更新于:2024-11-01

Aesthetic Medical International Holdings Group Ltd.

更新于:2024-11-01

概览

关联

100 项与 Aesthetic Medical International Holdings Group Ltd. 相关的临床结果

登录后查看更多信息

0 项与 Aesthetic Medical International Holdings Group Ltd. 相关的专利(医药)

登录后查看更多信息

5

项与 Aesthetic Medical International Holdings Group Ltd. 相关的新闻(医药)2023-12-12

Shenzhen, China, Dec. 12, 2023 (GLOBE NEWSWIRE) -- Aesthetic Medical International Holdings Group Limited (Nasdaq: AIH) (the “Company” or “AIH”), a leading provider of aesthetic medical services in China, announced (1) the appointment of Onestop Assurance PAC as the Company’s independent registered public accounting firm to replace Union Power HK CPA Limited (“Union Power”), effective December 12, 2023; (2) the resignation of Mr. JIM Wai Hang from his position as an independent director and a member of the audit committee of the board of directors of the Company (the“Board”), due to personal reasons, with effect on and from December 12, 2023; and (3) the appointment of Ms. XU Tianqing as an independent director and a member of the audit committee of the Board, with effect on and from December 12, 2023. Change of Auditor The change of the Company’s independent registered public accounting firm was made after careful consideration and evaluation process and was approved by the audit committee and the Board. The audit reports of Union Power on the consolidated financial statements of the Company as of and for the fiscal years ended December 31, 2021 and 2022 did not contain any adverse opinion or disclaimer of opinion, nor were they qualified or modified as to uncertainty, audit scope, or accounting principles. During the fiscal years ended December 31, 2021 and 2022 and through the subsequent interim to date, there were no disagreements between the Company and Union Power on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedures, which, if not resolved to Union Power’s satisfaction, would have caused Union Power to make reference thereto in their report on the financial statements for such years. Union Power has confirmed that there are no matters relating to their retirement that need to be brought to the attention of the shareholders of the Company. The Board has also confirmed that the Company has no disagreement or unresolved matters with Union Power, and is not aware of any matters that need to be brought to the attention of the shareholders of the Company. Change of Director Mr. JIM Wai Hang resigned from the Board, effective on and from December 12, 2023. Mr. JIM Wai Hang resigned for personal reasons and not due to any disagreement with the Company on any matter relating to the Company's operations, policies, or practices. Mr. JIM Wai Hang has confirmed that he has no disagreement with the Board and there is no other matter relating to his resignation as an independent director that needs to be brought to the attention of the shareholders of the Company or the Nasdaq. Ms. XU Tianqing was appointed as an independent director and a member of the audit committee of the Board, effective on and from December 12, 2023. The biographical details of Ms. XU Tianqing are set out below. Ms. XU Tianqing has over 5 years of experience in the financial services industry across principal investment and investment banking, currently covering the Greater China Region for ADV Partners. Prior to joining ADV, Ms. XU Tianqing worked at Barclays Capital’s investment banking division from 2018 to 2021. Ms. XU Tianqing holds a dual bachelor’s degree in Molecular & Cell Biology and Economics from the University of California, Berkeley. About Aesthetic Medical International Holdings Group Limited AIH, known as “Peng’ai” in China, is a leading provider of aesthetic medical services in China. AIH operates through treatment centers that are spread across major cities in mainland China, with a major focus on the Guangdong-Hong Kong-Macau Greater Bay area and the Yangtze River Delta area. Leveraging over 20 years of clinical experience, AIH provides one-stop aesthetic service offerings, including surgical aesthetic treatments, non-surgical aesthetic treatments, general medical services, and other aesthetic services. For more information regarding the Company, please visit https://ir.aihgroup.net/. Cautionary Statements This press release contains “forward-looking statements.” These statements are made under the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995. These forward-looking statements can be identified by terminology such as “will”, “expects”, “anticipates”, “aims”, “future”, “intends”, “plans”, “believes”, “estimates”, “likely to” and similar statements. Statements that are not historical facts, including statements about the Company’s beliefs, plans and expectations, are forward-looking statements. Forward-looking statements involve inherent risks and uncertainties. These risks and uncertainties and others that relate to the Company’s business and financial condition are detailed from time to time in the Company’s SEC filings, and could cause the actual results to differ materially from those contained in any forward-looking statement. These forward-looking statements are made only as of the date indicated, and the Company undertakes no obligation to update or revise the information contained in any forward-looking statements, except as required under applicable law. Investor Relations Contacts For investor and media inquiries, please contact:Aesthetic Medical International Holdings Group LimitedEmail: ir@pengai.com.cnWebsite: https://ir.aihgroup.net

高管变更

2023-09-08

SHENZHEN, China, Sept. 08, 2023 (GLOBE NEWSWIRE) -- Aesthetic Medical International Holdings Group Limited (Nasdaq: AIH) (the “Company” or “AIH”), a leading provider of aesthetic medical services in China, announced that it has received a notification letter (the “Notification Letter”) from the Nasdaq Stock Market LLC (the “Nasdaq”) dated September 6, 2023, notifying the Company that it is not in compliance with the minimum bid price requirement as set forth under Nasdaq Listing Rule 5550(a)(2) for continued listing on the Nasdaq. This press release is issued pursuant to Nasdaq Listing Rule 5810(b), which requires prompt disclosure upon the receipt of a deficiency notification.

Nasdaq Listing Rule 5550(a)(2) requires listed securities to maintain a minimum bid price of US$1.00 per share, and Listing Rule 5810(c)(3)(A) provides that a failure to meet the minimum bid price requirement exists if the deficiency continues for a period of 30 consecutive business days. Based on the closing bid price of the Company’s ordinary shares for the 31 consecutive business days from July 24, 2023 to September 5, 2023, the Company no longer meets the minimum bid price requirement.

In accordance with the Nasdaq Listing Rule 5810(c)(3)(A), the Company has been provided 180 calendar days, or until March 4, 2024, to regain compliance with Nasdaq Listing Rule 5550(a)(2). To regain compliance, the Company’s ordinary shares must have a closing bid price of at least US$1.00 for a minimum of 10 consecutive business days. In the event that the Company does not regain compliance by March 4, 2024, the Company may be eligible for additional time to regain compliance or may face delisting.

The receipt of the Notification Letter has no immediate effect on the Company’s business operations or the listing of the Company’s ordinary shares, which will continue to trade uninterrupted on the Nasdaq under the ticker “AIH”. To address this issue, the Company intends to continuously monitor its closing bid price and is in the process of considering various measures to improve its financial position and results of operations, which the Company expects to countervail the short-term adverse effects on its trading price and cure the deficiency in due time.

About Aesthetic Medical International Holdings Group Limited

AIH, known as “Peng’ai” in China, is a leading provider of aesthetic medical services in China. AIH operates through treatment centers that are spread across major cities in mainland China, with a major focus on the Guangdong-Hong Kong-Macau Greater Bay area and the Yangtze River Delta area. Leveraging over 20 years of clinical experience, AIH provides one-stop aesthetic service offerings, including surgical aesthetic treatments, non-surgical aesthetic treatments, general medical services, and other aesthetic services. For more information regarding the Company, please visit https://ir.aihgroup.net/.

Cautionary Statements

This press release contains “forward-looking statements.” These statements are made under the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995. These forward-looking statements can be identified by terminology such as “will”, “expects”, “anticipates”, “aims”, “future”, “intends”, “plans”, “believes”, “estimates”, “likely to” and similar statements. Statements that are not historical facts, including statements about the Company’s beliefs, plans and expectations, are forward-looking statements. Forward-looking statements involve inherent risks and uncertainties. These risks and uncertainties and others that relate to the Company’s business and financial condition are detailed from time to time in the Company’s SEC filings, and could cause the actual results to differ materially from those contained in any forward-looking statement. These forward-looking statements are made only as of the date indicated, and the Company undertakes no obligation to update or revise the information contained in any forward-looking statements, except as required under applicable law.

Investor Relations Contacts

For investor and media inquiries, please contact:Aesthetic Medical International Holdings Group LimitedEmail: ir@pengai.com.cnWebsite: https://ir.aihgroup.net

2023-09-05

SHENZHEN, China, Sept. 05, 2023 (GLOBE NEWSWIRE) -- Aesthetic Medical International Holdings Group Limited (Nasdaq: AIH) (the “Company” or “AIH”), a leading provider of aesthetic medical services in China, announced its unaudited financial results for the six months ended June 30, 2023.

Mr. ZHANG Chen, the Chairman of the Company, commented, “On August 16, 2023, I was honored to be elected as the Chairman of AIH. This was a significant date for us as it marked the successful closure of a series of equity transactions that were initiated on July 20, 2022. As Chairman, I am committed to working closely with our team to ensure that we continue to execute our new strategic initiatives and deliver value to our stakeholders. I am excited to lead AIH during this transformative period and am confident that we will achieve success together. In the first half of 2023, we observed the results of our informatization and digitization efforts. With information technology as our foundation and refined management as our ultimate goal, we have taken the first step towards data accuracy across various departments, which enabled real-time observation and analysis of data from each module in the actual operation of the Company. Our informational and digital transformation initiative aims to identify and address issues in real-time by analyzing data, improving efficiency, and making data-driven decisions.”

Mr. ZHANG Chen continued, “Moving forward, we plan to build upon our informational and digital infrastructure and continue to strengthen our customer relationship management department. By improving the accuracy and segmentation of our data analysis, we can better understand our customers' needs and preferences, and tailor our products and services to meet those needs. We also plan to prioritize talent training, both internally and externally, by implementing a comprehensive training system that emphasizes skill development and career advancement. In addition, we are committed to the standardization of energy-based treatments as the core of our future brand expansion. Our expansion efforts will be centered around a consumer-oriented business plan that emphasizes our commitment to customer satisfaction. Finally, we understand the importance of remaining grounded and building a strong foundation as we navigate the current economic recovery. With these efforts, I am confident that AIH can establish itself as an outstanding enterprise in the future.”

First Half 2023 Financial Highlights

•

Total revenue was RMB319.3 million (USD44.0 million), a decrease of 5.7% from RMB338.6 million in the first half of 2022.

•

Gross profit was RMB151.8 million (USD20.9 million), a decrease of 19.6% from RMB188.7 million in the first half of 2022.

•

Selling, general and administrative ("SG&A") expenses together were RMB159.8 million (USD22.0 million), a decrease of 9.9% from RMB177.3 million in the first half of 2022, and SG&A expenses as a percentage of revenue decreased from 52.4% to 50.0%.

•

EBITDA1 was RMB22.4 million (USD3.1 million), compared with RMB44.8 million in the first half of 2022.

•

Adjusted EBITDA1 was RMB26.7 million (USD3.7 million), decreased from RMB58.0 million in the first half of 2022.

1 EBITDA and adjusted EBITDA are not prepared in accordance with International Financial Reporting Standards as issued by the International Accounting Standard Board, or IFRS. For more information regarding non-IFRS financials, please refer to “Non-IFRS Financial Measures” and “Reconciliations of IFRS and Non-IFRS Results” appearing elsewhere in this press release.

First Half 2023 Operational Highlights

New and repeat customers

For the Six Months Ended June 30,

2022

2023

Number

% of Total

Number

% of Total

% Change

New Customers

22,284

20.1

%

32,685

31.4

%

46.7

%

Repeat Customers

88,791

79.9

%

71,488

68.6

%

-19.5

%

Total Active Customers

111,075

100.0

%

104,173

100.0

%

-6.2

%

•

As a result of the divestment of treatment centers and the temporary closing of treatment centers in January 2023, the Company recorded a decrease of 6.2% year-on-year in the total active customers.

Number of aesthetic medical treatment cases

For the Six Months Ended June 30,

2022

2023

Number

% of Total

Number

% of Total

% Change

Energy-based Treatments

207,581

71.9

%

177,603

69.3

%

-14.4

%

Minimally Invasive Aesthetic Treatments

51,728

17.9

%

43,414

16.9

%

-16.1

%

Surgical Treatments

16,174

5.6

%

22,054

8.6

%

36.4

%

General healthcare services and other aesthetic medical services

13,034

4.5

%

13,378

5.2

%

2.6

%

Total number of treatment cases

288,517

100.0

%

256,449

100.0

%

-11.1

%

•

As a result of the divestment of treatment centers and the temporary closing of treatment centers in January 2023, the Company recorded a decrease in the number of treatment cases of 11.1% year-on-year.

•

Total number of non-surgical aesthetic medical treatments as a percentage of the total number of aesthetic treatments decreased by 3.6 percentage points.

Average spending per customer

•

Average spending per customer increased by 6.0% from RMB1,174 in the first half of 2022 to RMB1,245 in the first half of 2023, primarily driven by the strategic decision to remove most of the low-price treatment promotions from our service offerings.

First Half 2023 Unaudited Financial Results

For the Six Months Ended June 30,

(RMB millions, except per share data and percentages)

2022

2023

% Change

Revenue

338.6

319.3

-5.7

%

Non-surgical aesthetic medical services

237.1

229.9

-3.0

%

Minimally invasive aesthetic treatments

103.8

114.2

10.0

%

Energy-based treatments

133.3

115.7

-13.2

%

Surgical aesthetic medical services

73.6

57.8

-21.5

%

General healthcare services and other aesthetic medical services

27.9

31.6

13.3

%

Gross profit

188.7

151.8

-19.6

%

Gross margin

55.7

%

47.5

%

-8.2

p.p.2

(Loss) for the period

(3.7

)

(11.4

)

N.M.

4

(Loss) margin

(1.1

)%

(3.6

)%

N.M.

4

EBITDA3

44.8

22.4

-50.1

%

Adjusted EBITDA3

58.0

26.7

-54.0

%

Adjusted EBITDA margin

17.1

%

8.4

%

-8.7

p.p.2

Adjusted profit/(loss)3

9.5

(7.0

)

N.M.

4

Adjusted profit/(loss) margin

2.8

%

(2.2

)%

N.M.

4

Basic (loss) per share

(0.07

)

(0.08

)

-14.3

%

Diluted (loss) per share

(0.07

)

(0.08

)

-14.3

%

Notes:

2 p.p. represents percentage points

3 Refer to below “Non-IFRS Financial Measures”

4N.M. represents not meaningful

Revenue

Total revenue was RMB319.3 million (USD44.0 million), representing a decrease of 5.7% from RMB338.6 million in the first half of 2022, primarily attributable to the divestment of underperforming assets in 2022 as well as the temporary closing of treatment centers in January 2023.

Cost of sales and services rendered

Cost of sales and services rendered was RMB167.5 million (USD23.1 million), representing an increase of 11.7% from RMB149.9 million in the first half of 2022.

Gross profit

Gross profit was RMB151.8 million (USD20.9 million), representing a decrease of 19.6% from RMB188.7 million in the first half of 2022. Gross profit margin was 47.5%, a decrease of 8.2 percentage points from 55.7% in the first half of 2022. The decrease was attributable to the temporary closing of treatment centers in January 2023.

Selling expenses

Selling expenses were RMB105.1 million (USD14.5 million), representing 32.9% of the Company’s total revenue in the first half of 2023, compared with RMB111.7 million in the first half of 2022, which represented 33.0% of the Company’s total revenue of the first half of 2022. Selling expenses as of revenue decreased by 0.1 percentage points year-on-year. The reduction in the selling expenses and its contribution was mainly a result of the Company's strategic reduction of online advertising budgets, as well as the divestment of underperforming assets in 2022.

General and administrative expenses

General and administrative expenses were RMB54.7 million (USD7.5 million), representing a decrease of 16.6% from RMB65.6 million in the first half of 2022, primarily due to the divestment of underperforming assets in 2022 and optimization of the organizational structure and management capacity.

Other gains/(losses), net

Other gains/(losses), net was a loss of RMB3.9 million (USD0.5 million), compared with a profit of RMB1.0 million in the first half of 2022, primarily due to the disposal of one of our subsidiaries.

Loss for the period

As a result of the foregoing, the Company recorded a loss of RMB11.4 million (USD1.6 million) for the first half of 2023, compared with a loss of RMB3.7 million in the first half of 2022. Basic and diluted loss per share were both loss of RMB 0.08 (loss of USD0.01 per share) in the first half of 2023, compared with basic and diluted loss per share of RMB0.07 in the first half of 2022.

Certain Non-IFRS items5

EBITDA for the first half of 2023 was RMB22.4 million (USD3.1 million), compared with RMB44.8 million in the first half of 2022.

Adjusted EBITDA for the first half of 2023 was RMB26.7 million (USD3.7 million), compared with RMB58.0 million in the first half of 2022.

Adjusted profit/(loss) after tax for the first half of 2023 was a loss of RMB7.0 million (USD1.0 million), compared with RMB9.5 million in the first half of 2022.

5 EBITDA, adjusted EBITDA, and adjusted profit/(loss) are not prepared in accordance with International Financial Reporting Standards as issued by the International Accounting Standard Board, or IFRS. For more information regarding non-IFRS financials, please refer to “Non-IFRS Financial Measures” and “Reconciliations of IFRS and Non-IFRS Results” appearing elsewhere in this press release.

Cash and cash equivalents

Cash and cash equivalents amounted to RMB87.9 million (USD12.1 million) as of June 30, 2023, compared with RMB26.2 million as of June 30, 2022. The increase in cash and cash equivalents was primarily attributable to the private placement offerings to Hawyu (HK) Limited and MY Universe (HK) Limited.

Liquidity and capital resources

The Company had a net current asset of a loss of RMB297.5 million (USD41.0 million) as of June 30, 2023, which included current borrowings of RMB111.9 million.

Recent Developments

Renovation of Shenzhen Pengcheng Hospital and Safe Beauty Initiative Ceremony

The renovation of Shenzhen Pengcheng Hospital's facade, lobby, and energy-based department was completed in July 2023. On the 28th of the same month, the “2023 Aesthetic Medical Industry Safe Beauty Initiative Ceremony” was successfully held. Ms. Hu Qing, Chief Operating Officer of the Company, delivered a speech at the ceremony. She stated that Shenzhen Pengcheng Hospital, as the founding hospital of AIH, has always been at the forefront of the industry and has demonstrative significance in the industry. It is believed that Shenzhen Pengcheng Hospital will continue to prioritize “Safe Beauty” and will constantly improve and innovate to create a new industry service model. The hospital aims to provide more convenient, high-end, and high-quality aesthetic experiences. Ms. Hu emphasized that the Shenzhen Pengcheng Aesthetic Medical Beauty brand upgrade is part of AIH's upgrading, marking an important step towards the modernization of the aesthetic medical industry.

Significant Efforts Made in Medical Safety Control

During the first half of 2023, the Company has made significant efforts in terms of medical safety control. Firstly, AIH has released the first issue of its medical management newsletter, which includes regulations for the practice behavior of institutions and physicians, strengthening the ability to deal with medical emergencies, and improving the management of prophylactic antimicrobial drugs used in surgery. Additionally, AIH has strengthened the safety management of anesthesia for general anesthesia surgery and standardized the content of medical documents. Secondly, AIH has developed operational capacity assessment standards for surgical, minimally invasive, and energy-based treatments for the recruitment of new physicians. Finally, AIH has established a monthly medical institution operation reporting system to better understand the operations of each medical institution under the Company in a timely manner.

Successful Closing of Share Transfer, Conversion of Convertible Note and Issue of Warrants

Reference is made to the press release of the Company filed with the Securities and Exchange Commission (the “SEC”) on July 20, 2022 and form 6-K of the Company filed with the SEC on February 16, 2023 and August 17, 2023 (collectively, “Previous Disclosure”) in relation to, among other, entry into a share purchase agreement, a subscription agreement, a shareholders’ agreement and a cooperation agreement. All capitalized terms not otherwise defined herein shall have the meanings ascribed to them in the Previous Disclosure. On August 16, 2023, the Company has closed its previously announced (i) Share Transfer of an aggregate of 21,321,962 ordinary shares of the Company from Seefar, Jubilee, and Pengai Hospital Management Corporation to Wanda; (ii) issue of a total number of 12,088,808 ordinary shares of the Company to ADV at a conversion price of US dollars equivalent of RMB4.203 per ordinary share; and (iii) issue and allotment of 4,655,386 and 6,423,983 warrants to Seefar and Wanda respectively, which can be converted into one ordinary share per warrant upon exercise.

Exchange Rate

This press release contains translations of certain Renminbi (RMB) amounts into U.S. dollars (USD) solely for the convenience of the reader. Unless otherwise specified, all translations of Renminbi amounts into U.S. dollar amounts in this press release are made at RMB7.2513 to USD1.0, which was the U.S. dollars middle rate announced by the Board of Governors of the Federal Reserve System of the United States on June 30, 2023.

Non-IFRS Financial Measures

EBITDA represents profit before income tax, adjusted to exclude finance costs and amortization and depreciation. Adjusted EBITDA represents EBITDA, adjusted to exclude professional fee, share-based payment, loss on disposal of subsidiaries.

Adjusted profit/(loss) represents profit/(loss) for the period, adjusted to exclude professional fee, share-based payment, loss on disposal of subsidiaries.

EBITDA, adjusted EBITDA and adjusted profit/(loss) are non-IFRS financial measures. You should not consider EBITDA, adjusted EBITDA and adjusted profit/(loss) as a substitute for or superior to net income prepared in accordance with IFRS. Furthermore, because non-IFRS measures are not determined in accordance with IFRS, they are susceptible to varying calculations and may not be comparable to other similarly titled measures presented by other companies. You are encouraged to review the Company’s financial information in its entirety and not rely on a single financial measure.

The Company presents EBITDA, adjusted EBITDA and adjusted profit/(loss) as supplemental performance measures because it believes that such measures provide useful information to the investors in understanding and evaluating the Company’s results of operations, and facilitate operating performance comparisons from period to period and company to company.

About Aesthetic Medical International Holdings Group Limited

AIH, known as “Peng’ai” in China, is a leading provider of aesthetic medical services in China. AIH operates through treatment centers that are spread across major cities in mainland China, with a major focus on the Guangdong-Hong Kong-Macau Greater Bay area and the Yangtze River Delta area. Leveraging over 20 years of clinical experience, AIH provides one-stop aesthetic service offerings, including surgical aesthetic treatments, non-surgical aesthetic treatments, general medical services, and other aesthetic services. For more information regarding the Company, please visit .

Cautionary Statements

This press release contains “forward-looking statements.” These statements are made under the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995. These forward-looking statements can be identified by terminology such as “will”, “expects”, “anticipates”, “aims”, “future”, “intends”, “plans”, “believes”, “estimates”, “likely to” and similar statements. Statements that are not historical facts, including statements about the Company’s beliefs, plans and expectations, are forward-looking statements. Forward-looking statements involve inherent risks and uncertainties. These risks and uncertainties and others that relate to the Company’s business and financial condition are detailed from time to time in the Company’s SEC filings, and could cause the actual results to differ materially from those contained in any forward-looking statement. These forward-looking statements are made only as of the date indicated, and the Company undertakes no obligation to update or revise the information contained in any forward-looking statements, except as required under applicable law.

Investor Relations Contacts

For investor and media inquiries, please contact:

Aesthetic Medical International Holdings Group Limited

Email: ir@pengai.com.cn

Website:

AESTHETIC MEDICAL INTERNATIONAL HOLDINGS GROUP LIMITED

CONSOLIDATED BALANCE SHEETS

30 June

30 June

30 June

2022

2023

2023

RMB’000

RMB’000

USD’000

ASSETS

Non-current assets

Property, plant and equipment

361,887

303,848

41,903

Investment properties

-

23,065

3,181

Intangible assets

38,878

36,500

5,034

Investments accounted for using the equity method

5,764

-

-

Prepayments and deposits

18,737

11,434

1,577

Deferred income tax assets

44,299

69,482

9,581

469,565

444,329

61,276

Current assets

Inventories

28,809

23,710

3,270

Trade receivables

6,075

7,379

1,018

Other receivables, deposits and prepayments

35,194

33,121

4,568

Amounts due from related parties

3,537

2,873

395

Restricted cash

-

2,049

283

Asset held-for-sale

-

1,083

149

Cash and cash equivalents

26,228

87,877

12,119

99,843

158,092

21,802

Total assets

569,408

602,421

83,078

EQUITY AND LIABILITIES

Equity attributable to owners of the Company

Share capital

469

873

120

Treasury shares

(2023

)

(2023

)

(279

)

Accumulated losses

(1,064,524

)

(1,150,846

)

(158,709

)

Other reserves

914,864

1,197,885

165,196

(151,214

)

45,889

6,328

Non-controlling interests

(29,479

)

(14,025

)

(1,934

)

Total equity

(180,693

)

31,864

4,394

AESTHETIC MEDICAL INTERNATIONAL HOLDINGS GROUP LIMITED

CONSOLIDATED BALANCE SHEETS (CONTINUED)

30 June

30 June

30 June

2022

2023

2023

RMB’000

RMB’000

USD’000

LIABILITIES

Non-current liabilities

Borrowings

72,950

29,545

4,074

Lease liabilities

112,980

85,450

11,784

Convertible note

38,059

-

-

223,989

114,995

15,858

Current liabilities

Trade payables

44,438

36,414

5,022

Accruals, other payables and provisions

75,936

36,857

5,084

Contingent consideration and consideration payable

6,850

3,592

495

Amounts due to related parties

473

-

-

Contract liabilities

193,209

165,390

22,808

Borrowings

167,232

111,937

15,437

Lease liabilities

29,175

27,391

3,777

Current income tax liabilities

8,799

9,416

1,299

Convertible note

-

64,565

8,904

526,112

455,562

62,826

Total liabilities

750,101

570,557

78,684

Total equity and liabilities

569,408

602,421

83,078

AESTHETIC MEDICAL INTERNATIONAL HOLDINGS GROUP LIMITED

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

30 June

30 June

30 June

2022

2023

2023

RMB’000

RMB’000

USD’000

Revenue

338,594

319,303

44,034

Cost of sales and services rendered

(149,898

)

(167,547

)

(23,106

)

Gross profit

188,696

151,756

20,928

Selling expenses

(111,692

)

(105,113

)

(14,496

)

General and administrative expenses

(65,643

)

(54,668

)

(7,539

)

Finance income

78

78

11

Finance costs

(17,003

)

(9,650

)

(1,331

)

Other gains/(losses), net

998

(3,878

)

(535

)

(Loss) before income tax

(4,566

)

(21,475

)

(2,962

)

Income tax credit

820

10,124

1,397

(Loss) for the period

(3,746

)

(11,351

)

(1,565

)

Total comprehensive (loss)/income for the period

(3,746

)

(11,351

)

(1,565

)

(Loss)/profit attributable to:

Owners of the Company

(4,621

)

(10,078

)

(1,390

)

Non-controlling interests

875

(1,273

)

(175

)

(Loss)/profit for the period

(3,746

)

(11,351

)

(1,565

)

AESTHETIC MEDICAL INTERNATIONAL HOLDINGS GROUP LIMITED

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

30 June

30 June

30 June

2022

2023

2023

RMB’000

RMB’000

USD’000

(Loss)/earnings per share for (loss)/profit attributable to owners of the Company (in RMB per share)

—Basic

(0.07

)

(0.08

)

(0.01

)

—Diluted

(0.07

)

(0.08

)

(0.01

)

Total comprehensive (loss)/income attributable to:

Owners of the Company

(4,621

)

(10,078

)

(1,390

)

Non-controlling interests

875

(1,273

)

(175

)

Total comprehensive (loss)/income for the year

(3,746

)

(11,351

)

(1,565

)

EBITDA

44,834

22,361

3,084

Adjusted EBITDA

58,033

26,728

3,686

Adjusted profit/(loss)

9,453

(6,984

)

(963

)

AESTHETIC MEDICAL INTERNATIONAL HOLDINGS GROUP LIMITED

RECONCILIATIONS OF IFRS AND NON-IFRS RESULTS

EBITDA and Adjusted EBITDA

For the Six Months Ended June 30,

2022

2023

2023

RMB’000

RMB’000

USD’000

(Loss)/profit before income tax for the period

(4,566

)

(21,475

)

(2,962

)

Adjustments

+ Finance costs

17,003

9,650

1,331

+ Amortization and depreciation

32,397

34,186

4,715

EBITDA

44,834

22,361

3,084

+ Professional fees

2,736

1,476

203

+ Share-based compensation expense

10,463

+ Loss on disposal of subsidiaries

2,891

399

Adjusted EBITDA

58,033

26,728

3,686

AESTHETIC MEDICAL INTERNATIONAL HOLDINGS GROUP LIMITED

RECONCILIATIONS OF IFRS AND NON-IFRS RESULTS (CONTINUED)

Adjusted Profit/(Loss)

For the Six Months Ended June 30,

2022

2023

2023

RMB’000

RMB’000

USD’000

(Loss)/profit for the period

(3,746

)

(11,351

)

(1,565

)

Adjustments

+ Professional fees

2,736

1,476

203

+ Share-based compensation expense

10,463

+ Loss on disposal of subsidiaries

2,891

399

Adjusted profit/(loss)

9,453

(6,984

)

(963

)

财报

100 项与 Aesthetic Medical International Holdings Group Ltd. 相关的药物交易

登录后查看更多信息

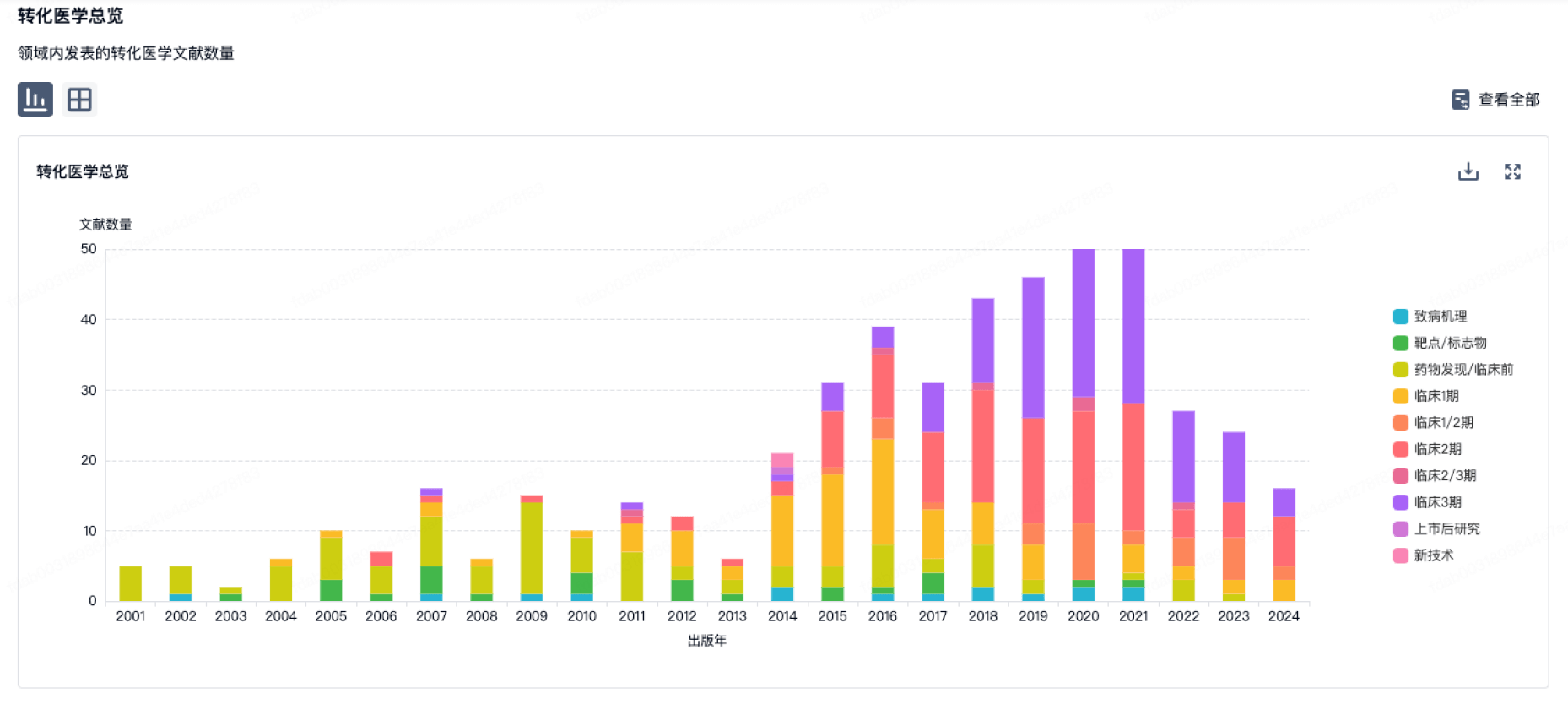

100 项与 Aesthetic Medical International Holdings Group Ltd. 相关的转化医学

登录后查看更多信息

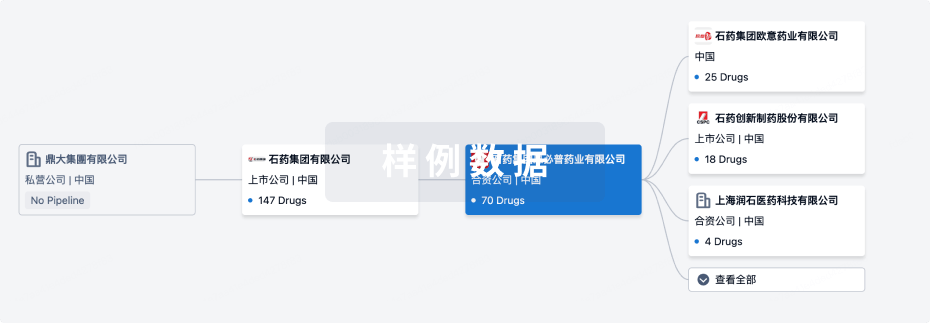

组织架构

使用我们的机构树数据加速您的研究。

登录

或

管线布局

2024年11月20日管线快照

无数据报导

登录后保持更新

药物交易

使用我们的药物交易数据加速您的研究。

登录

或

转化医学

使用我们的转化医学数据加速您的研究。

登录

或

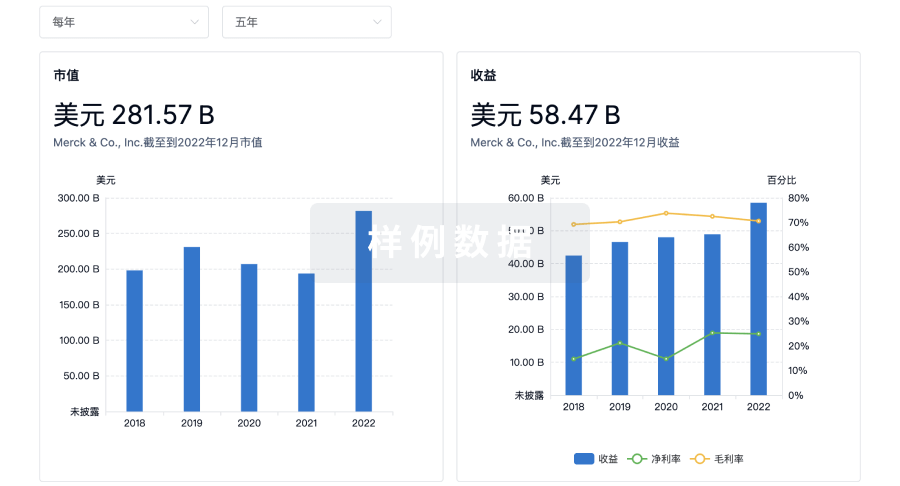

营收

使用 Synapse 探索超过 36 万个组织的财务状况。

登录

或

科研基金(NIH)

访问超过 200 万项资助和基金信息,以提升您的研究之旅。

登录

或

投资

深入了解从初创企业到成熟企业的最新公司投资动态。

登录

或

融资

发掘融资趋势以验证和推进您的投资机会。

登录

或

标准版

¥16800

元/账号/年

新药情报库 | 省钱又好用!

立即使用

来和芽仔聊天吧

立即开始免费试用!

智慧芽新药情报库是智慧芽专为生命科学人士构建的基于AI的创新药情报平台,助您全方位提升您的研发与决策效率。

立即开始数据试用!

智慧芽新药库数据也通过智慧芽数据服务平台,以API或者数据包形式对外开放,助您更加充分利用智慧芽新药情报信息。

生物序列数据库

生物药研发创新

免费使用

化学结构数据库

小分子化药研发创新

免费使用