更新于:2024-11-01

Rich Industries, Inc.

更新于:2024-11-01

概览

关联

100 项与 Rich Industries, Inc. 相关的临床结果

登录后查看更多信息

0 项与 Rich Industries, Inc. 相关的专利(医药)

登录后查看更多信息

3

项与 Rich Industries, Inc. 相关的新闻(医药)2022-11-10

Topline 24-week data from Phase 1b trial in subjects with non-alcoholic fatty liver disease (NAFLD) expected mid-December 2022 Interim 24-week readout from MOMENTUM Phase 2 obesity trial expected Q1 2023 GAITHERSBURG, Md., Nov. 10, 2022 (GLOBE NEWSWIRE) -- Altimmune, Inc. (Nasdaq: ALT), a clinical-stage biopharmaceutical company, today announced financial results for the three and nine months ended September 30, 2022, and provided a business update. “We continue on course in our advancement of pemvidutide for two important clinical indications, obesity and non-alcoholic steatohepatitis (NASH), and look forward to data readouts from our NAFLD trial extension in mid-December 2022 and from our interim 24-week readout on approximately 160 subjects from our MOMENTUM Phase 2 obesity trial in Q1 2023,” said Vipin K. Garg, Ph.D., President and Chief Executive Officer of Altimmune. “We believe that the promising reductions in liver fat content and alanine aminotransferase (ALT) levels observed in our recently completed 12-week Phase 1b NAFLD trial should translate into success on the approvable NASH endpoints, including NASH resolution and fibrosis improvement, in late-phase biopsy trials. The magnitude of the effects on the liver combined with meaningful reductions in body weight could represent important points of differentiation from other drugs in development for NASH.” Dr. Garg added, “Turning to our MOMENTUM obesity trial, we believe that the level of weight loss we expect to see at 48 weeks will be similar to the leading drugs in the class. The trial is being conducted in a typical obesity population at established obesity trial sites and employs lifestyle interventions that are standard in obesity trials. We believe the absence of dose titration, together with the favorable tolerability profile, reductions in serum lipids and reductions in liver fat content observed in clinical trials to date, could translate into greater ease of administration, improved adherence to therapy and greater potential for cardiovascular benefit in this patient population.” Recent Highlights and Anticipated Milestones: Pemvidutide Topline data readout from 12-week Phase 1b NAFLD trial in September 2022 This trial was conducted in the U.S., with Dr. Stephen A. Harrison, Director, Pinnacle Research and University of Oxford, serving as Principal Investigator.A total of 94 subjects were randomized and dosed, with approximately 80% being of Hispanic ethnicity, and with a median liver fat content of approximately 22%.A 68.5% relative reduction in liver fat content was achieved at the 1.8 mg dose at Week 12, with 94.4% of subjects achieving a 30% reduction of liver fat and 55.6% achieving normalization of liver fat, defined as 5% or less on MRI-PDFF, at Week 12.As announced in a late-breaking abstract presented on November 7, 2022, at the annual meeting of the American Association for the Study of Liver Diseases (AASLD) in Washington, DC, greater than 83% of subjects who received pemvidutide and who participated in a corrected T1 (cT1) imaging sub-study achieved an 80 millisecond (ms) or more reduction in cT1 relaxation times at Week 12 at each pemvidutide dose. Elevated cT1 scores have been correlated with hepatic and cardiovascular events in clinical studies. An 80 ms reduction has been shown to correlate with a 2-point improvement in NAFLD Activity Score on liver biopsies. Topline 24-week data from NAFLD trial (12-week extension) expected mid-December 2022 This extension trial provides 12 weeks of additional treatment to subjects with NAFLD who completed the 12-week Phase 1b trial, allowing subjects to receive a total of 24 weeks of treatment.Although the extension trial was initiated several months after the start of the original 12-week Phase 1b NAFLD trial, a total of 66 of 94 subjects (70%) rolled over into this trial. Randomization and first dosing of all subjects is complete in 48-week Phase 2 MOMENTUM obesity trial – 24-week interim analysis of approximately 160 subjects expected in Q1 2023 This Phase 2 trial is being conducted at 30 sites across the U.S., with Dr. Lou Aronne, Professor of Clinical Medicine, Weill Cornell Medical College, a leading authority in obesity and obesity clinical trials, serving as the Principal Investigator.The trial was designed to enroll approximately 320 non-diabetic subjects with obesity, or overweight with at least one co-morbidity. Subjects were randomized 1:1:1:1 to 1.2 mg, 1.8 mg, 2.4 mg pemvidutide or placebo administered weekly for 48 weeks in conjunction with diet and exercise. Baseline characteristics of the study population include median body weight and body mass index (BMI) of approximately 101 kg and 36 kg/m2, respectively, and median liver fat content of approximately 5%, as measured in approximately 100 subjects participating in a body composition sub-study. The study population is approximately 75% female, and approximately 20% of subjects are of Hispanic ethnicity.The primary endpoint is the relative (percent) change in body weight at 48 weeks compared to baseline. Additional readouts include metabolic and lipid profiles, cardiovascular measures and glucose homeostasis.A 24-week interim analysis on approximately 160 subjects is planned in Q1 2023. Enrollment complete in Phase 1b trial of subjects with type 2 diabetes This 12-week safety trial will evaluate the effects of pemvidutide in approximately 48 subjects with type 2 diabetes and obesity or overweight.Data readout is expected in Q1 2023. HepTcell™ Enrollment continuing in the Phase 2 clinical trial in chronic hepatitis B Endpoints include virological markers of hepatitis B infection and functional cure.Data readout is expected in H2 2023. Financial Results for the Three Months Ended September 30, 2022 Altimmune had cash, cash equivalents and short-term investments totaling $201.9 million at September 30, 2022.Revenue was minimal for the three months ended September 30, 2022 compared to $0.2 million in the same period in 2021. The change in revenue quarter over quarter was primarily due to the discontinuation of development activities for the T-COVID and NasoShield programs in 2021.Research and development expenses were $20.3 million for the three months ended September 30, 2022, compared to $29.2 million in the same period in 2021. The expenses for the quarter ended September 30, 2022 included $14.0 million in direct costs related to development activities for pemvidutide and $1.8 million in direct costs related to development activities for HepTcell.General and administrative expenses were $4.5 million for the three months ended September 30, 2022, compared to $4.2 million in the same period in 2021. The change was primarily attributable to increased stock compensation expense.Net loss for the three months ended September 30, 2022 was $23.5 million, or $0.48 net loss per share, compared to a net loss of $33.5 million, or $0.81 net loss per share, in the same period in 2021. Conference Call Information: Date:Thursday, November 10, 2022Time:8:30 am Eastern TimeWebcast:The conference call will be webcast live on Altimmune’s Investor Relations website at https://ir.altimmune.com/investors.Dial-in:Participants who would like to join the call may register here to receive the dial-in numbers and unique PIN to access the call. Following the conclusion of the call, the webcast will be available for replay on the Investor Relations page of the Company’s website at www.altimmune.com. The Company has used, and intends to continue to use, the IR portion of its website as a means of disclosing material non-public information and for complying with disclosure obligations under Regulation FD. About Pemvidutide Pemvidutide is a novel, investigational, peptide-based GLP-1/glucagon dual receptor agonist in development for the treatment of obesity and NASH. Activation of the GLP-1 and glucagon receptors is believed to mimic the complementary effects of diet and exercise on weight loss, with GLP-1 suppressing appetite and glucagon increasing energy expenditure. Pemvidutide incorporates the EuPortTM domain, a proprietary technology that increases its serum half-life for weekly dosing while slowing the entry of pemvidutide into the bloodstream, which may improve its tolerability. In a 12-week Phase 1b clinical trial, NAFLD subjects treated with pemvidutide demonstrated promising reductions in liver fat content, serum ALT levels and body weight. About HepTcell HepTcell is a novel, investigational, immunotherapeutic comprised of nine synthetic peptides representing conserved hepatitis B (HBV) sequences formulated with IC31®, a TLR9-based adjuvant from Valneva SE. The HBV-directed peptides are designed to drive T cell responses against all HBV genotypes towards a functional cure for chronic HBV in patients of diverse genetic backgrounds. About Altimmune Altimmune is a clinical-stage biopharmaceutical company focused on the development of novel peptide-based therapeutics for the treatment of obesity and liver diseases. The company’s lead product candidate, pemvidutide, is a GLP-1/glucagon dual receptor agonist that is being developed for the treatment of obesity and NASH. In addition, Altimmune is developing HepTcell™, an immunotherapeutic designed to achieve a functional cure for chronic hepatitis B. For more information, please visit www.altimmune.com. Follow @Altimmune, Inc. on LinkedInFollow @AltimmuneInc on Twitter Forward-Looking Statement Any statements made in this press release relating to future financial or business performance, conditions, plans, prospects, trends, or strategies and other financial and business matters, including without limitation, the timing of key milestones for our clinical assets, the timing of the data readout of the NAFLD trial, diabetic subject trial, drug-drug interaction trial and the Phase 2 obesity clinical trial of pemvidutide, the timing of the data readouts for the Phase 2 clinical trial of HepTcell, and the prospects for regulatory approval, use, commercializing or selling any product or drug candidates, are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. In addition, when or if used in this press release, the words “may,” “could,” “should,” “anticipate,” “believe,” “estimate,” “expect,” “intend,” “plan,” “predict” and similar expressions and their variants, as they relate to Altimmune, Inc. (the “Company”) may identify forward-looking statements. The Company cautions that these forward-looking statements are subject to numerous assumptions, risks, and uncertainties, which change over time. Important factors that may cause actual results to differ materially from the results discussed in the forward looking statements or historical experience include risks and uncertainties, including risks relating to: potential impacts from the ongoing conflict in Ukraine and COVID-19, such as delays in regulatory review, manufacturing and supply chain interruptions, access to clinical sites, enrollment, adverse effects on healthcare systems and disruption of the global economy; the reliability of the results of studies relating to human safety and possible adverse effects resulting from the administration of the Company’s product candidates; the Company’s ability to manufacture clinical trial materials on the timelines anticipated; and the success of future product advancements, including the success of future clinical trials. Further information on the factors and risks that could affect the Company's business, financial conditions and results of operations are contained in the Company’s filings with the U.S. Securities and Exchange Commission, including under the heading “Risk Factors” in the Company’s annual report on Form 10-K for the fiscal year ended December 31, 2021 and our other filings with the SEC, which are available at www.sec.gov. Investor & Media Contacts: Rich Eisenstadt Chief Financial OfficerPhone: 240-654-1450reisenstadt@altimmune.com ALTIMMUNE, INC.CONSOLIDATED BALANCE SHEETS(In thousands, except share and per share data) September 30, December 31, 2022 2021 (Unaudited) ASSETS

Current assets:

Cash and cash equivalents$127,465 $190,301 Restricted cash 34 34 Total cash, cash equivalents and restricted cash 127,499 190,335 Short-term investments 74,362 — Accounts receivable 633 429 Income tax and R&D incentive receivables 3,720 5,410 Prepaid expenses and other current assets 4,790 7,952 Total current assets 211,004 204,126 Property and equipment, net 1,172 1,448 Intangible assets, net 12,419 12,419 Other assets 682 872 Total assets$225,277 $218,865 LIABILITIES AND STOCKHOLDERS’ EQUITY

Current liabilities:

Accounts payable$1,419 $2,034 Contingent consideration — 6,090 Accrued expenses and other current liabilities 14,323 10,152 Total current liabilities 15,742 18,276 Other long-term liabilities 4,506 1,454 Total liabilities 20,248 19,730 Commitments and contingencies (Note 14)

Stockholders’ equity:

Common stock, $0.0001 par value; 200,000,000 shares authorized; 49,161,637 and 40,993,768 shares issued and outstanding as of September 30, 2022 and December 31, 2021, respectively 5 4 Additional paid-in capital 566,551 497,342 Accumulated deficit (356,224) (293,171)Accumulated other comprehensive loss, net (5,303) (5,040)Total stockholders’ equity 205,029 199,135 Total liabilities and stockholders’ equity$225,277 $218,865

ALTIMMUNE, INC.CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS(Unaudited)(In thousands, except share and per share data)

Three Months Ended Nine Months Ended September 30, September 30, 2022 2021 2022 2021 Revenues$2 $158 $42 $1,133 Operating expenses:

Research and development 20,262 29,206 51,359 54,356 General and administrative 4,492 4,156 13,329 11,636 Impairment loss on construction-in-progress — — — 8,070 Total operating expenses 24,754 33,362 64,688 74,062 Loss from operations (24,752) (33,204) (64,646) (72,929)Other income (expense):

Interest expense (64) (33) (191) (67)Interest income 1,053 13 1,402 88 Other income (expense), net 50 (286) 185 (293)Total other income (expense), net 1,039 (306) 1,396 (272)Net loss before income taxes (23,713) (33,510) (63,250) (73,201)Income tax benefit 197 — 197 — Net loss (23,516) (33,510) (63,053) (73,201)Other comprehensive income — unrealized (loss) gain on short-term investments (143) (2) (263) 4 Comprehensive loss$(23,659) $(33,512) $(63,316) $(73,197)Net loss per share, basic and diluted$(0.48) $(0.81) $(1.37) $(1.79)Weighted-average common shares outstanding, basic and diluted 49,286,535 41,370,768 45,881,547 40,843,905

小分子药物财报

2022-09-14

All 3 pemvidutide dosing groups (1.2 mg, 1.8 mg, 2.4 mg) achieved the primary endpoint of relative and absolute reductions in liver fat, with a 68.5% relative reduction in liver fat content in subjects receiving 1.8 mg dose at 12 weeks of treatmentMean weight loss of 4.9% (placebo-adjusted 4.7%) in subjects without diabetes receiving 1.8 mg dose at 12 weeks of treatmentAltimmune to host conference call today at 8:30 am ET GAITHERSBURG, Md., Sept. 14, 2022 (GLOBE NEWSWIRE) -- Altimmune, Inc. (Nasdaq: ALT), a clinical-stage biopharmaceutical company, today announced positive topline results from its 12-week Phase 1b study of pemvidutide1 in subjects with non-alcoholic fatty liver disease (NAFLD). The trial was a randomized, double-blind, placebo-controlled study, with Dr. Stephen A. Harrison, Medical Director, Pinnacle Research, serving as the Principal Investigator. Subjects were randomized 1:1:1:1 to 1.2 mg, 1.8 mg, 2.4 mg pemvidutide or placebo administered weekly for 12 weeks. No dose titration was used with 1.2 mg or 1.8 mg dose, while a short 4-week dose titration was employed at the 2.4 mg dose. The primary efficacy endpoint was the percent (%) reduction in liver fat content from baseline, and the key secondary efficacy endpoint was the % weight loss from baseline, both at 12 weeks of treatment. The trial was conducted without adjunctive diet and exercise interventions that are the standard for obesity trials. Ninety-four (94) subjects were randomized and treated at 13 sites across the U.S. Mean BMI at baseline was approximately 36 kg/m2 and mean liver fat content (LFC), as measured by MRI-PDFF, was approximately 22%. Twenty-seven (29%) subjects had type 2 diabetes at baseline, and approximately 75% of study subjects were of Hispanic ethnicity. The trial met its primary endpoint in all pemvidutide treatment groups. At the 1.8 mg dose (with and without diabetes), pemvidutide achieved a mean reduction of liver fat content of 68.5%, with 94.4% of subjects achieving a 30% reduction in liver fat, 72.2% achieving a 50% reduction in liver fat, and 55.6% of subjects achieving normalization of liver fat, defined as liver fat fraction of 5% or less. In addition, mean serum alanine aminotransferase (ALT) levels declined in all subjects, and in subjects with baseline serum ALT above 30 IU/L, levels declined more than 17 IU/L at all dose levels and 27.0 IU/L in the 2.4 mg dose cohort. The trial also met its key secondary endpoint in all pemvidutide treatment groups. Employing an efficacy estimand, mean weight losses of 4.9% (placebo-adjusted 4.7%) in subjects without diabetes and 4.4% in subjects with diabetes (placebo-adjusted 3.9%) were achieved at the 1.8 and 2.4 mg doses, respectively. Pemvidutide was reported to be generally well tolerated. Gastrointestinal events comprised the majority of the adverse events (AEs). Even without dose titration, the symptoms experienced by subjects were predominantly mild and transient in nature, consistent with known GLP-1 class effects. No serious or severe AEs were reported. Two subjects treated with pemvidutide discontinued treatment due to AEs [1 (4.3%) at 1.8 mg and 1 (4.2%) at 2.4 mg], both secondary to gastrointestinal intolerability. No clinically significant ALT elevations (defined as an increase to 3-fold or greater the upper limit of normal) were observed. Glycemic control was unaffected, with no clinically meaningful changes in HbA1c or fasting glucose. Clinically meaningful reductions in systolic blood pressure were observed, along with the 2-3 beat per minute increase in heart rate typical for GLP-1 class of drugs. “We are pleased with the results of this trial, including the extent of liver fat and serum ALT reductions. Weight loss was within our target range, and good tolerability was observed without the need for dose titration. In addition, no clinically significant ALT elevations were observed,” said Vipin K. Garg, Ph.D., President and Chief Executive Officer of Altimmune. “With these positive results in hand, we look forward to reporting data from the 24-week NAFLD trial, as well as 24-week interim data from our MOMENTUM obesity trial.” Dr. Stephen Harrison, Principal Investigator, remarked, “Significant reductions in the liver fat fraction and serum ALT have been shown to correlate with improvement of non-alcoholic steatohepatitis (NASH) in clinical trials. The marked decreases in both liver fat and serum ALT, together with approximately 5% weight loss in just 12 weeks in this NAFLD patient population, highlight pemvidutide as potentially a promising therapeutic for both NASH and obesity.” Dr. Harrison also noted, “It is important to recognize that the baseline liver fat content and demographics in this study diverged substantially from a typical obesity study population.” Baseline Study Demographics CharacteristicTreatmentPlacebo(n = 24)1.2 mg(n=23)1.8 mg(n=23)2.4 mg(n=24)Age, years mean (SD)47.9 (14)48.6 (11)50.3 (9)48.8 (8)Sexfemale, n (%)14 (58.3%)9 (39.1%)12 (52.2%)15 (62.5%)Racewhite, n (%)21 (87.5%)21 (91.3%)20 (87.0%)24 (100%)other, n (%)3 (12.5%)2 (8.7%)3 (13.0%)0 (0.0%)EthnicityHispanic, n (%)14 (58.3%)20 (87.0%)19 (82.6%)18 (75.0%)Non-Hispanic, n (%)10 (41.7%)3 (13.0%)4 (17.4%)6 (25.0%)BMI, kg/m2mean (SD)36.9 (4.7)36.3 (5.6)35.4 (3.9)35.3 (5.0)Body weight, kgmean (SD)105.1 (20.8)102.4 (14.6)98.9 (19.7)98.2 (18.9)Diabetes statusT2D, n (%)6 (25.0%)7 (30.4%)7 (30.4%)7 (33.3%)LFC, %mean (SD)23.8 (9.2)21.6 (7.3)21.8 (8.0)20.2 (7.0) Reduction of Liver Fat Content (MRI-PDFF)—All Subjects EndpointTreatmentPlacebo(n = 24)1.2 mg(n=20)1.8 mg(n=18)2.4 mg(n=20)Absolute reduction, %mean (SE)0.2 (1.7)8.9 (1.8)**14.7 (1.7)**11.3 (2.0)**Relative reduction, %mean (SE)4.4 (8.7)46.6 (8.1)**68.5 (9.7)**57.1 (8.0)**30% reductionn (%)1 (4.2%)13 (65.0%)**17 (94.4%)**17 (85.0%)**50% reductionn (%)0 (0.0%)8 (40.0%)**13 (72.2%)**14 (70.0%)**Normalization (≤ 5% LFC)n (%)0 (0.0%)4 (20.0%)*10 (55.6%)**10 (50.0%)** *p < .05, **p<.001 compared to placebo Reductions in Body Weight—Efficacy Estimand PopulationTreatmentPlacebo(n = 24)1.2 mg(n=23)1.8 mg(n=23)2.4 mg(n=24)No diabetes, (% change)LSM (SE)-0.2 (0.7)-3.4**(0.8)-4.9**(0.8)-3.5**(0.8)Diabetes, (% change)LSM (SE)-0.5(1.3)-3.3*(1.1)-3.8*(1.2)-4.4*(1.3)All subjects (% change)LSM (SE)-0.2(0.7)-3.4**(0.7)-4.3**(0.7)-3.7**(0.7) LSM, least square mean; *p < .05, **p<.001 compared to placebo Summary of Safety Findings CharacteristicTreatmentPlacebo(n = 24)1.2 mg(n=23)1.8 mg(n=23)2.4 mg(n=24)Severe AEs n (%)0 (0.0%)0 (0.0%)0 (0.0%)0 (0.0%)SAEs n (%)0 (0.0%)0 (0.0%)0 (0.0%)0 (0.0%)AEs leading to treatment discontinuation n (%)0 (0.0%)0 (0.0%)1 (4.3%)1 (4.2%)Nauseamild, n (%)3 (12.5%)3 (13.0%)6 (26.1%)6 (25.0%)mod, n (%)0 (0.0%)1 (4.3%)6 (26.1%)3 (12.5%)Vomitingmild, n (%)0 (0.0%)3 (13.0%)2 (8.7%)2 (8.3%)mod, n (%)0 (0.0%)0 (0.0%)0 (0.0%)0 (0.0%)Diarrheamild, n (%)4 (16.7%)3 (13.0%)5 (21.7%)1 (4.2%)mod, n (%)0 (0.0%)0 (0.0%)0 (0.0%)0 (0.0%)ConstipationMild, n (%)0 (0.0%)3 (13.0%)4 (17.4%)1 (4.2%)mod, n (%)0 (0.0%)1 (4.3%)0 (0.0%)0 (0.0%) 1 proposed INN About Pemvidutide Pemvidutide is a novel, investigational, peptide-based GLP-1/glucagon dual receptor agonist in development for the treatment of obesity and NASH. Activation of the GLP-1 and glucagon receptors is believed to mimic the complementary effects of diet and exercise on weight loss, with GLP-1 suppressing appetite and glucagon increasing energy expenditure. Pemvidutide incorporates the EuPortTM domain, a proprietary technology that increases its serum half-life for weekly dosing while likely slowing the entry of pemvidutide into the bloodstream, which may improve its tolerability. In a 12-week Phase 1 clinical trial, pemvidutide-treated subjects demonstrated substantial reductions in body weight, liver fat and serum lipids commonly associated with cardiovascular disease. Conference Call InformationAltimmune management will host a conference call and webcast with a slide presentation presented by Dr. Stephen A. Harrison beginning at 8:30 am E.T. Following the conclusion of the call, the webcast will be available for replay on the Investor Relations page of the Company’s website at www.altimmune.com. The Company has used, and intends to continue to use, the IR portion of its website as a means of disclosing material non-public information and for complying with disclosure obligations under Regulation FD. Conference Call Information:Date:Wednesday, September 14Time:8:30 am Eastern TimeWebcast:The conference call will be webcast live on Altimmune’s Investor Relations website at https://ir.altimmune.com/investors.Dial-in:Participants who would like to join the call may register here to receive the dial-in numbers and unique PIN to access the call. About Altimmune Altimmune is a clinical-stage biopharmaceutical company focused on the development of novel peptide-based therapeutics for the treatment of obesity and liver diseases. The company’s lead product candidate, pemvidutide, is a GLP-1/glucagon dual receptor agonist that is being developed for the treatment of obesity and NASH. In addition, Altimmune is developing HepTcell™, an immunotherapeutic designed to achieve a functional cure for chronic hepatitis B. For more information, please visit www.altimmune.com. Follow @Altimmune, Inc. on LinkedInFollow @AltimmuneInc on Twitter Forward-Looking Statement Any statements made in this press release relating to future financial or business performance, conditions, plans, prospects, trends, or strategies and other financial and business matters, including without limitation, the timing of key milestones for our clinical assets, the timing of the data readouts of the NAFLD trials, the Phase 2 obesity clinical trial of pemvidutide, and the prospects for regulatory approval, commercializing or selling any product or drug candidates, are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. In addition, when or if used in this press release, the words “may,” “could,” “should,” “anticipate,” “believe,” “estimate,” “expect,” “intend,” “plan,” “predict” and similar expressions and their variants, as they relate to Altimmune, Inc. (the “Company”) may identify forward-looking statements. The Company cautions that these forward-looking statements are subject to numerous assumptions, risks, and uncertainties, which change over time. Important factors that may cause actual results to differ materially from the results discussed in the forward looking statements or historical experience include risks and uncertainties, including risks relating to: potential impacts from the ongoing conflict in Ukraine and the COVID-19 pandemic, such as delays in regulatory review, manufacturing and supply chain interruptions, access to clinical sites, enrollment, adverse effects on healthcare systems and disruption of the global economy; the impact of liver fat content and demographics in the Phase 1b NAFLD study on the success of future trials; the reliability of the results of studies relating to human safety and possible adverse effects resulting from the administration of the Company’s product candidates; the Company’s ability to manufacture clinical trial materials on the timelines anticipated; and the success of future product advancements, including the success of future clinical trials. Further information on the factors and risks that could affect the Company’s business, financial conditions and results of operations are contained in the Company’s filings with the U.S. Securities and Exchange Commission, including under the heading “Risk Factors” in the Company’s annual report on Form 10-K for the fiscal year ended December 31, 2021 and our other filings with the SEC, which are available at www.sec.gov. Investor & Media Contacts: Rich EisenstadtChief Financial OfficerPhone: 240-654-1450reisenstadt@altimmune.com

合作

2022-08-11

Topline data from 12-week Phase 1b trial in subjects with obesity/overweight and non-alcoholic fatty liver disease (NAFLD) expected mid-September 2022GAITHERSBURG, Md., Aug. 11, 2022 (GLOBE NEWSWIRE) -- Altimmune, Inc. (Nasdaq: ALT), a clinical-stage biopharmaceutical company, today announced financial results for the three and six months ended June 30, 2022, and provided a business update. “We continue to advance the development of pemvidutide, our GLP-1/glucagon dual receptor agonist, and look forward to reporting important readouts from our ongoing clinical trials during the coming months,” said Vipin K. Garg, Ph.D., President and Chief Executive Officer of Altimmune. “We expect to announce top line data from our 12-week trial in subjects with obesity/overweight and NAFLD in mid-September 2022, followed by 24-week data from an extension of that trial in Q4 2022. Enrollment in our Phase 2 MOMENTUM obesity trial has been very robust. As of August 10, 167 subjects have been randomized, and approximately 25 additional subjects are being randomized each week. At this rate, we expect to complete the randomization of all 320 subjects in September 2022. We have also made the decision to conduct the interim analysis of this trial when approximately 50%, or 160 study participants, complete 24 weeks of treatment, which we expect will occur in Q1 2023. While we had planned to conduct an interim analysis on approximately 100 subjects at year end 2022, it is our current belief that an interim analysis on 50% of the subjects would be more meaningful.” “We believe that pemvidutide has the potential to deliver weight loss equaling or exceeding 20% after only 48 weeks of treatment. In addition, we believe that pemvidutide will have a highly differentiated product profile compared to other obesity products in development— including, no dose titration, faster weight loss and robust reductions in lipids. If achieved, we believe these features would translate into greater ease of administration, improved adherence to therapy, and greater potential for cardiovascular benefit,” Dr. Garg added. Recent Highlights and Anticipated Milestones: Pemvidutide1 (ALT-801) Topline data from 12-week Phase 1b trial in subjects with obesity/overweight and NAFLD expected mid-September 2022 This trial is being conducted in the U.S., with Dr. Stephen A. Harrison, Director, Pinnacle Research and University of Oxford, serving as Principal Investigator.The trial is fully enrolled and has randomized and dosed a total of 94 subjects, of whom approximately 29% have type 2 diabetes. Treatments included 1.2 mg, 1.8 mg, 2.4 mg pemvidutide or placebo in a 1:1:1:1 ratio administered weekly for 12 weeks.The topline data will include: liver fat assessment by MRI-PDFFweight lossadverse events (AEs leading to discontinuation, rates of gastrointestinal AEs, severe and serious AEs)laboratory parameters, including liver function tests and glucoseserum lipidshemoglobin A1cheart rate and blood pressure

Topline data from a 12-week extension to the Phase 1b trial expected in Q4 2022 This extension trial provides 12 weeks of additional treatment to subjects who completed the 12-week Phase 1b trial in subjects with obesity/overweight and NAFLD. This extension allows subjects to receive a total of 24 weeks of treatment.The principal readouts are weight loss and the safety of pemvidutide at 24 weeks of treatment.

Enrollment is over 50% complete in 48-week Phase 2 MOMENTUM obesity trial – 24-week interim analysis of 160 subjects expected in Q1 2023 This Phase 2 trial is being conducted at approximately 25 sites in the U.S., with Dr. Lou Aronne, Professor of Clinical Medicine, Weill Cornell Medical College, a leading authority in obesity and obesity clinical trials, serving as the Principal Investigator.The trial is expected to enroll approximately 320 non-diabetic subjects with obesity/overweight with at least one co-morbidity. Subjects are being randomized 1:1:1:1 to 1.2 mg, 1.8 mg, 2.4 mg pemvidutide or placebo administered weekly for 48 weeks in conjunction with diet and exercise.The primary endpoint is the relative (percent) change in body weight at 48 weeks compared to baseline. Additional readouts include metabolic and lipid profiles, cardiovascular measures and glucose homeostasis.As of August 10, 2022, 167 subjects have been randomized and approximately 25 additional subjects are being randomized each week. Based on the current rate of enrollment, Altimmune expects to complete the randomization of all 320 subjects in September 2022.A 24-week interim analysis on approximately 50%, or 160 subjects, is planned in Q1 2023. Enrollment ongoing in Phase 1b trial of diabetic subjects with obesity and overweight This 12-week trial will evaluate the effects of pemvidutide on glucose control in approximately 48 subjects with type 2 diabetes.Completion of enrollment is expected in September 2022, and data readout is expected in Q1 2023.

1proposed INN HepTcell Enrollment continuing in the Phase 2 clinical trial in chronic hepatitis B Endpoints include virological markers of hepatitis B infection and functional cure.Data readout is expected in H2 2023.

Financial Results for the Three Months Ended June 30, 2022 Altimmune had cash, cash equivalents and short-term investments totaling $184.8 million at June 30, 2022.Revenue was minimal for the three months ended June 30, 2022 compared to $0.1 million in the same period in 2021. The change in revenue quarter over quarter was primarily due to the discontinuation of development activities for the T-COVID and NasoShield programs.Research and development expenses were $16.0 million for the three months ended June 30, 2022, compared to $13.3 million in the same period in 2021. The expenses for the quarter ended June 30, 2022 included $8.7 million in direct costs related to development activities for pemvidutide and $1.4 million in direct costs related to development activities for HepTcell. In addition, approximately $1.9 million of expense was a non-cash expense associated with the achievement of the Phase 2 development milestone for pemvidutide.General and administrative expenses were $4.4 million for the three months ended June 30, 2022, compared to $3.7 million in the same period in 2021. The change was primarily attributable to increased labor and labor-related expenses, including stock compensation.Net loss for the three months ended June 30, 2022 was $20.1 million, or $0.42 net loss per share, compared to a net loss of $24.8 million, or $0.60 net loss per share, in the same period in 2021. Net loss for the three months ended June 30, 2021 included an $8.1 million impairment loss relating to a write-down of the construction-in-progress associated with the construction of the Lonza facility, which was to manufacture AdCOVID. Conference Call Information: Date:Thursday, August 11Time:8:30 am Eastern TimeWebcast:The conference call will be webcast live on Altimmune’s Investor Relations website at https://ir.altimmune.com/investors.Dial-in:Participants who would like to join the call may register here to receive the dial-in numbers and unique PIN to access the call. Following the conclusion of the call, the webcast will be available for replay on the Investor Relations page of the Company’s website at www.altimmune.com. The Company has used, and intends to continue to use, the IR portion of its website as a means of disclosing material non-public information and for complying with disclosure obligations under Regulation FD. About PemvidutidePemvidutide is a novel, investigational, peptide-based GLP-1/glucagon dual receptor agonist in development for the treatment of obesity and NASH. Activation of the GLP-1 and glucagon receptors is believed to mimic the complementary effects of diet and exercise on weight loss, with GLP-1 suppressing appetite and glucagon increasing energy expenditure. By combining GLP-1 and glucagon activity in a single peptide, pemvidutide has the potential to achieve weight loss equaling or exceeding 20% after only 48 weeks of treatment. Pemvidutide incorporates the EuPortTM domain, a proprietary technology that increases its serum half-life for weekly dosing while slowing the entry of pemvidutide into the bloodstream, which may improve its tolerability. In a 12-week Phase 1 clinical trial, pemvidutide-treated subjects demonstrated striking reductions in body weight, liver fat and serum lipids commonly associated with cardiovascular disease. About HepTcellHepTcell is a novel, investigational, immunotherapeutic comprised of nine synthetic peptides representing conserved hepatitis B (HBV) sequences formulated with IC31®, a TLR9-based adjuvant from Valneva SE. The HBV-directed peptides are designed to drive T cell responses against all HBV genotypes towards a functional cure for chronic HBV in patients of diverse genetic backgrounds. About AltimmuneAltimmune is a clinical-stage biopharmaceutical company focused on the development of novel peptide-based therapeutics for the treatment of obesity and liver diseases. The company’s lead product candidate, pemvidutide, is a GLP-1/glucagon dual receptor agonist that is being developed for the treatment of obesity and NASH. In addition, Altimmune is developing HepTcell™, an immunotherapeutic designed to achieve a functional cure for chronic hepatitis B. For more information, please visit www.altimmune.com. Follow @Altimmune, Inc. on LinkedInFollow @AltimmuneInc on Twitter Forward-Looking Statement Any statements made in this press release relating to future financial or business performance, conditions, plans, prospects, trends, or strategies and other financial and business matters, including without limitation, the timing of key milestones for our clinical assets, the timing of the data readouts of the NAFLD trials, diabetic subject trial, drug-drug interaction trial, and the Phase 2 obesity clinical trial of pemvidutide, the timing of the data readouts for the Phase 2 clinical trial of HepTcell, and the prospects for regulatory approval, use, commercializing or selling any product or drug candidates, are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. In addition, when or if used in this press release, the words “may,” “could,” “should,” “anticipate,” “believe,” “estimate,” “expect,” “intend,” “plan,” “predict” and similar expressions and their variants, as they relate to Altimmune, Inc. (the “Company”) may identify forward-looking statements. The Company cautions that these forward-looking statements are subject to numerous assumptions, risks, and uncertainties, which change over time. Important factors that may cause actual results to differ materially from the results discussed in the forward looking statements or historical experience include risks and uncertainties, including risks relating to: potential impacts from the ongoing conflict in Ukraine and the COVID-19 pandemic, such as delays in regulatory review, manufacturing and supply chain interruptions, access to clinical sites, enrollment, adverse effects on healthcare systems and disruption of the global economy; the reliability of the results of studies relating to human safety and possible adverse effects resulting from the administration of the Company’s product candidates; the Company’s ability to manufacture clinical trial materials on the timelines anticipated; and the success of future product advancements, including the success of future clinical trials. Further information on the factors and risks that could affect the Company's business, financial conditions and results of operations are contained in the Company’s filings with the U.S. Securities and Exchange Commission, including under the heading “Risk Factors” in the Company’s annual report on Form 10-K for the fiscal year ended December 31, 2021 and our other filings with the SEC, which are available at www.sec.gov. Investor & Media Contacts: Rich Eisenstadt

Chief Financial Officer

Phone: 240-654-1450

reisenstadt@altimmune.com ALTIMMUNE, INC.CONSOLIDATED BALANCE SHEETS(In thousands, except share and per share data)

June 30, December 31, 2022 2021 (Unaudited) ASSETS

Current assets:

Cash and cash equivalents $135,858 $190,301 Restricted cash 34 34 Total cash, cash equivalents and restricted cash 135,892 190,335 Short-term investments 48,898 — Accounts receivable 195 429 Income tax and R&D incentive receivables 5,900 5,410 Prepaid expenses and other current assets 4,619 7,952 Total current assets 195,504 204,126 Property and equipment, net 1,236 1,448 Intangible assets, net 12,419 12,419 Other assets 747 872 Total assets $209,906 $218,865 LIABILITIES AND STOCKHOLDERS’ EQUITY

Current liabilities:

Accounts payable $2,872 $2,034 Contingent consideration — 6,090 Accrued expenses and other current liabilities 10,973 10,152 Total current liabilities 13,845 18,276 Other long-term liabilities 1,526 1,454 Total liabilities 15,371 19,730 Commitments and contingencies (Note 14)

Stockholders’ equity:

Common stock, $0.0001 par value; 200,000,000 shares authorized; 46,372,105 and 40,993,768 shares issued and outstanding as of June 30, 2022 and December 31, 2021, respectively 5 4 Additional paid-in capital 532,398 497,342 Accumulated deficit (332,708) (293,171)Accumulated other comprehensive loss, net (5,160) (5,040)Total stockholders’ equity 194,535 199,135 Total liabilities and stockholders’ equity $209,906 $218,865

ALTIMMUNE, INC.CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS(Unaudited)(In thousands, except share and per share data) Three Months Ended Six Months Ended June 30, June 30, 2022

2021 2022

2021 Revenues $8 $137 $40 $975 Operating expenses:

Research and development 15,993 13,272 31,097 25,150 General and administrative 4,410 3,659 8,837 7,480 Impairment loss on construction-in-progress — 8,070 — 8,070 Total operating expenses 20,403 25,001 39,934 40,700 Loss from operations (20,395) (24,864) (39,894) (39,725) Other income (expense):

Interest expense (65) (22) (127) (34) Interest income 328 33 349 75 Other income (expense), net 25 26 135 (7) Total other income (expense), net 288 37 357 34 Net loss (20,107) (24,827) (39,537) (39,691) Other comprehensive income — unrealized (loss) gain on short-term investments (120) 1 (120) 6 Comprehensive loss $(20,227) $(24,826) $(39,657) $(39,685) Net loss per share, basic and diluted $(0.42) $(0.60) $(0.90) $(0.99) Weighted-average common shares outstanding, basic and diluted 47,502,599 41,356,643 44,150,835 40,142,561

财报

100 项与 Rich Industries, Inc. 相关的药物交易

登录后查看更多信息

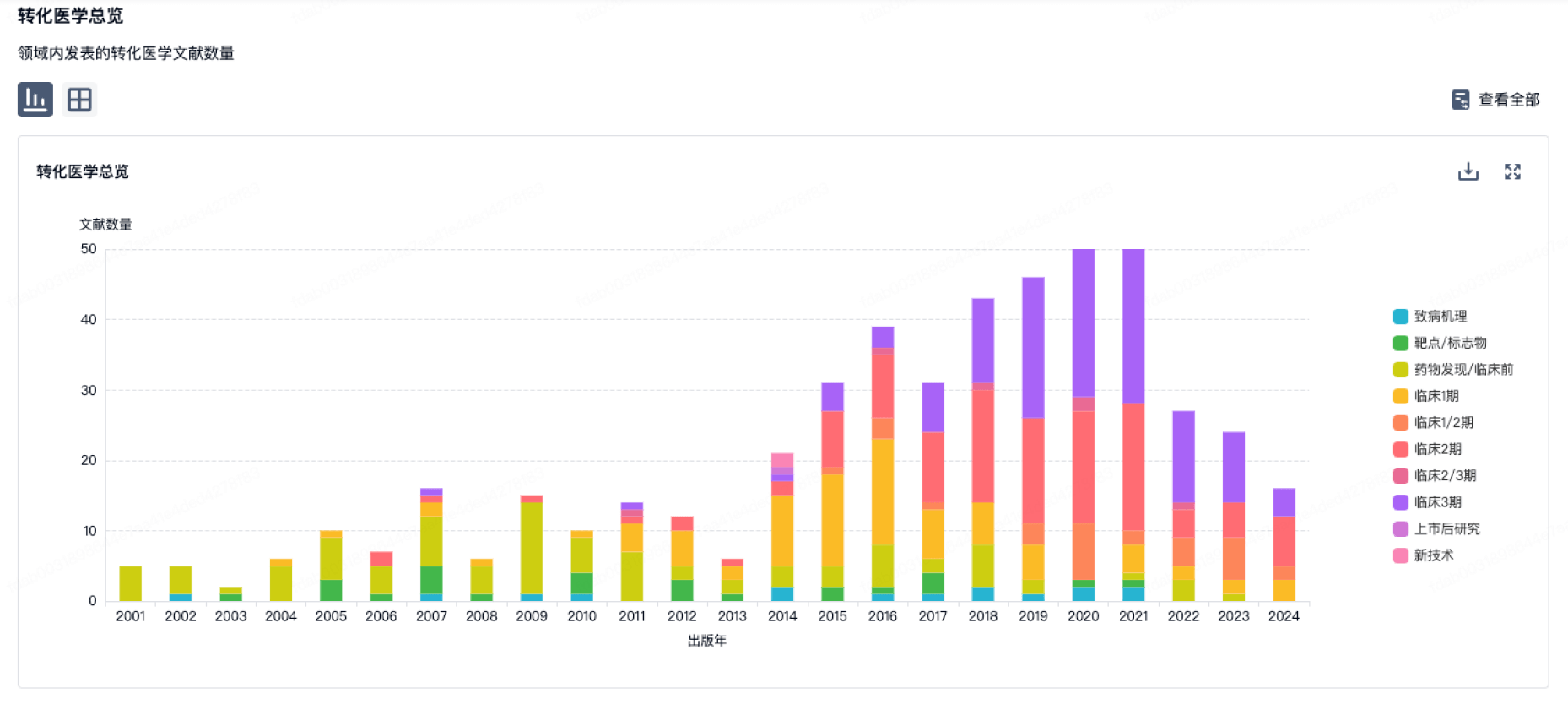

100 项与 Rich Industries, Inc. 相关的转化医学

登录后查看更多信息

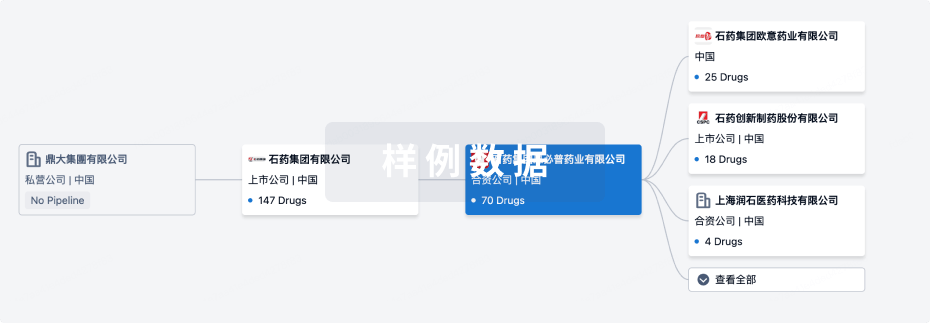

组织架构

使用我们的机构树数据加速您的研究。

登录

或

管线布局

2024年11月20日管线快照

无数据报导

登录后保持更新

药物交易

使用我们的药物交易数据加速您的研究。

登录

或

转化医学

使用我们的转化医学数据加速您的研究。

登录

或

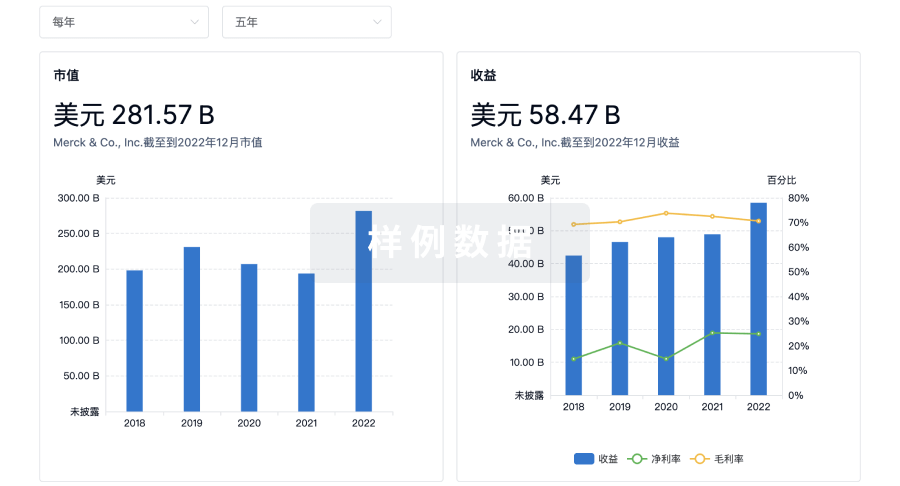

营收

使用 Synapse 探索超过 36 万个组织的财务状况。

登录

或

科研基金(NIH)

访问超过 200 万项资助和基金信息,以提升您的研究之旅。

登录

或

投资

深入了解从初创企业到成熟企业的最新公司投资动态。

登录

或

融资

发掘融资趋势以验证和推进您的投资机会。

登录

或

标准版

¥16800

元/账号/年

新药情报库 | 省钱又好用!

立即使用

来和芽仔聊天吧

立即开始免费试用!

智慧芽新药情报库是智慧芽专为生命科学人士构建的基于AI的创新药情报平台,助您全方位提升您的研发与决策效率。

立即开始数据试用!

智慧芽新药库数据也通过智慧芽数据服务平台,以API或者数据包形式对外开放,助您更加充分利用智慧芽新药情报信息。

生物序列数据库

生物药研发创新

免费使用

化学结构数据库

小分子化药研发创新

免费使用