预约演示

更新于:2025-05-07

Oviva Therapeutics, Inc.

更新于:2025-05-07

概览

标签

内分泌与代谢疾病

泌尿生殖系统疾病

小分子化药

疾病领域得分

一眼洞穿机构专注的疾病领域

暂无数据

技术平台

公司药物应用最多的技术

暂无数据

靶点

公司最常开发的靶点

暂无数据

| 疾病领域 | 数量 |

|---|---|

| 内分泌与代谢疾病 | 1 |

| 排名前五的药物类型 | 数量 |

|---|---|

| 小分子化药 | 1 |

| 排名前五的靶点 | 数量 |

|---|---|

| AMHR2(抗苗勒氏管激素受体II) | 1 |

关联

1

项与 Oviva Therapeutics, Inc. 相关的药物靶点 |

作用机制 AMHR2调节剂 |

在研适应症 |

非在研适应症- |

最高研发阶段临床前 |

首次获批国家/地区- |

首次获批日期- |

100 项与 Oviva Therapeutics, Inc. 相关的临床结果

登录后查看更多信息

0 项与 Oviva Therapeutics, Inc. 相关的专利(医药)

登录后查看更多信息

9

项与 Oviva Therapeutics, Inc. 相关的新闻(医药)2025-04-29

BOSTON, April 29, 2025 /PRNewswire/ -- Granata Bio ("Granata") today announced the acquisition of Oviva Therapeutics, Inc. ("Oviva"), a pioneering women's health biotech company focused on advancing treatments that address female physiology, with an emphasis on ovarian aging.

Oviva's lead candidate, OVI-586, is a first-in-class therapeutic designed to enhance women's health span— the period of life spent in optimal health— by extending ovarian function. Since the ovaries are the first organ to decline with age, preserving the ovarian reserve presents a novel approach to addressing key women's health challenges. OVI-586 holds potential applications across menopause, contraception, and in vitro fertilization (IVF), offering new possibilities for patients seeking advanced reproductive and endocrine health solutions.

"This is a big day for women's health. Cambrian partnered with Drs. Daisy Robinton, David Pepin, and Pat Donahue to found Oviva and develop the first truly novel mechanism in women's health in the last 50 years. We're thrilled about this acquisition and looking forward to seeing Oviva's OVI-586 progress to the next stage of development under Granata's leadership. This transaction reflects the importance of Cambrian's objective: identify amazing scientific discoveries and turn those discoveries into great businesses," said James Peyer, Founder and CEO of Cambrian BioPharma, Inc.

"At Granata Bio, our mission is to identify and develop innovative solutions for fertility patients. The acquisition of Oviva Therapeutics marks a significant milestone in our efforts to bring forward new therapies for those with limited treatment options. In IVF stimulation, OVI-586 offers a biologically grounded approach to improving ovarian response— even in patients with diminished ovarian reserve. We're excited to continue advancing OVI-586 and explore its potential in assisted reproductive technology (ART) and beyond," said Evan Sussman, Co-Founder and CEO of Granata Bio.

About Oviva Therapeutics

Oviva Therapeutics, Inc. is leading a movement to improve women's experience of aging through biomedical research, development and advocacy. Oviva addresses the vast unmet need in women's health by expanding funding, research, and clinical development, and is currently developing first-in-class therapeutics to improve ovarian function and consequently extend female healthspan.

About Granata Bio

Granata Bio is a U.S.-based biopharmaceutical company dedicated to advancing innovation in women's health and infertility. Founded in 2018, the company's pipeline includes a range of fertility therapies, with collaborations spanning multiple drug classes to address unmet needs in reproductive medicine.

For all inquiries contact

[email protected]

.

SOURCE Granata Bio

WANT YOUR COMPANY'S NEWS FEATURED ON PRNEWSWIRE.COM?

440k+

Newsrooms &

Influencers

9k+

Digital Media

Outlets

270k+

Journalists

Opted In

GET STARTED

并购

2023-09-12

[12-September-2023]

NEW YORK, Sept. 12, 2023 /PRNewswire/ -- Oviva Therapeutics, a premier biotech company dedicated to addressing the vast unmet need in women's health by developing first-in-class therapeutics to preserve ovarian function and consequently extend female healthspan, today announced the appointment of Rachel Rimsky Rubin as its new Chief Operating Officer (COO), effective as of September 5, 2023.

Rubin joins Oviva with nearly a decade of experience developing the business operations and strategy of early stage biotech organizations, working from her foundation in investment management. She brings with her a proven track record of designing and implementing operational structures and strategy in dynamic biotechnology and healthcare technology companies that support and accelerate execution of the business vision.

Prior to joining Oviva, Rubin served as Vice President of Investments and Programs at Roivant Social Ventures. Before that, she led business operations and talent acquisition for Roivant Health, a subsidiary of Roivant Sciences that incubates new healthcare technology and biotechnology businesses. Earlier in her career, Rubin worked as Vice President of the Alternative Investments and Manager Selection business at Goldman Sachs, and she held hedge fund investment roles at financial institutions GAM and Deutsche Bank. Rachel holds a B.S. from Cornell University.

"We are thrilled to welcome Rachel Rimsky Rubin to the Oviva team as our first Chief Operating Officer," said Daisy Robinton, Co-Founder and CEO of Oviva Therapeutics. "Her exceptional leadership and expertise will undoubtedly propel us forward as we navigate this critical juncture of growth and innovation. We believe her addition to our leadership team will significantly accelerate our mission to transform women's health."

In her role, Rubin will build infrastructure and implement company strategy to usher Oviva through its next phase of growth. She will lead global operations and work collaboratively with Oviva's cross-functional team to formulate and implement company objectives. Rubin will play a key role in ensuring Oviva's preclinical and programmatic goals are translated into operational procedures and will work alongside Oviva's CEO to continue building the Oviva team in parallel to the business' growth.

"I am thrilled to join the Oviva team at this exciting time for the business. We are building and scaling Oviva's business as we pursue development of medicines that will support women throughout each stage of their lives," said Rubin. "I am passionate about increasing women's success with IVF - and, importantly - giving women agency over their health. Our work at Oviva directly targets these areas and I could not be more excited to work on this mission."

The appointment of Ms. Rubin signifies an exciting chapter in Oviva's journey, aligning seamlessly with Oviva's commitment to initiate a new era of women's health that is informed by foundational biomedical research and innovative therapeutics development to extend ovarian function and female healthspan, paired with advocacy to broaden the reach of the findings and of the therapeutics developed. To learn more please visit .

About Oviva Therapeutics

Oviva Therapeutics, Inc., a Cambrian Bio PipeCo, is a biotechnology company dedicated to addressing the vast unmet need in women's health by driving biomedical research and clinical development of first-in-class therapeutics aimed at preserving ovarian function and extending female healthspan. We are engaging with scientists, clinicians, policy makers and the general public to elevate the conversation around women's health and galvanize advocacy in this field. In bringing together stakeholders across disciplines, we are inviting diverse perspectives and skill sets to drive innovation and progress in this space. For more information, please visit or follow us on LinkedIn.

About Cambrian Bio

Cambrian Bio is a clinical-stage drug development company focused on creating therapeutics targeting key biological pathways that decline or malfunction with age. The medicines developed at Cambrian have the potential to treat and prevent some of today's most debilitating diseases. Each program at Cambrian is run by its R&D team in collaboration with a team of experts dedicated to a Pipeline Company (PipeCo). This model allows Cambrian to develop new drugs efficiently with highly qualified individuals, partner flexibly across the healthcare ecosystem, and return rewards to the scientists whose vision and drive build new medicines. To date, Cambrian Bio has more than a dozen novel therapeutics in its pipeline. For more information, please visit or follow them on Twitter @CambrianBio and LinkedIn.

高管变更

2023-06-28

In the past seven years, approximately $530 million has been invested in startups addressing menopause care. But that's actually just a drop in the bucket of VC funding.

Menopause is having its moment. High-profile investments and startups with celebrity names attached have brought long-overdue attention to this once-taboo area of women's health.

Actress Naomi Watts launched a beauty and wellness brand focused on menopause health, called Stripes, in partnership with biotech company Amyris. Actress Judy Greer became a founding partner at menopause-focused startup Wile with a focus on products for women in their 40s and 50s.

Generally, women lack education and resources about symptoms related to perimenopause and menopause, Greer said during Fortune's recent Brainstorm Health Conference.

"There's so little education out there about perimenopause. Menopause is one day of your life, 365 days after you've had your last period. So we're talking about one day versus potentially 12 years leading up to this one day. We're not educating our health practitioners. They're not learning about this. When you're a woman, and you either are done having kids or you decide you don't want to have kids, it's like, 'Good luck. Don't get osteoporosis'," Greer said during a panel discussion about menopause education.

The global menopause market hit $15.4 billion in 2021 and is projected to reach $24.4 billion by 2030, according to data from Grand View Research.

The World Health Organization estimates that more than 50 million women in the U.S. are over the age of 51, the average age that menopause hits. Approximately 1.3 million women become menopausal each year. Hormonal changes during menopause often cause women to experience hot flashes, incontinence, sleep loss, mood changes and brain fog, and physical changes such as weight gain or loss, a slowing metabolism, and joint pain.

For women, managing menopause and perimenopause symptoms can be challenging both personally and professionally. A national survey in the U.S. revealed that 4 out of every 10 women said menopause symptoms interfered with their work performance or productivity at least on a weekly basis. What's more, 17% of women said they have actually quit a job or considered quitting due to menopause symptoms.

The annual global economic impact of menopause, between productivity loss and healthcare costs, is estimated at $150 billion, Bloomberg reported.

There is clearly a huge business opportunity and also a need to fill gaps in care and overcome medical barriers for the millions of women experiencing menopause.

Studies show that medical residents and practitioners have significant knowledge gaps that inhibit their ability to address menopausal symptoms. A survey published in the Journal of the North American Menopause Society published back in 2013 indicated that only 20% of OB/GYN residency programs provide any kind of menopause training, mostly elective courses.

According to findings from a survey conducted by the American Association of Retired Persons, only 1 in 5 women in the U.S. received a referral to a menopause specialist. Of the 60% of women who seek medical attention, an appalling 75% of them are left untreated.

"There's this massive white space out there. It goes far beyond the anti-aging rhetoric of like wrinkles and weight gain that really is ripe for innovation," said Gwendolyn Floyd, CEO of Wile, speaking on the same Fortune Brainstorm Health panel as Greer. "There are big challenges but it's such a huge opportunity and it's vital that we address it."

Startups disrupting menopause care

A recent market analysis from venture capital firm SJF Ventures outlines the startups disrupting menopause care and the opportunities for investors.

The menopause market includes therapeutic solutions that lengthen ovarian health, medical devices that cool a body experiencing hot flashes, virtual clinical care that connects patients with physicians who specialize in menopause care and direct-to-consumer subscription services for hormone replacement therapy, according to report author Devon Sanford, an associate at SJF Ventures.

The analysis identified 50 companies categorized into five sectors: biopharma, consumer goods, digital technology, medical devices and virtual and hybrid care.

In the biopharma market, Oviva Therapeutics has developed novel therapeutics to address ovarian health and longevity, and Gameto is focused on solving diseases of the female reproductive system.

There is a growing list of companies offering health supplements, personal care and sexual wellness products for aging women such as Bonafide Health, which provides hormone- and prescription-free health products for menopause symptoms, Sanford noted in the report.

In the digital health space, Midday is one startup that developed a personalized menopause app to help people manage their menopause symptoms and midlife health.

There's a big focus on innovation with medical devices and wearables to help alleviate menopause symptoms. Embr Labs is a pioneer in this sector and developed the Embr Wave, a wearable that's a personalized cooling device for hot flashes. Founded in 2014, Embr Labs' technology was invented by the company's founders while at MIT and the company has raised $50 million from investors to date.

A growing list of startups offer virtual and hybrid care for menopause symptoms including Elektra Health, Stella and Gennev. Evernow, a telehealth company focused on providing services for perimenopause and menopause, banked $28.5 million in series A funding with backing from notable angel investors Gwyneth Paltrow, Drew Barrymore, Cameron Diaz and Color co-founder Othman Laraki.

Northwell Holdings and Aegis Ventures teamed up to launch a new virtual menopause care startup called Upliv. The startup partners with employers to provide telehealth and whole-person care to workers who are dealing with perimenopause or menopause symptoms.

Women's health startups also are expanding their offerings into menopause care. Carrot Fertility rolled out benefits for menopause and low testosterone services to its platform last year and also added hormone replacement therapy (HRT) coverage. Women's health "unicorn" Maven Clinic broadened its services to include a dedicated program for menopause and ongoing care.

Primary care provider Parsley Health also provides menopause support as part of its women's health program.

Hello Heart, a startup that helps people manage their heart health at home using their smartphone, rolled out a new feature that provides menopausal women with the tools and information they need to take control of their heart health.

Market ripe for more investment, innovation

In the past seven years, going back to 2015, approximately $530 million has been invested in startups addressing menopause care, according to SJF Ventures' report, citing PitchBook and Crunchbase data. That figure excludes large health tech companies like Everlywell and Maven Clinic, which offer menopause care as part of a suite of services.

"While $530 million may seem substantial at first glance, it is a drop in the bucket of VC funding. As a point of comparison, fem-tech startups received $1.9 billion in 2021. This means all menopause care investments account for just 3% of fem-tech funding from one year. In the same year, digital healthcare companies received $30.7 billion," Sanford wrote in the report.

In 2022, $10.2 million was deployed in this sector in 17 deals. So far in 2023, funding already has doubled with $25 million invested in menopause startups.

Sanford notes that 80% of healthcare dollars are controlled by women, so the people experiencing the problem are the same people deciding how to spend on healthcare costs. "People experience menopause at a greater rate than pregnancy or motherhood, yet patients consistently cite a lack of effective medical support and solutions to menopausal side effects," she wrote.

Companies solving for these challenges can reach a large audience with high spending power, Sanford wrote.

One challenge for investors and startup founders is that menopause care represents unchartered territory for exit opportunities. Most startups have not surpassed early-stage funding rounds. Of the 50 companies SJF Ventures identified in the analysis, only three have been acquired and no companies in the space have gone public so far.

Another hurdle is getting employers and insurers to cover the services. Most menopause care startups are direct-to-consumer companies.

"We anticipate that securing payers or employers will be challenging in the near term but will likely gain traction quickly over the next decade. Payers may be less apt to cover menopause care compared to innovations in chronic care (e.g. diabetes, COPD, kidney care) as menopause symptoms are often less acute and cost payers less in hospital stays or ER admissions," Sanford wrote in the analysis.

A Gennev survey of 2,500 women in 2021 found that 99% of respondents are not provided with any menopause care benefits at work. But trends in the payer and employer space may be starting to shift.

Some players in the market have started pilot partnerships with payers or have secured insurance coverage. Gennev's services are covered by Aetna in all 50 states. Midi, a virtual care clinic for women over 40, works with major insurance plans in 12 states including Aetna, UnitedHealthcare and some Blues plans.

A Mercer health and benefits strategy report released earlier this year found that 15% of employers intend to offer menopause care benefits in 2024, up from 4% in 2023.

"At SJF, our hope is to see more menopause companies targeting insurance and employer coverage, as such coverage would ensure middle- to low-income Americans can access services that they otherwise could not afford," Sanford wrote.

Sanford also noted that it will be interesting to watch menopause care companies compete against one-stop shops such as Maven or Carrot Fertility. "It remains to be seen whether employers will be more interested in specialty services with high-quality care or bundled packages that reduce point-solution fatigue," she wrote.

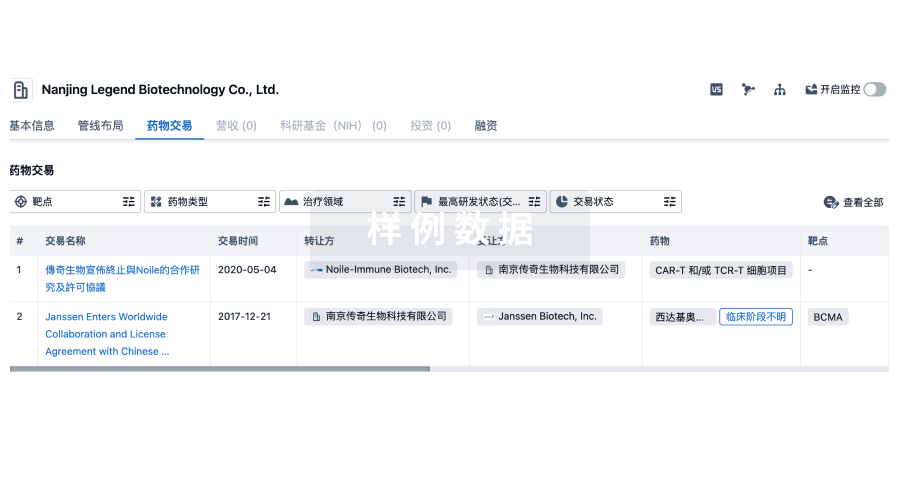

100 项与 Oviva Therapeutics, Inc. 相关的药物交易

登录后查看更多信息

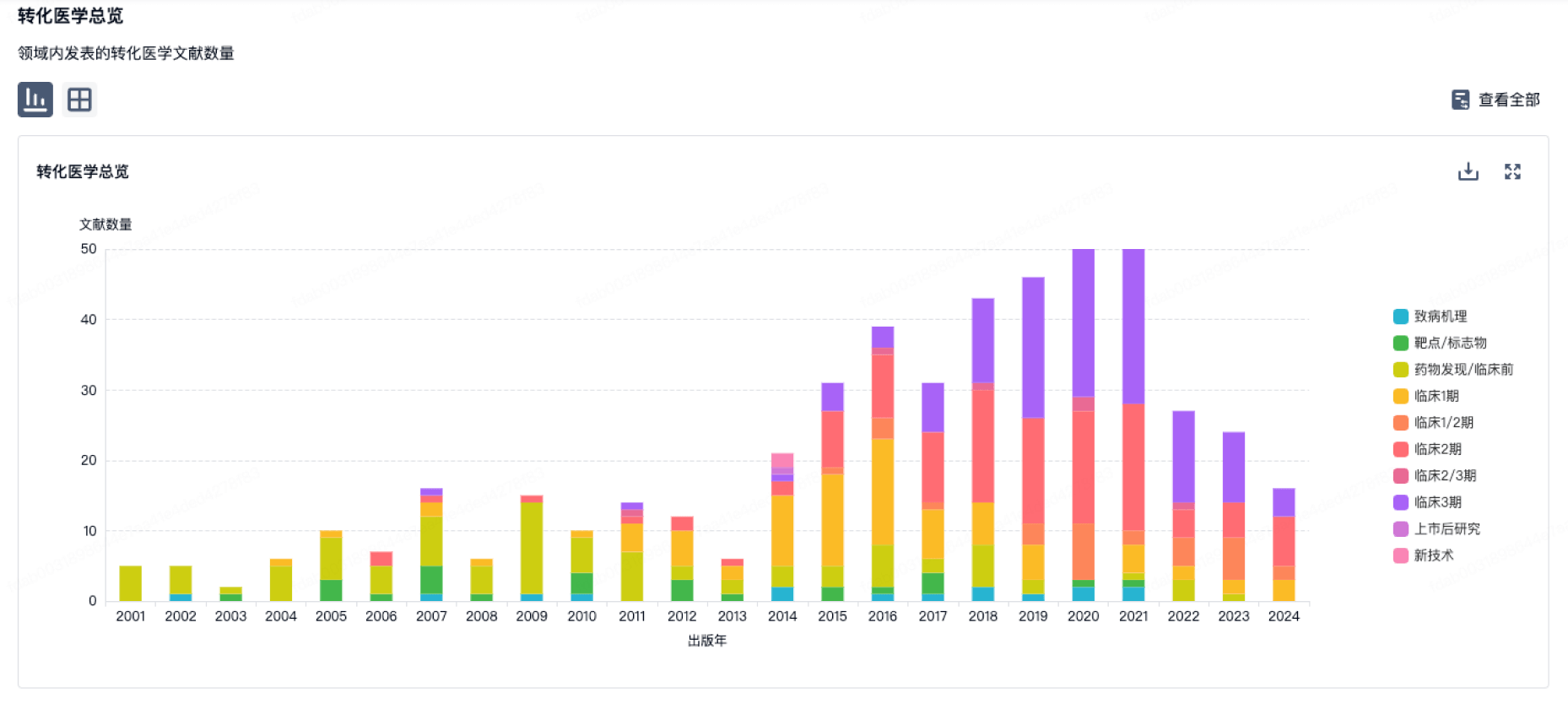

100 项与 Oviva Therapeutics, Inc. 相关的转化医学

登录后查看更多信息

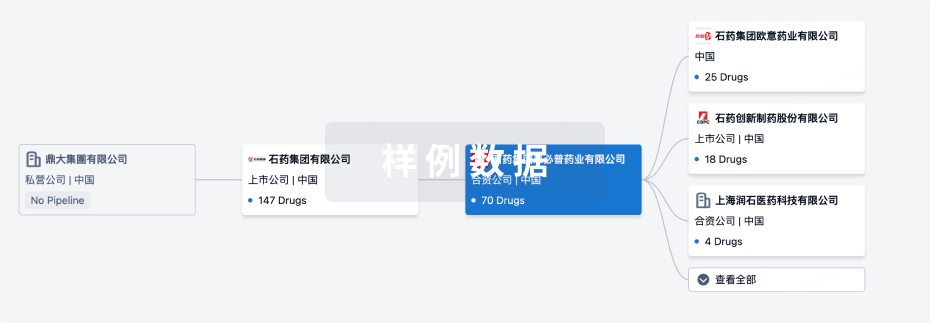

组织架构

使用我们的机构树数据加速您的研究。

登录

或

管线布局

2025年07月20日管线快照

管线布局中药物为当前组织机构及其子机构作为药物机构进行统计,早期临床1期并入临床1期,临床1/2期并入临床2期,临床2/3期并入临床3期

临床前

1

登录后查看更多信息

药物交易

使用我们的药物交易数据加速您的研究。

登录

或

转化医学

使用我们的转化医学数据加速您的研究。

登录

或

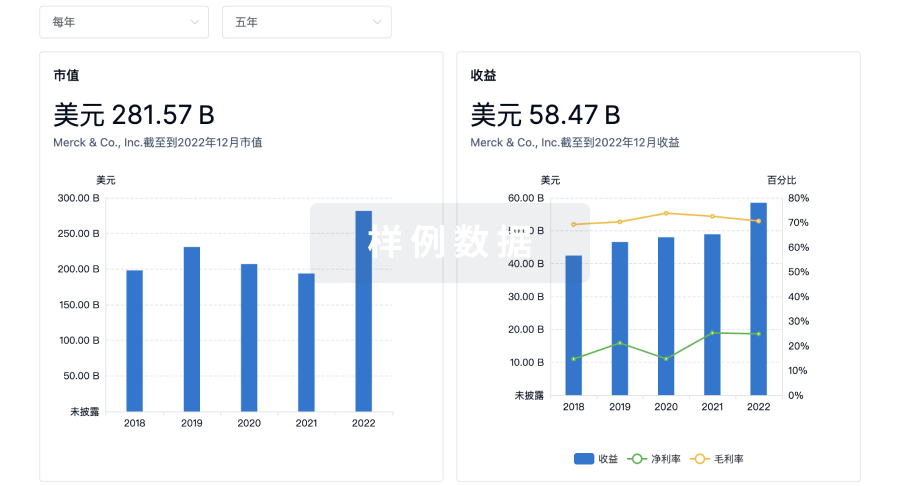

营收

使用 Synapse 探索超过 36 万个组织的财务状况。

登录

或

科研基金(NIH)

访问超过 200 万项资助和基金信息,以提升您的研究之旅。

登录

或

投资

深入了解从初创企业到成熟企业的最新公司投资动态。

登录

或

融资

发掘融资趋势以验证和推进您的投资机会。

登录

或

Eureka LS:

全新生物医药AI Agent 覆盖科研全链路,让突破性发现快人一步

立即开始免费试用!

智慧芽新药情报库是智慧芽专为生命科学人士构建的基于AI的创新药情报平台,助您全方位提升您的研发与决策效率。

立即开始数据试用!

智慧芽新药库数据也通过智慧芽数据服务平台,以API或者数据包形式对外开放,助您更加充分利用智慧芽新药情报信息。

生物序列数据库

生物药研发创新

免费使用

化学结构数据库

小分子化药研发创新

免费使用