预约演示

更新于:2025-01-23

CarepathRx LLC

更新于:2025-01-23

概览

关联

100 项与 CarepathRx LLC 相关的临床结果

登录后查看更多信息

0 项与 CarepathRx LLC 相关的专利(医药)

登录后查看更多信息

8

项与 CarepathRx LLC 相关的新闻(医药)2023-06-05

None

Evernorth has inked a strategic partnership with CarepathRx Health System Solutions that aims to boost access to specialty pharmacy care.

Through the partnership, the two will provide integrated specialty pharmacy services to CHSS' growing clientele, which includes more than 600 hospitals, health systems and physicians. This will allow these providers to diversify the ways they can support patients, according to an announcement.

As part of the partnership, Evernorth will make a "significant minority investment" in CHSS that it expects to close late in the second quarter or in the third quarter of 2023.

“Forging deeper relationships with physicians and other specialty and infusion pharmacies—a critical point of care for people with chronic and complex needs—is a key priority as we work to increase access to care and improve affordability,” said Eric Palmer, CEO of Evernorth, in the release. “Specialty care continues to be a focal point for hospital, health system and physician partners, and our collaboration with CHSS is an important step in delivering on our commitment to bring them even more patient care services to improve overall outcomes.”

Providers that tap into the new offerings will gain access to enhanced coordination for infusion services, virtual care tools, value-based care opportunities and site of care flexibility, the partners said.

Evernorth said that its Accredo specialty pharmacy and other offerings are "highly complimentary" to CHSS' work to assist hospitals in expanding in-house specialty pharmacy capabiltiies.

Over time, the fusing of these capabilities will make it easier to manage care for patients with complex and complex conditions. Continuity of care for specialty drugs and better management of infusion services will both be key focuses, according to the announcement.

“At CarepathRx, we believe health systems, hospitals, and physicians play the most important roles in providing the best care to patients with chronic and complex diseases,” said John Figueroa, CEO of CarepathRx, in the release.. “Through specialty and infusion pharmacy partnerships, CHSS has created a model for health systems to extend their reach to alternate sites of care and into the home. This partnership with Evernorth is truly unique and will accelerate CHSS’ mission by creating payer-physician connections and leveraging Evernorth’s specialty and care services.”

2023-03-06

Healthcare mergers and acquisitions are in no short supply as providers, retailers, health tech companies and other industry players look to expand their businesses and gain a competitive edge. (Getty/Natee Meepian)

Healthcare mergers and acquisitions are in no short supply as providers, health tech companies, retailers and other industry players look to expand their businesses and gain a competitive edge. Here’s a roundup of new deals that were revealed, closed, rumored or called off during the month of February.

Providers

Sanford Health and Fairview Health Services have agreed to push back their planned megamerger by two months after the Minnesota attorney general’s office asked the Midwest systems for more time to review the 58-hospital deal. The organizations are now targeting a May 31 close.

CVS Health finally put the rumors to rest by announcing a definitive agreement to purchase Medicare-focused primary care provider Oak Street Health in an all-cash deal valued at $10.6 billion. The company said Oak Street's model—which is tech-enabled, multipayer and value-based—has proven to be scalable, making it an attractive target for their business. Oak Street includes about 600 physicians across 169 medical centers located in 21 states. It's expected to grow to over 300 centers by 2026.

CommonSpirit Health is entering Utah with the purchase of five Steward Health Care hospitals via the Catholic system’s Centura Health joint venture. The deal also includes 35 medical group clinics and a clinically integrated network of providers, and, according to regulatory filings, was purchased for $685 million “plus certain working capital adjustments.” CommonSpirit had announced a day before that it would be taking sole control of 15 Centura Health hospitals amidst the joint venture’s breakup with AdventHealth, which claimed the remaining five.

Community Health Systems announced late Tuesday that it has signed a deal to sell two North Carolina hospitals to Novant Health for about $320 million, adding to the latter’s current total of 15 hospitals. The deal is slated to close later this year pending regulatory approvals and closing conditions.

SUNY Upstate Medical University and Crouse Health called off their plans to merge, instead settling for a “strategic affiliation agreement” as they continue to operate as separate and independent entities. The deal had drawn scrutiny from federal regulators that argued a deal could drive higher costs, reduce care quality and diminish the bargaining power of local hospital workers.

Flagler Health+ and the University of Florida’s UF Health have entered into an exclusive, nonbinder letter of intent to merge. The organizations said they’re aiming to bring the 335-bed Flagler Hospital and other components of Flager Health+ into UF Health’s fold sometime later this year. The organizations said any deal would not impact daily operations.

Lifepoint Health has acquired a majority ownership interest in national behavioral health provider Springstone’s operating company. The deal will add 18 behavioral health hospitals and 35 outpatient locations across nine states into Lifepoint’s collection.

Logan Health has signed a letter of intent to merge with Billings Clinic. The former is a six-hospital, 622-bed system based in Montana while the latter is an integrated multispecialty group practice with a 336-bed hospital and trauma center serving Montana, Wyoming and the western Dakotas. The nonprofit systems hope to have a definitive agreement this spring and a deal finalized by the summer.

UAB Health System is set to bring RMC Health System under its wing as an affiliate. Leadership signed a letter of intent and aim to finalize a deal this summer.

AdventHealth wrote in quarterly filings that it signed definitive agreements in January with two third parties to sell nine skilled nursing facilities in Florida, Texas and Kansas. The deals are expected to close in early 2023.

ProMedica has agreed to sell off its hospice and home-care assets for a $710 million valuation to Gentiva, a hospice company backed by Humana, per Bloomberg. The deal expands Gentiva’s reach from roughly 380 locations to over 500, and its patient count from about 25,000 to 34,000.

Amedisys has sold off its personal care division to HouseWorks, a personal care services provider active in Massachusetts, New Hampshire, Pennsylvania and Maine. Terms of the deal expected to close in the second quarter were not disclosed. Following the close, HouseWorks said it would partner with home care software maker eCaring to handle home care services in Amedisys’ markets.

Payers

UnitedHealth Group's $5.4 billion acquisition of LHC Group has officially closed, allowing UHG subsidiary Optum and LHC to join their expertise in value-based home care. The deal closed after a lengthy probe from the Federal Trade Commission, which requested additional details on the merger in June, and pushback from an LHC shareholder.

Elevance Health (formerly Anthem) has closed its acquisition of BioPlus, a specialty pharmacy subsidiary of CarepathRx. BioPlus is joining Elevance’s CarelonRx pharmacy benefit management arm, which Elevance said will help it better meet members’ specialty drug needs and whole-person health goals. Terms were not disclosed.

Tech

Amazon has closed its $3.9 billion deal to buy One Medical, furthering its ambitions to offer medical services and expand its growing healthcare business to employers. The deal expands Amazon's reach into primary care as it now officially operates 188 clinics in 29 markets. It also gives Amazon a foot in the lucrative employer market. Still, the Federal Trade Commission is reportedly continuing its investigation of the merger.

Aledade, the maker of data analytics software for independent doctors’ offices as they transition to value-based models, acquired value-based care analytics company Curia. The purchase aims to help Aledade flex out its tech capabilities, including its ability to extract insights from disparate data sources, make accurate predictions using past data and optimize workflows. Terms of the deal were not disclosed.

Elation Health, an EHR provider, picked up medical billing company Lightning MD for an undisclosed sum. The company said adding Lightning’s billing interface will add to its suite of solutions and move Elation a step closer to its goal of becoming an all-in-one technology offering for primary care practices.

Ventra Health, a tech-enabled revenue cycle management, practice management and advisory services firm serving hospital-based physician specialties, said it acquired Philippines-based revenue cycle management services company Deras Global for an undisclosed sum.

并购

2023-02-15

Elevance Health said in a release that the deal to purchase BioPlus will help the insurer better meet its members' specialty drug needs, backing its focus on whole-person health.

Elevance Health has closed its acquisition of BioPlus, a specialty pharmacy company, the insurer announced Wednesday.

BioPlus was a subsidiary of CarepathRx, part of Nautic Partners' portfolio. BioPlus will join the insurer's Carelon arm, which is a major focus of growth within Elevance, formerly Anthem.

The specialty pharmacy company provides a range of services for people with complex or chronic illnesses such as cancer, multiple sclerosis, hepatitis C, autoimmune diseases or rheumatological conditions. It covers more than 100 drugs with a limited distribution and reaches all 50 states.

Elevance said in the release that the deal will help the insurer better meet its members' specialty drug needs, backing its focus on whole-person health.

“Specialty pharmacy is a critical driver of value for patients, and we are excited to welcome BioPlus, the largest independent specialty pharmacy, to our Elevance Health family,” said Pete Haytaian, executive vice president of Elevance Health and president of Carelon, in the release. “Together, we will enhance our abilities to provide end-to-end pharmacy services for our consumers by delivering greater affordability and access to critical medications, as well as a superior patient experience."

BioPlus will now operate as part of CarelonRx, the company's pharmacy benefit management arm.

Elevance Health plans to further build out BioPlus' services to more disease states, ensuring access to necessary medications.

并购

100 项与 CarepathRx LLC 相关的药物交易

登录后查看更多信息

100 项与 CarepathRx LLC 相关的转化医学

登录后查看更多信息

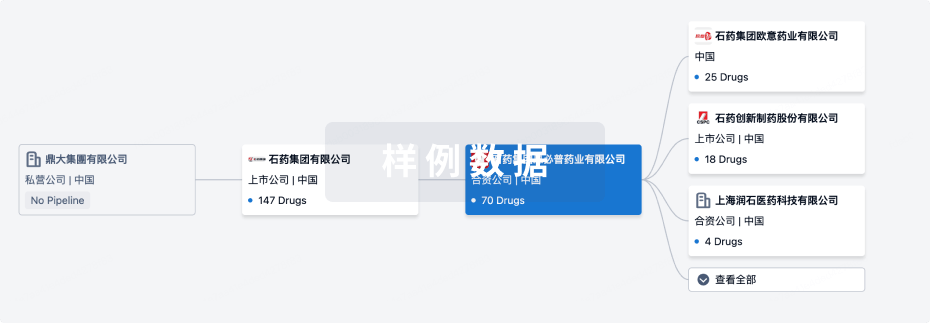

组织架构

使用我们的机构树数据加速您的研究。

登录

或

管线布局

2025年02月06日管线快照

无数据报导

登录后保持更新

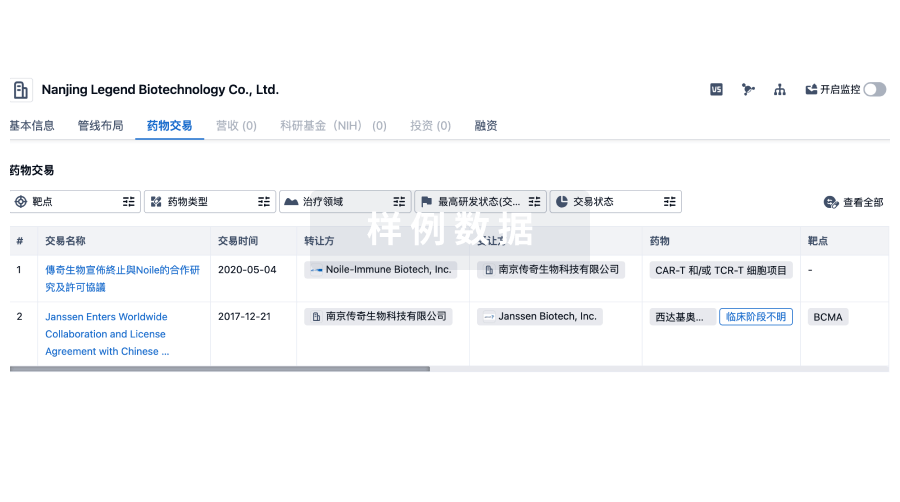

药物交易

使用我们的药物交易数据加速您的研究。

登录

或

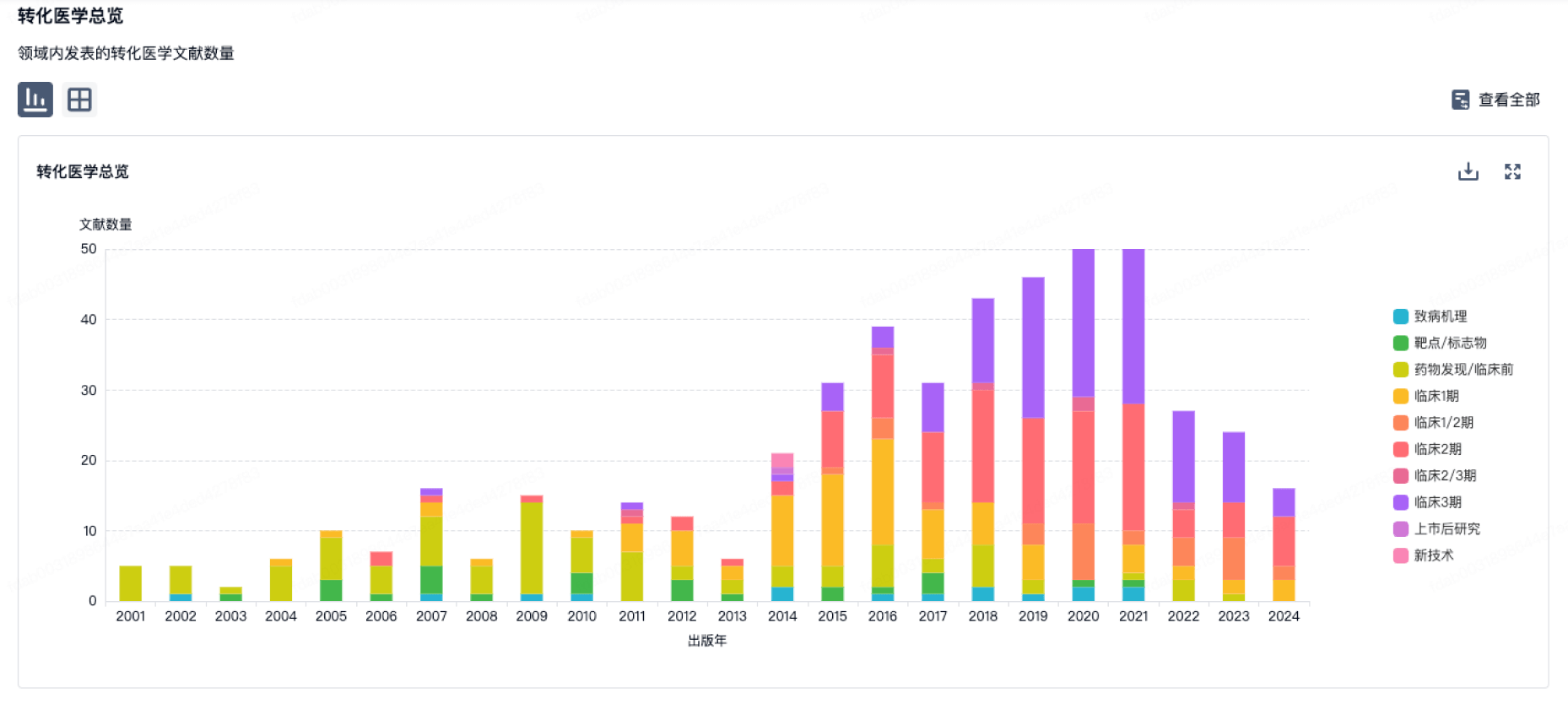

转化医学

使用我们的转化医学数据加速您的研究。

登录

或

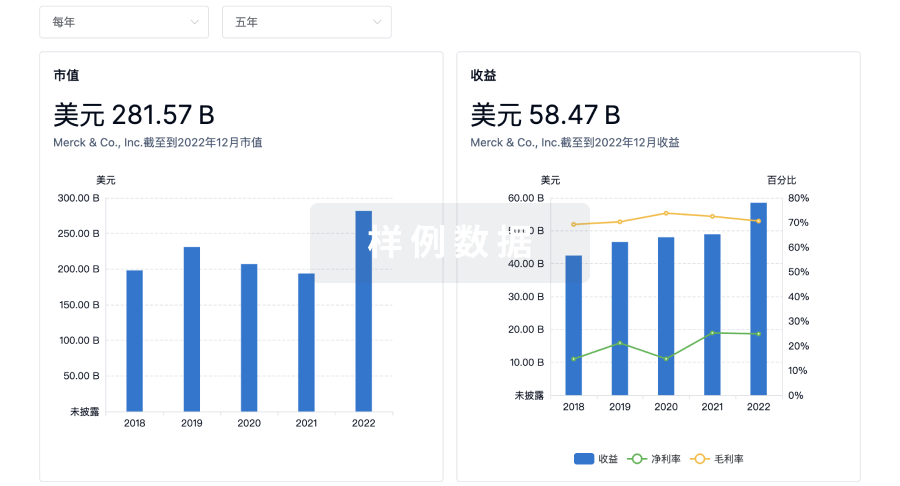

营收

使用 Synapse 探索超过 36 万个组织的财务状况。

登录

或

科研基金(NIH)

访问超过 200 万项资助和基金信息,以提升您的研究之旅。

登录

或

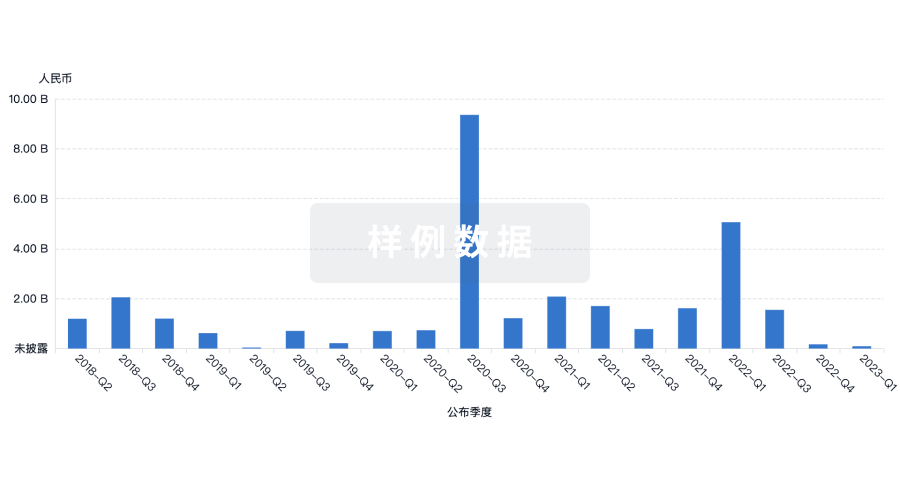

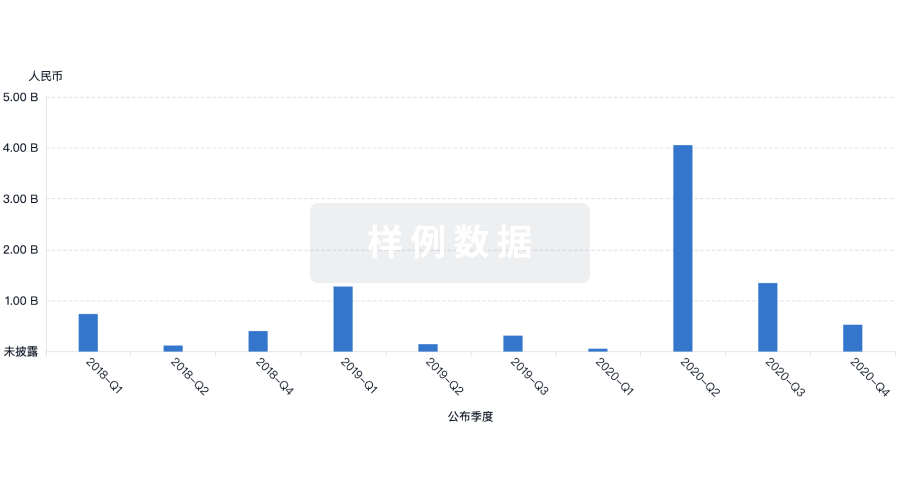

投资

深入了解从初创企业到成熟企业的最新公司投资动态。

登录

或

融资

发掘融资趋势以验证和推进您的投资机会。

登录

或

来和芽仔聊天吧

立即开始免费试用!

智慧芽新药情报库是智慧芽专为生命科学人士构建的基于AI的创新药情报平台,助您全方位提升您的研发与决策效率。

立即开始数据试用!

智慧芽新药库数据也通过智慧芽数据服务平台,以API或者数据包形式对外开放,助您更加充分利用智慧芽新药情报信息。

生物序列数据库

生物药研发创新

免费使用

化学结构数据库

小分子化药研发创新

免费使用