预约演示

更新于:2025-08-12

Johnston Pain Management

更新于:2025-08-12

概览

关联

100 项与 Johnston Pain Management 相关的临床结果

登录后查看更多信息

0 项与 Johnston Pain Management 相关的专利(医药)

登录后查看更多信息

72

项与 Johnston Pain Management 相关的新闻(医药)2025-06-11

周三和好朋友吃饭,他问我一个问题,就是中国的BD比例还能提升嘛?因为今年已经占到了40%,那假设未来MNC每年BD的金额是一致的,那么占比那么高,未来是否意味着已经到顶了呢?我挺欣赏我朋友这个问题,不愧是拿过香港的HF第一名的人。通常我们会有这种思路来思考成长股,如果一个公司的主要产品在某个领域所占比例已经非常高,那意味着份额提升的最佳时代已经过去,接下去的份额提升会非常困难,如果总量不能增长,那么意味着最好的时代已经过去了。但是问题好不代表问题中的数据是对的,今年的40%和去年的30%这个数字很多券商人引用。源头是dealForma的database,JPM和dealforma每个季度都会有一个deal tracker,里面会有相应的数字。我想这里有个误解,去年的30%和今年的40%都是以数量来记的,如果以金额计那可能5%都没有到。去年三月在Boston遇到了citadel的主观团队的一个小哥,小哥虽然是个美国人,但是很坚定的和我们说他觉得中国的医药很有意思。就像之前说的,医药是为数不多的还没有在全球化的道路上走出从0-1的行业,而这个从0-1的过程,对于没有深入学习过医药这个行业的投资人来说,是最容易的一个阶段。越来越多的BD,越来越大的金额,预示着未来中国的药物一定会在全球占有越来越大的份额。这也是本次中国的医药公司的上涨逻辑。所以围绕BD,也会产生一些问题,这些问题的答案决定了这次中国医药能走多远。主要核心问题有两个1)关于总量问题:包括BD的天花板在哪儿,美国政府是否会限制MNC对中国医药的BD?2)关于分配:什么适应症,什么资产容易BD出去,什么样的资产容易卖高价?1)关于总量问题,其实每年IQVIA都有一个报告是关于MNC BD的review,有很多内容和数据可以关注。2024年的MA 总金额是1280亿美金,BD首付款的总金额230亿美金。也就是说,BD的首付总额仅仅相当于MA总金额的1/5不到。如果把BD和MA作为一个整体,那么中国Deal的总金额占比不到5%,这5%里面相信还有80%的资产到不了上市。所以要说到达渗透率的顶部,那还有很长很长的路要走。虽然从数量的角度上,每年licensing out deal的数量占比非常高。但是其实从金额的角度看,每年最大的deal支出还是在中国几乎没有发生过的M&A上。目前MA仍然以美国为主,欧洲其次,ROW占比非常小。主要原因和地缘政治,数据质量,和临床能力等都有关系。如果希望M&A发生在A/H,那这些结构性的问题还有待解决。香港如果要做M&A,并不是董事会就能解决,而是需要有90%的流通股东,或者75%的非相关股东同意。比起美国的biotech,这样的监管要求就很难促成好的M&A。而大药厂也想出了,以deal来替代M&A的形式,比如有两家一级市场公司就是以Deal来代替了M&A。但是总体金额都没法和美国相比。从某种意义上说,一个M&A deal很可能相当于10个,甚至100个BD deal的总金额。而对药厂来说M&A是相对慎重的,而BD更多是一种在中途可以放弃的选择全。2)关于结构问题,什么样的资产容易做BD/容易做大额BD。其实BD(包括M&A),如果看的多的话是有规律的。从大药企的角度出发,比较容易思考。大药企做BD的目的有几个:1)弥补自己的战略空缺。2)减少自己的风险承担。第一条非常好理解,弥补自己的战略空缺。就是说,首先,这个资产必须在大药厂的战略目标上。每个大药厂的战略目标有所不同,如果翻看大药企的战略比如AZ集中在肿瘤和慢性病,Sanofi集中在自免,LLY集中在代谢,但也想重开肿瘤,NVO集中在代谢,abbv集中在自免和部分肿瘤,BMS心血管,肿瘤,CNS等等。如果不在战略目标上,很多企业是不会考虑的。其次,这个资产需要弥补空缺。什么空缺呢?可能也可能是某一个他们拳头产品的下一代,也可能是一个壁垒极高的新领域(比如眼科和CNS)。但是总体来说,在变化极快的市场中,壁垒高/市场大/下一代,必须是三选二的。第二条,自己的风险承担不要太大。大药厂为什么选择买,而不选择自己做?这就像投资人为什么不下场做,而要选择投资。因为小的biotech本来就是一个赛狗机制,大药厂只买跑赢剩下的,或者在不一样赛道跑的。这对他们来说是非常好的risk management。大药企有自己的销售网络和临床体系,对他们来说在管道中增加一个资产的边际成本很低,而小药厂因为无法自己做商业化,议价权相对较低,因此大药厂做deal一般能获得比他们自己试错要更好的价格。虽然deal可以错,但是他们需要避免一种错误,就是花了大价钱买了最后失败的产品。就像abbv买cerevel一样,同样的靶点,同样的机制KarTX成功了,他们的三期却失败了。怎么避免这样的情况产生呢?就是花小钱买希望,和花大钱买确定性。也就是说,不确定性很高但是市场特别大的资产,会在早期花小钱去买去布局,大钱都用来买确定性很高的资产。也就是说,对于不同的适应症和不同的asset来说,确定性直接决定了这个deal的大小。那么,确定性来自于什么呢?有以下几个方面:1)阶段:同一个适应症,phase3比phase1/2的确定性要高,上市的资产比临床阶段的确定性要高。2)人数:同一个适应症,同一个阶段,200人的临床比20人的临床确定性要高,800人的临床比200人的临床确定性要高。3)数据可重复性:不同适应症,不同数据质量不同。比如,肿瘤的数据可重复性比自免/CNS的数据可重复性要高,因为肿瘤有客观指标,可以看病人的影像学资料,肿瘤缩小了就是缩小了,做DD比较容易。而自免和CNS的大部分适应症没有客观指标,都是主观评分(不管来自于医生还是病人),DD很难做,很难确定一个好的effectsize是来源于药物还是其他(包括评价者和sponsor的影响)。为什么oncology的deal这么多,而且早期的中大deal(超过10亿美金首付)也比较多,除了适应症多之外,更重要的是数据可重复性高。一些MOA一期到三期的可转化性强。做大一期的公司比较容易做到大deal,比如当年的百利和现在的三生,还有未来的许多中国公司主要集中在这个领域。为什么自免/CNS/代谢的deal稀少(特别是CNS),且大多数大deal集中在phase3甚至上市以后?因为这些领域没有客观指标,容易买到坑,数据的信任度更低,MNC天然倾向于买更确定的资产人数更多,阶段更靠后,更明确的MOA。因此这些领域的中美数据互信也是相当重要的话题。共建Biomedical创新生态圈!如何加入BiG会员?

2025-06-10

The transaction will enable strong commercial synergies, thanks to Faes Farma's presence in complementary markets and recent acquisition of Laboratorios Edol

It enables funding further development of SIFI's portfolio, most notably Akantior in the USA

SIFI's existing infrastructure, including its Aci S. Antonio facilities, will further expand under the combined entity

CATANIA, Italy, June 10, 2025 /PRNewswire/ -- SIFI, a leading international ophthalmic company, today announced that its shareholders have signed an agreement, subject to conditions precedent, to sell 100% of SIFI shares to Faes Farma, a leading European pharmaceutical company listed on the Spanish stock exchange.

The transaction validates SIFI's unique business model centred around the consolidated pharmaceutical and surgical units, combined with the fast-growing contract manufacturing and rare diseases units.

SIFI will enable Faes Farma to offer one of the most comprehensive ophthalmology portfolios in the industry, with a complementary geographic presence. The integration of SIFI and Laboratorios Edol, a leading Portuguese pharmaceutical recently acquired by Faes Farma, positions ophthalmology as a pivotal area for the combined entity (the "Group"), representing approximately 20% of its pro-forma revenue, and allows for further portfolio synergies.

SIFI facilitates the Group's entry into new high-growth regions in Europe, such as Italy, France, Romania, and Turkey, while bolstering the Group's presence in others, such as Iberia, Mexico and Latin America. Furthermore, product integration should unlock cross-selling opportunities, improving growth and margins through operational and cost efficiencies.

The Group will invest into the further development of Akantior (polihexanide 0.08%) into existing and new geographies, most notably in the USA, as well as the development of polihexanide into additional orphan indications.

Akantior is approved by the European Medicines Agency (EMA) and United Kingdom's Medicines & Healthcare products Regulatory Agency (MHRA) for the treatment of Acanthamoeba Keratitis (AK) in adults and children aged 12 and older. Akantior is the first and only approved therapy for AK anywhere in the world, addressing an ultra-rare, severe, and progressive corneal infection affecting approximately 3,000 patients annually in Europe and the United States. Launched in Germany in October 2024, pricing and reimbursement procedures are underway in other European countries. It is also in the pre-registration phase with the FDA (U.S. Food and Drug Administration) with orphan drug designation.

Polihexanide will soon begin clinical development for Fungal Keratitis, after promising preclinical data and the granting of orphan drug designation in Europe and US.

SIFI will continue to operate its two state-of-the-art plants in Aci S. Antonio, focused on the production of ophthalmic medications and intraocular lenses, leveraging on recently secured long-term contract manufacturing agreements, with significant recurring revenue potential. Additionally, SIFI's facilities will optimize the Group's industrial capabilities, enhancing operational efficiency.

"Faes Farma shares similar values, culture and is highly complementary to our organization, which is set to become the pillar of the enlarged group's ambitious strategy in ophthalmology, a therapeutic area where the SIFI brand is synonymous with quality, innovation and long-term commitment. This transaction represents a key milestone for our company and will accelerate growth, unlock synergies, and enhance long-term value for all stakeholders, first and foremost by expanding global access to the medicines and devices we provide for ophthalmic patients.", stated

Fabrizio Chines, CEO of SIFI.

"We are impressed with the strength of SIFI's business model and the capabilities of its management team. This transaction strengthens our position in ophthalmology, a therapeutic area with significant growth potential, and accelerates our international expansion with direct access to new markets in Europe. We look forward to working with Fabrizio Chines and SIFI's management team to fulfill our commitment to an innovative and more global ophthalmic franchise, offering a broader range of solutions aligned with the needs of professionals and patients and our common ambitions.", stated

Eduardo Recoder de la Cuadra, CEO of Faes Farma.

The transaction values SIFI at an upfront Enterprise Value equal to a double-digit multiple of 2024 EBITDA, plus earn-outs linked to certain regulatory and commercial milestones related to Akantior. The transaction is expected to close in the third quarter of 2025, subject to customary approval by competition and foreign investment authorities and the extraordinary shareholders' meeting of Faes Farma, which is expected during July 2025.

Evercore Partners International LLP ("Evercore") and Mediobanca - Banca di Credito Finanziario S.p.A. ("Mediobanca") are acting as exclusive financial advisor to SIFI's shareholders (founding families and 21 Invest SGR S.p.A. on behalf of managed fund 21 Investimenti III ("21 Invest")). Hogan Lovells Studio Legale ("Hogan Lovells") is acting as legal advisor.

J.P. Morgan SE ("JPM") is acting as Faes Farma's exclusive financial advisor and debt financing provider in connection with the transaction. Cuatrecasas Legal SLP ("Cuatrecasas") and Chiomenti Studio Legale ("Chiomenti") serve as legal advisor and Ernst & Young Servicios Corporativos S.L. ("EY"), Gide Loyrette Nouel ("Gide"), Wolf Theiss Rechtsanwälte GmbH & Co KG ("Wolf Theiss") and A.T. Kearney as due diligence providers for Faes Farma.

About SIFI

SIFI is a leading international ophthalmic company headquartered in Italy, featuring an integrated business model from research and development to manufacturing and commercialization in both pharmaceutical and biomedical sectors. Founded in 1935, SIFI's mission is to improve people's lives through meaningful innovation in eye care. The company exports to more than 60 countries worldwide with a direct presence in major European markets, Mexico, and through joint ventures in China and the United Arab Emirates.

For more information, visit

About Faes Farma

Faes Farma is a company with more than 90 years of experience and a presence in more than 130 countries through marketed or licensed products. Faes combine passion, science, and innovation to transform people's health. Faes research, produce, and market prescription drugs, healthcare products, and animal nutrition products, and we aspire to become a leading pharmaceutical group in excellence and innovation. At Faes Farma, people are guided by our values: offering top-quality solutions for health and well-being, with the patient as our priority; developing innovative products that adapt to society's needs; and ensuring integrity, transparency, and commitment through responsible management and excellence.

For more information, visit

WANT YOUR COMPANY'S NEWS FEATURED ON PRNEWSWIRE.COM?

440k+

Newsrooms &

Influencers

9k+

Digital Media

Outlets

270k+

Journalists

Opted In

GET STARTED

并购上市批准孤儿药

2025-04-22

The XBI has plunged 27% since Donald Trump won the election, leaving the public markets an ugly mess for a biotech industry yearning for better times. Talk to CEOs these days and the mood for many is bleak — with worries about what the impact of tariffs and trade wars will have on the economy, adding some bitter seasoning to a stew of anxiety over a

reorganization of the FDA

and the

abrupt mass exit

of staffers under a controversial HHS chief whose skeptical views on vaccines skew to quackery.

Trump’s recent attacks on Fed chief Jerome Powell have only further destabilized a market unsettled by daily social media posts from the White House.

But it may amaze you to find out that it’s not all bad news for the first few months of the year. If you narrow the focus, a close look at the charts Chris Dokomajilar at DealForma posted for Q1 shows that several of the most-watched biotech numbers nevertheless continued to hang steady. That’s the silver lining to some troubling trends — though these numbers don’t include the turbulence we’ve witnessed in April.

The bottom line: IPOs remain in the doldrums, with PIPEs and follow-ons continuing to struggle after a much more bullish Q1 in 2024 inspired short-lived hopes. But dealmaking activity remains consistent, Phase 2 assets are drawing some sizable payouts, and a fluctuating M&A scene held up in a period of reduced expectations — compared to the fondly remembered Covid boom.

One big new trend you cannot ignore: Despite all the combative remarks between Chinese and US officials, Big Pharma is increasingly turning to Chinese biotechs for clinical-stage drugs.

The big question now is how things will hold up in Q2, at a time uncertainty is killing hopes for a near-term recovery of biotech.

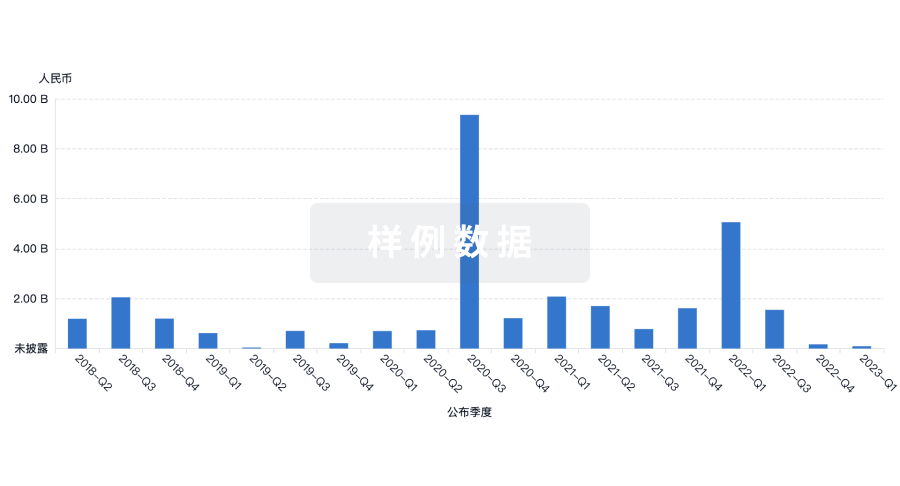

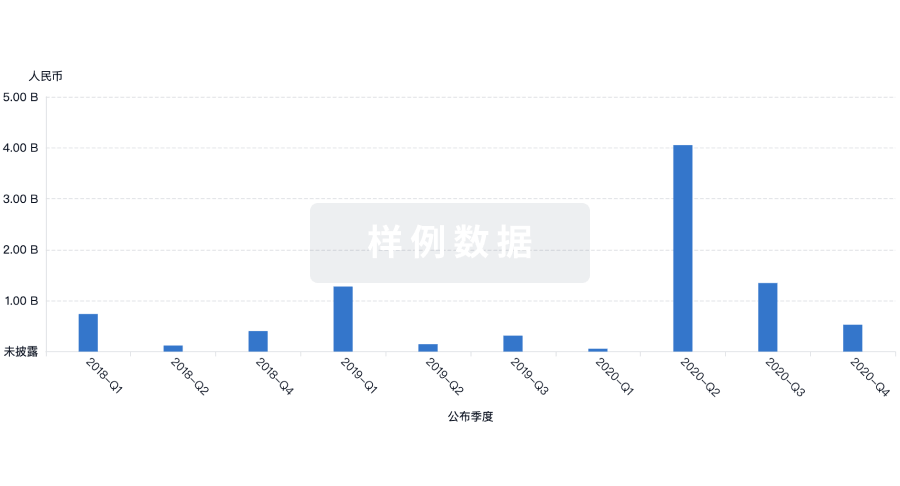

Dealmaking activity slid somewhat compared to the big spike we saw in the last three months of 2024, but the number of deals was up significantly over Q1 2024 and registered as the second-highest quarterly performance compared to the past four years.

AI SaaS and other service deals surged last year and remained strong in Q1, which is the primary reason why dealmaking has continued on a strong pace at the start of 2025. And it bodes well for continued work in AI, as industry players hustle to avoid being left behind of that big trend.

Just looking at the number of deals, M&A and licensing/R&D partnerships also held steady in the first quarter, with some fluctuations.

VC activity was steady for Q1 2025, compared to the same quarter a year ago, with the venture class focusing much of their money and attention on Phase 1.

The venture numbers fall very much in line with what we tracked through last year, with $6.7 billion in total for Q1 compared to $27.6 billion in all of last year. The Q1 total also matched the performance of Q1 2024, though it all pales in comparison to the quarterly numbers driving a much more enthusiastic 2021.

Breaking out the pie chart on where the full $34.3 billion through last year went, and you’ll see the biggest piece going to small molecules (25%) with non-ADC antibodies at 15% and AI/ML coming in at a close third with 12%.

IPOs remain in the doldrums, which will be a surprise to no one with the slightest interest in biotech.

The whole IPO field went cold after a torrid 2020 and the first half of 2021, and has been stuttering along ever since, periodically jumping enough to kindle hopes for a return of generalist investors, only to see the numbers dwindle again as deals go under water.

It doesn’t help that a slew of biotechs are now

trading for less than cash

. And the experience of the new IPOs leaves a lot to be desired.

Aardvark Therapeutics

went public at $16 a share in February and has since lost close to half of that value. With examples like that scattered around like wrecked cars on the speedway, it’s no surprise to see biotechs hanging on to their S-1s.

As the public markets skittered in and out of bear territory, with tariffs inspiring fears of slow growth and higher prices and a mood of general uncertainty that has generalists looking for a financially secure port in the storm, Q2 is not looking like the time for a rebound.

Back at the start of 2024, one of the bright spots for biotech could be seen in the surge of new PIPEs and follow-ons that raised serious money for public companies.

But the encouraging trend barely survived the first half of last year.

In the first three months of 2025, the number of PIPEs dropped significantly, though the total raised edged up somewhat compared to Q4 2024. A meager 23 follow-ons raised only $2.9 billion in Q1 of this year, less than a third of what was gathered in the same quarter a year ago.

M&A, which tends to fluctuate quarter to quarter, outperformed some meager numbers posted a year ago.

Back in January, J&J got the M&A ball rolling with its

$14.6 billion deal

to acquire Intra-Cellular Therapies. That one deal accounted for a big chunk of the $33.7 billion in M&A DealForma tracked in Q1.

That is much better than the $19.3 billion charted for the same period a year ago, as 2024 got off to a slow start on a field that has proven quite a disappointment in biopharma.

Back at JPM, I made the bold prediction that we’d see a couple more deals over $10 billion by the end of the year. Right now, that’s looking like a long shot, at best. But it’s early yet.

Biopharma licensing pacts also slid down from a surge at the end of 2024, though the numbers looked better than a year ago for the same period.

The $4.4 billion shelled out in upfront cash for therapeutics and platforms in Q1 this year registered a sharp drop from the $7.1 billion on the table in Q4 of last year, but it was still significantly higher than a weak $1.7 billion start to 2024.

Add in the biobucks and the Q1 tally comes in at $56.1 billion, compared to $35.6 billion for the same period a year ago.

Look out over a few years and you’ll see that Q4 often ends on a high note, so perhaps a solid start indicates better performance for the months ahead. This year, though, will likely be notoriously difficult to predict.

After claiming only a small, marginal number of deals with $50 million-plus upfront in 2022, the number of these deals originating from China — Chinese biotechs licensing to global partners — has rapidly swelled to 42% of the global share for these large pacts in Q1 2025, according to DealForma.

The sudden emergence of Chinese biotechs as a source of major new drug programs has clearly shaken the biotech industry, presenting a rival to US biotechs which had grown accustomed to dominating this arena.

Now China’s reputation for speed in clinical trials, along with an increasingly innovative approach to drug development, has the potential to blindside companies that had thought they had a clear shot at holding on to best-in-class, first-in-class boasting rights. And it’s all happening as trade tensions between the US and China reach extremes few could have predicted.

The surge in China deals comes as large-cap companies have proven willing to pay out more for the drugs roped in from the smaller biotechs, with Phase 2 assets performing particularly well.

YTD the median of upfront cash and equity from Big Pharmas for Phase 2 drugs has hit $200 million, compared to $150 million for all of 2024. Phase 1 has dipped — from $168 million to $90 million — though Q1 2025 has no Phase 3 deals to compare with last year’s track record.

Right now, the bright and shining allure of discovery-stage drugs can’t compare to hard human data on drugs poised to go into pivotal trials.

ADC deals have been doing a fast fade, perhaps underscoring that the best partnerships have been identified and struck, Dokomajilar notes.

Back in 2023, ADCs were all the rage. But while 2025 got off to a promising start — compared to all of 2024 — it’s unlikely to come close to that earlier, torrid pace.

临床2期引进/卖出

100 项与 Johnston Pain Management 相关的药物交易

登录后查看更多信息

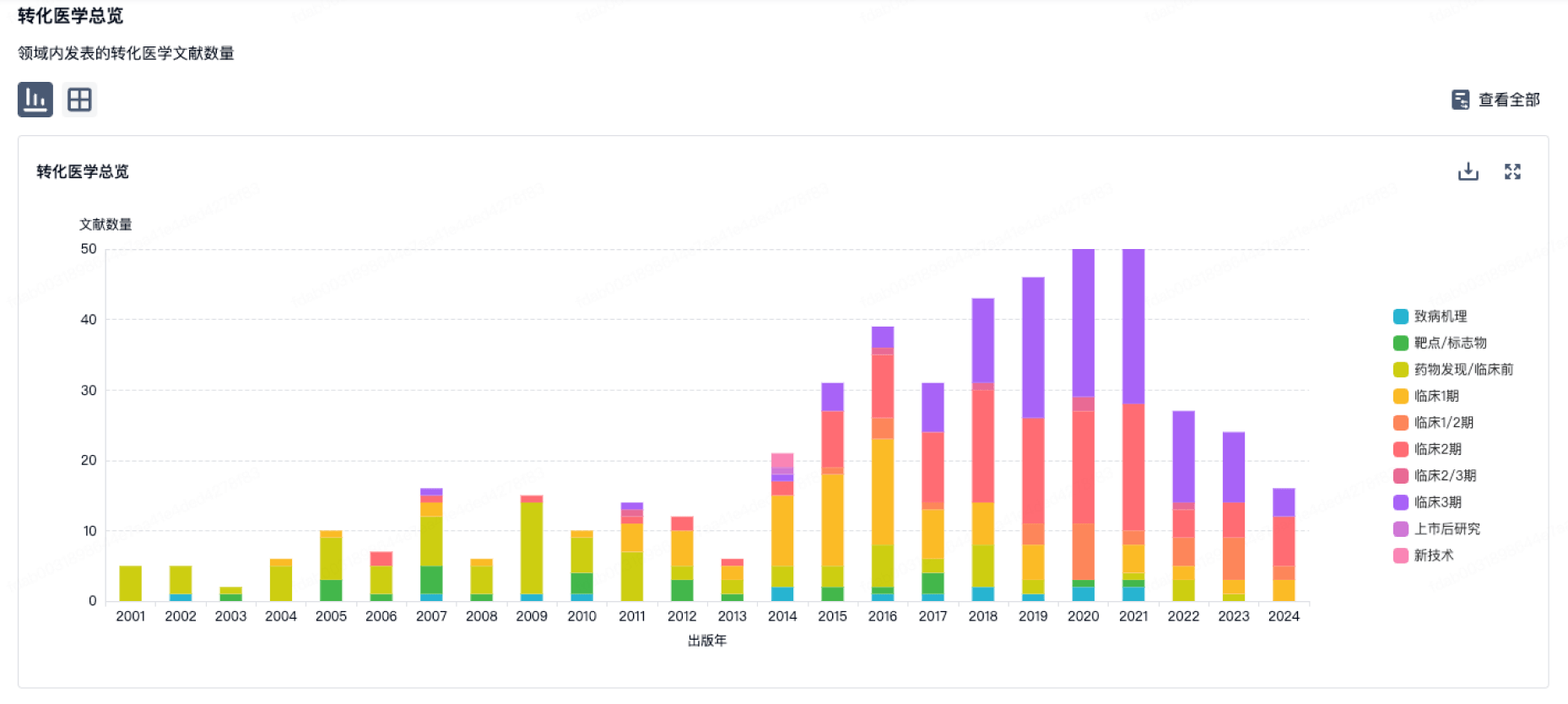

100 项与 Johnston Pain Management 相关的转化医学

登录后查看更多信息

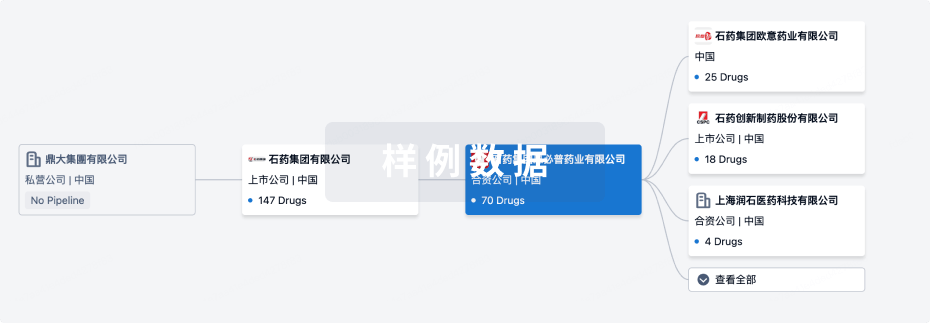

组织架构

使用我们的机构树数据加速您的研究。

登录

或

管线布局

2025年09月21日管线快照

无数据报导

登录后保持更新

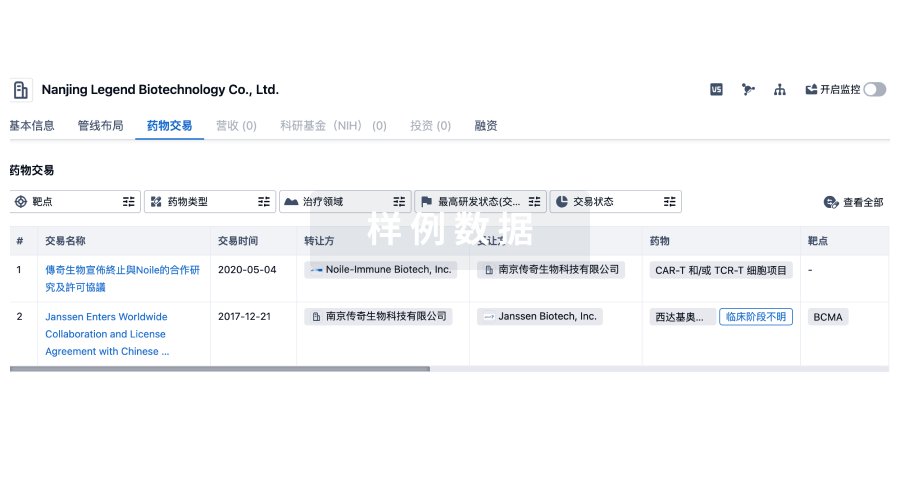

药物交易

使用我们的药物交易数据加速您的研究。

登录

或

转化医学

使用我们的转化医学数据加速您的研究。

登录

或

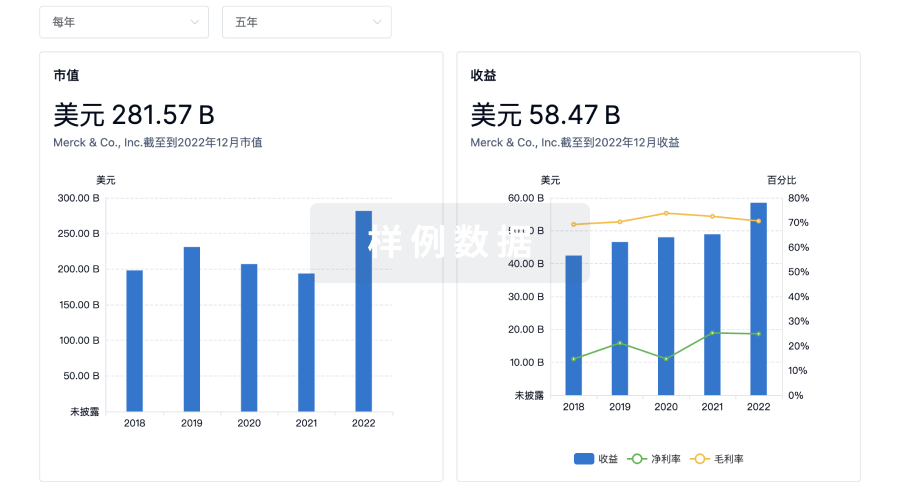

营收

使用 Synapse 探索超过 36 万个组织的财务状况。

登录

或

科研基金(NIH)

访问超过 200 万项资助和基金信息,以提升您的研究之旅。

登录

或

投资

深入了解从初创企业到成熟企业的最新公司投资动态。

登录

或

融资

发掘融资趋势以验证和推进您的投资机会。

登录

或

Eureka LS:

全新生物医药AI Agent 覆盖科研全链路,让突破性发现快人一步

立即开始免费试用!

智慧芽新药情报库是智慧芽专为生命科学人士构建的基于AI的创新药情报平台,助您全方位提升您的研发与决策效率。

立即开始数据试用!

智慧芽新药库数据也通过智慧芽数据服务平台,以API或者数据包形式对外开放,助您更加充分利用智慧芽新药情报信息。

生物序列数据库

生物药研发创新

免费使用

化学结构数据库

小分子化药研发创新

免费使用