预约演示

更新于:2025-08-29

Kinnjiu Biopharma Ltd.

中国香港

中国香港

更新于:2025-08-29

概览

标签

肿瘤

小分子化药

疾病领域得分

一眼洞穿机构专注的疾病领域

暂无数据

技术平台

公司药物应用最多的技术

暂无数据

靶点

公司最常开发的靶点

暂无数据

| 疾病领域 | 数量 |

|---|---|

| 肿瘤 | 2 |

| 排名前五的药物类型 | 数量 |

|---|---|

| 小分子化药 | 2 |

| 排名前五的靶点 | 数量 |

|---|---|

| BRAF(丝氨酸/苏氨酸蛋白激酶B-raf) | 1 |

| FGFR2 x FGFR3 | 1 |

关联

2

项与 Kinnjiu Biopharma Ltd. 相关的药物靶点 |

作用机制 BRAF抑制剂 |

在研适应症 |

非在研适应症- |

最高研发阶段临床1期 |

首次获批国家/地区- |

首次获批日期- |

作用机制 FGFR2拮抗剂 [+1] |

最高研发阶段临床1期 |

首次获批国家/地区- |

首次获批日期- |

100 项与 Kinnjiu Biopharma Ltd. 相关的临床结果

登录后查看更多信息

0 项与 Kinnjiu Biopharma Ltd. 相关的专利(医药)

登录后查看更多信息

8

项与 Kinnjiu Biopharma Ltd. 相关的新闻(医药)2024-01-03

2022年,经济经历了无数的起伏,随着经济的起伏,就业市场也在起伏。这一趋势贯穿整个2023年。2023年,全球生物制药领域面临巨大挑战,许多企业为了可持续发展,不得不进行裁员和重组,其中不乏有一些世界500强企业。现在,让我们回顾一下,在这一年中,哪些企业采取了裁员措施,背后的原因又是什么。十二月(12项)12月19日,Aclaris Therapeutics宣布将裁员46%(截至2022年底有100名员工),停止对zunsemetinib(ATI-450)在免疫炎症性疾病适应症上的开发,但将继续探索其在某些癌症中的应用,并继续开发其管线中的其他候选药物。12月19日,免疫疗法公司Asher Bio裁员34人,占其员工总数的60%,并专注于一种名为AB248的药物候选。该药物目前正在与Keytruda进行一期临床试验。公司曾在2021年获得1.08亿美元的B轮融资。12月18日,生物技术公司Atara Biotherapeutics将在加利福尼亚州千橡市裁员73人。该免疫疗法公司在11月1日宣布计划裁员约30%;一周后,该公司的股价在一项用于多发性硬化症的候选药物的二期临床试验失败的消息后暴跌。12月14日,Reneo Pharmaceuticals宣布将裁员70%,原因是用于治疗罕见遗传疾病的临床试验失败。该公司测试了一种名为mavodelpar的PPARδ激动剂,但该疗法未达到主要和次要终点,公司已停止开发。消息公布后,股价下跌了87%。12月13日,免疫学公司Vir Biotechnology宣布将裁员约12%的员工,并关闭位于密苏里州圣路易斯和俄勒冈州波特兰的研发设施。CEO表示这些决定将使公司能够优先投资于慢性丙型肝炎和慢性乙型肝炎项目的临床执行,并扩展其单克隆抗体平台的应用领域。12月13日,Novo Holdings旗下的抗感染治疗和危重护理疗法制造商Xellia Pharmaceuticals将在其位于俄亥俄州贝德福德的工厂裁员80人。该工厂在2021年更换所有权并进行了2亿美元的改造后重新开放,当时有大约300名员工。12月11日,Altamira Therapeutics宣布裁员约25%,以专注于RNA递送领域。公司在“精简”过程中剥离了传统资产,目前员工人数在11至50人之间。12月8日,Catalent Pharma Solutions年度报告显示,今年裁员1,100人。这些裁员主要集中在生物制品和企业部门,此举是在5.39亿美元的收入损失背景下进行的。12月7日,Ferring Pharmaceuticals将在接下来的几个月裁员55名明尼苏达州的员工和79名新泽西州的员工。该公司的一位发言人称,明尼苏达州罗斯维尔的裁员将影响该地约四分之一的职位。12月5日,IGM Biosciences宣布裁员约22%的员工,以延长现金储备至2026年。该公司将优先考虑结直肠癌和自身免疫性疾病的候选药物,并停止在血液肿瘤学和靶向细胞因子产品方面的项目。12月5日,ReNAgade Therapeutics在5月份获得300万美元的A轮融资,并计划裁员10%。该公司在创立时有约100名员工。公司尚未透露其项目管线的详细信息,但致力于释放RNA药物在身体任何部位治疗疾病的潜力。12月4日,Travere Therapeutics宣布将裁员约20%,以延长其现金储备至2028年。该公司目前有462名员工,Travere将裁员与Filspari(sparsentan)的批准和上市流程挂钩。Filspari已经获得了IgA肾病的加速批准,并且该公司一直在测试其对局灶性节段性肾小球硬化症(FSGS)的疗效。十一月(25项)11月30日,初创企业Orna Therapeutics裁员,但人数未透露。CEO表示此举是出于“防御性”考虑,将确保公司能够将其主力产品“达到一个有意义的临床转折点,而无需依赖资本市场”。该候选疗法名为ORN-101,由通过脂质纳米粒子传递的环形RNA组成,用于治疗肿瘤。11月29日,Generation Bio公司计划裁员40%,此举是对非病毒基因治疗领域面临的挑战的战略回应。重组计划还包括关键人员的离职,其中包括医学首席Douglass Kerr和开发负责人Tracy Zimmerman在内。Generation预计通过裁员和精简研发重点,未来三年将实现1.2亿美元的成本节约。11月29日,吉利德子公司凯特将其细胞疗法业务员工人数减少约7%。副总裁Cindy Perettie表示,可能会减少与新战略重点不一致的角色,这可能影响到一些团队成员。但吉利德发言人提到,目前正创建90个新职位,“与组织重点更一致”,可能提供5%的净影响力。11月28日,Candel Therapeutics计划裁员约一半的员工(现有84人),以推进领先项目CAN-2409在非小细胞肺癌、胰腺癌和前列腺癌方面的研究,预计2024年公布结果。同时支持CAN-3110的持续研发,该药物针对复发性高级别胶质瘤。11月28日,加拿大生物技术公司AbCellera Biologics将裁员约10%,以专注于治疗性抗体的临床开发。该公司拥有582名员工,正在使用其专有引擎生成和测试大量抗体,以找出功能性和可开发性的候选药物。这一重组计划旨在提高对其治疗性抗体的关注。11月28日,Novocure宣布裁员约200人,占员工总数的13%。该生物技术公司计划优先准备在预期批准后启动转移性非小细胞肺癌的治疗,以及脑转移和实体瘤的试验。此前,其基于电场的治疗未能达到卵巢癌III期研究的主要终点。11月28日,Generation Bio向SEC提交的文件中,宣布将裁员约40%,首席医疗官和首席开发官也将离职,预计将延长资金渠道至2027年下半年。重组旨在将细胞靶向脂质纳米颗粒(ctLNP)递送系统扩展到肝脏以外的靶点。CEO Geoff McDonough表示,利用ctLNP开发肝外目标的路径明确,并正在调整投资以支持这一目标。11月16日,858 Therapeutics正在裁员并关闭其纽约办事处。该公司曾两年前以六千万美元的A轮融资退出隐形模式,当时宣布已收购总部位于纽约的 Gotham Therapeutics,并计划在未来一年半内将团队规模扩大到40人左右。11月14日,生物技术公司Atreca宣布裁员40%,Q3亏损3600万美元。此前已经历多轮裁员,并终止了在加利福尼亚州圣卡洛斯总部的租约,以削减成本。该公司专注于抗体-药物偶联物,至去年底拥有90名员工。11月14日,辉瑞计划裁员约500名员工,并终止英国肯特郡Sandwich的制药科学小分子部门,以削减成本并节省35亿美元。这一计划是上个月宣布的全面成本削减计划的一部分。11月13日,Theseus Pharmaceuticals宣布裁员72%,约26人,其中包括研发总裁William C. Shakespeare,他将继续担任顾问至明年年中。该公司专注于开发癌症疗法,在胃肠间质瘤的I/II期试验中发现该候选药物有剂量限制性毒性后,该公司将终止对该药物的开发。公告称,公司计划考虑出售公司资产、出售公司、合并或其他战略行动,以最大化股东价值。11月13日,Orbital Therapeutics是Beam Therapeutics的分拆公司,专注于开发RNA疫苗和治疗方法。该公司将关闭位于南旧金山的办公室并裁员16人,但扩大在剑桥的运营并增加团队规模。该公司在2022年9月成立,并于今年4月宣布获得2.7亿美元的A轮融资。11月10日,赛默飞将在新年关闭其位于阿拉巴马州奥本的工厂,并裁员97名员工。这一举动是继今年Thermo Fisher在美国各地设施进行多次裁员之后的又一次裁员行动。11月8日,SQZ Biotechnologies在其第三季度财报中宣布将裁员约80%。罗氏公司已宣布终止与SQZ的多年合作,该合作旨在开发针对HPV16阳性实体肿瘤的产品,尽管今年早些时候发布了积极的初步I期结果。11月8日,Regenxbio宣布将裁员15%,以延长其现金储备至2025年,并优先考虑其治疗湿性年龄相关黄斑变性和糖尿病视网膜病变、杜兴肌营养不良症和粘多糖贮积症II的候选治疗。裁员将主要发生在罕见神经退行性疾病开发、早期研究和其他一般行政领域。LinkedIn页面显示,该公司目前员工数量在201至500人之间。11月7日,Lyell Immunopharma宣布将裁员约25%,包括首席医学官等,以重组公司并优先投资于临床阶段项目和核心研究平台,简化运营。2022年底员工人数为274人。估值从上市时的40亿美元跌至约5.5亿美元,GSK一年前终止了与其的交易。11月7日,Arbutus Biopharma宣布将裁员24%,并发布了其候选疗法以实现功能性治愈慢性乙型肝炎的最新进展。此外,该公司还宣布其首席执行官William Collier将于今年年底退休,而Arbutus的联合创始人兼首席运营官Michael J. McElhaugh将担任临时CEO。11月7日,Pyxis Oncology宣布将裁员约40%,以延长公司现金储备至2026年初,并优先考虑其I期临床试验阶段的两个候选药物PYX-201和PYX-106。11月7日,辉瑞计划削减位于爱尔兰基尔代尔的制造工厂约100个工作岗位,以在削减35亿美元成本。同时还计划在都柏林和科克增加230个岗位。11月3日,辉瑞因COVID-19产品销售下滑,计划在密歇根州卡拉马祖裁员约200人,以恢复财务稳定。辉瑞已启动广泛的削减成本计划,目标到2024年节省35亿美元。11月2日,Locanabio公司的首席执行官Jim Burns在LinkedIn上宣布,该公司计划在年底关闭,该公司旨在开发RNA编辑疗法,但因资金问题决定关闭。11月2日,Kronos Bio宣布裁员19%,以优化资助KB-0742临床研究,并继续专注于lanraplenib的临床开发、成熟的发现项目的推进以及与Genentech的合作。该公司首席执行官表示,重组将延长其现金储备至2026年。根据美国证券交易委员会的文件,Kronos在今年年初有97名员工。11月2日,Seres Therapeutics宣布将重组,包括裁员41%和约160个职位。公司称其微生物组疗法VOWST的销售数据积极,并计划优先推进VOWST的商业推出,同时继续进行微生物组疗法候选药物SER-155的Ib期研究。Seres将缩减所有非合作研发项目和活动。总裁兼首席执行官Eric Shaff表示,考虑到生物制药公司的挑战性财务环境,集中资源于VOWST将提供有吸引力的营收增长机会,并更高效地运营。11月1日,Rani Therapeutics将裁员25%,暂停或推迟多个候选治疗方案的开发,同时推进其他方案进入I期或II期临床试验,并扩大制造能力。这些措施将延长其现金储备至2025年。11月1日,Sangamo Therapeutics将关闭位于加利福尼亚州布里斯班的总部,并裁员约162人,占员工总数40%。其中包括首席运营官和首席科学官。该公司将迁至加利福尼亚州里士满的设施,暂停法布里病和CAR-Treg细胞疗法的投资,寻求合作伙伴继续开发。将专注于神经系统疾病的表观遗传调控疗法和新型AAV外壳传递技术。预计重组将减少一半运营支出,延长资金至2024年第三季度。十月(16项)10月30日,Galapagos和Alfasigma签署意向书,将Galapagos的Jyseleca(filgotinib)转让给Alfasigma,其潜在交易将涉及将大约400名员工转移到Alfasigma,同时将有100人被裁员。10月30日,辉瑞计划于2024年初关闭位于新泽西州皮帕克的工厂,并将大部分员工重新分配,不同意重新分配的员工雇佣关系将终止。此外,辉瑞还宣布关闭北卡罗来纳州的两个工厂,并在科罗拉多州进行未指明数量的裁员。10月26日,ElevateBio计划裁减13%的员工,此次裁员针对公司临床前工作的员工,目前尚不清楚该公司有多少员工。值得一提的是该公司在5月份刚刚完成了4.01亿美元的D轮融资。10月24日,安进公司在收购Horizon Therapeutics后,计划裁减350名员工,此次裁员将影响与安进现有团队重叠的Horizon公司的职位。这是安进公司今年的第三轮裁员。10月24日,BrainStorm Cell Therapeutics宣布,将裁减30%的员工。FDA上月拒绝其ALS候选药物NurOwn,BrainStorm宣布裁员是为了“加速NurOwn开发的战略调整”。被裁的员工包括首席医疗官Kirk Taylor。截至6月30日,BrainStorm报告称美国和以色列共有44名员工被裁。10月24日,Idorsia Pharmaceuticals宣布将其瑞士总部的员工人数减半。声明指出,通过取消空缺职位、不替补离职员工以及主要在研发及相关辅助职能中达成的最多300名终止协议,瑞士Allschwil总部约有475个职位被裁减。10月19日,基因编辑公司Beam Therapeutics将裁员约100人,占公司员工总数的20%,以延长现金流至2026年。10月16日,细胞疗法公司Nkarta将裁员18人,占公司员工总数的10%,旨在将其预计现金运转期限延长至2026年。10月13日,辉瑞周五晚间启动了一项全面的成本削减计划,旨在通过2024年节省35亿美元,因为该公司的COVID-19产品销售急剧下降,但目前尚不清楚有多少员工将受到影响。10月11日,Sana Biotechnology宣布,作为其投资组合重新调整计划的一部分,将裁员29%(约120人)。Sana将缩小其研发重点,专注于其离体细胞疗法平台,并放弃体内基因传递项目,以期将2024年的运营现金流消耗降至2亿美元以下。据该公司称,这将使Sana目前的现金运转期限进一步延长至2025年。10月9日,Biogen正在裁减Reata Pharmaceuticals位于德克萨斯州普莱诺的113名员工。这次裁员定于11月下旬生效,是在Biogen于2023年7月以73亿美元收购Reata仅几个月后进行的。10月7日,生物技术公司Eikon Therapeutics为了提高效率而裁员。10月5日,基因疗法生物技术公司Atsena Therapeutics最近裁减了数量不详的员工以节约现金。10月5日,基因疗法公司uniQure周四宣布,将裁减114名员工,约占其员工总数的20%。uniQure还将终止一半以上的研究和科技项目,公司表示,这些举措将节省1.8亿美元,将其现金使用期限延长至2027年。作为重组的一部分,首席科学官Ricardo Dolmetsch将离开公司。10月3日,Kezar Life Sciences宣布将裁减41%的员工,同时其首席执行官和首席医疗官将离职。据公告显示,Kezar已暂停所有研究和药物发现工作,重点是为实验药物zetomipzomib治疗狼疮性肾炎的IIb期临床试验筹集足够资金。10月2日,Syros Pharmaceuticals宣布将裁减35%的员工,同时其首席执行官和首席科学官也将离职。九月(15项)9月28日,PTC Therapeutics周四宣布,将进一步裁减25%的员工。此举延续了该公司5月份开始的重组计划。9月26日,丹麦生物技术公司Galecto在8月中期试验的主要疗效终点失败后,正在寻找战略替代方案。周二,该公司宣布将裁减大约70%的员工,相当于约30人,目标是将其现金使用期限延长至2025年。9月26日,AM-Pharma宣布完成裁员,但未透露具体人数,同时 Juliane Bernholz接替Erik van den Berg担任首席执行官。以上措施是该公司“劳动力重新调整”的一部分。9月26日,Poxel正在寻求新的融资,以启动其肾上腺白质脑病(ALD)项目PXL770和PXL065的二期概念验证研究,并执行其罕见病战略。该公司员工人数有所减少,从2022年12月底的37人降至目前的15人。9月22日,ImmunityBio在经过四个多月的努力后,未能获得批准,决定裁员48人。加州政府9月19日的通知中披露了这一裁员事件,受影响的员工包括公司位于加利福尼亚州El Segundo的员工以及向该站点报告的远程工作人员。9月19日,NightHawk Biosciences决定放弃研发业务,专注于其合同研发和制造组织Scorpius Biomanufacturing,计划解雇13名研发业务员工,相当于其员工总数的14%。9月19日,去年以Fresh Tracks Therapeutics全新开始后,前身为Brickell Biotech的公司将永久性关闭。Fresh Tracks将终止所有临床和临床前开发项目,并在10月初解雇“大多数员工”。9月18日,基于圣地亚哥的生物技术公司Histogen宣布关闭,专注于治疗传染性疾病的它曾考虑过多种潜在的战略替代方案,但最终决定停止所有临床开发项目,并在9月底之前解雇大多数员工。9月18日,生物技术公司Kinnate Biopharma正在实施“重新优先化和劳动力重组”计划,将现有员工减少70%。最终Kinnate将仅剩下28名全职员工。该裁员包括Kinnate子公司Kinnjiu Biopharma的所有员工。9月15日,Lyndra Therapeutics在更换CEO后裁员近四分之一,此次裁员是公司决定外包商业制造和合作开发及商业化“未来所有产品”的结果。9月12日,多种因素导致2seventy bio宣布将裁员约40%,并重组公司,其中包括首席执行官Nick Leschly的离职。做出这个决定的原因是“困难重重的宏观经济环境”,但公司后期项目的延误和“复杂的Abecma商业动态”也是因素之一。此次裁员将为公司每年节省至少6500万美元的成本。9月11日,以色列生物技术公司Enlivex将减少50%的员工,以延长其现金流直至2025年底,并将专注于炎症和自身免疫性疾病,同时寻求外部合作或授权,将肿瘤学项目暂时搁置。9月6日,CSL Vifor在加州的员工人数将减少85人,从10月25日开始生效。9月5日,Infinity Pharmaceuticals在7月份计划与MEI Pharma合并失败后,裁员78%(21名员工)。周五,该公司精简后的董事会(7月份从8名董事减少到5名)终止了CEO Adelene Perkins和首席医疗官Robert Ilaria Jr.的职务,这是正在进行的重组计划的一部分。另外三名员工也被解雇。截至9月5日,公司官网显示CEO Seth Tasker是领导团队中唯一成员。八月(19项)8月23日,诺华制药(Novartis):该公司将在位于新泽西州伊斯特汉诺威总部裁掉103个工作岗位,重点是临床运营。8月22日,Lava Therapeutics:该公司将裁掉36%的员工,作为重新调整其产品组合的努力的一部分。8月22日,Aravive:该公司将裁掉70%的员工,并关闭其伪装蛋白类药物batiraxcept的临床开发项目。8月18日,BlueRock Therapeutics:该公司将裁掉约50名员工,影响到纽约、多伦多和马萨诸塞剑桥的场所。8月15日,赛默飞世尔科学公司(Thermo Fisher Scientific):该公司将从佛罗里达州阿拉楚阿的两个场所裁掉205名员工。8月15日,Alaunos Therapeutics:由于资金短缺和战略重点转移,该公司将裁掉60%的员工。8月14日,BioXcel Therapeutics:该公司将裁掉超过一半的员工以减少运营费用。8月14日,布里斯托-迈尔斯斯奎布(Bristol Myers Squibb):该公司将裁掉108名员工,因销售和收入预测下调。8月10日,Atreca:该公司将暂停其主导候选药物的开发,并裁掉40%的员工。8月9日,Galera Therapeutics:由于FDA拒绝了avasopasem manganese的申请,该公司将裁掉约70%的员工。8月9日,INOVIO制药公司(INOVIO Pharmaceuticals):该公司将放弃其宫颈病变项目VGX-3100的开发,并裁掉58名员工,相当于INOVIO总员工总数的30%。8月8日,Salarius Pharmaceuticals:该公司将裁掉超过一半的团队,并探索战略选择。8月8日,Emergent BioSolutions:该公司将与约400名员工分道扬镳,专注于其核心业务。8月8日,Curebase:该公司将裁员,并逐步停止其全方位的临床运营业务。8月8日,Celsius Therapeutics:该公司已裁掉大约三分之二的员工,并暂停大部分早期研究,以便专注于第一阶段试验的启动。8月3日,Karyopharm Therapeutics:该公司将裁掉约20%的员工,以便专注于其后期核心项目。8月2日,Intergalactic Therapeutics:由于经济挑战,该公司将解雇所有员工,并探索战略选择。8月2日,查尔斯河实验室(Charles River Laboratories):该公司将关闭位于南旧金山的发现研究场所,影响55名员工。8月2日,SterRx:纽约的SterRx公司将关闭其设施,并裁掉161名员工,原因是经济原因。七月(24项)7月28日,Ribon Therapeutics:该公司在整个组织范围内进行裁员,并停止了临床前和平台工作,以优先考虑两个临床项目。受影响的员工数量未披露。7月28日,Homology Medicines:在对HM1-103进行Phase I研究取得积极数据后,该公司在评估战略选择后决定裁员几乎整个员工队伍。该决定是由于当前的融资环境和预期的临床开发时间表。7月27日,Mersana Therapeutics:在其主要抗体药物联合物UpRi在卵巢癌中的Phase III失败后,该公司将裁员约一半的员工。7月25日,Infinity Pharmaceuticals:在计划中与MEI Pharma的合并破裂后,该公司将裁员约78%的现有员工。7月25日,Biogen:该公司计划裁员11%的员工,约1,000个工作岗位,作为为阿尔茨海默病药物Leqembi的上市做准备而进行的成本削减和重组努力的一部分。7月24日,Heron Therapeutics:该公司正在实施一项企业重组计划,将使25%的员工失去工作,其中包括精简运营支出和减少研发。7月21日,Illumina:该公司将在加利福尼亚州裁员151名员工,包括圣地亚哥的79名工人,福斯特市的71名和海沃德的1名,作为一项旨在在年底前节省1亿美元的举措的一部分。7月21日,Eliem Therapeutics:在此前裁员55%的员工后,该公司放弃了剩余的项目,并正在探索战略选择,包括潜在的业务出售。7月21日,Idorsia:该公司计划在瑞士总部裁员多达500名员工,并将支出减半,同时等待其治疗失眠的产品Quviviq产生更多现金。7月21日,Codexis:该公司将不再开发自己的治疗产品,将专注于销售现有的技术和服务,导致员工减少25%,并关闭其在加利福尼亚州圣卡洛斯的设施。7月21日,Passage Bio:该公司计划裁员26%的员工,主要是在化学、制造和控制(CMC)部门,包括首席财务官和首席技术官。7月19日,Amgen:该公司正在从其位于加利福尼亚州圣卡洛斯的设施裁员四名员工,这是自今年1月以来的第三轮裁员。7月19日,FibroGen:在其特发性肺纤维化候选药物在Phase III试验中失败后,该公司将裁员104名员工,约占其员工总数的32%。7月19日,Amarin Corporation PLC:该公司计划裁员所有美国销售职位的员工,并裁减30%的非销售职位,作为新任首席执行官上任后进行的重组举措。7月19日,Pieris Pharmaceuticals:在阿斯利康退出其合作和许可协议后,该公司正在进行重组,裁员70%的员工。7月12日,Capsida Biotherapeutics:该公司正在裁员一部分员工,具体数量未披露,可能达到团队人数的25%。7月12日,Sagent Pharmaceuticals:该公司将在北卡罗来纳州罗利的园区裁员81名员工。7月12日,AVROBIO:该公司停止了三个基因疗法的开发,裁掉大约一半的员工,并正在寻找买家收购其余资产。7月19日,Theratechnologies:该公司正在裁员其研发部门的未指定数量员工,以节省资金。7月12日,BAKX Therapeutics:该公司已经关闭、解散,并裁员几乎所有员工。7月7日,TrueBinding:该公司经历了两轮裁员,与2022年7月相比,员工人数减少了27%。7月7日,Galvanize Therapeutics:该公司在获得资金仅10个月后进行了一轮裁员,但具体的裁员人数未知。7月6日,住友制药美国(Sumitomo Pharma America):计划裁员62名纽约市办公室的员工,这是该公司将其七个子公司合并为一家名为住友制药美国的公司的努力的一部分。7月5日,Zymergen:该公司计划在加利福尼亚州阿拉米达县裁员3名员工。六月(15项)6月30日,Bellerophon Therapeutics:该公司裁员"几乎所有"员工,包括公司的高级管理层。这是在该公司唯一的临床项目未能达到纤维性间质性肺病的主要终点之后宣布的。6月30日,Eiger BioPharmaceuticals:该公司裁员其员工总数的25%,并将重点转向正在开发的GLP-1受体拮抗剂,用于治疗代谢性疾病。同时,该公司还将停止在肝脏疾病候选药物上的研发支出。6月27日,Illumina:该公司已经开始在圣地亚哥裁员,以在2023年底之前削减1亿美元的年度开支。该公司拒绝确认裁员人数。6月27日,Intercept Pharmaceuticals:在FDA拒绝其用于治疗非酒精性脂肪性肝病患者的obeticholic酸片剂的申请后,该公司放弃了其NASH项目,并裁员约三分之一的员工。Intercept预计这些裁员将每年节省约1.4亿美元。6月22日,Federation Bio:在推出其第一阶段I试验仅六个月后,确认裁员一些未披露数量的员工。该公司未透露裁员原因。6月21日,Nutcracker Therapeutics:裁员12名员工,以便专注于其三个临床前项目。该公司强调,目前没有计划裁员这些项目。6月20日,Thermo Fisher Scientific:该公司计划裁员圣地亚哥地区的88名员工。这是该公司宣布关闭三个圣地亚哥地区的场所两个月后的消息。这使得Thermo Fisher在该地区的总裁员人数自2023年初以来达到近600人。6月20日,Molecular Templates:该公司裁员其员工总数的44%,作为一项重组计划的一部分,以节省现金流并可能寻找买家。这轮裁员是继3月份宣布裁员大约一半员工之后的进一步裁员。6月20日,Twist Bioscience:该公司裁员加州的212名员工,其中大多数为旧金山的员工。这是该公司在5月宣布的一项重组计划的一部分,计划削减总员工人数约25%。6月14日,Encoded Therapeutics:该公司裁员其员工总数的约10%,以延长现金流并专注于推进其治疗Dravet综合征的主要资产。6月12日,Rejuvenate Bio:该公司裁掉了"相当大比例"的员工,并对其产品线进行了裁减。但没有具体说明有多少员工会受到裁员影响。6月5日,GreenLight Biosciences:该公司将裁掉96名员工,生效日期为7月29日。裁员消息发布不久后,该公司宣布已同意由Fall Line Capital, LLC领导的一组买家收购。6月2日,Oncorus:该公司将裁掉55名员工,这是其"几乎所有"的员工。裁员名单包括CEO Ted Ashburn、COO Stephen Harbin和CMO John Goldberg。临时CFO Alexander Nolte将继续留任,以寻找该生物技术公司在资金耗尽之前找到买家。6月2日,Roche:该公司计划在2029年之前出售位于加利福尼亚州Vacaville的药物制造工厂,或者关闭该工厂。该工厂目前雇佣着800名员工,虽然Roche不愿确认有关时间表或受影响员工人数的任何详细信息,但它确认了出售该工厂的计划。6月2日,Catalent:该公司计划裁掉位于印第安纳州布卢明顿的工厂的150名员工。这是由于在COVID-19大流行期间难以维持公司的增长所导致的重组的一部分。五月(17项)5月31日,Rain Oncology:该公司裁掉了其65%的员工,包括首席医疗官。这则消息发布一周前,该公司的主力候选药物milademetan在一个III期脂肪肉瘤试验中表现不佳。Rain还暂停了一个II期试验,并完全中止了另一个研究milademetan的I/II期试验。5月24日,Takeda:该公司计划在圣地亚哥裁掉27名员工,这是在他们宣布计划在马萨诸塞州裁掉180多名员工两周后的消息。加利福尼亚州的裁员与公司决定停止在AAV基因治疗和罕见血液学领域的发现和临床前工作直接相关。5月24日,PTC Therapeutics, Inc.:该公司实施了一项优先考虑流程,包括放弃几个基因治疗的临床前和早期研究项目,并裁掉了8%的员工。5月23日,Affimed:该公司在四月裁掉了约25%的员工。这些裁员是重组努力的一部分,公司希望优先考虑其产品线中的三个临床项目。5月19日,Urovant Sciences:该公司将在6月29日裁掉22名员工。这则消息发布仅几周之前,该公司披露其将与其母公司Sumitomo以及其他六家子公司合并。5月16日,GeneDx:该公司将在5月28日开始裁掉19名员工。据CT Insider报道,最近的裁员只涉及远程员工。5月11日,Adaptive Phage Therapeutics, Inc.:该公司裁掉了22个岗位,占其总员工人数的23%,以将重点转向临床试验并延长现金储备。裁员于5月9日生效。5月10日,Roche:该公司在新泽西州布兰奇堡裁掉了165个岗位,该地是其在美国最大的诊断运营中心所在地。裁员将于7月25日生效。5月9日,Novavax:该公司将全球员工人数削减约25%。这次裁员将包括该公司在2022年年报中提到的近2000名员工中的约500名。5月9日,Gossamer Bio:该公司宣布计划裁掉其员工总数的25%,以将重点转向将于今年第三季度进入III期的肺动脉高压(PAH)候选药物。该生物技术公司表示,除PAH候选药物外,它计划放弃所有临床和临床前项目。5月9日,ADC Therapeutics:该公司计划裁掉约17%的员工,总共约54人,以及两个临床前项目。这则消息是在ADC疗法Zynlonta在治疗弥漫大B细胞淋巴瘤方面销售不佳之后发布的。5月8日,Takeda:该公司计划在马萨诸塞州裁掉约186名员工。裁员将影响马萨诸塞州的三个城市(剑桥、莱克星顿和北雷丁)中四个地点的员工。5月8日,Bristol Myers Squibb:该公司计划从其新泽西州普林斯顿的设施裁掉48名员工。尽管在WARN报告中没有提供有关哪些部门将受到影响的其他信息,但根据公司的网站,该设施的员工来自商业、研发和支持功能团队。5月8日,EQRx:该公司宣布计划裁掉170个岗位和一些药物候选品,作为重组努力的一部分。该初创公司原本旨在开发价格合理的品牌替代处方药,但严格的FDA法规迫使公司进行转型。5月8日,Mammoth Biosciences:该公司在三月裁掉了35个岗位,Mammoth首席执行官Trevor Martin向Endpoints News证实了这一消息。该生物技术公司计划放弃CRISPR诊断方面的努力,将重点转向治疗性研究。5月4日,Selecta Biosciences:该公司宣布计划裁掉约25%的员工,作为实施“资本优先考虑倡议”的一部分。这些裁员预计将延长公司的现金流到2025年下半年。5月3日,Zymergen:该公司计划于6月20日在加利福尼亚阿拉米达县裁掉27名员工。该公司在2022年7月被Ginkgo Bioworks收购,这是自那时以来实施的第三轮裁员。四月(20项)4月27日,Transplant Genomics:该公司裁掉了九名远程工作人员。报告是在4月27日提交的,裁员从次日开始生效。4月27日,住友制药美国(Sumitomo Pharma America):该公司计划从住友制药美国控股和住友制药肿瘤学(位于马萨诸塞州)合并裁掉122名员工。它还将从子公司Sunovion Pharmaceuticals裁掉101个工作岗位。这一消息是在该公司宣布将其多个子公司合并为一家公司——住友制药美国公司——一个月后发布的。4月27日,Cepheid:一家以制造快速冠状病毒检测著称的公司,计划裁掉加利福尼亚湾区的625名员工。这是该公司在过去六个月内的第二轮裁员。去年11月,该公司宣布计划在湾区裁掉925个工作岗位。4月27日,Care Access:该公司裁掉了约一半的员工。这一消息是在辉瑞切断与该初创公司合作进行莱姆病疫苗研究两个月后发布的。4月26日,Thermo Fisher Scientific:该公司计划裁掉与关闭三个位于圣地亚哥的设施相关的218名员工。这是该公司今年迄今为止在圣地亚哥实施的第三轮裁员,最新一轮裁员使该地区的裁员总数超过500人。今年3月,Thermo Fisher还宣布计划关闭新泽西州的一个制造工厂,并裁掉113名员工。4月26日,Sangamo Therapeutics:该公司宣布计划裁掉约120名员工(约占总员工数的27%),作为重组的一部分。这一消息是在诺华和生物基因结束与该生物技术公司的合作关系仅仅一个月后发布的。4月26日,Evelo Biosciences:该公司宣布裁员并放弃一个特应性皮炎项目,以延长其现金流。这是该公司三个月内的第二轮裁员。该公司没有具体说明将裁员多少人。4月20日,Foundation Medicine:该公司计划裁掉约135名员工,首席执行官Brian Alexander表示,裁员是决定采用“更精简、更高效的组织结构”的一部分。4月17日,Enzyvant Therapeutics:该公司计划裁掉北卡罗来纳州的20名员工,包括一些高管职位,裁员是“将Enzyvant及其多个附属公司整合为一家新公司”的结果。4月17日,Emerald Cloud Lab:该公司计划从位于南旧金山的总部裁掉30名员工,生效日期为4月30日。这些裁员可能是该公司计划将总部迁至德克萨斯州奥斯汀的一部分,该新设施预计将于7月开放。4月17日,Nektar Therapeutics:该公司计划实施一项重组计划,将其旧金山办事处的员工人数削减约60%。该公司表示将把重点转向免疫学研究项目,裁员将有助于延长其现金流至2026年中期。4月14日,Talaris Therapeutics:该公司计划裁掉约80名员工,其中包括大部分高级管理人员。总体而言,裁员包括公司总员工人数的约95%。这是Talaris在2月份决定裁掉约三分之一员工和结束两项临床试验之后的举措。4月12日,Aeglea Biotherapeutics:该公司宣布计划裁掉除约10名员工以外的所有员工,作为重组计划的一部分。这一宣布是在该公司关于其经典高半胱氨酸血症候选药物pegtarviliase正在进行的I/II期研究的中期数据不佳后发布的。4月12日,Oncocyte Corporation:该公司宣布计划裁掉约20%的员工,以延长其现金流至2024年。公司在新闻稿中没有给出裁员的原因,只表示这些裁员是为了降低成本和优化效率。4月12日,GentiBio, Inc:该公司裁掉了一定数量的员工。首席执行官称这次裁员规模“相对较小”,并将“具有挑战性的生物技术宏观环境”作为裁员原因。4月10日,Biogen:该公司正在裁掉一定数量的员工,但拒绝透露受影响的员工人数。4月7日,Pear Therapeutics:该公司申请了破产,并寻求出售其资产,根据一份SEC文件。这将导致裁员170名员工(约占总员工数的92%),留下15名员工继续工作,直到公司的资产被出售。4月6日,Thermo Fisher Scientific:该公司计划关闭新泽西州的一个制造设施,并裁掉113名员工。这是该公司今年宣布的第三轮裁员。自今年2月以来,该公司已经裁掉了超过350名员工,都是来自圣地亚哥的制造设施。4月6日,LumiraDx:该公司宣布计划启动一项重组计划,将裁员约40%的员工。该公司预计每年将节省约3600万美元。4月3日,NGM Biopharmaceuticals:该公司正在实施一项重组计划,将裁员75名员工,占公司总员工数的33%,根据一份SEC文件。首席执行官David Woodhouse表示,裁员与2022年10月CATALINA试验失败有关。三月(19项)3月31日,Molecular Templates:该公司将裁员约一半的员工,剩余员工略多于100人。此次裁员是为了将其项目组缩减到仅有三个项目和与BMS的临床前合作项目。3月28日,Alector:该公司计划裁员约30名员工,以便将资源集中在研究上。该公司在一份SEC文件中表示,这将使其能够优先发展免疫神经学项目。3月28日,Applied Molecular Transport, Inc. (AMT):该公司宣布裁员约57%,根据3月28日的公告。博士Tahir Mahmood将辞去首席执行官职务,由总裁兼首席运营官Shawn Cross接任。3月28日,Satsuma Pharmaceuticals:该公司宣布计划裁员36%的员工,自3月31日起生效。此前,该公司公布了一项研究其偏头痛治疗药物STS101的三期临床试验结果,并于本月初向美国食品和药物管理局(FDA)提交了新药申请(NDA)。3月28日,9 Meters Biopharma:该公司宣布计划裁员约一半的员工,以延长现金流。这一宣布是该公司第四季度财报的一部分。3月23日,Merck KGaA:该公司计划从5月22日开始裁员其位于马萨诸塞州比勒里卡的研究中心的六名员工,根据马萨诸塞州的WARN报告。今年1月,该公司宣布计划在同一地点裁员133名员工,以便优先发展研发,并更多地依赖合作伙伴进行药物开发。3月23日,Genentech, Inc.:该公司计划关闭位于加利福尼亚州南旧金山的一家生产设施。根据该公司的WARN报告,这将导致271名员工被裁员。3月20日,Ferring Pharmaceuticals:该公司将关闭其位于加利福尼亚州圣迭戈的研究设施,并裁员89人。根据加利福尼亚州的WARN报告,裁员将于5月26日生效。3月20日,Evofem Biosciences:该公司裁员8名员工,此前仅仅四个月前该公司曾裁员39人。该公司还计划将首席执行官的薪水削减40%,以节约资金。3月16日,Amgen:该公司计划裁员450名员工,根据路透社的报道。这是Amgen今年的第二轮裁员,首轮裁员在一月份,涉及300名员工。3月15日,Vaxart, Inc.:该公司计划重新调整其项目组,优先发展口服诺如病毒疫苗项目,并推迟其COVID-19疫苗的临床试验。这一重组计划包括裁员约27%的员工,以延长现金流至2024年。3月9日,Olema Oncology:该公司宣布将重点转向推进用于ER+/HER2-转移性乳腺癌的治疗药物OP-1250进入三期临床试验阶段。重组计划将包括裁员约25%的员工。3月8日,Neoleukin Therapeutics:该公司宣布正在审查包括出售、合并、资产剥离、许可或其他战略交易在内的战略选择。因此,该公司将在2023年上半年裁员其70%的员工。3月7日,Thermo Fisher Scientific:该公司将在圣地亚哥裁员154人,根据一份WARN报告。这一消息发生在该公司宣布计划在圣地亚哥的三个制造工厂裁员230名员工的一个月后。公司称这两轮裁员的原因是COVID-19测试工具需求减少。3月6日,atai Life Sciences:该公司宣布裁员约30%的员工,以延长其现金流至2026年上半年。该公司表示,该决定是在对其项目组进行战略审查后做出的,旨在提高效率并缩小重点范围。3月6日,Coherus BioSciences:该公司在其年度报告中宣布,为了重组计划,已从其员工名单中裁员约60名全职和兼职员工。该公司今年的运营费用比2022年4月的预期低近1亿美元。3月2日,MorphoSys AG:该公司计划放弃其临床前项目并裁员17%的员工,以延长现金流。裁员将在该公司的Planegg总部进行,共有70名员工将失去工作。3月1日,Novo Nordisk:该公司将在西雅图裁员86人,从5月1日起生效,根据一份WARN通知。一位发言人告诉GeekWire,该公司将关闭其位于西雅图的湿实验室操作,但将继续在该地区进行数字疗法、数据科学和人工智能方面的工作。3月1日,G1 Therapeutics:该公司发布了其2022年全年财报,报告称为了降低2023年的运营费用,已裁员约30%。这发生在该生物技术公司结束其在结直肠癌中的主导候选药物的晚期研究两周后,导致股价暴跌50%。二月(17项)2月28日,Theravance Biopharma:该公司宣布停止其针对肺部炎症的JAK抑制剂项目的研究活动,并将员工人数减少约17%。这一战略调整是在该公司最大股东之一Irenic Capital的一封信件后采取的,Irenic Capital敦促该公司重新审视其治理结构并重新评估其业务战略。2月24日,ObsEva:该公司正在裁员其美国执行团队和董事会成员。这些裁员包括公司的首席执行官、首席医学官和其他一些人员。2月22日,Graphite Bio:该公司宣布停止开发其主力资产nulabeglogene autogedtemcel(nula-cel)。与此同时,这家位于湾区的生物技术公司正在推出一项企业重组计划,将裁减约50%的员工。2月22日,Impel Pharmaceuticals:该公司正在实施重组计划,包括裁减16%的员工。该公司计划放弃其用于自闭症谵妄和攻击性急性治疗的INP105,并将重点放在开发其Trudhesa鼻喷雾剂上。2月22日,Jounce Therapeutics:该公司宣布计划与处于临床阶段的生物技术公司Redx Pharma进行全股票交易合并。这一消息是在该公司宣布裁减57%员工的重组计划后的第二天公布的。2月21日,National Resilience Inc.:该公司宣布计划出售位于马尔伯勒(Marlborough)的一处制造厂,并缩减在Allston的另一处厂房的运营规模。这一决定将导致共计约213个工作岗位的裁减。2月21日,Aileron Therapeutics:该公司宣布计划放弃其主力候选药物ALRN-6924,因为在针对乳腺癌患者的Phase 1b试验中,该候选药物未能达到主要或次要终点。因此,该公司将员工数量从九人减少到三人。2月15日,Grifols:该公司宣布了一项全面计划,旨在节约资金和资源,将导致2000个美国工作岗位的裁减。该公司表示其目标是在2023年节省大约4.28亿美元。2月13日,Frequency Therapeutics:该公司因决定放弃所有旨在治疗感音神经性听力损失(SNHL)的项目而裁减其55%的员工。此前,该公司的候选药物FX-322在Phase IIb试验中未能达到SNHL患者的主要终点。2月9日,Eliem Therapeutics:该公司放弃了即将进入Phase II的抗抑郁药物候选药物,并裁减55%的员工,以延长现金运营时间至2027年。2月8日,Aligos Therapeutics:该公司宣布实施了管线优化计划,员工减少约25%。该生物技术公司现将优先考虑其NASH和COVID-19资产,包括与默克的NASH合作项目。2月6日,Thermo Fisher Scientific:该公司将在加利福尼亚州圣地亚哥县的三个地点裁减共230个工作岗位。此举是在该公司报告2022年其COVID-19检测销售大幅下滑后采取的。2月6日,Magenta Therapeutics:该公司根据向美国证券交易委员会(SEC)提交的文件,裁减了56个员工岗位,约占其总员工数的84%。此前,该生物技术公司在一项Phase I/II试验中因患者死亡事件而暂停了其临床项目的开发。2月3日,Eisai Inc.:该公司向新泽西州提交了WARN通知,称计划裁减91个工作岗位。这一裁员将于4月30日生效。2月3日,Vyant Bio:该公司宣布计划裁减员工,以延长其现金运营时间,尽管该公告没有具体说明将裁减多少个工作岗位。该决定是基于管理层认为“公司股价未反映业务的基本价值”。2月3日,Medicago:该公司宣布将关闭其业务,原因是COVID-19疫情的放缓。此前,该公司在去年11月宣布计划裁减位于北卡罗莱纳州的一家制造厂的62名员工。2月1日,Evelo Biosciences:该公司宣布实施节约成本的举措,包括裁减员工岗位,具体数量未透露。在同一公告中,该公司还表示其特应性皮炎候选药物EDP1815在Phase II试验中未能达到主要终点。一月(16项)1月31日,Instil Bio:该公司计划将其员工规模裁减至仅剩15人,以延长其现金流到2026年。这次额外的裁员是在该公司12月份宣布计划裁员60%之后进行的。1月31日,INOVIO:该公司宣布计划重新组织其研发项目,以提高“运营效率”,并裁减11%的员工。通过裁减多个项目,该公司预计可以节省约340万美元。1月30日,Quince Therapeutics:该公司计划重新调整其研发项目,并裁减47%的员工,根据提交给美国证券交易委员会的文件。这一新策略是该公司决定出售其蛋白酶抑制剂组合之后的结果。1月30日,Amgen:该公司正在实施组织变革,包括裁减约300名团队成员,以“更好地应对行业困境”。一位公司发言人称,这次裁员主要影响Amgen的商业团队,并涉及美国的员工。1月24日,Finch Therapeutics:该公司宣布计划终止其主要资产CP101的三期临床试验,这是一种治疗细菌感染的药物。因此,该公司将裁减约95%的员工。Finch表示,由于缺乏资金和合作伙伴来开发该药物,决定做出这一决定。1月23日,Merck KGaA:该公司旗下的EMD Serono计划在其马萨诸塞州比勒里卡研究中心裁减133名员工。这是在几个月前该生物技术公司宣布计划优先考虑研发,并更多地依赖合作伙伴开发药物之后的举措。1月19日,ReNeuron:该公司宣布计划进行重组,并裁减40%的员工,以延长其现金流至2024年。这是继首席执行官凯瑟琳·伊斯特德辞职两周后的举措。1月19日,Cyteir Therapeutics:该公司宣布进行重组,重点优先考虑其在卵巢癌研究中的候选药物CYT-0851。这一转变将导致员工数量减少70%。1月12日,Akili Interactive Labs:该公司宣布,由于经济环境的最近变化,将立即裁减约30%的员工,共裁减46名员工。1月11日,Verily Life Sciences:该公司计划进行重组,包括裁减约15%的员工,总共超过200个岗位。1月11日,Abzena:该公司根据向加州州政府提交的WARN通知,从其位于加利福尼亚州圣地亚哥的地点裁减了66名员工。1月9日,Calithera Biosciences:该公司的董事会决定解散公司并清算其资产,大多数员工将在第一季度末被解雇。Calithera在2021年从武田公司购买了两个二期癌症资产,但在11月宣布资产的数据延迟。1月9日,Editas Medicine:该公司宣布在进行管线重组时裁减了20%的员工,包括首席科学官马克·谢尔曼博士。这是继该公司在11月宣布由于数据不如预期而暂停其主要资产EDIT-101之后的举措。1月6日,Elevation Oncology:该公司裁减了30%的员工,包括首席执行官肖恩·利兰德。作为重组的一部分,Elevation还决定搁置其固体肿瘤疗法seribantumab。1月5日,Century Therapeutics:该公司宣布计划裁减25%的员工,以延长三个候选药物的现金流:CNTY-101和CNTY-102用于B细胞恶性肿瘤,以及CNTY-107用于实体瘤。1月4日,Y-mAbs Therapeutics:该公司表示将实施一项重组计划,到5月底将公司员工规模削减35%。该生物技术公司表示计划优先考虑其用于复发/难治高危神经母细胞瘤的治疗药物Danyelza。由此可见,全球生物制药公司每月都有接近20项裁员计划,这说明今年生物制药企业的处境艰难,原因可能是多方面的,但裁员计划也是为了公司在将来能有更好的发展,也希望这些企业为了能够达成所愿。来源:Biospace识别微信二维码,添加生物制品圈小编,符合条件者即可加入生物制品微信群!请注明:姓名+研究方向!版权声明本公众号所有转载文章系出于传递更多信息之目的,且明确注明来源和作者,不希望被转载的媒体或个人可与我们联系(cbplib@163.com),我们将立即进行删除处理。所有文章仅代表作者观点,不代表本站立场。

免疫疗法临床2期高管变更

2023-11-04

2022年,经济经历了无数的起伏,随着经济的起伏,就业市场也在起伏。这一趋势贯穿整个2023年。在过去的两个月里(9、10月),生物制药领域共发生了31起裁员(数据来源:BioSpace),较上半年来说,裁员趋势似乎有所下降。推荐阅读:2023全球超100家生物制药企业裁员信息汇总十月(16项)10月30日,Galapagos和Alfasigma签署意向书,将Galapagos的Jyseleca(filgotinib)转让给Alfasigma,其潜在交易将涉及将大约400名员工转移到Alfasigma,同时将有100人被裁员。10月30日,辉瑞计划于2024年初关闭位于新泽西州皮帕克的工厂,并将大部分员工重新分配,不同意重新分配的员工雇佣关系将终止。此外,辉瑞还宣布关闭北卡罗来纳州的两个工厂,并在科罗拉多州进行未指明数量的裁员。10月26日,ElevateBio计划裁减13%的员工,此次裁员针对公司临床前工作的员工,目前尚不清楚该公司有多少员工。值得一提的是该公司在5月份刚刚完成了4.01亿美元的D轮融资。10月24日,安进公司在收购Horizon Therapeutics后,计划裁减350名员工,此次裁员将影响与安进现有团队重叠的Horizon公司的职位。这是安进公司今年的第三轮裁员。10月24日,BrainStorm Cell Therapeutics宣布,将裁减30%的员工。FDA上月拒绝其ALS候选药物NurOwn,BrainStorm宣布裁员是为了“加速NurOwn开发的战略调整”。被裁的员工包括首席医疗官Kirk Taylor。截至6月30日,BrainStorm报告称美国和以色列共有44名员工被裁。10月24日,Idorsia Pharmaceuticals宣布将其瑞士总部的员工人数减半。声明指出,通过取消空缺职位、不替补离职员工以及主要在研发及相关辅助职能中达成的最多300名终止协议,瑞士Allschwil总部约有475个职位被裁减。10月19日,基因编辑公司Beam Therapeutics将裁员约100人,占公司员工总数的20%,以延长现金流至2026年。10月16日,细胞疗法公司Nkarta将裁员18人,占公司员工总数的10%,旨在将其预计现金运转期限延长至2026年。10月13日,辉瑞周五晚间启动了一项全面的成本削减计划,旨在通过2024年节省35亿美元,因为该公司的COVID-19产品销售急剧下降,但目前尚不清楚有多少员工将受到影响。10月11日,Sana Biotechnology宣布,作为其投资组合重新调整计划的一部分,将裁员29%(约120人)。Sana将缩小其研发重点,专注于其离体细胞疗法平台,并放弃体内基因传递项目,以期将2024年的运营现金流消耗降至2亿美元以下。据该公司称,这将使Sana目前的现金运转期限进一步延长至2025年。10月9日,Biogen正在裁减Reata Pharmaceuticals位于德克萨斯州普莱诺的113名员工。这次裁员定于11月下旬生效,是在Biogen于2023年7月以73亿美元收购Reata仅几个月后进行的。10月7日,生物技术公司Eikon Therapeutics为了提高效率而裁员。10月5日,基因疗法生物技术公司Atsena Therapeutics最近裁减了数量不详的员工以节约现金。10月5日,基因疗法公司uniQure周四宣布,将裁减114名员工,约占其员工总数的20%。uniQure还将终止一半以上的研究和科技项目,公司表示,这些举措将节省1.8亿美元,将其现金使用期限延长至2027年。作为重组的一部分,首席科学官Ricardo Dolmetsch将离开公司。10月3日,Kezar Life Sciences宣布将裁减41%的员工,同时其首席执行官和首席医疗官将离职。据公告显示,Kezar已暂停所有研究和药物发现工作,重点是为实验药物zetomipzomib治疗狼疮性肾炎的IIb期临床试验筹集足够资金。10月2日,Syros Pharmaceuticals宣布将裁减35%的员工,同时其首席执行官和首席科学官也将离职。九月(15项)9月28日,PTC Therapeutics周四宣布,将进一步裁减25%的员工。此举延续了该公司5月份开始的重组计划。9月26日,丹麦生物技术公司Galecto在8月中期试验的主要疗效终点失败后,正在寻找战略替代方案。周二,该公司宣布将裁减大约70%的员工,相当于约30人,目标是将其现金使用期限延长至2025年。9月26日,AM-Pharma宣布完成裁员,但未透露具体人数,同时 Juliane Bernholz接替Erik van den Berg担任首席执行官。以上措施是该公司“劳动力重新调整”的一部分。9月26日,法国生物制药公司Poxel正在寻求新的融资,以启动其肾上腺脑白质营养不良(ALD)资产PXL770和PXL065的II期概念验证研究,并“执行其罕见疾病战略”。9月22日,ImmunityBio在经过四个多月的努力后,未能获得批准,决定裁员48人。加州政府9月19日的通知中披露了这一裁员事件,受影响的员工包括公司位于加利福尼亚州El Segundo的员工以及向该站点报告的远程工作人员。9月19日,NightHawk Biosciences决定放弃研发业务,专注于其合同研发和制造组织Scorpius Biomanufacturing,计划解雇13名研发业务员工,相当于其员工总数的14%。9月19日,去年以Fresh Tracks Therapeutics全新开始后,前身为Brickell Biotech的公司将永久性关闭。Fresh Tracks将终止所有临床和临床前开发项目,并在10月初解雇“大多数员工”。9月18日,基于圣地亚哥的生物技术公司Histogen宣布关闭,专注于治疗传染性疾病的它曾考虑过多种潜在的战略替代方案,但最终决定停止所有临床开发项目,并在9月底之前解雇大多数员工。9月18日,生物技术公司Kinnate Biopharma正在实施“重新优先化和劳动力重组”计划,将现有员工减少70%。最终Kinnate将仅剩下28名全职员工。该裁员包括Kinnate子公司Kinnjiu Biopharma的所有员工。9月15日,Lyndra Therapeutics在更换CEO后裁员近四分之一,此次裁员是公司决定外包商业制造和合作开发及商业化“未来所有产品”的结果。9月12日,多种因素导致2seventy bio宣布将裁员约40%,并重组公司,其中包括首席执行官Nick Leschly的离职。做出这个决定的原因是“困难重重的宏观经济环境”,但公司后期项目的延误和“复杂的Abecma商业动态”也是因素之一。此次裁员将为公司每年节省至少6500万美元的成本。9月11日,以色列生物技术公司Enlivex将减少50%的员工,以延长其现金流直至2025年底,并将专注于炎症和自身免疫性疾病,同时寻求外部合作或授权,将肿瘤学项目暂时搁置。9月6日,CSL Vifor在加州的员工人数将减少85人,从10月25日开始生效。9月5日,Infinity Pharmaceuticals在7月份计划与MEI Pharma合并失败后,裁员78%(21名员工)。周五,该公司精简后的董事会(7月份从8名董事减少到5名)终止了CEO Adelene Perkins和首席医疗官Robert Ilaria Jr.的职务,这是正在进行的重组计划的一部分。另外三名员工也被解雇。截至9月5日,公司官网显示CEO Seth Tasker是领导团队中唯一成员。识别微信二维码,添加生物制品圈小编,符合条件者即可加入生物制品微信群!请注明:姓名+研究方向!版权声明本公众号所有转载文章系出于传递更多信息之目的,且明确注明来源和作者,不希望被转载的媒体或个人可与我们联系(cbplib@163.com),我们将立即进行删除处理。所有文章仅代表作者观点,不代表本站立场。

高管变更并购细胞疗法基因疗法

2023-09-19

Shares in Kinnate Biopharma fell as much as 21% on Tuesday after the company said that it will cut 70% of its workforce and significantly trim its pipeline. CEO Nima Farzan said the overhaul reflects “the current financing environment, oncology regulatory landscape and development timelines.”After the job cuts, Kinnate will be left with 28 full-time employees, while it will also separate from all staff of its wholly-owned subsidiary in China, Kinnjiu Biopharma, a joint venture that it fully acquired earlier this year. The company noted that as of June 30, it had just over $200 million in cash, which is anticipated to fund operations into at least the second quarter of 2026.Kinnate indicated that it will pause development of the MEK inhibitor KIN-7136, whilst exploring strategic alternatives for the pan-RAF inhibitor exarafenib as monotherapy and the FGFR inhibitor KIN-3248. The drugmaker plans to refocus efforts on exarafenib combined with Pfizer’s MEK inhibitor Mektovi (binimetinib), the c-MET inhibitor KIN-8741 and discovery efforts around its CDK4 selective programme.‘Limited’ antitumour activityAccording to the company, exarafenib monotherapy showed “limited” antitumour activity in patients with BRAF Class II fusion or non-fusion driven cancers in the KN-8701 study. Meanwhile, a study of exarafenib plus Mektovi is currently under way, with a primary focus on NRAS mutant melanoma. Kinnate noted that as of September 11, among 16 efficacy-evaluable patients with NRAS mutant melanoma who had not received prior RAF, MEK or ERK inhibitors, six achieved confirmed and unconfirmed partial responses, representing an overall response rate of 38%.In terms of KIN-8741, the company said that it plans to file an investigational new drug application with the FDA in the fourth quarter. Kinnate added that it aims to nominate drug candidates in its CDK4 selective programme before the end of the year.Kinnate went public at the end of 2020, raising $276 million through the sale of 13.8 million shares priced at $20 a piece. However, on Tuesday, the company’s stock was trading at around $1.40 per share.

财报临床1期临床2期生物类似药

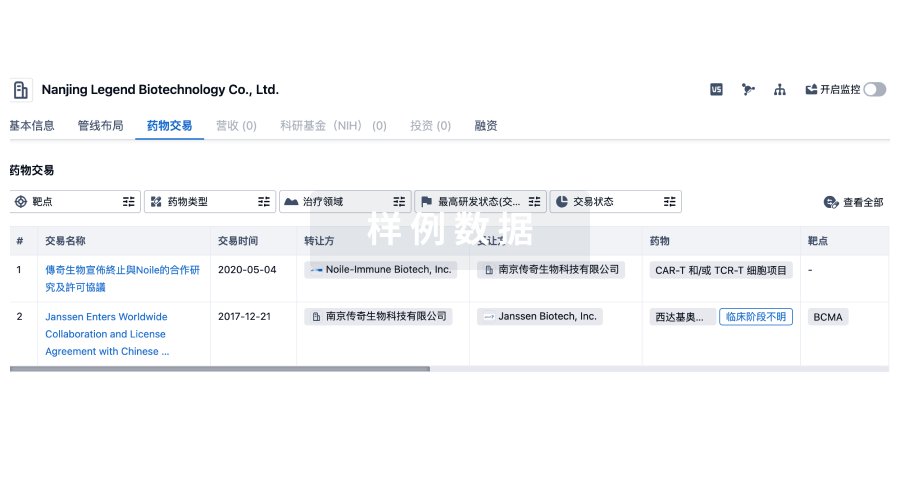

100 项与 Kinnjiu Biopharma Ltd. 相关的药物交易

登录后查看更多信息

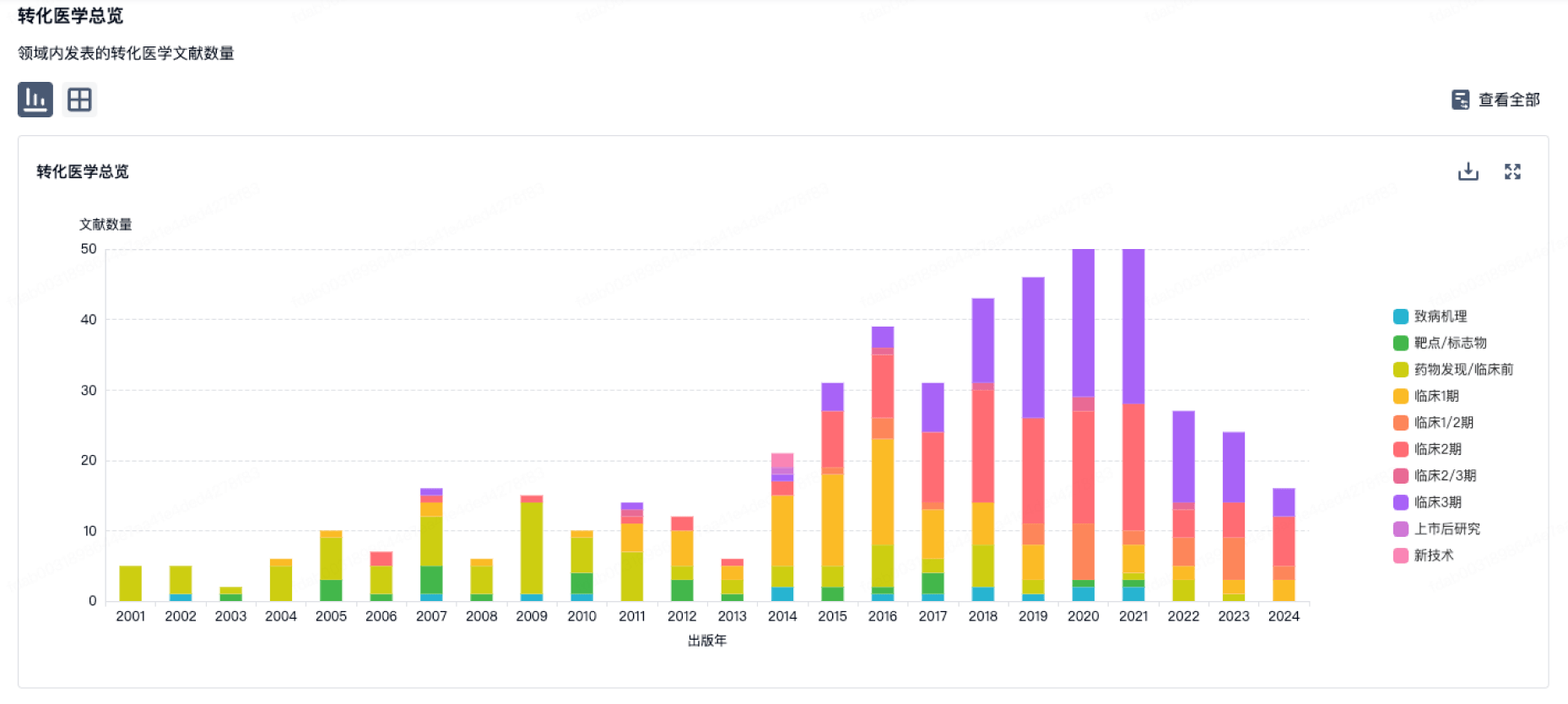

100 项与 Kinnjiu Biopharma Ltd. 相关的转化医学

登录后查看更多信息

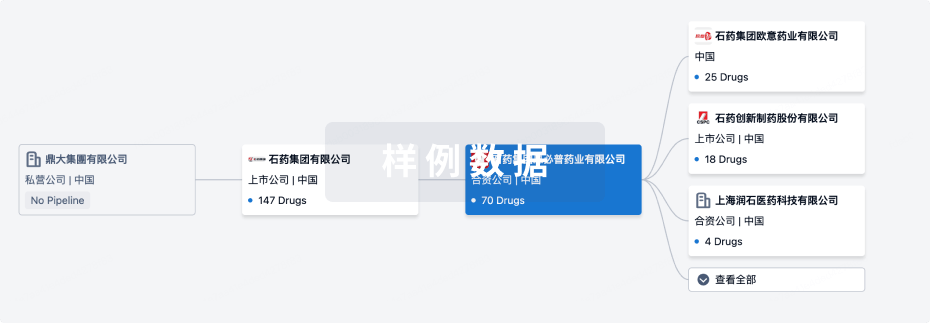

组织架构

使用我们的机构树数据加速您的研究。

登录

或

管线布局

2025年10月04日管线快照

管线布局中药物为当前组织机构及其子机构作为药物机构进行统计,早期临床1期并入临床1期,临床1/2期并入临床2期,临床2/3期并入临床3期

临床1期

2

登录后查看更多信息

当前项目

| 药物(靶点) | 适应症 | 全球最高研发状态 |

|---|---|---|

Exarafenib ( BRAF ) | BRAF突变实体瘤 更多 | 临床1期 |

Resigratinib ( FGFR2 x FGFR3 ) | FGFR3突变肿瘤 更多 | 终止 |

登录后查看更多信息

药物交易

使用我们的药物交易数据加速您的研究。

登录

或

转化医学

使用我们的转化医学数据加速您的研究。

登录

或

营收

使用 Synapse 探索超过 36 万个组织的财务状况。

登录

或

科研基金(NIH)

访问超过 200 万项资助和基金信息,以提升您的研究之旅。

登录

或

投资

深入了解从初创企业到成熟企业的最新公司投资动态。

登录

或

融资

发掘融资趋势以验证和推进您的投资机会。

登录

或

Eureka LS:

全新生物医药AI Agent 覆盖科研全链路,让突破性发现快人一步

立即开始免费试用!

智慧芽新药情报库是智慧芽专为生命科学人士构建的基于AI的创新药情报平台,助您全方位提升您的研发与决策效率。

立即开始数据试用!

智慧芽新药库数据也通过智慧芽数据服务平台,以API或者数据包形式对外开放,助您更加充分利用智慧芽新药情报信息。

生物序列数据库

生物药研发创新

免费使用

化学结构数据库

小分子化药研发创新

免费使用