expense

(16,613

)

(17,857

)

(68,881

)

(73,552

)

Income tax (expense) benefit

5,333

870

(1,067

)

1,429

Net income/(loss)

$

(24,138

)

$

(33,104

)

$

36,908

$

(102,496

)

Basic net (loss) income per share

$

(0.38

)

$

(0.52

)

$

0.58

$

(1.63

)

Diluted net income (loss) per share

$

(0.38

)

$

(0.52

)

$

0.57

$

(1.63

)

Basic shares used in calculation

64,004

63,137

63,794

62,702

Diluted shares used in calculation

64,004

63,137

64,208

62,702

CONSOLIDATED CONDENSED BALANCE SHEETS

(in thousands)

(unaudited)

December 31,

2018

December 31,

2017

Cash, cash equivalents and marketable securities

$

110,949

$

128,089

Accounts receivable, net

37,211

72,482

Inventories

3,396

13,042

Property and equipment, net

13,064

13,024

Intangible assets, net

692,099

793,873

Investments

11,784

—

Prepaid and other assets

64,363

18,107

Total assets

$

932,866

$

1,038,617

Accounts payable

$

6,138

$

14,732

Income tax payable

—

126

Interest payable

11,645

13,220

Accrued liabilities

31,361

60,496

Accrued rebates, returns and discounts

75,759

135,828

Senior notes

278,309

357,220

Convertible notes

287,798

269,510

Contingent consideration liability

1,038

1,613

Other liabilities

20,483

16,364

Shareholders’ equity

220,335

169,508

Total liabilities and shareholders’ equity

$

932,866

$

1,038,617

RECONCILIATION OF GAAP NET INCOME (LOSS) TO NON-GAAP ADJUSTED EBITDA

(in thousands)

(unaudited)

Three Months Ended December 31,

Twelve Months Ended December 31,

2018

2017

2018

2017

(unaudited)

(unaudited)

GAAP net income/(loss)

$

(24,138

)

$

(33,104

)

$

36,908

$

(102,496

)

Commercialization agreement revenues

(1)

21,262

—

(25,164

)

—

Commercialization agreement cost of sales

(2)

—

—

6,200

—

Nucynta sales reserve

(3)

—

—

(10,711

)

—

Nucynta and Lazanda revenue reserves

(4)

(1,024

)

—

(1,562

)

—

Expenses for opioid-related litigation, investigations and regulations

(5)

3,537

—

7,897

—

Intangible amortization related to product acquisitions

25,443

25,541

101,774

102,745

Contingent consideration related to product acquisitions

143

(104

)

(515

)

(6,629

)

Stock-based compensation

2,549

3,095

10,439

12,965

Purdue litigation settlement

—

—

(62,000

)

—

Interest and other income

(224

)

(77

)

(1,197

)

(410

)

Interest expense

16,613

18,361

68,881

78,190

Depreciation

254

918

1,931

2,757

Provision for (benefit from) income taxes

(5,333

)

(870

)

1,067

(1,429

)

Restructuring and related costs

(6)

1,881

9,817

21,264

16,834

Acquired in process research and development

—

24,900

—

24,900

Gain on divestiture of Lazanda

—

(17,064

)

—

(17,064

)

Managed care dispute reserve

—

—

—

4,742

Transaction and other costs

—

1,435

123

1,435

Non-GAAP adjusted EBITDA

$

40,963

$

32,848

$

155,335

$

116,540

___________________

(1) For the period from January 8, 2018 through November 8, 2018, the adjustment relates to the non-cash value assigned to inventory transferred to Collegium. As of the date of the amendment, on November 8, 2018, the Company ceased recognition of fixed revenues and will begin recognition of variable revenues when they become due beginning in January 2019. Cash collected during the fourth quarter remained in-line with the pre-modification agreement amount of $33.8 million. The adjustment for the three months ended December 31, 2018 relates to the cash received in excess of the GAAP revenue recognized. The Company has consistently shown non-GAAP revenue for the Commercialization Agreement on a cash basis.

(2) Represents the cash received for inventory transferred to Collegium at the commencement of the Commercialization Agreement.

(3) Represents a $12.5 million benefit related to the release of sales reserves for which the Company is no longer financially responsible, net of $1.8 million in royalties payable to a third party.

(4) Removal of the impact of revenue adjustment estimates related to products that we are no longer commercializing.

(5) Legal costs/expenses related to opioid-related litigation, investigations and regulations pertaining to the Company’s historical commercialization of opioid products.

(6) Restructuring and other costs represents non-recurring costs associated with the Company’s restructuring, reincorporation, headquarters relocation and CEO transition.

RECONCILIATION OF GAAP NET INCOME/(LOSS) TO NON-GAAP ADJUSTED EARNINGS

(in thousands, except per share amounts)

(unaudited)

Three Months Ended December 31,

Twelve Months Ended December 31,

2018

2017

2018

2017

(unaudited)

(unaudited)

GAAP net income/(loss)

$

(24,138

)

$

(33,104

)

$

36,908

$

(102,496

)

Commercialization agreement revenues

(1)

21,262

—

(25,164

)

—

Commercialization agreement cost of sales

(2)

—

—

6,200

—

Nucynta sales reserve

(3)

—

—

(10,711

)

—

Nucynta and Lazanda revenue reserves

(4)

(1,024

)

—

(1,562

)

—

Expenses for opioid-related litigation, investigations and regulations

(5)

3,537

—

7,897

—

Intangible amortization related to product acquisitions

25,443

25,541

101,774

102,745

Contingent consideration related to product acquisitions

143

(104

)

(515

)

(6,629

)

Stock-based compensation

2,549

3,095

10,439

12,965

Restructuring and related costs

(6)

1,881

9,817

21,264

16,834

Acquired in process research and development

—

24,900

—

24,900

Gain on divestiture of Lazanda

—

(17,064

)

—

(17,064

)

Purdue litigation settlement

—

—

(62,000

)

—

Non-cash interest expense on debt

5,579

5,340

21,877

20,953

Managed care dispute reserve

—

—

—

4,742

Valuation allowance on deferred tax assets

—

11,017

—

30,291

Other costs

—

—

123

—

Income tax effect of non-GAAP adjustments

(7)

(12,147

)

(18,626

)

(13,305

)

(56,875

)

Non-GAAP adjusted earnings

$

23,085

$

10,813

$

93,225

$

30,366

Add interest expense of convertible debt, net of tax

(8)

1,704

1,348

6,814

5,390

Numerator

$

24,789

$

12,160

$

100,039

$

35,756

Shares used in calculation

(8)

81,935

81,360

82,139

81,619

Non-GAAP adjusted earnings per share

$

0.30

$

0.15

$

1.22

$

0.44

___________________

(1) For the period from January 8, 2018 through November 8, 2018, the adjustment relates to the non-cash value assigned to inventory transferred to Collegium. As of the date of the amendment, on November 8, 2018, the Company ceased recognition of fixed revenues and will begin recognition of variable revenues when they become due beginning in January 2019. Cash collected during the fourth quarter remained in-line with the pre-modification agreement amount of $33.8 million. The adjustment for the three months ended December 31, 2018 relates to the cash received in excess of the GAAP revenue recognized. The Company has consistently shown non-GAAP revenue for the Commercialization Agreement on a cash basis.

(2) Represents the cash received for inventory transferred to Collegium at the commencement of the Commercialization Agreement.

(3) Represents a $12.5 million benefit related to the release of sales reserves for which the Company is no longer financially responsible, net of $1.8 million in royalties payable to a third party.

(4) Removal of the impact of revenue adjustment estimates related to products that we are no longer commercializing.

(5) Legal costs/expenses related to opioid-related litigation, investigations and regulations pertaining to the Company’s historical commercialization of opioid products.

(6) Restructuring and other costs represents non-recurring costs associated with the Company’s restructuring, reincorporation, headquarters relocation and CEO transition.

(7) Calculated by taking the pre-tax non-GAAP adjustments and applying the statutory tax rate.

(8) The Company uses the if-converted method to compute diluted earnings per share with respect to its convertible debt.

RECONCILIATION OF GAAP NET INCOME (LOSS) PER SHARE TO

NON-GAAP ADJUSTED EARNINGS PER SHARE

(unaudited)

Three Months Ended December 31,

Twelve Months Ended December 31,

2018

2017

2018

2017

GAAP net income/(loss) per share

(0.38

)

(0.52

)

0.57

(1.63

)

Conversion from basic shares to diluted shares

0.09

0.12

(0.13

)

0.38

Commercialization agreement revenues

0.26

—

(0.30

)

—

Commercialization agreement cost of sales

—

—

0.08

—

Nucynta sales reserve

—

—

(0.13

)

—

Non-cash interest expense on debt

0.07

0.07

0.27

0.26

Nucynta and Lazanda revenue reserves

—

—

(0.01

)

—

Managed care dispute reserve

—

—

—

0.06

Expenses for opioid-related litigation, investigations and regulations

0.04

—

0.09

—

Purdue litigation settlement

—

—

(0.75

)

—

Intangible amortization related to product acquisitions

0.31

0.31

1.23

1.25

Contingent consideration related to product acquisitions

(0.01

)

—

(0.01

)

(0.08

)

Stock based compensation

0.03

0.04

0.13

0.16

Restructuring and related costs

0.03

0.12

0.26

0.21

Acquired in process research and development

—

0.30

—

0.30

Gain on divestiture of Lazanda

—

(0.21

)

—

(0.21

)

Valuation allowance on deferred tax assets

—

0.14

—

0.37

Income tax effect of non-GAAP adjustments

(0.16

)

(0.23

)

(0.16

)

(0.70

)

Add interest expense of convertible debt, net of tax

0.02

0.02

0.08

0.07

Non-GAAP adjusted diluted earnings per share

0.30

0.15

1.22

0.44

RECONCILIATIONS OF GAAP REPORTED TO NON-GAAP ADJUSTED INFORMATION

For the three months ended December 31, 2018

(in thousands)

(unaudited)

Commercialization

agreement revenues

Product Sales

Royalties and

milestones

Total Revenue

Cost of sales

Research and

development

expense

Selling, general and

administrative

expense

GAAP as reported

$

12,983

$

29,339

$

277

$

42,599

$

704

$

2,207

$

25,468

Commercialization agreement revenues and cost of sales

21,262

—

—

21,262

—

—

—

Nucynta sales reserve

—

—

—

—

—

—

—

Third party royalties

(82

)

—

—

(82

)

82

—

—

Nucynta and Lazanda revenue reserves

—

(1,024

)

—

(1,024

)

—

—

—

Expenses for opioid-related litigation, investigations and regulations

—

—

—

—

—

—

(3,537

)

Contingent consideration related to product acquisitions

—

—

—

—

—

—

(143

)

Stock based compensation

—

—

—

—

—

(109

)

(2,440

)

Restructuring and other costs

—

—

—

—

—

—

(22

)

Non-GAAP adjusted EBITDA

$

34,163

$

28,315

$

277

$

62,755

$

786

$

2,098

$

19,326

For non-GAAP adjusted EBITDA purposes, the company adjusts the full costs of restructuring, amortization of intangible assets, interest expense and taxes.

RECONCILIATIONS OF GAAP REPORTED TO NON-GAAP ADJUSTED INFORMATION

For the twelve months ended December 31, 2018

(in thousands)

(unaudited)

Commercialization

agreement revenues

Product Sales

Royalties and

milestones

Total Revenue

Cost of sales

Research and

development

expense

Selling, general and

administrative

expense

GAAP as reported

$

155,743

$

129,966

$

26,061

$

311,770

$

18,476

$

8,042

$

119,218

Commercialization agreement revenues and cost of sales

(25,164

)

—

—

(25,164

)

—

—

—

Nucynta sales reserve

—

(10,711

)

—

(10,711

)

—

—

—

Third party royalties

3,659

—

—

3,659

(3,659

)

—

—

Nucynta and Lazanda revenue reserves

—

(1,562

)

—

(1,562

)

—

—

—

Expenses for opioid-related litigation, investigations and regulations

—

—

—

—

—

—

(7,897

)

Contingent consideration related to product acquisitions

—

—

—

—

—

—

515

Stock based compensation

—

—

—

—

(30

)

(446

)

(9,963

)

Restructuring and other costs

—

—

—

—

—

—

(661

)

Other costs

—

—

—

—

—

—

(123

)

Non-GAAP adjusted EBITDA

$

134,238

$

117,693

$

26,061

$

277,992

$

14,787

$

7,596

$

101,089

For non-GAAP adjusted EBITDA purposes, the company adjusts the full costs of restructuring, amortization of intangible assets, interest expense and taxes.

FULL-YEAR 2019 NON-GAAP GUIDANCE RECONCILIATION

(in millions)

(unaudited)

Earnings

(1)

Low End

High End

GAAP

($71

)

($61

)

Specified Items

(2)

$

186

$

186

Non-GAAP

$

115

$

125

___________________

(1) GAAP net income guidance refers to GAAP net income and non-GAAP earnings guidance refers to non-GAAP adjusted EBITDA.

(2) For purposes of this forward-looking reconciliation, a description of the categories of specified items included in this reconciliation are detailed in the tables above.

Source: Assertio Therapeutics, Inc.

PDF Version

财报申请上市引进/卖出并购

100 项与 West Therapeutic Development LLC 相关的药物交易

登录后查看更多信息

100 项与 West Therapeutic Development LLC 相关的转化医学

登录后查看更多信息

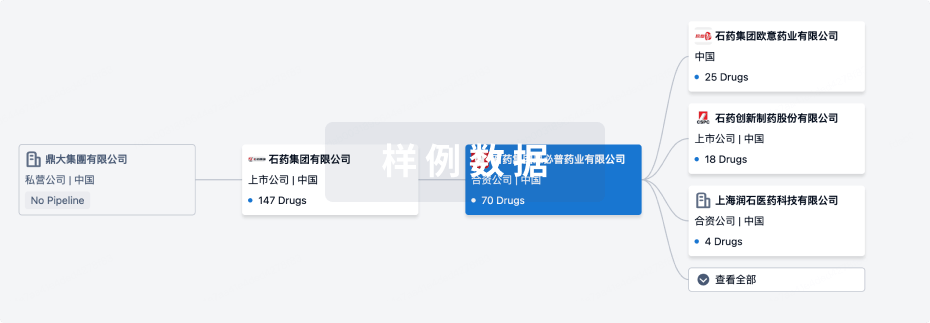

组织架构

使用我们的机构树数据加速您的研究。

登录

或

管线布局

2025年11月03日管线快照

无数据报导

登录后保持更新

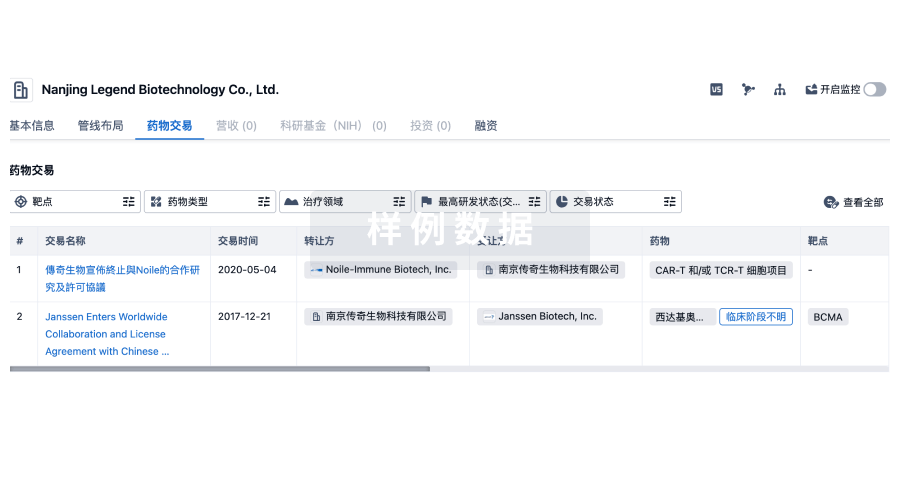

药物交易

使用我们的药物交易数据加速您的研究。

登录

或

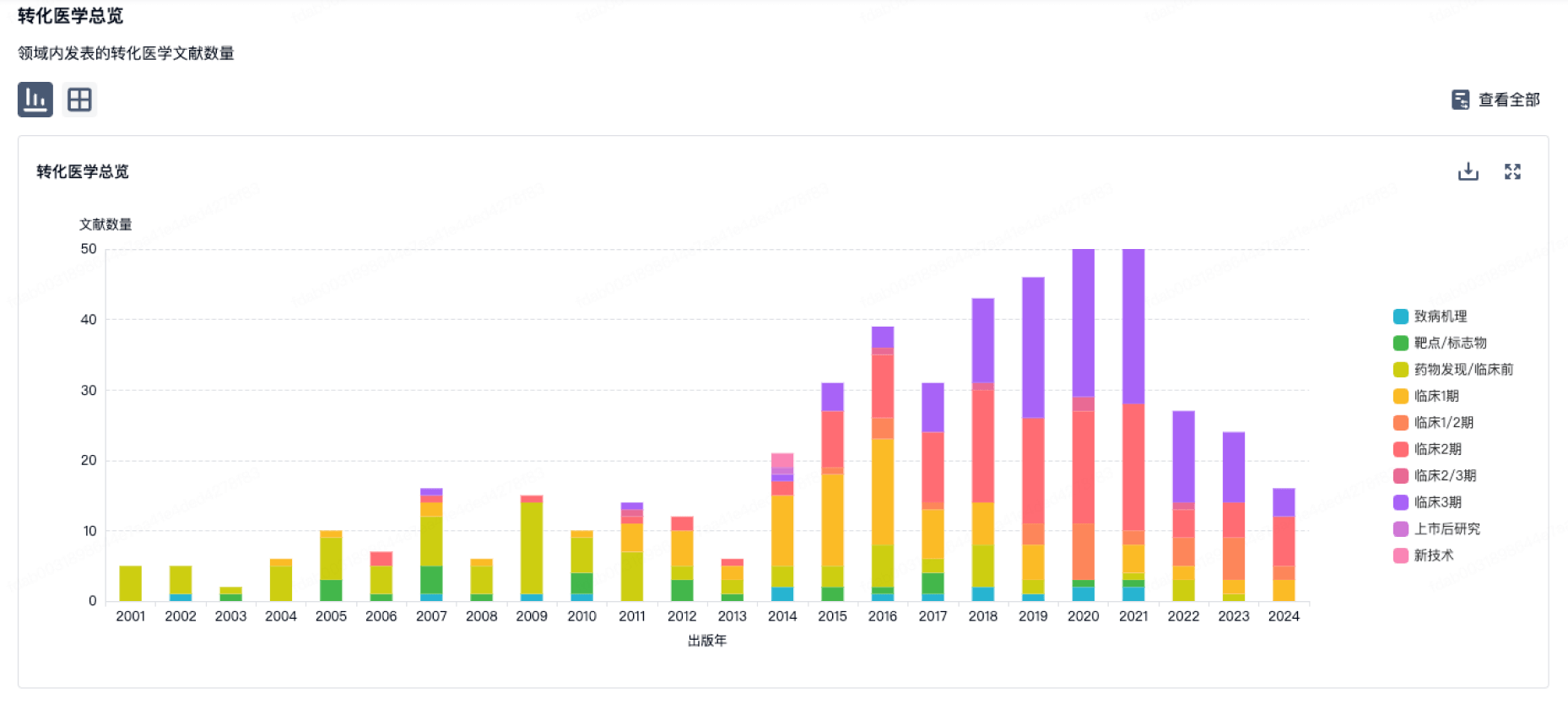

转化医学

使用我们的转化医学数据加速您的研究。

登录

或

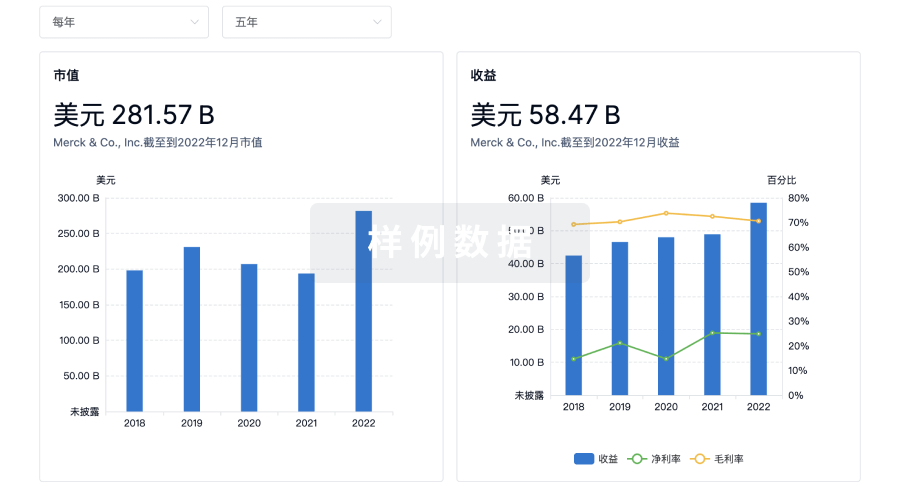

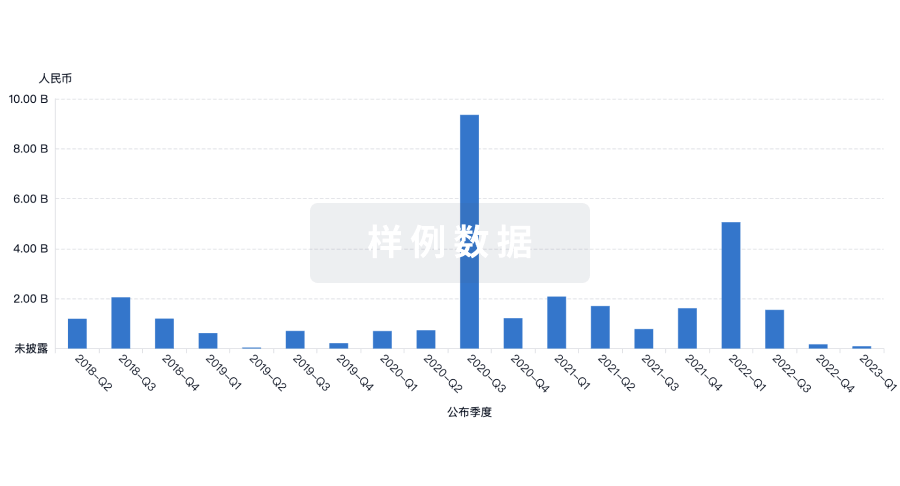

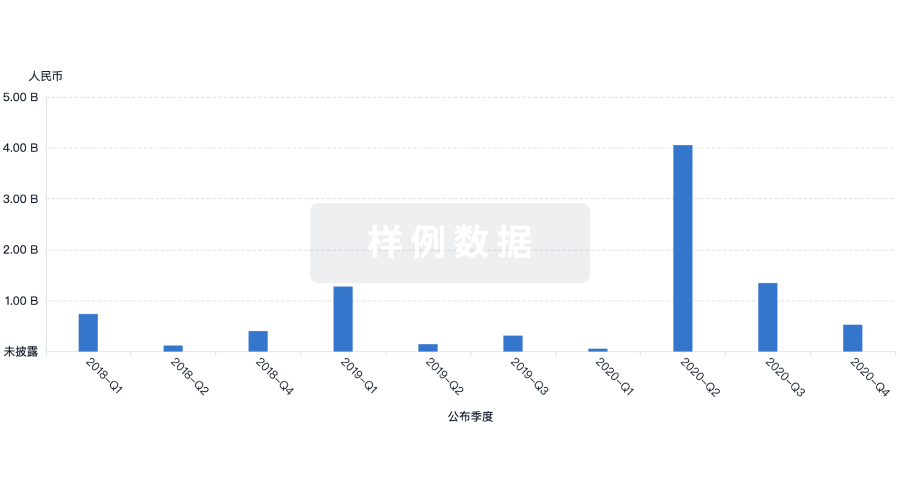

营收

使用 Synapse 探索超过 36 万个组织的财务状况。

登录

或

科研基金(NIH)

访问超过 200 万项资助和基金信息,以提升您的研究之旅。

登录

或

投资

深入了解从初创企业到成熟企业的最新公司投资动态。

登录

或

融资

发掘融资趋势以验证和推进您的投资机会。

登录

或

生物医药百科问答

全新生物医药AI Agent 覆盖科研全链路,让突破性发现快人一步

立即开始免费试用!

智慧芽新药情报库是智慧芽专为生命科学人士构建的基于AI的创新药情报平台,助您全方位提升您的研发与决策效率。

立即开始数据试用!

智慧芽新药库数据也通过智慧芽数据服务平台,以API或者数据包形式对外开放,助您更加充分利用智慧芽新药情报信息。

生物序列数据库

生物药研发创新

免费使用

化学结构数据库

小分子化药研发创新

免费使用