预约演示

更新于:2025-05-07

RMC-5552

更新于:2025-05-07

概要

基本信息

药物类型 小分子化药 |

别名 |

作用方式 抑制剂 |

作用机制 EIF4EBP1 抑制剂(eukaryotic translation initiation factor 4E binding protein 1 inhibitors)、mTORC1抑制剂(哺乳动物雷帕霉素靶蛋白(mTORC1)复合体抑制剂) |

治疗领域 |

在研适应症 |

非在研适应症 |

非在研机构- |

权益机构- |

最高研发阶段临床1期 |

首次获批日期- |

最高研发阶段(中国)- |

特殊审评- |

登录后查看时间轴

结构/序列

分子式C93H136N10O24 |

InChIKeyIUTYTXDIGUNPAA-ONHMSXCVSA-N |

CAS号2382768-62-7 |

关联

2

项与 RMC-5552 相关的临床试验NCT05557292

A Phase I/Ib, Open-Label, Dose-Escalation Study of RMC-5552 Monotherapy in Adult Subjects With Recurrent Glioblastoma

This phase I/Ib trial tests the side effects, best dose, tolerability, and effectiveness of RMC-5552 in treating patients with glioblastoma that has come back (recurrent). RMC-5552 is a type of medicine called an mechanistic target of rapamycin (mTOR) inhibitor. These types of drugs prevent the formation of a specific group of proteins called mTOR. This protein controls cancer cell growth, and the study doctors believe stopping mTOR from forming may help to kill tumor cells.

开始日期2023-04-03 |

申办/合作机构 |

NCT04774952

A Phase 1/1b, Open-Label, Multicenter, Dose-Escalation Study of RMC 5552 Monotherapy in Adult Subjects With Relapsed/Refractory Solid Tumors

The purpose of this study is to evaluate the safety, tolerability, pharmacokinetic (PK), and pharmacodynamic (PD) profiles of escalating doses of RMC-5552 monotherapy in adult participants with relapsed/refractory solid tumors and to identify the recommended Phase 2 dose (RP2D).

开始日期2021-04-07 |

申办/合作机构 |

100 项与 RMC-5552 相关的临床结果

登录后查看更多信息

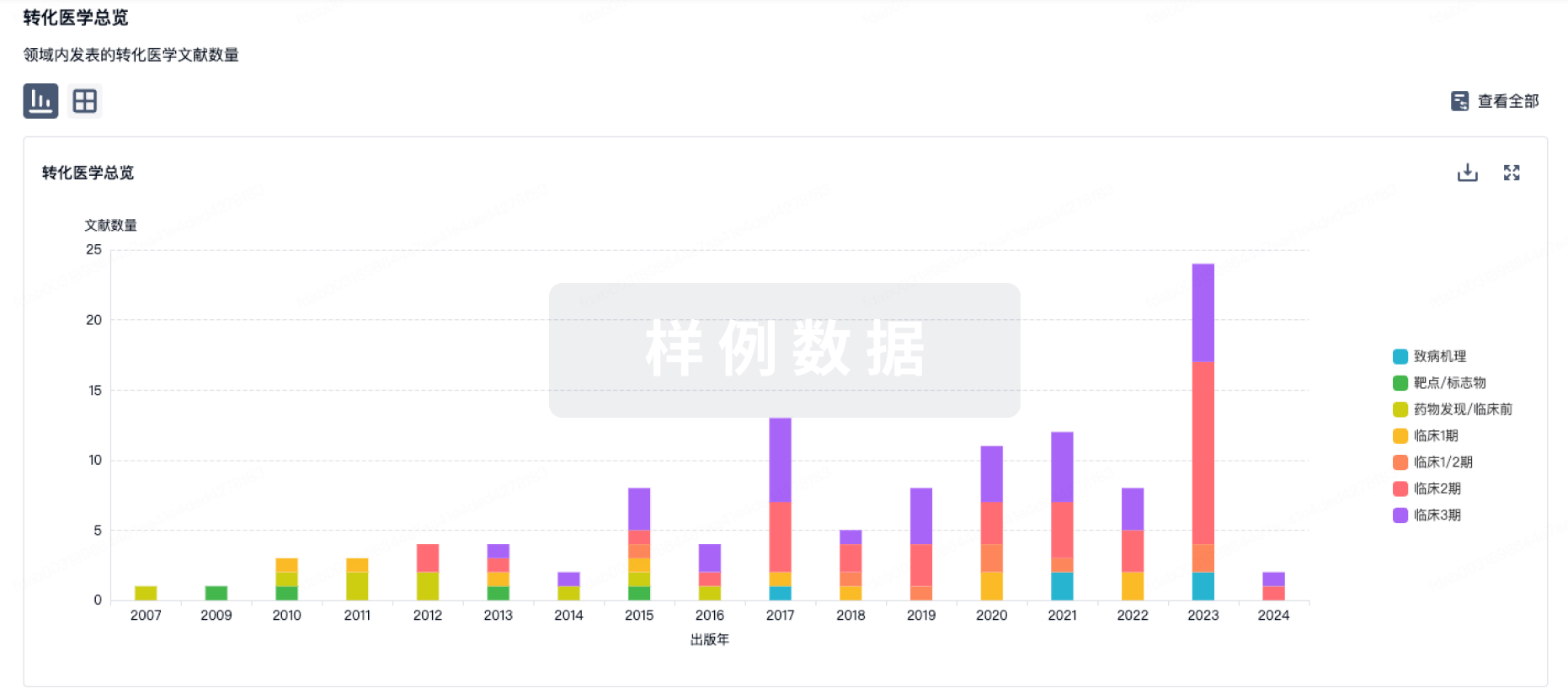

100 项与 RMC-5552 相关的转化医学

登录后查看更多信息

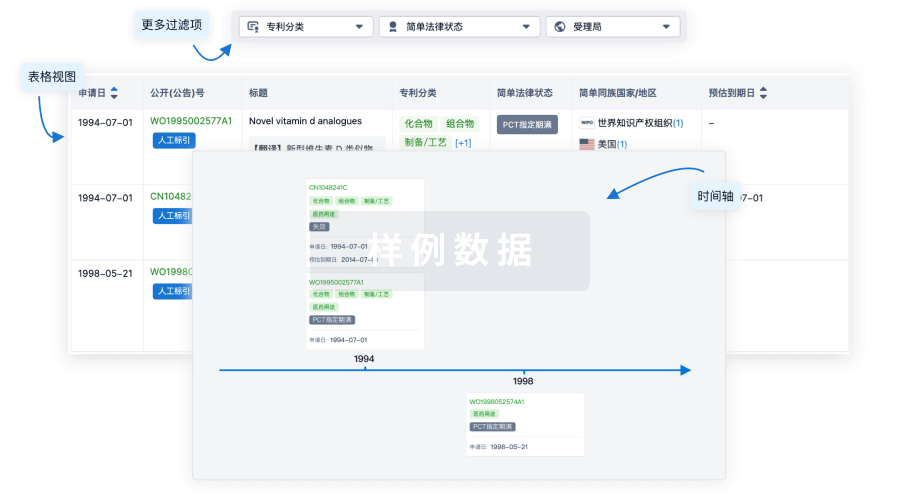

100 项与 RMC-5552 相关的专利(医药)

登录后查看更多信息

3

项与 RMC-5552 相关的文献(医药)2024-01-01·Neuro-Oncology Advances

Preclinical evaluation of the third-generation, bi-steric mechanistic target of rapamycin complex 1-selective inhibitor RMC-6272 in NF2-deficient models

Article

作者: Ramesh, Vijaya ; Plotkin, Scott R ; Bhattacharyya, Srirupa ; Beauchamp, Roberta L ; Kosa, Lili ; Robert, Francis ; Chang, Long-Sheng ; Oblinger, Janet L

2023-01-12·Journal of Medicinal Chemistry1区 · 医学

Discovery of RMC-5552, a Selective Bi-Steric Inhibitor of mTORC1, for the Treatment of mTORC1-Activated Tumors

1区 · 医学

Article

作者: Meyerowitz, Justin G. ; Tomlinson, Aidan C. A. ; Wang, Zhican ; Wang, Zhengping ; Pitzen, Jennifer ; Semko, Chris M. ; Tzitzilonis, Christos ; Aggen, James B. ; Smith, Jacqueline A. M. ; Thottumkara, Arun P. ; Yang, Yu C. ; Zhao, Yongyuan ; Wildes, David ; Lee, Bianca J. ; Gill, Adrian L. ; Choi, Jong S. ; Lee, Julie C. ; Kiss, Gert ; Knox, John E. ; Wang, Gang ; Evans, James W. ; Burnett, G. Leslie ; Won, Walter S. ; Mellem, Kevin T. ; Marquez, Abby ; Gliedt, Micah K. ; Singh, Mallika ; Cregg, James ; Jiang, Jingjing

American Journal of Respiratory Cell and Molecular Biology

The Bi-Steric Inhibitor RMC-5552 Reduces mTORC1 Signaling and Growth in Lymphangioleiomyomatosis

Article

作者: Cantu, Edward ; Evans, Jilly F. ; Basil, Maria C. ; Ledwell, Owen A. ; Kanth, Swaroop V. ; Tang, Yan ; Krymskaya, Vera P ; Rue, Ryan ; Lin, Susan M. ; Mukhitov, Alexander R ; Henske, Elizabeth P ; Diesler, Rémi

65

项与 RMC-5552 相关的新闻(医药)2024-12-05

Underwriters’ full exercise of option brings gross proceeds to $862.5 millionREDWOOD CITY, Calif., Dec. 05, 2024 (GLOBE NEWSWIRE) -- Revolution Medicines, Inc. (Nasdaq: RVMD), a clinical-stage oncology company developing targeted therapies for patients with RAS-addicted cancers, today announced the closing of its underwritten public offering of 16,576,088 shares of its common stock at a public offering price of $46.00 per share, before underwriting discounts and commissions, and, in lieu of shares of common stock, to certain investors, pre-funded warrants to purchase 2,173,917 shares of common stock at a public offering price of $45.9999, which represents the per share public offering price for the common stock less the $0.0001 per share exercise price for each pre-funded warrant. The shares of common stock issued and sold in the offering include 2,445,652 shares issued upon exercise in full by the underwriters of their option to purchase additional shares of common stock at the public offering price, less underwriting discounts and commissions. The gross proceeds from the offering, before deducting underwriting discounts and commissions and other offering expenses payable by Revolution Medicines, were $862.5 million. All shares and pre-funded warrants in the offering were offered by Revolution Medicines. J.P. Morgan, TD Cowen, Goldman Sachs & Co. LLC and Guggenheim Securities acted as joint book-running managers for the offering. UBS Investment Bank acted as lead manager. A shelf registration statement relating to these securities was filed with the U.S. Securities and Exchange Commission (SEC) on March 4, 2024, and automatically became effective upon filing. This offering was made solely by means of a prospectus. A copy of the final prospectus supplement and the accompanying prospectus relating to this offering may be obtained for free by visiting EDGAR on the SEC’s website at www.sec.gov. Alternatively, a copy of the final prospectus supplement and the accompanying prospectus relating to this offering may be obtained by contacting: J.P. Morgan Securities LLC, Attention: Broadridge Financial Solutions, 1155 Long Island Avenue, Edgewood, New York 11717, by email at prospectus-eq_fi@jpmchase.com and postsalemanualrequests@broadridge.com; TD Securities (USA) LLC, 1 Vanderbilt Avenue, New York, New York 10017, by telephone at (855) 495-9846 or by email at TD.ECM_Prospectus@tdsecurities.com; Goldman Sachs & Co. LLC, Attention: Prospectus Department, 200 West Street, New York, NY 10282, by telephone at (866) 471-2526 or by email at prospectus-ny@ny.email.gs.com; and Guggenheim Securities, LLC, Attention: Equity Syndicate Department, 330 Madison Avenue, 8th Floor, New York, New York 10017, by telephone at (212) 518-9544 or by email at GSEquityProspectusDelivery@guggenheimpartners.com. This press release shall not constitute an offer to sell or a solicitation of an offer to buy these securities, nor shall there be any sale of these securities in any state or other jurisdiction in which such offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of any such state or other jurisdiction. About Revolution Medicines, Inc. Revolution Medicines is a clinical-stage oncology company developing novel targeted therapies for RAS-addicted cancers. The company’s R&D pipeline comprises RAS(ON) inhibitors designed to suppress diverse oncogenic variants of RAS proteins. The company’s RAS(ON) inhibitors RMC-6236, a RAS(ON) multi-selective inhibitor, RMC-6291, a RAS(ON) G12C-selective inhibitor, and RMC-9805, a RAS(ON) G12D-selective inhibitor, are currently in clinical development. Additional development opportunities in the company’s pipeline focus on RAS(ON) mutant-selective inhibitors, including RMC-5127 (G12V), RMC-0708 (Q61H) and RMC-8839 (G13C), in addition to RAS companion inhibitors RMC-4630 and RMC-5552. Revolution Medicines Investors & Media Contacts: investors@revmed.com; media@revmed.com

临床研究

2024-12-04

REDWOOD CITY, Calif., Dec. 03, 2024 (GLOBE NEWSWIRE) -- Revolution Medicines, Inc. (Nasdaq: RVMD), a clinical-stage oncology company developing targeted therapies for patients with RAS-addicted cancers, today announced the pricing of 14,130,436 shares of its common stock at a public offering price of $46.00 per share, before underwriting discounts and commissions, and, in lieu of shares of common stock, to certain investors, pre-funded warrants to purchase 2,173,917 shares of common stock at a public offering price of $45.9999, which represents the per share public offering price for the common stock less the $0.0001 per share exercise price for each pre-funded warrant. All of the shares and pre-funded warrants in the offering are to be sold by Revolution Medicines. In addition, Revolution Medicines has granted the underwriters a 30-day option to purchase up to an additional 2,445,652 shares of common stock at the public offering price, less underwriting discounts and commissions. The gross proceeds from the offering are expected to be approximately $750.0 million before deducting underwriting discounts and commissions and other offering expenses, excluding any exercise of the underwriters’ option to purchase additional shares and excluding the exercise of any pre-funded warrants. The offering is expected to close on December 5, 2024, subject to customary closing conditions. J.P. Morgan, TD Cowen, Goldman Sachs & Co. LLC and Guggenheim Securities are acting as joint book-running managers for the offering. UBS Investment Bank is acting as lead manager. A shelf registration statement relating to these securities was filed with the U.S. Securities and Exchange Commission (SEC) on March 4, 2024, and automatically became effective upon filing. This offering is being made solely by means of a prospectus. A copy of the final prospectus supplement and the accompanying prospectus relating to this offering may be obtained for free by visiting EDGAR on the SEC’s website at www.sec.gov. Alternatively, a copy of the final prospectus supplement and the accompanying prospectus relating to this offering may be obtained by contacting: J.P. Morgan Securities LLC, Attention: Broadridge Financial Solutions, 1155 Long Island Avenue, Edgewood, New York 11717, by email at prospectus-eq_fi@jpmchase.com and postsalemanualrequests@broadridge.com; TD Securities (USA) LLC, 1 Vanderbilt Avenue, New York, New York 10017, by telephone at (855) 495-9846 or by email at TD.ECM_Prospectus@tdsecurities.com; Goldman Sachs & Co. LLC, Attention: Prospectus Department, 200 West Street, New York, NY 10282, by telephone at (866) 471-2526 or by email at prospectus-ny@ny.email.gs.com; and Guggenheim Securities, LLC, Attention: Equity Syndicate Department, 330 Madison Avenue, 8th Floor, New York, New York 10017, by telephone at (212) 518-9544 or by email at GSEquityProspectusDelivery@guggenheimpartners.com. This press release shall not constitute an offer to sell or a solicitation of an offer to buy these securities, nor shall there be any sale of these securities in any state or other jurisdiction in which such offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of any such state or other jurisdiction. About Revolution Medicines, Inc. Revolution Medicines is a clinical-stage oncology company developing novel targeted therapies for RAS-addicted cancers. The company’s R&D pipeline comprises RAS(ON) inhibitors designed to suppress diverse oncogenic variants of RAS proteins. The company’s RAS(ON) inhibitors RMC-6236, a RAS(ON) multi-selective inhibitor, RMC-6291, a RAS(ON) G12C-selective inhibitor, and RMC-9805, a RAS(ON) G12D-selective inhibitor, are currently in clinical development. Additional development opportunities in the company’s pipeline focus on RAS(ON) mutant-selective inhibitors, including RMC-5127 (G12V), RMC-0708 (Q61H) and RMC-8839 (G13C), in addition to RAS companion inhibitors RMC-4630 and RMC-5552. Forward Looking Statements To the extent that statements contained in this press release are not descriptions of historical facts regarding Revolution Medicines, they are forward-looking statements reflecting the current beliefs and expectations of management made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, including statements regarding the expected completion and timing of closing of the public offering. Such forward-looking statements involve risks and uncertainties, including, without limitation, risks and uncertainties related to market conditions and the satisfaction of closing conditions related to the public offering. Such forward-looking statements involve substantial risks and uncertainties that relate to future events, and the actual results could differ significantly from those expressed or implied by the forward-looking statements. Revolution Medicines undertakes no obligation to update or revise any forward-looking statements. For a further description of the risks and uncertainties relating to Revolution Medicines’ business in general, see the prospectus supplement related to the public offering and Revolution Medicines’ current and future reports filed with the SEC, including Revolution Medicines’ Quarterly Report on Form 10-Q for the quarter ended September 30, 2024, filed with the SEC on November 6, 2024.

2024-12-02

REDWOOD CITY, Calif., Dec. 02, 2024 (GLOBE NEWSWIRE) -- Revolution Medicines, Inc. (Nasdaq: RVMD), a clinical-stage oncology company developing targeted therapies for patients with RAS-addicted cancers, today announced that it has commenced an underwritten public offering to sell up to $600.0 million of shares of its common stock. All of the shares of common stock are being offered by Revolution Medicines. In addition, Revolution Medicines intends to grant the underwriters a 30-day option to purchase up to an additional $90.0 million of shares of common stock. The offering is subject to market and other conditions, and there can be no assurance as to whether or when the offering may be completed, or as to the actual size or terms of the offering. J.P. Morgan, TD Cowen, Goldman Sachs & Co. LLC and Guggenheim Securities are acting as joint book-running managers for the proposed offering. UBS Investment Bank is acting as lead manager. A shelf registration statement relating to these securities was filed with the U.S. Securities and Exchange Commission (SEC) on March 4, 2024, and automatically became effective upon filing. This offering is being made solely by means of a prospectus. A copy of the preliminary prospectus supplement and the accompanying prospectus relating to this offering may be obtained for free by visiting EDGAR on the SEC’s website at www.sec.gov. Alternatively, a copy of the preliminary prospectus supplement and the accompanying prospectus relating to this offering may be obtained by contacting: J.P. Morgan Securities LLC, Attention: Broadridge Financial Solutions, 1155 Long Island Avenue, Edgewood, New York 11717, by email at prospectus-eq_fi@jpmchase.com and postsalemanualrequests@broadridge.com; TD Securities (USA) LLC, 1 Vanderbilt Avenue, New York, New York 10017, by telephone at (855) 495-9846 or by email at TD.ECM_Prospectus@tdsecurities.com; Goldman Sachs & Co. LLC, Attention: Prospectus Department, 200 West Street, New York, NY 10282, by telephone at (866) 471-2526 or by email at prospectus-ny@ny.email.gs.com; and Guggenheim Securities, LLC, Attention: Equity Syndicate Department, 330 Madison Avenue, 8th Floor, New York, New York 10017, by telephone at (212) 518-9544 or by email at GSEquityProspectusDelivery@guggenheimpartners.com. This press release shall not constitute an offer to sell or a solicitation of an offer to buy these securities, nor shall there be any sale of these securities in any state or other jurisdiction in which such offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of any such state or other jurisdiction. About Revolution Medicines, Inc. Revolution Medicines is a clinical-stage oncology company developing novel targeted therapies for RAS-addicted cancers. The company’s R&D pipeline comprises RAS(ON) inhibitors designed to suppress diverse oncogenic variants of RAS proteins. The company’s RAS(ON) inhibitors RMC-6236, a RAS(ON) multi-selective inhibitor, RMC-6291, a RAS(ON) G12C-selective inhibitor, and RMC-9805, a RAS(ON) G12D-selective inhibitor, are currently in clinical development. Additional development opportunities in the company’s pipeline focus on RAS(ON) mutant-selective inhibitors, including RMC-5127 (G12V), RMC-0708 (Q61H) and RMC-8839 (G13C), in addition to RAS companion inhibitors RMC-4630 and RMC-5552. Forward Looking Statements To the extent that statements contained in this press release are not descriptions of historical facts regarding Revolution Medicines, they are forward-looking statements reflecting the current beliefs and expectations of management made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, including statements regarding completion, timing and size of the proposed public offering. Such forward-looking statements involve risks and uncertainties, including, without limitation, risks and uncertainties related to market conditions and the satisfaction of closing conditions related to the proposed public offering. Such forward-looking statements involve substantial risks and uncertainties that relate to future events, and the actual results could differ significantly from those expressed or implied by the forward-looking statements. Revolution Medicines undertakes no obligation to update or revise any forward-looking statements. For a further description of the risks and uncertainties relating to Revolution Medicines’ business in general, see the preliminary prospectus supplement related to the proposed public offering and Revolution Medicines’ current and future reports filed with the SEC, including Revolution Medicines’ Quarterly Report on Form 10-Q for the quarter ended September 30, 2024, filed with the SEC on November 6, 2024.

临床研究

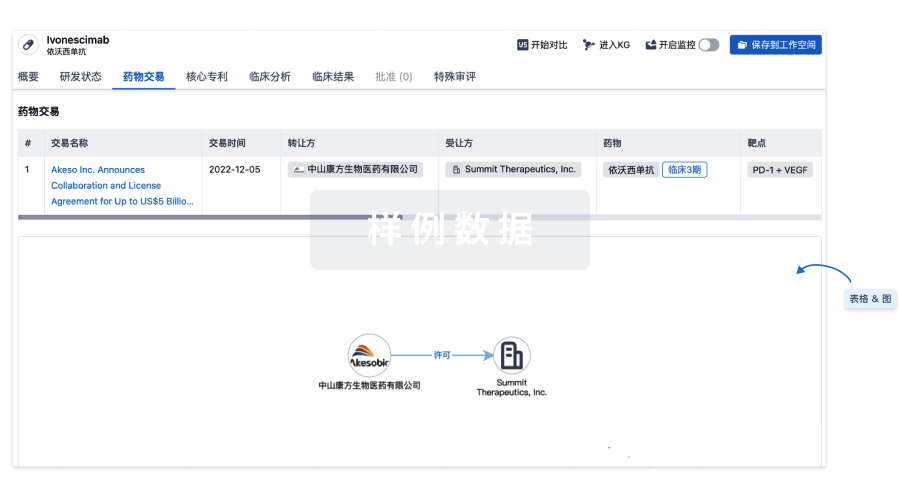

100 项与 RMC-5552 相关的药物交易

登录后查看更多信息

研发状态

10 条进展最快的记录, 后查看更多信息

登录

| 适应症 | 最高研发状态 | 国家/地区 | 公司 | 日期 |

|---|---|---|---|---|

| 复发性胶质母细胞瘤 | 临床3期 | 美国 | 2023-04-03 | |

| 晚期恶性实体瘤 | 临床1期 | 美国 | 2021-04-07 |

登录后查看更多信息

临床结果

临床结果

适应症

分期

评价

查看全部结果

| 研究 | 分期 | 人群特征 | 评价人数 | 分组 | 结果 | 评价 | 发布日期 |

|---|

No Data | |||||||

登录后查看更多信息

转化医学

使用我们的转化医学数据加速您的研究。

登录

或

药物交易

使用我们的药物交易数据加速您的研究。

登录

或

核心专利

使用我们的核心专利数据促进您的研究。

登录

或

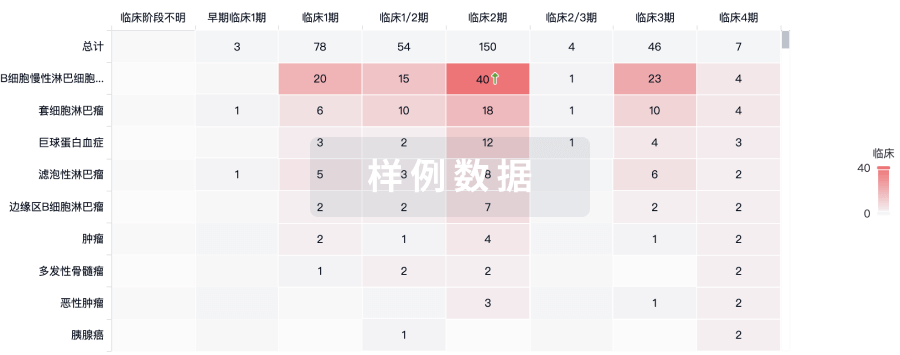

临床分析

紧跟全球注册中心的最新临床试验。

登录

或

批准

利用最新的监管批准信息加速您的研究。

登录

或

特殊审评

只需点击几下即可了解关键药物信息。

登录

或

Eureka LS:

全新生物医药AI Agent 覆盖科研全链路,让突破性发现快人一步

立即开始免费试用!

智慧芽新药情报库是智慧芽专为生命科学人士构建的基于AI的创新药情报平台,助您全方位提升您的研发与决策效率。

立即开始数据试用!

智慧芽新药库数据也通过智慧芽数据服务平台,以API或者数据包形式对外开放,助您更加充分利用智慧芽新药情报信息。

生物序列数据库

生物药研发创新

免费使用

化学结构数据库

小分子化药研发创新

免费使用