预约演示

更新于:2025-05-07

AT-466

MBNL1靶向AAV(Astellas)

更新于:2025-05-07

概要

基本信息

权益机构- |

最高研发阶段临床前 |

首次获批日期- |

最高研发阶段(中国)- |

特殊审评- |

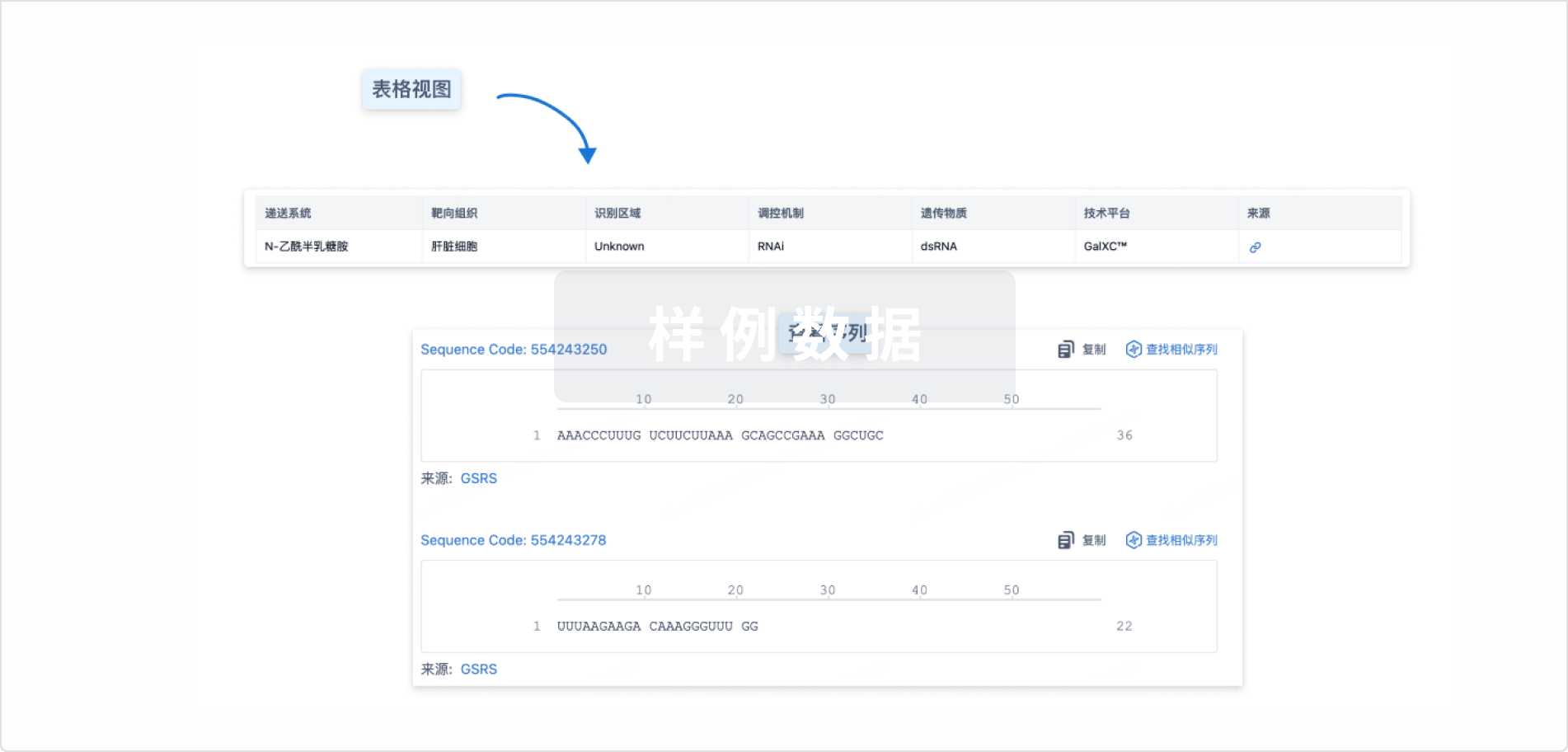

结构/序列

使用我们的RNA技术数据为新药研发加速。

登录

或

关联

100 项与 MBNL1靶向AAV(Astellas) 相关的临床结果

登录后查看更多信息

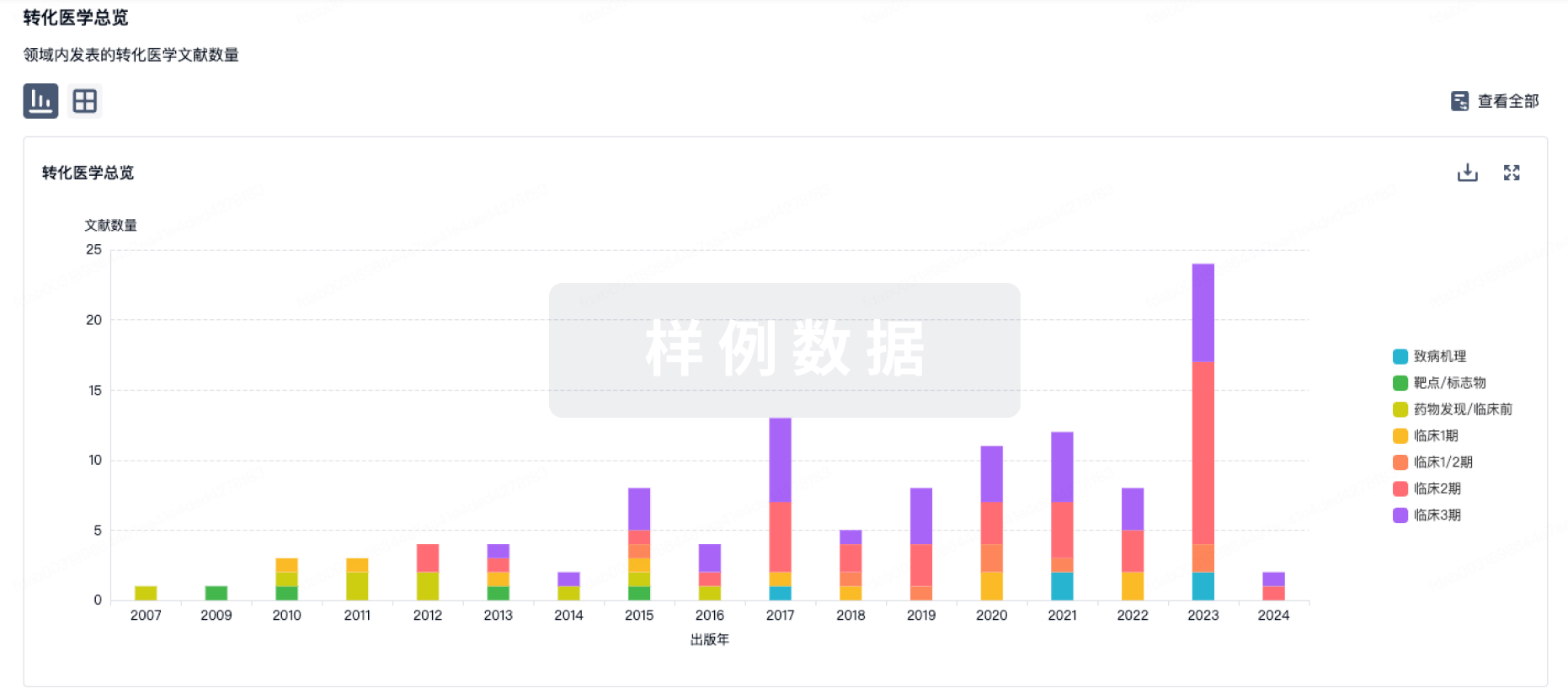

100 项与 MBNL1靶向AAV(Astellas) 相关的转化医学

登录后查看更多信息

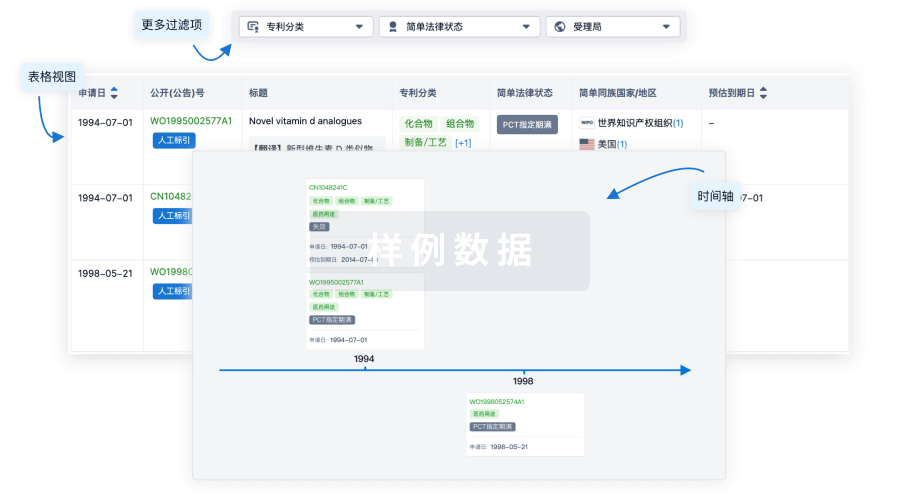

100 项与 MBNL1靶向AAV(Astellas) 相关的专利(医药)

登录后查看更多信息

11

项与 MBNL1靶向AAV(Astellas) 相关的新闻(医药)2025-02-26

·药智网

据行业媒体Fierce Pharma统计,2024年第四季度,全球生物医药行业再掀增长狂潮。在已公布财报的22家营收超20亿美元的巨头中,仅有一家企业出现同比下滑。

而且值得注意的是,Teva虽然是唯一一个业绩出现下滑的公司,但下滑原因主要是由于其在2023年第四季度与赛诺菲的药物合作中收到了5亿美元的预付款,若扣除这笔额外收入,Teva的业绩实际上也是呈现增长态势。

图片来源:参考资料

在第四季度收入超过20亿美元的22家生物制药公司中,有9家实现了两位数的增长,另外9家公司实现了至少5%的个位数增长。

1

礼来、诺和诺德领跑

礼来(Eli Lilly)以45%的同比增幅强势登顶,旗下糖尿病药物Mounjaro和减肥神药Zepbound持续供不应求。而且其乳腺癌药物Verzenio(16亿美元)与心衰药物Jardiance(12亿美元)的销售额也在持续增长,创下季度新高。

诺和诺德(Novo Nordisk)凭借30%增长稳居第二,且已连续12个季度同比增长率超过20%。其糖尿病和肥胖新药司美格鲁肽持续放量,2024年销售额近300亿美元,助推企业市值超过4000亿美元,稳坐欧洲药企头把交椅。

2

阿斯利康、辉瑞超预期

除了礼来和诺和诺德,还有多家公司在2024年第四季度实现了双位数增长。

阿斯利康(AstraZeneca)肿瘤与呼吸免疫双赛道齐飞,单季暴涨24%,全年营收突破行业预期。

辉瑞上演惊天逆转:Q1暴跌19%后,Q4借新冠药物Comirnaty和Paxlovid(41亿美元)强势反弹23%,

安斯泰来凭借与辉瑞合作的抗前列腺癌药Xtandi及ADC药物Padcev的热销,第四季度营收暴涨22%。不过,安斯泰来在眼病药物Syfovre研发受挫,基因疗法AT466也前景不明,公司已计提1800亿日元(约12亿美元)资产减值。

福泰制药(Vertex)与诺华(Novartis)也取得了15%季度增速。诺华CEO曾表示,“剥离非核心资产后,我们已成为专注创新的纯血药企,长期竞争力更强。”

其他两位数增长的药企还有安进和再生元。安进的收入增长主要来源于收购Horizon。再生元的增长主要依赖其自免明星——Dupixent,该药还在去年斩获了慢阻肺(COPD)新适应症。另外,抗癌药Libtayo也在2024年首破10亿美元大关。

3

艾伯维、渤健走出低谷

艾伯维(AbbVie)的免疫新星Skyrizi/Rinvoq组合快速放量,剑指2027年310亿美元销售目标。艾伯维也因此实现了6%的增幅,创三年来最佳战绩,证明其已走出Humira专利到期的低谷。

强生(Johnson&Johnson)第四季度营收微增5%,但其分拆的消费健康业务(新公司Kenvue)2024年销售额151亿美元,同比仅增0.1%。这也说明了为什么强生要分拆此业务。

赛诺菲(Sanofi)也在剥离消费健康部门的战略重组中表现亮眼,第四季度营收增长9%。

渤健(Biogen)第四季度销售额增长3%,这是其连续四年下滑后首次回升,尽管2024年整体仍下降2%。这一转折点显示公司在阿尔茨海默病药物Aduhelm受挫后逐步恢复。

4

隐忧与挑战

在业绩增长的同时,还有部分企业暴露出“隐忧”。

吉利德科学(Gilead Sciences)第四季度受HIV产品推动,营收增长6%,延续全年增长势头。但公司预计2025年销售额将从288亿美元回落至约280-286亿美元区间。

百时美施贵宝(BMS)当季增长7%,全年保持稳定,但宣布到2027年将再削减20亿美元成本,并预计2025年营收从483亿降至455亿美元。

武田在2024年的前三个季度每个季度都实现两位数的收入增长,但第四季度的销售额仅增长了3%。

葛兰素史克(GSK)第四季度仅增长1%,其RSV疫苗Arexvy受美国CDC政策调整拖累,销售额暴跌70%。此外,默沙东、辉瑞等疫苗依赖型企业也在担忧美国卫生部长换帅带来的审批变数。

参考来源:

https://www.fiercepharma.com/pharma/eli-lilly-novo-nordisk-lead-revenue-boom-always-tricky-fourth-quarter

声明:本内容仅用作医药行业信息传播,不代表药智网立场。对本文有异议或投诉,请联系maxuelian@yaozh.com。

责任编辑 | 小月石

合作、投稿 | 马老师 18323856316(同微信)

阅读原文,是受欢迎的文章哦

抗体药物偶联物财报并购引进/卖出专利到期

2025-02-24

Two familiar leaders—Eli Lilly (+45%) and Novo Nordisk (+30%)—paced an industry revenue boom in the fourth quarter. So far, Teva is the only drugmaker that posted a year-over-year sales decline in the fourth quarter.

Revenues in the biopharma industry continued to boom in the fourth quarter of last year, following a pattern seen increasingly throughout 2024. Of the world’s 22 biopharma companies that had reported quarterly revenue of at least $2 billion by Feb. 24, only one posted a year-over-year decline.And that decrease had a caveat. Teva saw its revenue fall by 5% in the fourth quarter because of a $500 million upfront payment it received in a drug collaboration with Sanofi in the fourth quarter of 2023. Without that addition, which the company chalked up as revenue, Teva would have reported a 5% increase in the most recent period.How rare is it to see a quarter in which just one biopharma had a revenue decline? Consider that in the first quarter of 2024, seven companies reported falling sales year-over-year.“Q4 is always tricky,” Pankit Bhalodia, West Monroe's managing director of healthcare and life sciences, said in an interview. “I don’t know how much of this is in anticipation of all the changes that might potentially happen in ’25 with the new [Trump] administration, with increased demand or whatnot.” The revenue increase leaders of the fourth quarter were familiar—Eli Lilly (45%) and Novo Nordisk (30%). For both companies, the increases were their highest for any quarter in 2024. While Lilly has delivered seven straight quarters with at least a 20% increase, Novo has topped the 20% growth mark in 12 consecutive quarters.Boosted by hefty sales of its diabetes and obesity drugs, Lilly posted an annual revenue increase of 32% in 2024, while Novo, with a similar growth portfolio, generated a 26% revenue bump for the year. Lilly’s revenue increase in the quarter wasn’t just due to its GLP-1/GIP products, however. The company also said that sales of its non-incretin drugs jumped by 20% year over year and pointed to the performance of breast cancer therapy Verzenio and heart failure treatment Jardiance, which rang up quarterly figures of $1.6 billion and $1.2 billion, respectively.Since announcing in January at the J.P. Morgan Healthcare Conference that it expects revenue to increase 32% in 2025, Lilly has seen its market cap increase from $745 billion to $844 billion, which is more than twice the value of any other company in the industry.Much of the investor enthusiasm surrounds the prospects of Lilly’s obesity treatments in a market that is still growing. Asked during the company’s quarterly conference call whether Lilly was reaching the “edge of the demand curve” for obesity drugs, CEO David Ricks said, “We don’t think we’re close to it right now.”“There’s a lot of potential growth in the GLP area—in other potential indications and other disease states,” Steven Lupo, also of consulting firm West Monroe, added in an interview.In presenting its quarterly earnings, Novo projected a slowdown in its sales momentum, estimating revenue will increase between 16% and 24% in 2025. Since that announcement, Novo’s market cap has increased slightly to $349 billion. With its surge over the last few years, Novo has become the highest valued biopharma company in Europe.Other double-digit gainers Of the 22 biopharma companies that reported fourth quarter revenue of more than $2 billion by Feb. 24, nine posted double-digit increases and nine others had single-digit increases of at least 5%.Among those with double-digit growth in the fourth quarter was AstraZeneca, with a 24% revenue increase, sparked largely by 27% increases in sales for both its oncology drugs and its respiratory and immunologic treatments. The showing in the quarter closed a remarkable year for the company in which its sales increased by 18%. AZ expects a slowdown in its momentum in 2025, projecting a revenue increase in the high single digits.Pfizer started the year with a 19% revenue decline in the first quarter, then ended it with a 23% sales increase in the fourth quarter. While the acquisition of Seagen—and the nearly $1 billion quarterly increase in sales of antibody-drug conjugate drugs brought by the Seattle biotech—played a significant role in boosting revenues, a larger factor was a surprising spike in the combined sales of COVID-19 products Comirnaty and Paxlovid, which reached $4.1 billion in the fourth quarter.While Astellas achieved a 22% quarterly revenue increase—due largely to booming sales of its Pfizer-partnered prostate cancer treatment Xtandi and ADC bladder cancer drug Padcev—there also was bad news. Due largely to the struggles of eye disease drug Syfovre and myotonic dystrophy gene therapy prospect AT466, Astellas wrote off impairments of 180 billion Japanese yen ($1.2 billion).Vertex and Novartis achieved revenue increases of 15% each in the fourth quarter, which was the highest quarterly increase either company achieved in 2024.For Novartis, a series of divestments have left it as a pure-play innovator better equipped to take advantage of its strengths, according to CEO Vas Narasimhan.“The strategy of focusing the company has unlocked value and actually enabled Novartis to be much stronger for the long run,” he told reporters last month.Other drugmakers with double-digit revenue increases were Amgen and Regeneron at 11% each. Amgen’s revenue bump was down from at least 20% in each of the other quarters of 2024 as the company realized added sales from its $27.8 billion acquisition of Horizon, which came complete early in the fourth quarter of 2023.While Regeneron is struggling to make advances with its Eylea franchise, it is thriving with Sanofi-partnered Dupixent—which gained a key FDA nod to treat chronic obstructive pulmonary disease last year—and cancer treatment Libtayo, which reached blockbuster sales for the first time in 2024.Single-digit gainers It was a successful quarter for several drugmakers that saw single-digit revenue gains, including AbbVie (6%), which had its highest quarterly revenue increase since the fourth quarter of 2021. The performance is evidence that the company has come full circle from the loss of exclusivity of megablockbuster Humira and that its next-gen immunology duo Skyrizi and Rinvoq is primed to provide growth over the next decade. In its fourth-quarter earnings presentation, AbbVie estimated combined sales of the Humira follow-ons would reach $31 billion in 2027.Gilead Sciences saw a revenue increase of 6% in the quarter, continuing its momentum for the year. In 2024 overall, fueled by sales of HIV products, Gilead had a 6% bump in sales, which came after small revenue declines in the previous two years. The company expects a reversion in 2025, with sales falling from $28.8 billion to a range of $ billion to $28.6 billion.Johnson & Johnson had a modest 5% increase in the fourth quarter, but the company is making steady progress with its sales gains increasing in each quarter of 2024 as it rebuilds its revenue after spinning off its huge consumer health business. The new company, Kenvue, reported sales of $15.1 billion in 2024, which represented a 0.1% increase from the previous year, showing why J&J was anxious to shed the unit. For the purposes of these growth rankings, consumer healthcare companies like Kenvue are excluded. Another company that has undergone a recent reorganization—including an ongoing attempt to separate from its consumer health unit—is Sanofi. The French drugmaker closed a strong year with a 9% revenue increase in the fourth quarter.Bristol Myers Squibb also finished up a solid year with an 7% revenue gain in the fourth quarter, after increases of 9% and 8% in the previous two periods, though the bigger news during its fourth-quarter presentation was that the company will cut another $2 billion in costs by the end of 2027. BMS expects the sales momentum to halt next year, projecting revenue to decline from $48.3 billion to $45.5 billion this year.Biogen generated a 3% increase in sales in the fourth quarter, which was a promising turn-the-corner result considering that the company’s revenue has declined in each of the last four years, including a 2% drop in 2024.Disappointments A few drugmakers reported disappointing results in the fourth quarter. One was GSK, with a 1% increase as sales of Arexvy plummeted (PDF) by 70% year over year, largely because the Centers for Disease Control and Prevention narrowed its guidance on which adults should receive respiratory syncytial virus shots.For other companies that rely heavily on manufacturing vaccines—such as Merck, Sanofi, Pfizer and Moderna—there is considerable angst over what may become of the U.S. market with anti-vaccine activist Robert F. Kennedy Jr. taking over as secretary of the Department of Health and Human Services.“From a regulatory pathway and approval process—that’s probably one of the bigger concerns that I’m hearing,” Lupo said. “How will this effect what we’ve got in the pipeline? And when can we anticipate getting new products on the market?” After double-digit revenue increases in each of the previous three quarters of 2024, Takeda saw just a 3% sales increase in its last quarter. A few drugmakers not included in this summary—which will present fourth-quarter earnings in the next few weeks—are likely to report revenue decreases. They include Bayer and Viatris, which each had sales decreases in each of the first three quarters of 2024. Additionally, Merck KGaA, which has yet to report, entered the fourth quarter with a 1% revenue decline through the first nine months of 2024.

并购

2025-02-05

Astellas' total revenue reached 1.45 trillion Japanese yen ($9.52 billion) over the last nine months of 2024.

Navigating regulatory hurdles in the U.S. and Europe, plus fierce competition from rival Apellis, Astellas’ geographic atrophy (GA) med Izervay has taken a few beatings in recent months. Still, the Japanese drugmaker is chasing the light it sees in an upcoming FDA decision. Izervay pulled down $107 million in sales in the last three months of 2024, up merely 4% on a quarter-over-quarter basis. It marked a significant slowdown for the drug considering it remains in its early launch phase, delivering 26% sequential growth in the prior quarter.The rollout suffered a “temporary impact” from the FDA's "unexpected" decision to reject a label update for Izervay in GA secondary to age-related macular degeneration (AMD) as well as changes in inventory levels, Astellas Chief Financial Officer Atsushi Kitamura said on a conference call Tuesday.With its label-expansion bid, the company hopes to include in the drug's label positive two-year trial results for monthly and every-other-month dosing of Izervay in patients who have GA secondary to AMD. The drug's current label states that it's recommended "for up to 12 months."While the FDA rejection was not about any benefit-risk concerns, Astellas has heard that many retina specialists are pausing Izervay use for patients who have reached 12 months on the drug. For Astellas' launch, the good news is that the company has "rarely heard of switching to a competitive drug,” Kitamura said, emphasizing that patients will likely “quickly resume” treatment upon the expected label update. Following that setback, the company is now back on track with a new FDA decision date slated for Feb. 26, it announced in its quarterly earnings report. Given the quick turnaround on the resubmission, the FDA’s requested changes may have been “relatively minor,” William Blair analyst Lachlan Hanbury-Brown pointed out in a note to clients. Astellas had described the FDA’s comments at the time as focused on a “statistical matter” related to proposed labeling language. Still, the “negative optics” of the original rejection could hurt Izervay from a competitive standpoint, the analyst said Syfovre competition As to why patients aren’t switching to Apellis’ rival Syfovre in the meantime, Astellas' chief commercial officer Claus Zieler highlighted the established safety profile of Izervay.Syfovre and Izervay have been rubbing elbows in the GA market since Izervay launched six months after Syfovre in 2023. In its recent financial report, Astellas called Izervay the leading treatment option for new patient starts, boasting 60% of the new patient market share from October to November and 40% of the total market share.Between the two, Hanbury-Brown maintained in William Blair’s recent note that Apellis’ rival Syfovre stands to grab “significant” market share and has blockbuster potential due to its superior efficacy over Izervay.Astellas executives pushed back against similar assertions raised during the conference call that Syfovre has the efficacy edge over Izervay. Zieler argued that those statements are based on cross-trial comparisons and cannot be made without a head-to-head study.“What you can say, however, is that our safety profile is in line with our clinical study, and I don’t think Apellis can say that about its competitor drug,” Zieler remarked.Shortly after its launch, Syfovre was linked to rare but serious reports of a type of eye inflammation called retinal vasculitis. After an investigation, the company homed in on “variations” on the filter needle included in some injection kits as the possible culprit, but it couldn’t conclusively determine that the needles were to blame. European hurdles In Europe, neither drug has made it onto the market. Astellas clawed back its marketing authorization application in October following discussions with the European Medicines Agency, while Syfovre has been rejected twice by the regulator.The European pullback prompted a 115.1 billion Japanese yen ($760 million) impairment charge at Astellas during the quarter.That doesn’t mean Astellas is throwing in the towel on its global prospects. Reaching more patients worldwide is “extremely important,” Kitamura stressed. Along with a newly submitted application in its home country of Japan, the company has begun individual discussions with regulatory authorities in major countries and will “consider” a submission in Europe after it concludes discussions with officials there. Along with its Izervay impairment, Astellas also booked a 51.8 billion Japanese yen ($339 million) impairment loss on its myotonic dystrophy gene therapy prospect AT466 as the “development timeline and the competitive environment have changed from our initial assumptions,” Kitamura explained. Including another charge on terminated medical devices projects, the quarter’s impairments altogether totaled 180 billion Japanese yen ($1.18 billion).Over the last nine months of 2024, the company’s total revenue reached 1.45 trillion Japanese yen ($9.52 billion), a 22% jump from the same period last year. The bulk of sales came from Pfizer-partnered prostate cancer med Xtandi and bladder cancer antibody-drug conjugate Padcev, the latter of which saw a 110.4% sales jump to 117 billion Japanese yen ($767 million).

上市批准财报

100 项与 MBNL1靶向AAV(Astellas) 相关的药物交易

登录后查看更多信息

研发状态

10 条进展最快的记录, 后查看更多信息

登录

| 适应症 | 最高研发状态 | 国家/地区 | 公司 | 日期 |

|---|---|---|---|---|

| 肌强直性营养不良 | 药物发现 | 美国 | 2019-04-08 |

登录后查看更多信息

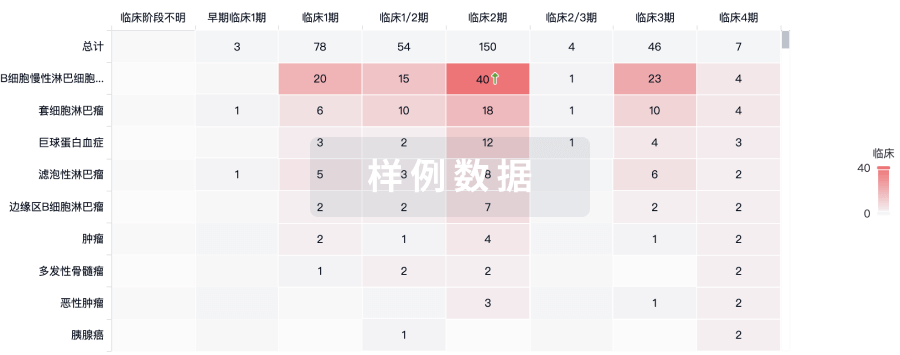

临床结果

临床结果

适应症

分期

评价

查看全部结果

| 研究 | 分期 | 人群特征 | 评价人数 | 分组 | 结果 | 评价 | 发布日期 |

|---|

No Data | |||||||

登录后查看更多信息

转化医学

使用我们的转化医学数据加速您的研究。

登录

或

药物交易

使用我们的药物交易数据加速您的研究。

登录

或

核心专利

使用我们的核心专利数据促进您的研究。

登录

或

临床分析

紧跟全球注册中心的最新临床试验。

登录

或

批准

利用最新的监管批准信息加速您的研究。

登录

或

特殊审评

只需点击几下即可了解关键药物信息。

登录

或

Eureka LS:

全新生物医药AI Agent 覆盖科研全链路,让突破性发现快人一步

立即开始免费试用!

智慧芽新药情报库是智慧芽专为生命科学人士构建的基于AI的创新药情报平台,助您全方位提升您的研发与决策效率。

立即开始数据试用!

智慧芽新药库数据也通过智慧芽数据服务平台,以API或者数据包形式对外开放,助您更加充分利用智慧芽新药情报信息。

生物序列数据库

生物药研发创新

免费使用

化学结构数据库

小分子化药研发创新

免费使用