预约演示

更新于:2025-08-15

Ascendis

更新于:2025-08-15

概览

关联

100 项与 Ascendis 相关的临床结果

登录后查看更多信息

0 项与 Ascendis 相关的专利(医药)

登录后查看更多信息

270

项与 Ascendis 相关的新闻(医药)2025-08-11

·同写意

创新药IPO的热潮,正再度涌来。

在港交所,光是今年上半年就有10家生物医药企业上市,几乎追平2024年全年的数量。而这些上岸者身后,近40家公司排队等待进入港股生物科技板块。

A股变化同样肉眼可见。3月,中国证监会公开支持符合条件的药企在沪深交易所发行上市。三个月后,科创板第五套上市标准重启,紧接着禾元生物IPO申请率先过会,进一步刺激了生物医药行业的投资信心。

这当然是个好消息,不过对于维梧资本管理合伙人付山,他心里始终有一层忧虑。

“技术、监管、商业化,平衡好这三方面风险是投资人该做的。”付山解释道,“尤其在识别技术的好坏上,需要专业化的人才团队。所以我一直呼吁,不做生物医药这一行的不要进来赶热闹,去抢IPO的红利,因为它不是长久、可持续的事情。”

那什么是“长久、可持续”的?

8月11日,即将迎来自己“而立之年”的维梧资本,在北京举办了场活动。会上,除去“创新药开发新模式”这一主题分享,另一项重要议程,就是维梧加速器的启动。

值得注意的是,两个加速器项目在现场进行签约仪式。维梧资本董事总经理刘卫东博士透露,这个开放的国际化平台旨在将创新资产与中国的本土优势结合起来,避开外部资本周期波动,加速全球药企的研发。按照计划,今年还会将有其他合作落地,其中不乏已处于评审论证阶段的项目。

同写意受邀参加了活动,并对付山、刘卫东进行采访,以深入了解这家即将迈向而立之年的投资机构想要重塑新药研发模式的野望。

付 山

维梧资本管理合伙人

刘卫东

维梧资本董事总经理

TONACEA

01

维梧走向“3.0版本”

与公众印象里的低调不同,维梧资本在生物医药产业可谓参与感十足。

1996年,作为维梧资本前身的BioAsia成立,借助投资把海外先进的生物医药技术带到亚洲。随着新世纪到来,创始团队判断中国大陆市场将是创新主场,由此逐渐转移重心,2006年完成在内地的第一笔投资。

这种战略调整,也吸引了付山的加盟。2013年,付山告别黑石集团合伙人的身份,出任维梧资本的管理合伙人并担任全球联席CEO和亚太区CEO。

外界评价,付山极大加快维梧资本在中国市场的本土化步伐,这从他主导的投资和孵化项目可见一斑——无论是CXO领域的明星药明康德,还是首批港股“18A”公司中的信达生物、再鼎生物、荣昌生物、诺诚健华,亦或是今年创下多项纪录的“生长发育第一股”维昇药业,背后都有维梧资本的参与。

毕业于北京大学历史系的付山,似乎很擅长把握时机。

2015年,国务院印发《关于改革药品医疗器械审评审批制度的意见》,本土创新药由此展现蓬勃之势。次年,维梧资本对单一基金架构进行分拆,形成多个策略基金平台,可以更全面地覆盖产业创新周期。

付山觉得,只要假以时日,中国的人才、供应链环节都并不会比海外差。对此,刘卫东也表示认同。

加入维梧资本前,刘卫东曾在合全药业、Array BioPharma等国内外创新公司从事研发生产,领导了多个从临床前到临床III期的项目研发和工艺落地。

“本土药企的硬通货,就是手里边的资产越来越好。而这又得益于整个国家系统性的改观,比如关键原材料和精密设备等方面,我们都已经很大程度实现了国产化替代。世界上很难再出现从人才、技术、供应链到临床有如此大规模的体系优势。”刘卫东补充说。

但是,这并不意味着所有药企都能抓住红利。以维梧资本投资的再鼎医药为典型,基于license-in打造的“VIC模式”早年备受追捧,却很快在环境变动中式微,一度传出联拓生物等Biotech被关停的消息。

按照付山的划分,再鼎医药指向的是维梧资本方法论的“1.0版本”,到了今年登陆港股的维昇药业,这套哲学已经升级为“2.0版本”。

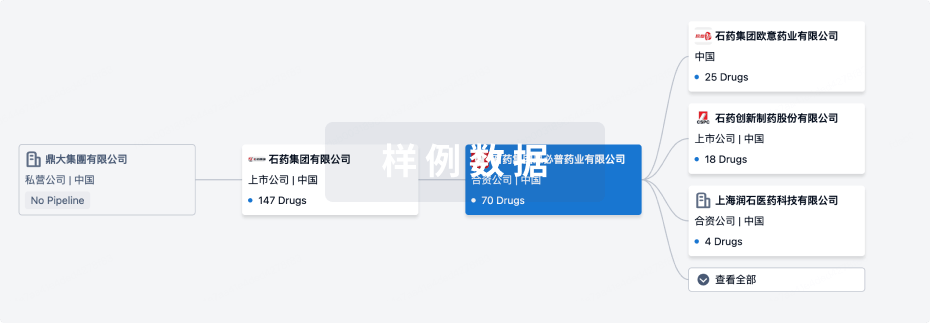

区别于通常的license-in交易,2018年,维梧资本联合被投公司Ascendis Pharma共同设立维昇药业时,维昇药业以股权换取Ascendis旗下三款内分泌新药的大中华区授权,并且维梧资本从投前到投后提供了实打实的运营赋能,以及供应链和BD资源赋能。

这样形成的利益共同体,使维昇药业可以快速启动项目开发,同时减少对外部资本市场的依赖,保持自身步调节奏。

“做创新药不仅仅涉及科学风险,还有监管风险、商业风险。如果药企光靠科学家来推动,发展很难提速,研发效率也低。”付山总结道,“另外,我们也能看到,这两年IPO窗口一关闭,过去由资本驱动、药企朝着上市目标一轮轮融资的模式很快受到挑战。投资人退出不了,企业的价值没办法实现。这些都是我们一直在思考、想要去改变的。”

换言之,如何将国家、产业纬度的系统性优势,更好地导向具体的创新药项目,进而形成规模化,便代表维梧资本“3.0版本”的维梧加速器所落脚之处。

当维昇药业的实践让付山看到药企、投资与市场之间关系变得亲和的可能性,那么,也就不难理解,通过一个平台把提炼后的经验推而广之,在眼下就是水到渠成的事情。

TONACEA

02

加速度,何以可能?

倘若梳理第三方服务平台的历史,会发现“孵化器”这类概念并不是新词。

1959年,在美国纽约,约瑟夫·曼库索创办了首家企业孵化器——贝特维亚工业中心。由此,一种为初创、小微等类型公司提供一系列支持的新型经济组织日渐繁荣。

中国孵化器行业始于1987年。从武汉东湖新技术创业者中心挂牌成立到2021年,中国包括生物医药在内的孵化器数量已达6227家,居世界第一。而模式上,根据艾瑞咨询的研究,中国孵化器经过空间赋能、政策赋能、资本赋能阶段的迭代,2016年之后进入产业赋能时代。

除了政府园区的参与,中国的创新市场也吸引着MNC的入局。3月,礼来旗下首个创新加速平台——礼来北京创新孵化器就在北京正式投入运营。

因此,维梧资本不得不回答市场的疑问:维梧加速器的差异化在哪?

“我觉得我们发挥作用和富集资源的方法是不同的。”付山回应。政府主导的服务平台,考虑到“追求公平、兼顾效率”的定位,通常在技术选择上不会太过聚焦,尤其是对风险较高的项目比较慎重。

至于跨国药企设立的孵化器,付山认为,它们的体系不及维梧加速器这般开放,“从资金、技术再到商业化都在MNC自己的能力圈里布局”,未必是最有效的。

刘卫东强调说:“首先我们叫‘加速器’,而不是‘孵化器’,这里面有本质区别。我们合作的项目不限于从最早期的从生物学靶点到PCC,这只是维梧加速器的第一个阶段。我们的逻辑在于,当前生物医药环境有很多挑战,我们希望利用开放、国际化的平台去加速问题的解决。”

创立企业孵化器的曼库索,据说是从一家养鸡企业活蹦乱跳的小鸡身上得到命名灵感。在同写意的采访中,也出现了“养鸡场”的比方。

“有的平台是盖了个‘养鸡场’,然后把‘笼子’租出去,有的则是在此基础上还扮演‘老母鸡’的角色,自己‘下蛋’。”刘卫东形容,“维梧加速器更像一个现代化的综合的‘养鸡场’,把不同种类的‘母鸡’引进来,持续产出FIC和BIC产品。”

然而,想要平衡好各方利益并非易事。

近些年来,国内生物医药泡沫泛起、破裂,一大批Biotech成为明日黄花,风光不再,给公众留下五花八门的喧嚣叙事——风险投资逐渐演变成击鼓传花的游戏,二级市场退出通道越是拥挤不堪,项目就越被催促着冲刺IPO,或者创始团队对赌失败,只好回购股份。当然,缺乏腾挪空间的药企,往往以卖身、关停退出产业江湖。

付山批评道,无论是孵化器还是NewCo形式,当前部分投资机构做的仅仅在于“融资”,而非“融智”。

国内投资生物医药的基金很多,但形成自己的大规模创新生态的机构寥寥无几。而海外公司虽然具备体量和路径优势,要说理解中国市场,到底还是隔了一层。维梧资本的卡位,就在于二者之间。

“我们的长处是,能从科学的角度对合作创业者做的事情评估,同时提出建议,因为我们的技术网络囊括了一大批活跃于研发一线的专家。”付山进一步解释。

如何弥补缺陷也很重要。刘卫东介绍,维梧资本提供的人才贯穿创新的不同阶段。他举例说:“项目在探索生物学机制阶段,生物学家发挥主导作用;到了做药环节,可能领头的就是化学家;再往后进入临床,那么PI意见的优先级就更高。”Biotech的公司框架里,如此“人才最优、利益最优、效率最优”的组合很难平衡,而在维梧加速器,则可以通过合理规划、资源整合,将这些掣肘问题有效解决。

质言之,从技术、临床动员再到资金、商业市场,这些要素所集合的开放、国际化系统,就是维梧加速器的底气。

TONACEA

03

冲突时代的危与机

不出海,便出局——这是近年来国内Biotech所身处的困境。随着行业迅速形成共识,与其说国际化是新潮的选择,在当下它更像一个常规的基础项。

恰因如此,地缘政治的矛盾冲突所带来的压力,显得十分致命。对于致力成为国际化平台的维梧加速器,也需直视现实。

2024年,美国众议院两党支持通过《生物安全法案》,以禁止获得美国政府资金或合同的企业与一份中国组织和公司名单上的实体开展合作。海外业务占据一定比重的药明康德等CXO,几度因该法案的进展而股价大跌。

尽管《生物安全法案》最终遭搁置,“脱钩”的威胁并未消失。

4月,促成《生物安全法案》的美国新兴生物技术国家安全委员会,又向国会提交报告和行动计划,希望切断美国国家安全机构、美国卫生与公众服务部合作的公司与中国企业的业务往来。同期,美国开始对所有贸易国家产品漫天加征关税,特朗普政府扬言,类似手段将很快在制药领域落地。

付山对此却表现得举重若轻。“生物医药行业从诞生之日起就带有国际化属性,从研发、生产到销售都是如此。”他如是回应。

背后的核心逻辑,围绕创新药赛道固有的高投入、高风险展开。这种特性决定着,大到国家、小到公司都对两件事念念不忘:第一,怎样降低研发成本,提高成功率?第二,如何开拓更多商业化市场,覆盖高额投入,获取利润。

“不管怎么说,这些问题都是经济规律决定的,对吧?”付山提醒,美国《通胀削减法案》的目的就是控费,而落到产业层面,美国药企不会画地为牢。

刘卫东认为,药物研发方面的know-how、IP往往是合作关键。对于Biotech,很大的担忧便在于自己的资产得不到保护。

维梧加速器的商业模式中,IP掌握在合作方手上。维梧资本平台主要提供资金等外围支持,利用国内在临床前开发和临床转化上的资源和成本优势,高效地获取PCC、POC分子,实现项目的价值跃升。

“在今天,无论BIC还是FIC,创新药成功离不开跨地域、跨专业的合作,维梧加速器将持续以开放、国际化的姿态向前发展。”刘卫东说。这个平台的项目来源非常广泛,从Biotech、FA、科研高校,也包括最大创新来源的美国市场上的头部基金。

不过,维梧加速器也有自己的聚焦重点。

刘卫东介绍,维梧资本最近和一家美国知名基金多次接洽,后者主要孵化来自全球高校和研究所的源头创新,每年从数千个项目申请中筛选出20到30个项目。而维梧加速器会从这些项目中优中选优,并充分利用维梧生态圈资源,在国内对它们进行加速研发。

“我们当然会优先考虑美国、中国、欧洲市场上的项目,毕竟这些地方的创新能力较强,”付山总结说,“但另一边,我们希望能把自己生态里的合作伙伴优势发挥出来,大家是强强联合。第三,还要充分考虑市场容量,例如我们大概不会去选择罕见病这种小适应症的资产。”

维梧资本的“子弹”管够。3月,其管理的维梧机会基金三期募资超7.4亿美元,主要投向处于临床前及临床阶段的中小市值Biotech。累计起来,维梧资本在管美元和人民币总规模近600亿元。

根据时间表,除了此次维梧加速器启动仪式上宣布的两家公司,还有一个论证中的项目预计也在今年落地。而未来,维梧资本将根据产业前沿势态,继续推动与更多创新项目的合作,加速具有临床价值的产品走向市场。

IPO

2025-08-05

BioMarin is projecting sales of Voxzogo to fall between $900 million and $935 million this year. It also has a potential replacement for the achondroplasia treatment in its pipeline which could hit the market by 2030, the company says.

Competition is coming for BioMarin’s potential blockbuster Voxzogo, but the California biotech may be able to answer with a longer-acting version of the C-type natriuretic peptide (CNP), which treats a form of dwarfism in children called achondroplasia.BioMarin revealed topline results for the early-stage candidate, BMN 333, that suggest it is a “potentially superior version of Voxzogo,” according to a research note from Evercore ISI analyst Cory Kasimov.In a phase 1 study of healthy adult volunteers, BMN 333 demonstrated area-under-the-curve (AUC) levels greater than three times those observed in other long-acting CNP studies, with no safety signals found, BioMarin said in an August 4 press release. AUC is a pharmacokinetic measure indicating the total exposure to a drug over time, the company added.With the result, BioMarin said that it plans to begin the dose-finding arm of its phase 2/3 registration-enabling program in the first half of next year, with the potential for a 2030 launch if the results are positive.Since close of the market on Friday, BioMarin's share price has increased by 12%.While BioMarin said that its goal with BMN 333 is to demonstrate its superiority to Voxzogo, which was approved in 2021, R&D chief Greg Friberg was quick to point out during the company’s second-quarter conference call on Monday that the result was “three times greater than the AUC levels reported for another long-acting CNP.”Friberg’s reference was to Ascendis’ TransCon CNP, which has demonstrated comparable results to Voxzogo in a phase 3 trial of achondroplasia patients and is scheduled for an FDA approval decision by November 30.One potential advantage of the Ascendis treatment, which is also known as navepegritide, is that it is injected weekly as opposed to daily for Voxzogo.As for BMN 333, the drug's profile so far demonstrates "a potential best-in-class molecule with the opportunity to drive even greater improvements in growth parameters versus available therapies, and by extension, to further improve measures of health and wellness in children with achondroplasia,” Friberg added on Monday. Another achondroplasia candidate to consider is Kyowa Kirin and BridgeBio’s daily oral FGFR3 inhibitor infigratinib. BridgeBio is conducting a phase 3 study in achondroplasia patients and is testing the treatment in hypochondroplasia, which is a form of short-limbed dwarfism.As for Voxzogo, which is the lone medicine on the market for achondroplasia, second-quarter sales came in at $221 million, a 20% increase year over year, bringing its first-half tally to $404 million. The company is projecting 2025 Voxzogo sales at a range of $900 million to $935 million, which would account for nearly 30% of its revenue.

临床结果临床3期上市批准临床1期

2025-07-30

·求实药社

2025年7月28日,Ascendis Pharma宣布美国FDA批准其长效生长激素药物TransCon hGH(lonapegsomatropin-tcgd)的补充生物制品许可申请(sBLA),用于治疗成人生长激素缺乏症(GHD)。该药物此前已获FDA批准用于儿童GHD患者。TransCon hGH基于Ascendis专有的TransCon技术平台开发,是一种创新型人生长激素前药。其独特机制在于:· 精准释放:通过每周单次注射,在体内可控释放未经修饰的天然生长激素;· 生物等效性:释放的激素与内源性激素结构完全一致,生物活性和作用机制等同于日制剂;· 依从性提升:年注射次数从365次降至52次,治疗天数减少86%。此次成人适应症获批基于关键Ⅲ期foresiGHt试验:· 研究设计:纳入259例23-80岁GHD患者,按1:1:1随机分组,接受TransCon hGH(周制剂)、安慰剂或日制剂生长激素(如Genotropin®)对照治疗;· 疗效数据:第38周时,TransCon hGH组显著达成主要终点(躯干脂肪减少)、关键次要终点(瘦体重增加)及胰岛素样生长因子-1(IGF-1)水平正常化率;· 安全性:整体耐受性良好,无治疗相关停药事件。免责声明:文章内容仅供参考,不构成投资建议。投资者据此操作,风险自担, 关于对文中陈述、观点判断保持中立,不对所包含内容的准确性、可靠性或完整性提供任何明示或暗示的保证。请读者仅作参考,并请自行承担全部。联系我们ICNS 2025展位火热预定中!扫码立即咨询电话:13816031174(同微信)赞助形式包括但不仅限于演讲席位、会场展位、会刊彩页、晚宴赞助、会议用品宣传等。点击此处“阅读全文”咨询更多!

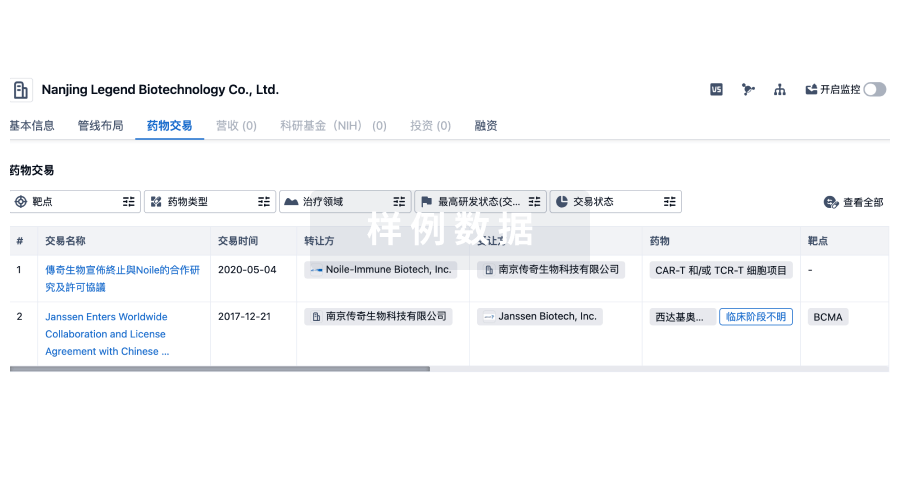

100 项与 Ascendis 相关的药物交易

登录后查看更多信息

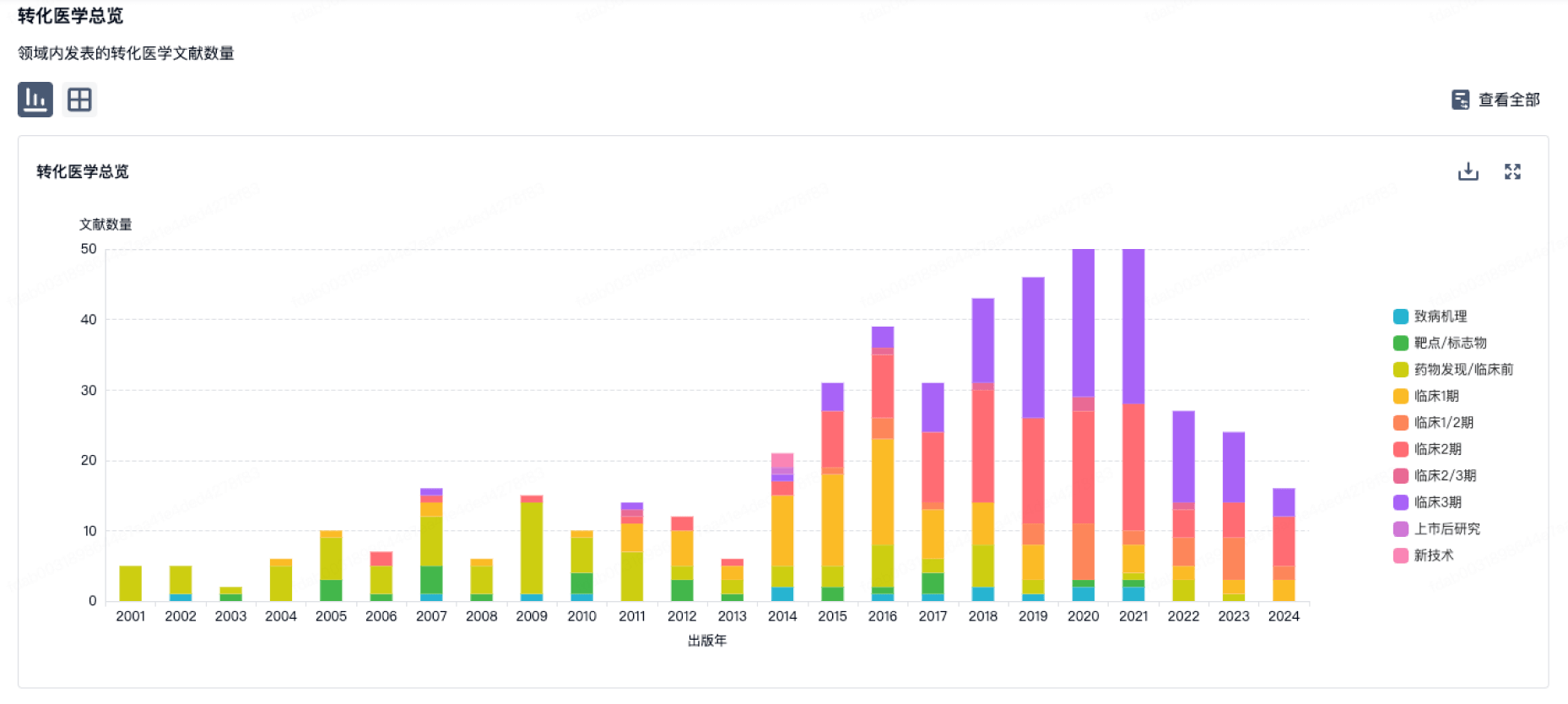

100 项与 Ascendis 相关的转化医学

登录后查看更多信息

组织架构

使用我们的机构树数据加速您的研究。

登录

或

管线布局

2025年08月23日管线快照

无数据报导

登录后保持更新

药物交易

使用我们的药物交易数据加速您的研究。

登录

或

转化医学

使用我们的转化医学数据加速您的研究。

登录

或

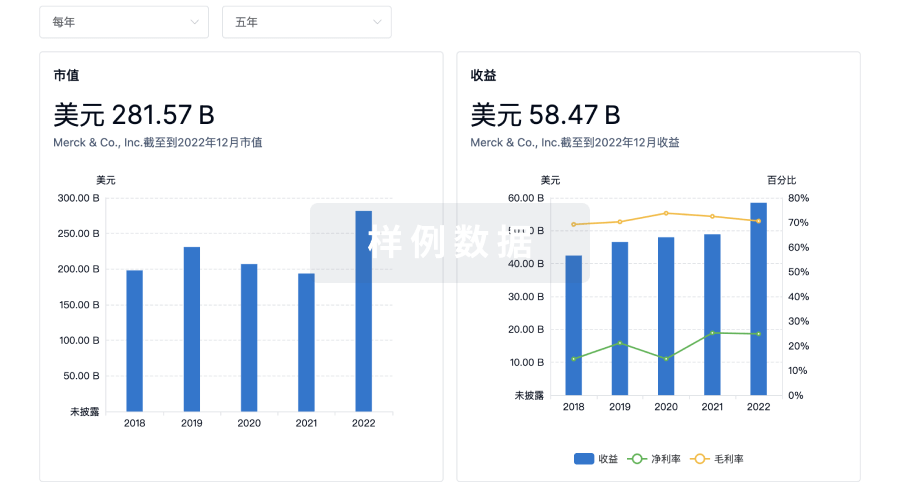

营收

使用 Synapse 探索超过 36 万个组织的财务状况。

登录

或

科研基金(NIH)

访问超过 200 万项资助和基金信息,以提升您的研究之旅。

登录

或

投资

深入了解从初创企业到成熟企业的最新公司投资动态。

登录

或

融资

发掘融资趋势以验证和推进您的投资机会。

登录

或

Eureka LS:

全新生物医药AI Agent 覆盖科研全链路,让突破性发现快人一步

立即开始免费试用!

智慧芽新药情报库是智慧芽专为生命科学人士构建的基于AI的创新药情报平台,助您全方位提升您的研发与决策效率。

立即开始数据试用!

智慧芽新药库数据也通过智慧芽数据服务平台,以API或者数据包形式对外开放,助您更加充分利用智慧芽新药情报信息。

生物序列数据库

生物药研发创新

免费使用

化学结构数据库

小分子化药研发创新

免费使用