预约演示

更新于:2025-05-07

Timberlyne Therapeutics

更新于:2025-05-07

概览

关联

100 项与 Timberlyne Therapeutics 相关的临床结果

登录后查看更多信息

0 项与 Timberlyne Therapeutics 相关的专利(医药)

登录后查看更多信息

62

项与 Timberlyne Therapeutics 相关的新闻(医药)2025-04-08

·药咖荟

美国对等关税的惊涛骇浪来了,药品获得豁免。这是暂时的。对等关税豁免特定产品,包括已宣布加征的汽车及零部件(25%)、钢铝(25%)以及未来要加征的芯片、药品。据彭博社,白宫正在考虑对制药业发起所谓的232条款关税调查。随着美国推进对药品进口征税的计划,制药业的关税暂缓可能不会持续太久。但制药业仍是国内受关税冲击最轻的行业之一。未来的药品征税计划可能主要针对欧盟,具体攻击目标是爱尔兰。医药制品是欧盟对美第一大出口商品,占比22.5%,很大原因是爱尔兰对美出口药品导致,2024年爱尔兰向美国出口药品达726亿欧元,全球十大制药商均在爱尔兰设有大型工厂。据中国医药保健品进出口商会,2024年,中国对美出口原料药45.2亿美元,对美出口西药制剂11.5亿美元,相比爱尔兰,体量渺小。虽然川普点名爱尔兰 “占美国便宜”,但红脖子并非刀枪不入,也要吃药。药品从来不是单纯的贸易问题,而是事关公共卫生安全。创新药基本不受关税影响,目前主要出海方式为BD对外授权。事情正发生微妙的变化。MNC近期与中国创新药企达成连续的BD交易,已引起美方注意。4月上旬,新兴生物技术国家安全委员会(NSCEB)将发布一份报告,为维持美国在生物技术创新领域领导地位提出全面政策建议。01 密集BD引起美方注意国内创新药企高效率低成本的早期临床推进(研发成本约为美国的1/3至1/5),以及对已知靶点的快速工程优化能力(ADC/多抗),已经超越海外Biotech,这也是导致XBI大跌的原因之一。据医药魔方,TOP MNC对中国创新药的兴趣高涨,2024年共达成29笔交易,占总交易数量31%。中国创新药企已成为TOP MNC的第二大项目来源地。2024年,国内创新药License-out共完成94 笔交易,总金额达到519 亿美元,同比增长26%。进入2025年,中国创新药资产热度爆棚,恒瑞医药口服 Lp(a) 抑制剂授权默沙东、联邦制药三靶点 GLP1授权诺和诺德、和铂医药创新药平台授权阿斯利康、信达生物DLL3授权罗氏、先声再明三抗新药授权艾伯维、康诺亚CD38单抗授权Timberlyne Therapeutics。2025Q1,License-out 共达成29 笔交易,合作领域向自免/代谢展开,侧重点转向早研管线,特别是海外买方对中国FIC机会的关注度显著提升,涉及新型靶点(CDH17)、创新作用机制(MoA)及治疗模式。BD交易的背后是创新药资源在全球范围的合理配置。2025年 MNC 普遍面临较大的“专利悬崖”问题,需要通过 BD 交易来补充创新管线。据2024年财报,强生、罗氏、默沙东、诺华、安进、拜耳、BMS 的现金储备均超 100亿美元,而中国创新药企能够提供更低价格、具有竞争力的早研管线。MNC仍然盘踞金字塔顶端,攫取利润最丰厚的一部分,中国创新药企卖青苗,只是为了活下去而已。然而,对方还是玻璃心了。3月下旬,几乎每天一个BD,太震撼了。华尔街一家投行3月31日的报告指出,“上周,制药公司与中国达成了连续的授权交易,我们持续看到制药公司对源自中国的me too或者me better这类成本较低的资产有着强烈的兴趣。”这些交易的共同特点是:靶点/生物学机制经过验证、临床效果有所改善、在大型市场有人体试验数据,并且预付款低于5亿美元。报告认为尚未看到类似于 DeepSeek时刻的情况,即中国的后期研发资产公布的数据明显优于美国同类产品。制药行业越来越多地转向中国进行BD交易,但目前美国在创新方面仍处于领先地位。但鉴于中国已具备强大的基础设施,假以时日,中国超越美国,以更低成本研发出更好的创新药物或许只是时间问题,就像DeepSeek的成本不到ChatGPT的十分之一。NSCEB认识到,除非美国现在就采取行动激励国内创新,否则中国可能很快就会取代美国成为全球生物技术领域的领导者。NSCEB曾经于2024年1月发布一份中期报告,概述与中国的竞争态势以及生物技术对国家安全的重要性,即将发布的最终报告将概述维持美国在全球生物技术领域领导地位的全面政策建议。4月10日,专注于技术与国家安全的非营利性智库 “特殊竞争研究项目” 将举办一场人工智能与生物技术峰会,委员会成员以及行业领袖将出席并发表演讲,其中包括生物技术创新组织(BIO)首席执行官约翰·克劳利。此后,将有一个为期18个月的实施期,在此期间国会可能会根据NSCEB的建议提出立法。以2021年3月发布的人工智能国家安全委员会(NSCAI)关于软件/人工智能的最终报告为例,随后在2021年7月提出《芯片与科学法案》,并于2022年8月通过。照此先例,预计今年夏天可能会首次提出相关立法。据投行的渠道调研,立法以激励美国国内创新措施为主,也就是“胡萝卜”政策,以推动将生产业务迁回美国。2024年生物技术创新组织的一项调查显示,79% 的生物制药公司与中国的CDMO/ CMO有合作或产品业务往来。激励措施可能包括延长专利独占期、将企业税率从20%降至15%、延长与《通货膨胀削减法案》(IRA)的谈判时间、税收抵免、政府补贴及其他资金支持,这些都将有助于美国本土的创新和投资。这些都是老调重弹了,既要领先地位,又要中低端制造业回流美国,上下游产业链通吃,这是不可能的任务。正所谓“川普造成的混乱局面无法避免,但这并不意味着他的愚蠢注定会得逞。”02 他们疯狂,但不敢肆意妄为这次有两个风向标,尽显中国企业的抗压韧性。金河生物对关税亮剑,将适时调高美国市场金霉素预混剂售价。金河生物是全球主要的兽用化药饲用金霉素预混剂生产企业,年产能5.5万吨,全球市场份额约50%左右,美国市场对金霉素预混剂产品的需求量较大且美国本土并无其他生产商。虽然本次加征34%关税后,不知道英科医疗还扛不扛得住,但在今年3月,一次性医疗级丁腈手套关税已经高达70%的情况下,英科医疗一次性丁腈手套产品仍是满产满销,体现出成本控制优势,以及对非美市场的开发能力。鉴史知今,我们回顾贸易战1.0发现一个奇怪现象。部分中国医药产品最初被列入2018年4月发布的拟议加征关税清单,包括 38项有机化学品(HS 29),涵盖常用中间体和原料药,主要为合成抗生素、抗病毒、抗癌、激素类药物中间体、还原剂和原料;47项医药产品(HS 30),涵盖如肝素、疫苗、含抗生素类药物、含胰岛素类药物、含青霉素 G 盐的药品、含有青霉素或链霉素的药品、含有麻黄碱或其盐的药品、含有芳香族或改良芳香族化合物合成的VB2 /VB12/VE药品。但于2018年6月发布的最终清单看,之前涉及的有机化学品和医药产品全部被排除在外。这种想暴捶却被迫强忍的结果,传递出药品不是普通商品的信号。时至今日,以川普草台班子清澈的愚蠢,药品关税既无法把医药全产业链带回美国本土,又无法不影响公共卫生安全。全球医药产业链高度融合,无法切割。据生物技术创新组织的数据,近九成美国生物科技公司至少一半获FDA批准的产品都依赖进口成分。据Cortellis generic Intelligence数据库,2020 - 2021年美国市场通用活性药物成分(API)全球第一大制造商是印度,占比62.1%,而中国向印度供应超70%原料药及中间体。抗生素、解热镇痛、激素等大宗原料药的全球生产基本都集中在中国。原料药供应链,美国无法取代中国、印度,在美国本土重建原料药制造业,想一想都觉得可笑,需要数十年时间,而且以其高昂的人工成本,这完全不可行。印度也无法取代中国,中国企业在建厂时间、原材料成本、电力成本、其他成本(融资、物流、生产和设置成本)、劳动生产率上都具有碾压级优势。为解决对中国进口的高度依赖,印度政府于2020年3月宣布一项 994亿卢比的一揽子计划用于原料药行业以促进国内生产和出口,然而没有效果。据印度DGCI&S 数据,2023-2024 财年从中国的原料药和中间体总进口额为 32.6亿美元,较上一财年增长5.89%,中国进口占整体进口的71.72%。基于相似的逻辑,CDMO/ CMO也无法回流美国。甚至MNC在爱尔兰的成品药制造大规模回迁美国也不可能。布鲁金斯学会健康政策中心高级研究员Marta Wosinska表示,建造一家制药厂需要三到五年的时间,“这根本行不通,时间太长,潜在收益太不确定,关税也可能随时变动。”她的潜台词是,谁都不是傻子,等厂建好了,早已物是人非。爱尔兰统计局(CSO)数据显示,2024年,爱尔兰对美商品贸易顺差500亿欧元,据美国政府统计该数据高达870亿美元(约合800亿欧元)。药品关税不仅是一个经济学问题,带来的后果远不限于药品涨价、推高通胀。2023年,美国短缺化疗药物顺铂注射液,紧急向齐鲁制药采购,连中文包装盒都没来得及换。美国药品短缺达到历史最高水平。据ASHP,截至2024年第一季度,美国有323种药物短缺,这是自2001年开始追踪短缺数据以来的最高纪录,“ 几乎所有类别的药物都面临着容易出现短缺的情况。一些最为令人担忧的短缺涉及非专利无菌注射药物,包括癌症化疗药物以及存放在医院急救车和手术区的急救药物。”川普擅长制造混乱,但医药供应链的混乱,将导致人道主义灾难。所以,他们的疯狂和愚蠢超出预期,但还是不敢肆意妄为。总之,药品关税可能最终无法避免,主要打击对象是欧盟(爱尔兰),而且在执行力度上有所顾忌。创新药基本不受影响,对边际变化也要保持警惕。END▲点击图片了解 《聚焦“国之大者”CBIITA 联合体荣获“中国产学研合作十大好平台”》更多优质内容,欢迎关注 媒体合作投稿转载/资料领取/加入社群 请添加药小咖与/智/者/同/行 为/创/新/赋/能

引进/卖出抗体药物偶联物财报医药出海

2025-04-07

·赛柏蓝

编者按:本文来自阿基米德Biotech,作者阿基米德君;赛柏蓝授权转载,编辑yuki美国对等关税的惊涛骇浪来了,药品获得豁免。这是暂时的。对等关税豁免特定产品,包括已宣布加征的汽车及零部件(25%)、钢铝(25%)以及未来要加征的芯片、药品。据海外媒体消息,白宫正在考虑对制药业发起所谓的232条款关税调查。随着美国推进对药品进口征税的计划,制药业的关税暂缓可能不会持续太久。但制药业仍是国内受关税冲击最轻的行业之一。未来的药品征税计划可能主要针对欧盟,具体攻击目标是爱尔兰。医药制品是欧盟对美第一大出口商品,占比22.5%,很大原因是爱尔兰对美出口药品导致,2024年爱尔兰向美国出口药品达726亿欧元,全球十大制药商均在爱尔兰设有大型工厂。中国医药保健品进出口商会数据显示,2024年,中国对美出口原料药45.2亿美元,对美出口西药制剂11.5亿美元,相比爱尔兰,体量渺小。创新药基本不受关税影响,目前主要出海方式为BD对外授权。事情正发生微妙的变化。MNC近期与中国创新药企达成连续的BD交易,已引起美方注意。4月上旬,新兴生物技术国家安全委员会(NSCEB)将发布一份报告,为维持美国在生物技术创新领域领导地位提出全面政策建议。01密集BD引起美方注意国内创新药企高效率低成本的早期临床推进(研发成本约为美国的1/3至1/5),以及对已知靶点的快速工程优化能力(ADC/多抗),已经超越海外Biotech,这也是导致XBI大跌的原因之一。医药魔方统计显示,TOP MNC对中国创新药的兴趣高涨,2024年共达成29笔交易,占总交易数量31%。中国创新药企已成为TOP MNC的第二大项目来源地。2024年,国内创新药License-out共完成94笔交易,总金额达到519亿美元,同比增长26%。进入2025年,中国创新药资产热度爆棚——恒瑞医药口服 Lp(a) 抑制剂授权默沙东、联邦制药三靶点GLP1授权诺和诺德、和铂医药创新药平台授权阿斯利康、信达生物DLL3授权罗氏、先声再明三抗新药授权艾伯维、康诺亚CD38单抗授权Timberlyne Therapeutics。2025Q1,License-out共达成29笔交易,合作领域向自免/代谢展开,侧重点转向早研管线,特别是海外买方对中国FIC机会的关注度显著提升,涉及新型靶点(CDH17)、创新作用机制(MoA)及治疗模式。BD交易的背后是创新药资源在全球范围的合理配置。2025年MNC普遍面临较大的“专利悬崖”问题,需要通过BD交易来补充创新管线。各企业2024年财报显示,强生、罗氏、默沙东、诺华、安进、拜耳、BMS 的现金储备均超100亿美元,而中国创新药企能够提供更低价格、具有竞争力的早研管线。华尔街一家投行3月31日的报告指出,“上周,制药公司与中国达成了连续的授权交易,我们持续看到制药公司对源自中国的me too或者me better这类成本较低的资产有着强烈的兴趣。”这些交易的共同特点是:靶点/生物学机制经过验证、临床效果有所改善、在大型市场有人体试验数据,并且预付款低于5亿美元。NSCEB曾经于2024年1月发布一份中期报告,概述与中国的竞争态势以及生物技术对国家安全的重要性,即将发布的最终报告将概述维持美国在全球生物技术领域领导地位的全面政策建议。4月10日,专注于技术与国家安全的非营利性智库 “特殊竞争研究项目” 将举办一场人工智能与生物技术峰会,委员会成员以及行业领袖将出席并发表演讲,其中包括生物技术创新组织(BIO)首席执行官约翰·克劳利。此后,将有一个为期18个月的实施期,在此期间国会可能会根据NSCEB的建议提出立法。参考此前人工智能行业相关案例中的时间间隔,预计今年夏天可能会首次提出相关立法。据投行的渠道调研,立法或以激励美国国内创新措施为主,以推动将生产业务迁回美国。02全球医药产业链高度融合这次有两个风向标,尽显中国企业抗压韧性。金河生物对关税亮剑,将适时调高美国市场金霉素预混剂售价。金河生物是全球主要的兽用化药饲用金霉素预混剂生产企业,年产能5.5万吨,全球市场份额约50%左右,美国市场对金霉素预混剂产品的需求量较大且美国本土并无其他生产商。虽然本次加征34%关税后,不知道英科医疗还扛不扛得住,但在今年3月,一次性医疗级丁腈手套关税已经高达70%的情况下,英科医疗一次性丁腈手套产品仍是满产满销,体现出成本控制优势,以及对非美市场的开发能力。鉴史知今,我们回顾贸易战1.0发现一个奇怪现象。部分中国医药产品最初被列入2018年4月发布的拟议加征关税清单,包括38项有机化学品(HS 29),涵盖常用中间体和原料药,主要为合成抗生素、抗病毒、抗癌、激素类药物中间体、还原剂和原料;47项医药产品(HS 30),涵盖如肝素、疫苗、含抗生素类药物、含胰岛素类药物、含青霉素G盐的药品、含有青霉素或链霉素的药品、含有麻黄碱或其盐的药品、含有芳香族或改良芳香族化合物合成的VB2/VB12/VE药品。但于2018年6月发布的最终清单看,之前涉及的有机化学品和医药产品全部被排除在外。这种结果传递出药品不是普通商品的信号。全球医药产业链高度融合,无法切割。据生物技术创新组织的数据,近九成美国生物科技公司至少一半获FDA批准的产品都依赖进口成分。据Cortellis generic Intelligence数据库,2020-2021年美国市场通用活性药物成分(API)全球第一大制造商是印度,占比62.1%,而中国向印度供应超70%原料药及中间体。抗生素、解热镇痛、激素等大宗原料药的全球生产基本都集中在中国。原料药供应链,美国无法取代中国、印度,在美国本土重建原料药制造业,从时间看需要数十年,再加上其高昂的人工成本,几乎不可行。印度也无法取代中国,中国企业在建厂时间、原材料成本、电力成本、其他成本(融资、物流、生产和设置成本)、劳动生产率上都具有碾压级优势。为解决对中国进口的高度依赖,印度政府于2020年3月宣布一项994亿卢比的一揽子计划用于原料药行业以促进国内生产和出口,然而没有效果。据印度DGCI&S数据,2023-2024财年从中国的原料药和中间体总进口额为32.6亿美元,较上一财年增长5.89%,中国进口占整体进口的71.72%。基于相似的逻辑,CDMO/CMO也无法回流美国。甚至MNC在爱尔兰的成品药制造大规模回迁美国也不可能。布鲁金斯学会健康政策中心高级研究员Marta Wosinska表示,建造一家制药厂需要三到五年的时间,“这根本行不通,时间太长,潜在收益太不确定,关税也可能随时变动。”她的潜台词是,谁都不是傻子,等厂建好了,早已物是人非。爱尔兰统计局(CSO)数据显示,2024年,爱尔兰对美商品贸易顺差500亿欧元,据美国政府统计该数据高达870亿美元(约合800亿欧元)。药品关税不仅是一个经济学问题,带来的后果远不限于药品涨价、推高通胀。2023年,美国短缺化疗药物顺铂注射液,紧急向齐鲁制药采购,连中文包装盒都没来得及换。美国药品短缺达到历史最高水平。据ASHP,截至2024年第一季度,美国有323种药物短缺,这是自2001年开始追踪短缺数据以来的最高纪录,“几乎所有类别的药物都面临着容易出现短缺的情况。一些最为令人担忧的短缺涉及非专利无菌注射药物,包括癌症化疗药物以及存放在医院急救车和手术区的急救药物。”总之,药品关税可能最终无法避免,主要打击对象是欧盟(爱尔兰),而且在执行力度上有所顾忌。创新药基本不受影响,对边际变化也要保持警惕。END内容沟通:郑瑶(13810174402)

引进/卖出抗体药物偶联物财报医药出海

2025-04-06

·汇聚南药

美国对等关税的惊涛骇浪来了,药品获得豁免。这是暂时的。对等关税豁免特定产品,包括已宣布加征的汽车及零部件(25%)、钢铝(25%)以及未来要加征的芯片、药品。据彭博社,白宫正在考虑对制药业发起所谓的232条款关税调查。随着美国推进对药品进口征税的计划,制药业的关税暂缓可能不会持续太久。但制药业仍是国内受关税冲击最轻的行业之一。未来的药品征税计划可能主要针对欧盟,具体攻击目标是爱尔兰。医药制品是欧盟对美第一大出口商品,占比22.5%,很大原因是爱尔兰对美出口药品导致,2024年爱尔兰向美国出口药品达726亿欧元,全球十大制药商均在爱尔兰设有大型工厂。据中国医药保健品进出口商会,2024年,中国对美出口原料药45.2亿美元,对美出口西药制剂11.5亿美元,相比爱尔兰,体量渺小。虽然川普点名爱尔兰 “占美国便宜”,但红脖子并非刀枪不入,也要吃药。药品从来不是单纯的贸易问题,而是事关公共卫生安全。创新药基本不受关税影响,目前主要出海方式为BD对外授权。事情正发生微妙的变化。MNC近期与中国创新药企达成连续的BD交易,已引起美方注意。4月上旬,新兴生物技术国家安全委员会(NSCEB)将发布一份报告,为维持美国在生物技术创新领域领导地位提出全面政策建议。01 密集BD引起美方注意国内创新药企高效率低成本的早期临床推进(研发成本约为美国的1/3至1/5),以及对已知靶点的快速工程优化能力(ADC/多抗),已经超越海外Biotech,这也是导致XBI大跌的原因之一。据医药魔方,TOP MNC对中国创新药的兴趣高涨,2024年共达成29笔交易,占总交易数量31%。中国创新药企已成为TOP MNC的第二大项目来源地。2024年,国内创新药License-out共完成94 笔交易,总金额达到519 亿美元,同比增长26%。进入2025年,中国创新药资产热度爆棚,恒瑞医药口服 Lp(a) 抑制剂授权默沙东、联邦制药三靶点 GLP1授权诺和诺德、和铂医药创新药平台授权阿斯利康、信达生物DLL3授权罗氏、先声再明三抗新药授权艾伯维、康诺亚CD38单抗授权Timberlyne Therapeutics。2025Q1,License-out 共达成29 笔交易,合作领域向自免/代谢展开,侧重点转向早研管线,特别是海外买方对中国FIC机会的关注度显著提升,涉及新型靶点(CDH17)、创新作用机制(MoA)及治疗模式。BD交易的背后是创新药资源在全球范围的合理配置。2025年 MNC 普遍面临较大的“专利悬崖”问题,需要通过 BD 交易来补充创新管线。据2024年财报,强生、罗氏、默沙东、诺华、安进、拜耳、BMS 的现金储备均超 100亿美元,而中国创新药企能够提供更低价格、具有竞争力的早研管线。MNC仍然盘踞金字塔顶端,攫取利润最丰厚的一部分,中国创新药企卖青苗,只是为了活下去而已。然而,对方还是玻璃心了。3月下旬,几乎每天一个BD,太震撼了。华尔街一家投行3月31日的报告指出,“上周,制药公司与中国达成了连续的授权交易,我们持续看到制药公司对源自中国的me too或者me better这类成本较低的资产有着强烈的兴趣。”这些交易的共同特点是:靶点/生物学机制经过验证、临床效果有所改善、在大型市场有人体试验数据,并且预付款低于5亿美元。报告认为尚未看到类似于 DeepSeek时刻的情况,即中国的后期研发资产公布的数据明显优于美国同类产品。制药行业越来越多地转向中国进行BD交易,但目前美国在创新方面仍处于领先地位。但鉴于中国已具备强大的基础设施,假以时日,中国超越美国,以更低成本研发出更好的创新药物或许只是时间问题,就像DeepSeek的成本不到ChatGPT的十分之一。NSCEB认识到,除非美国现在就采取行动激励国内创新,否则中国可能很快就会取代美国成为全球生物技术领域的领导者。NSCEB曾经于2024年1月发布一份中期报告,概述与中国的竞争态势以及生物技术对国家安全的重要性,即将发布的最终报告将概述维持美国在全球生物技术领域领导地位的全面政策建议。4月10日,专注于技术与国家安全的非营利性智库 “特殊竞争研究项目” 将举办一场人工智能与生物技术峰会,委员会成员以及行业领袖将出席并发表演讲,其中包括生物技术创新组织(BIO)首席执行官约翰·克劳利。此后,将有一个为期18个月的实施期,在此期间国会可能会根据NSCEB的建议提出立法。以2021年3月发布的人工智能国家安全委员会(NSCAI)关于软件/人工智能的最终报告为例,随后在2021年7月提出《芯片与科学法案》,并于2022年8月通过。照此先例,预计今年夏天可能会首次提出相关立法。据投行的渠道调研,立法以激励美国国内创新措施为主,也就是“胡萝卜”政策,以推动将生产业务迁回美国。2024年生物技术创新组织的一项调查显示,79% 的生物制药公司与中国的CDMO/ CMO有合作或产品业务往来。激励措施可能包括延长专利独占期、将企业税率从20%降至15%、延长与《通货膨胀削减法案》(IRA)的谈判时间、税收抵免、政府补贴及其他资金支持,这些都将有助于美国本土的创新和投资。这些都是老调重弹了,既要领先地位,又要中低端制造业回流美国,上下游产业链通吃,这是不可能的任务。正所谓“川普造成的混乱局面无法避免,但这并不意味着他的愚蠢注定会得逞。”02 他们疯狂,但不敢肆意妄为这次有两个风向标,尽显中国企业的抗压韧性。金河生物对关税亮剑,将适时调高美国市场金霉素预混剂售价。金河生物是全球主要的兽用化药饲用金霉素预混剂生产企业,年产能5.5万吨,全球市场份额约50%左右,美国市场对金霉素预混剂产品的需求量较大且美国本土并无其他生产商。虽然本次加征34%关税后,不知道英科医疗还扛不扛得住,但在今年3月,一次性医疗级丁腈手套关税已经高达70%的情况下,英科医疗一次性丁腈手套产品仍是满产满销,体现出成本控制优势,以及对非美市场的开发能力。鉴史知今,我们回顾贸易战1.0发现一个奇怪现象(详见1月16日《大战逼近,医药怕不怕?》)。部分中国医药产品最初被列入2018年4月发布的拟议加征关税清单,包括 38项有机化学品(HS 29),涵盖常用中间体和原料药,主要为合成抗生素、抗病毒、抗癌、激素类药物中间体、还原剂和原料;47项医药产品(HS 30),涵盖如肝素、疫苗、含抗生素类药物、含胰岛素类药物、含青霉素 G 盐的药品、含有青霉素或链霉素的药品、含有麻黄碱或其盐的药品、含有芳香族或改良芳香族化合物合成的VB2 /VB12/VE药品。但于2018年6月发布的最终清单看,之前涉及的有机化学品和医药产品全部被排除在外。这种想暴捶却被迫强忍的结果,传递出药品不是普通商品的信号。时至今日,以川普草台班子清澈的愚蠢,药品关税既无法把医药全产业链带回美国本土,又无法不影响公共卫生安全。全球医药产业链高度融合,无法切割。据生物技术创新组织的数据,近九成美国生物科技公司至少一半获FDA批准的产品都依赖进口成分。据Cortellis generic Intelligence数据库,2020 - 2021年美国市场通用活性药物成分(API)全球第一大制造商是印度,占比62.1%,而中国向印度供应超70%原料药及中间体。抗生素、解热镇痛、激素等大宗原料药的全球生产基本都集中在中国。原料药供应链,美国无法取代中国、印度,在美国本土重建原料药制造业,想一想都觉得可笑,需要数十年时间,而且以其高昂的人工成本,这完全不可行。印度也无法取代中国,中国企业在建厂时间、原材料成本、电力成本、其他成本(融资、物流、生产和设置成本)、劳动生产率上都具有碾压级优势。为解决对中国进口的高度依赖,印度政府于2020年3月宣布一项 994亿卢比的一揽子计划用于原料药行业以促进国内生产和出口,然而没有效果。据印度DGCI&S 数据,2023-24 财年从中国的原料药和中间体总进口额为 32.6亿美元,较上一财年增长5.89%,中国进口占整体进口的71.72%。基于相似的逻辑,CDMO/ CMO也无法回流美国。甚至MNC在爱尔兰的成品药制造大规模回迁美国也不可能。布鲁金斯学会健康政策中心高级研究员Marta Wosinska表示,建造一家制药厂需要三到五年的时间,“这根本行不通,时间太长,潜在收益太不确定,关税也可能随时变动。”她的潜台词是,谁都不是傻子,等厂建好了,早已物是人非。爱尔兰统计局(CSO)数据显示,2024年,爱尔兰对美商品贸易顺差500亿欧元,据美国政府统计该数据高达870亿美元(约合800亿欧元)。药品关税不仅是一个经济学问题,带来的后果远不限于药品涨价、推高通胀。2023年,美国短缺化疗药物顺铂注射液,紧急向齐鲁制药采购,连中文包装盒都没来得及换。美国药品短缺达到历史最高水平。据ASHP,截至2024年第一季度,美国有323种药物短缺,这是自2001年开始追踪短缺数据以来的最高纪录,“ 几乎所有类别的药物都面临着容易出现短缺的情况。一些最为令人担忧的短缺涉及非专利无菌注射药物,包括癌症化疗药物以及存放在医院急救车和手术区的急救药物。”川普擅长制造混乱,但医药供应链的混乱,将导致人道主义灾难。所以,他们的疯狂和愚蠢超出预期,但还是不敢肆意妄为。总之,药品关税可能最终无法避免,主要打击对象是欧盟(爱尔兰),而且在执行力度上有所顾忌。创新药基本不受影响,对边际变化也要保持警惕。 喜欢我们文章的朋友点个“在看”和“赞”吧,不然微信推送规则改变,有可能每天都会错过我们哦~免责声明“汇聚南药”公众号所转载文章来源于其他公众号平台,主要目的在于分享行业相关知识,传递当前最新资讯。图片、文章版权均属于原作者所有,如有侵权,请在留言栏及时告知,我们会在24小时内删除相关信息。信息来源:阿基米德Biotech往期推荐本平台不对转载文章的观点负责,文章所包含内容的准确性、可靠性或完整性提供任何明示暗示的保证。

引进/卖出抗体药物偶联物财报医药出海

100 项与 Timberlyne Therapeutics 相关的药物交易

登录后查看更多信息

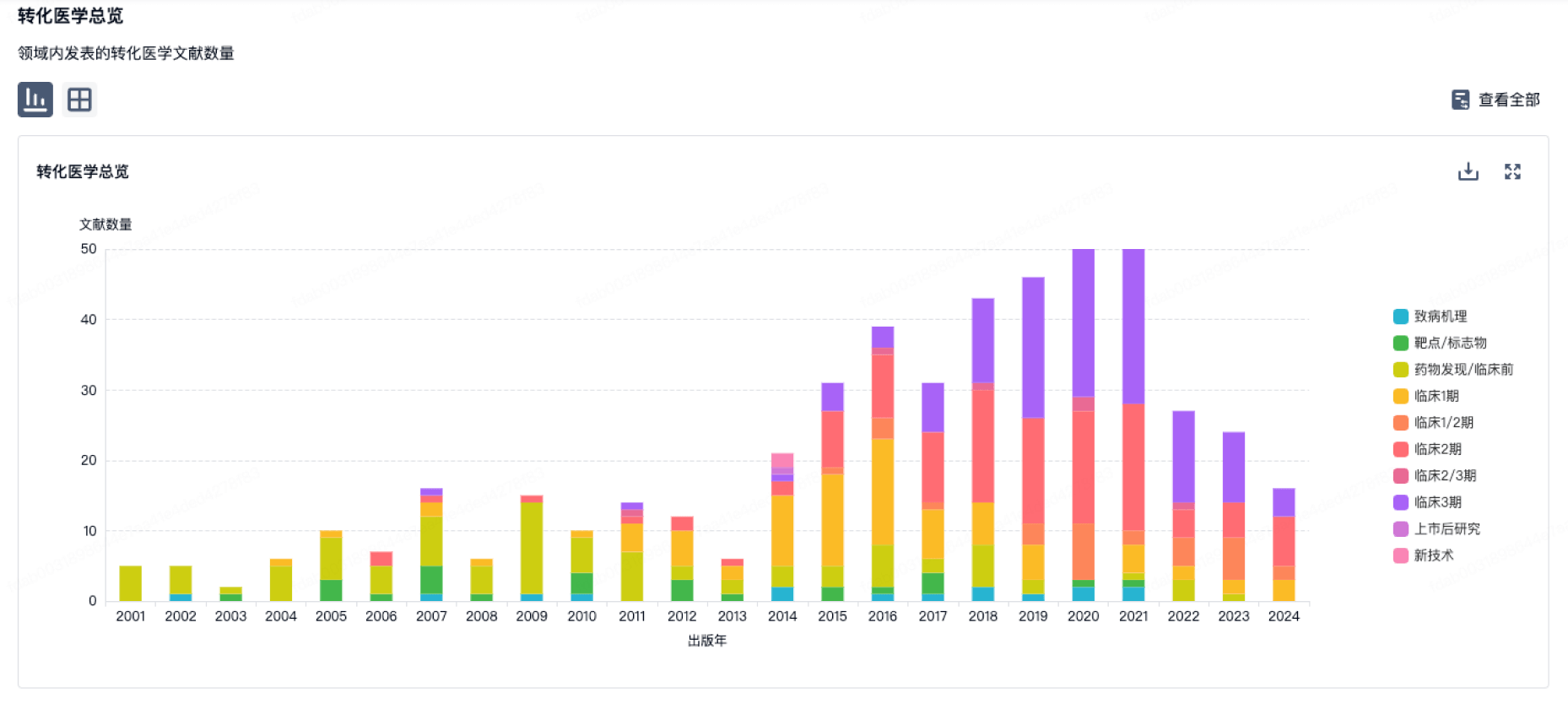

100 项与 Timberlyne Therapeutics 相关的转化医学

登录后查看更多信息

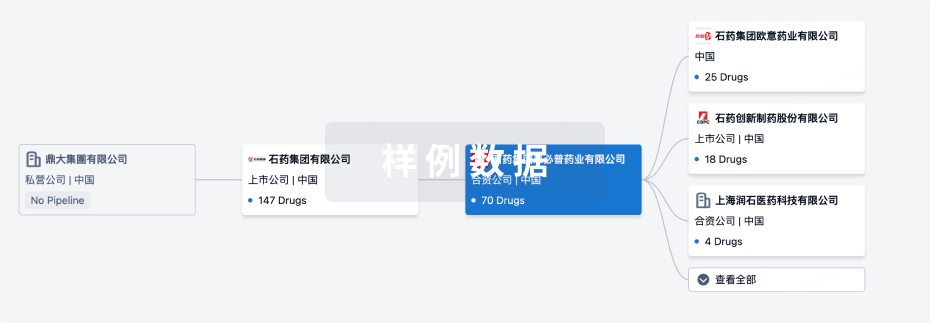

组织架构

使用我们的机构树数据加速您的研究。

登录

或

管线布局

2025年07月08日管线快照

无数据报导

登录后保持更新

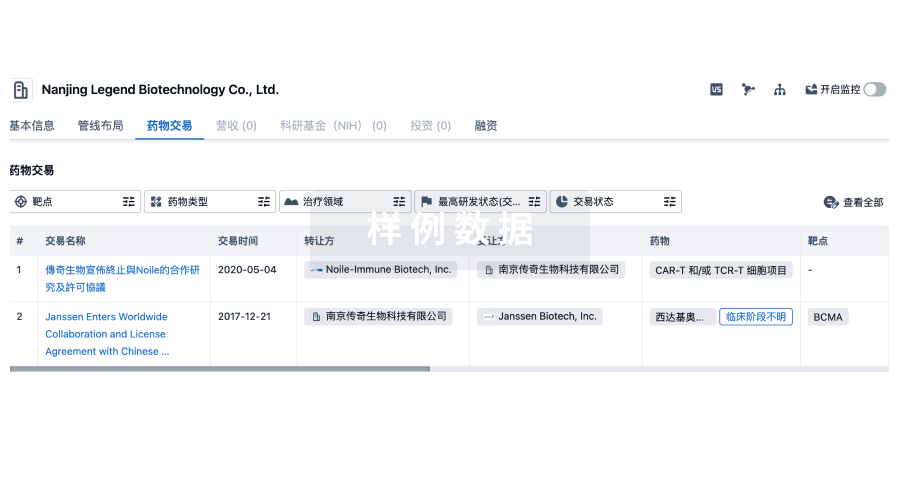

药物交易

使用我们的药物交易数据加速您的研究。

登录

或

转化医学

使用我们的转化医学数据加速您的研究。

登录

或

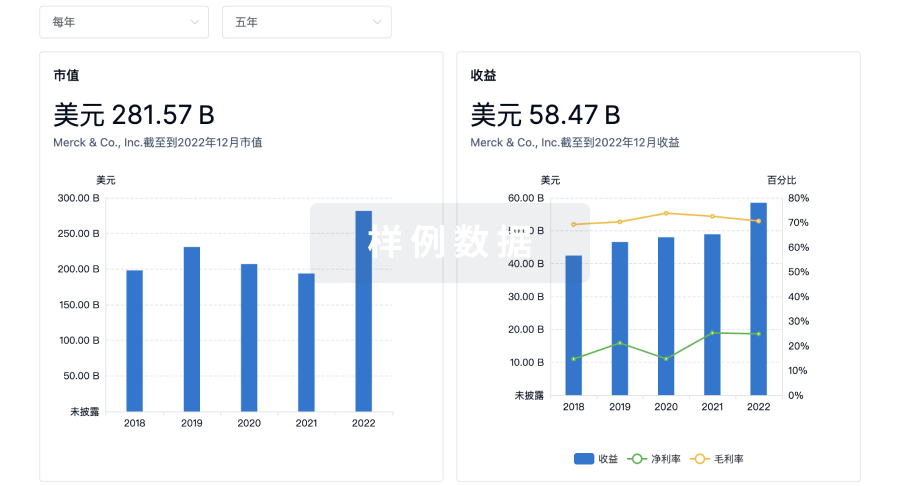

营收

使用 Synapse 探索超过 36 万个组织的财务状况。

登录

或

科研基金(NIH)

访问超过 200 万项资助和基金信息,以提升您的研究之旅。

登录

或

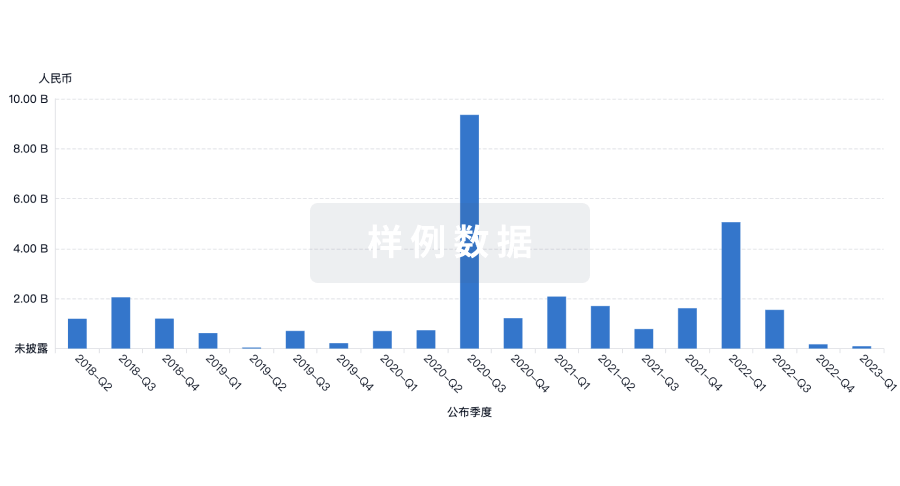

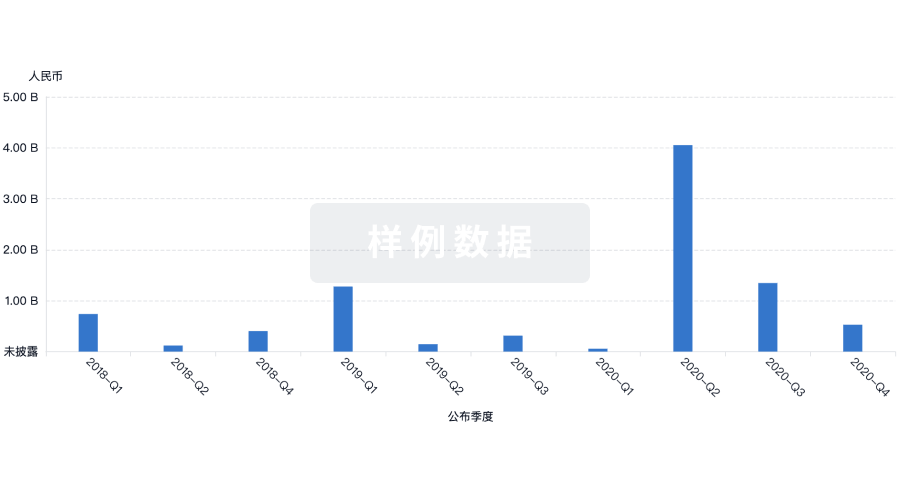

投资

深入了解从初创企业到成熟企业的最新公司投资动态。

登录

或

融资

发掘融资趋势以验证和推进您的投资机会。

登录

或

Eureka LS:

全新生物医药AI Agent 覆盖科研全链路,让突破性发现快人一步

立即开始免费试用!

智慧芽新药情报库是智慧芽专为生命科学人士构建的基于AI的创新药情报平台,助您全方位提升您的研发与决策效率。

立即开始数据试用!

智慧芽新药库数据也通过智慧芽数据服务平台,以API或者数据包形式对外开放,助您更加充分利用智慧芽新药情报信息。

生物序列数据库

生物药研发创新

免费使用

化学结构数据库

小分子化药研发创新

免费使用