预约演示

更新于:2025-05-15

Metyrapone/Oxazepam

美替拉酮/奥沙西泮

更新于:2025-05-15

概要

基本信息

药物类型 小分子化药 |

别名 EMB 001C、EMB-001、EMB-001C + [1] |

作用方式 抑制剂、正变构调节剂 |

作用机制 CYP11B1抑制剂(细胞色素P450家族成员11B1抑制剂)、GABAA receptor 正变构调节剂(γ-氨基丁酸A受体 正变构调节剂) |

治疗领域 |

在研适应症- |

在研机构- |

权益机构- |

最高研发阶段无进展临床2/3期 |

首次获批日期- |

最高研发阶段(中国)- |

特殊审评- |

登录后查看时间轴

结构/序列

分子式C15H11ClN2O2 |

InChIKeyADIMAYPTOBDMTL-UHFFFAOYSA-N |

CAS号604-75-1 |

查看全部结构式(2)

关联

4

项与 美替拉酮/奥沙西泮 相关的临床试验NCT04868253

Efficacy and Safety of Combination EMB-001 as a Potential Smoking Cessation Treatment

This open-label study will evaluate EMB-001, comprised of metyrapone, a cortisol synthesis inhibitor marketed as a diagnostic drug for testing hypothalamic-pituitary-adrenal (HPA) axis function, combined with oxazepam, an anxiolytic and sedative/hypnotic benzodiazepine, to help smokers abstain from smoking during a 12-week trial period.

开始日期2021-05-19 |

申办/合作机构 |

NCT04501874

A Phase 2, Randomized, Double-Blind, Placebo-Controlled, Parallel Group, Study to Evaluate the Safety and Efficacy of EMB 001 in Subjects With Moderate-to-Severe Cocaine Use Disorder

EMB-001 is a combination of 2 drugs: the cortisol synthesis inhibitor, metyrapone (Metopirone®), and the benzodiazepine receptor agonist, oxazepam (original trade name Serax®; now marketed as oxazepam (generic) only).

This is a Phase 2 study in approximately 80 adult subjects with moderate-to-severe Cocaine Use Disorder (CUD).

This is a Phase 2 study in approximately 80 adult subjects with moderate-to-severe Cocaine Use Disorder (CUD).

开始日期2020-07-29 |

申办/合作机构 |

NCT02856854

A Phase 1b, Randomized, Double-Blinded, Multiple-Dose, Placebo Controlled, Crossover Study To Evaluate The Safety, Tolerability And Pharmacokinetic Effects Of A Metyrapone And Oxazepam Combination (EMB-001) When Co-Administered With Cocaine

EMB-001 is a combination of 2 drugs: the cortisol synthesis inhibitor, metyrapone (Metopirone®), and the benzodiazepine receptor agonist, oxazepam (original trade name Serax®; now marketed as oxazepam (generic) only).

This Phase 1b cocaine interaction study is being conducted in order to assess the safety and PK of EMB-001 and cocaine in combination.

This Phase 1b cocaine interaction study is being conducted in order to assess the safety and PK of EMB-001 and cocaine in combination.

开始日期2016-07-01 |

申办/合作机构 |

100 项与 美替拉酮/奥沙西泮 相关的临床结果

登录后查看更多信息

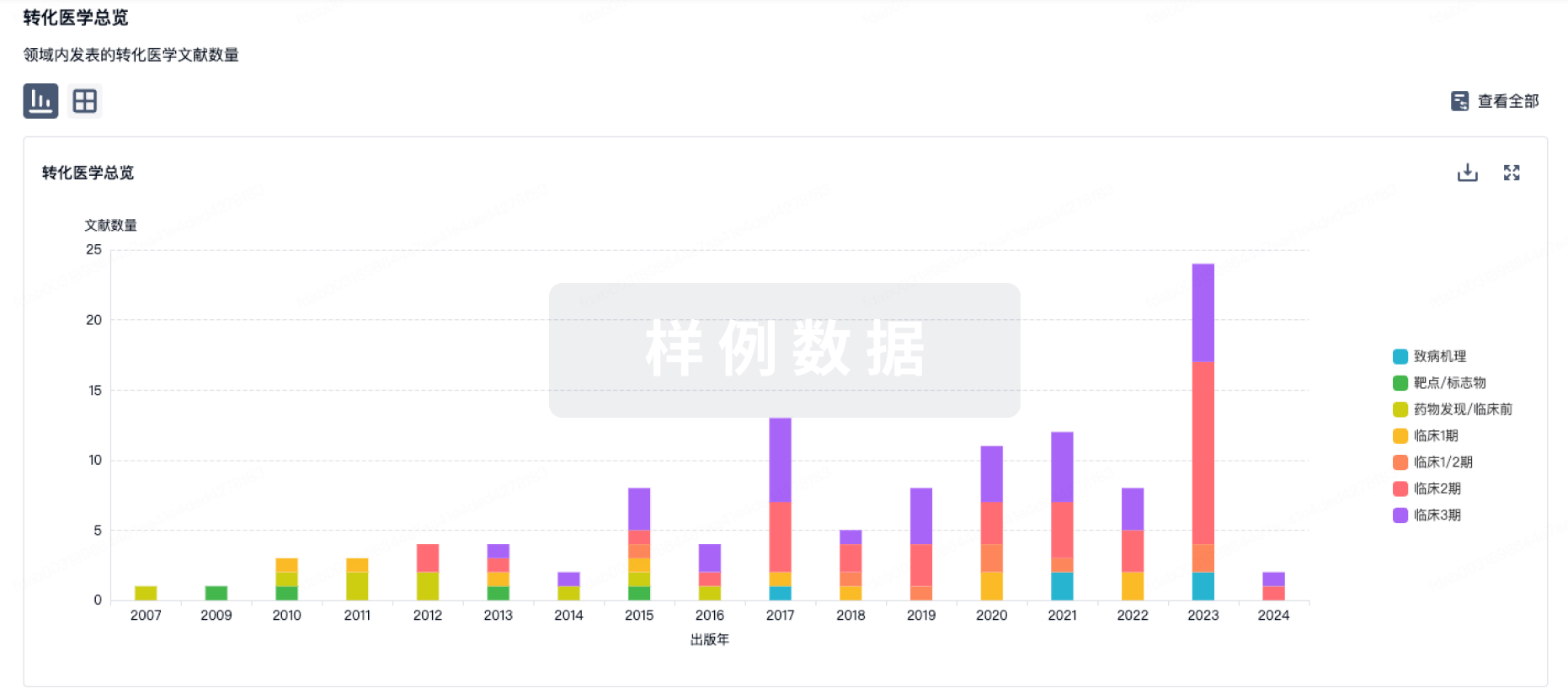

100 项与 美替拉酮/奥沙西泮 相关的转化医学

登录后查看更多信息

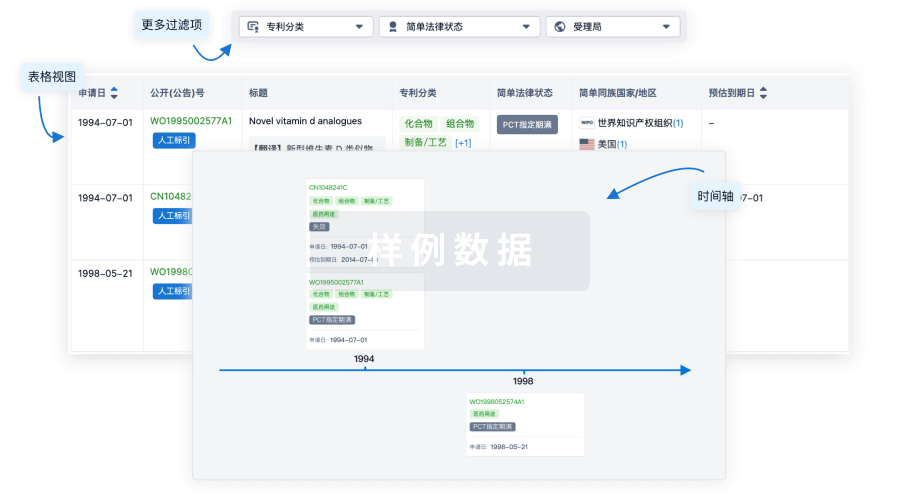

100 项与 美替拉酮/奥沙西泮 相关的专利(医药)

登录后查看更多信息

5

项与 美替拉酮/奥沙西泮 相关的文献(医药)2023-07-01·European Journal of Nuclear Medicine and Molecular Imaging

Preclinical evaluation of a novel EGFR&c-Met bispecific near infrared probe for visualization of esophageal cancer and metastatic lymph nodes.

Article

作者: Shan, Hong ; Mei, Chaoming ; Wang, Lizhu ; Yang, Meilin ; Li, Dan ; Zhang, Yaqin ; Liang, Mingzhu ; Xiao, Yitai

PURPOSE:

This study aimed to establish a near infrared fluorescent (NIRF) probe based on an EGFR&c-Met bispecific antibody for visualization of esophageal cancer (EC) and metastatic lymph nodes (mLNs).

METHODS:

EGFR and c-Met expression were assessed by immunohistochemistry. EGFR&c-Met bispecific antibody EMB01 was labeled with IRDye800cw. The binding of EMB01-IR800 was assessed by enzyme linked immunosorbent assay, flow cytometry, and immunofluorescence. Subcutaneous tumors, orthotopic tumors, and patient-derived xenograft (PDX) were established for in vivo fluorescent imaging. PDX models using lymph nodes with or without metastasis were constructed to assess the performance of EMB01-IR800 in differential diagnosis of lymph nodes.

RESULTS:

The prevalence of overexpressing EGFR or c-Met was significantly higher than single marker either in EC or corresponding mLNs. The bispecific probe EMB01-IR800 was successfully synthesized, with strong binding affinity. EMB01-IR800 showed strong cellular binding to both Kyse30 (EGFR overexpressing) and OE33 (c-Met overexpressing) cells. In vivo fluorescent imaging showed prominent EMB01-IR800 uptake in either Kyse30 or OE33 subcutaneous tumors. Likewise, EMB01-IR800 exhibited superior tumor enrichment in both thoracic orthotopic esophageal squamous cell carcinoma and abdominal orthotopic esophageal adenocarcinoma models. Moreover, EMB01-IR800 produced significantly higher fluorescence in patient-derived mLNs than in benign lymph nodes.

CONCLUSION:

This study demonstrated the complementary overexpression of EGFR and c-Met in EC. Compared to single-target probes, the EGFR&c-Met bispecific NIRF probe can efficiently depict heterogeneous esophageal tumors and mLNs, which greatly increased the sensitivity of tumor and mLN identification.

2016-02-14·Advances in bioinformatics

Inhibition of Mycobacterium-RmlA by Molecular Modeling, Dynamics Simulation, and Docking

Article

作者: Kumar Chitta, Suresh ; Pulaganti, Madhusudana ; Harathi, N. ; Anuradha, C. M.

The increasing resistance to anti-tb drugs has enforced strategies for finding new drug targets againstMycobacterium tuberculosis(Mtb). In recent years enzymes associated with the rhamnose pathway in Mtb have attracted attention as drug targets. The present work is onα-D-glucose-1-phosphate thymidylyltransferase (RmlA), the first enzyme involved in the biosynthesis of L-rhamnose, of Mtb cell wall. This study aims to derive a 3D structure of RmlA by using a comparative modeling approach. Structural refinement and energy minimization of the built model have been done with molecular dynamics. The reliability assessment of the built model was carried out with various protein checking tools such as Procheck, Whatif, ProsA, Errat, and Verify 3D. The obtained model investigates the relation between the structure and function. Molecular docking interactions of Mtb-RmlA with modified EMB (ethambutol) ligands and natural substrate have revealed specific key residues Arg13, Lys23, Asn109, and Thr223 which play an important role in ligand binding and selection. Compared to all EMB ligands, EMB-1 has shown better interaction with Mtb-RmlA model. The information thus discussed above will be useful for the rational design of safe and effective inhibitors specific to RmlA enzyme pertaining to the treatment of tuberculosis.

1969-06-01·Journal of bacteriology3区 · 生物学

Secondary and Tertiary Responses of the Induced Bactericidin from the West Indian Spiny Lobster,Panulirus argus

3区 · 生物学

Article

作者: Evans, E. Edward ; Painter, Barbara ; Weinheimer, Peter F. ; Evans, Marjorie L. ; Acton, Ronald T.

West Indian spiny lobsters,Panulirus argus, synthesized a hemolymph bactericidin after being injected with killed suspensions of gram-negative bacillus EMB-1 isolated from the normal gut of this lobster. To study differences between the primary response and secondary response, animals were given a primary antigen injection of EMB-1 followed by a second injection of the same antigen 22 to 51 days later. As a rule, secondary bactericidal responses were enhanced over the primary in a manner reminiscent of specific anamnesis in mammalian immunoglobulin synthesis. Immunological memory was also suggested when tertiary responses were compared to secondary and by the persistence of residual titers for many days or weeks without additional antigenic stimulation.

3

项与 美替拉酮/奥沙西泮 相关的新闻(医药)2024-12-19

点击蓝字 关注我们

近年来,随着技术的进步,双特异性抗体(bsAbs)基于其可同时靶向两种不同的抗原或表位,增强免疫系统对肿瘤细胞的识别和杀伤作用的特性,成为肺癌领域关注热点。《肿瘤瞭望》特邀河南省肿瘤医院王慧娟教授分享双抗在肺癌领域的不同治疗手段的研究进展,展望未来探索方向。特此整理,以飨读者。

王慧娟 教授

肿瘤学博士 主任医师 教授

河南省肿瘤医院

呼吸内科二病区主任

中国临床肿瘤学会(CSCO) 理事

中国临床肿瘤学会(CSCO)免疫治疗专家委员会 常委

中国临床肿瘤学会(CSCO)患者教育专家委员会 常委

中国抗癌协会肿瘤整体评估专业委员会 常委

中国抗癌协会国际医学交流专业委员会 常委

中国抗癌协会骨与软组织肿瘤整合康复专委会 常委

中国抗癌协会肺癌专委会 委员

中初保肺癌康复公益基金管理委员会 主任委员

中初保胸部肿瘤精准治疗专业委员会 副主委

国家临床医学研究中心中国呼吸肿瘤协作组青年委员会 副主委

中国医药教育协会疑难肿瘤专业委员会 常委

河南省抗癌协会青年理事会 常务理事

河南省抗癌协会肺癌专业委员会青年委员会 主任委员

中国抗癌协会肿瘤药物临床研究专业委员会 委员

中国抗癌协会肿瘤支持治疗专业委员会 委员

PART 1 双特异性抗体的研发概况

01

双特异性抗体的定义及结构分类

双特异性抗体(Bispecific Antibody,BsAb)可同时或先后结合两种抗原或同一抗原不同表位,是有别于单抗及单抗联合用药的 “单药”。根据结构可分为2大类:含Fc片段的双特异性抗体(IgG样)与不含Fc片段的双特异性抗体(非IgG样)。

02

从靶点作用形式看抗肿瘤双抗

从靶点的作用形式看,常见如下3种:

细胞桥接:靶向2种细胞的抗原(如Blinatumomab、IBI318)

双靶点阻断/强化:靶向同一/不同细胞上的两个抗原(如AK104 、IBI322 、KN046)、一端靶向肿瘤微环(如M7824、IBI363)

03

抗肿瘤双特异性抗体的经典作用机制

包括 T 细胞重定向、双信号抑制、同抗原非重叠表位、共定位阻断、双免疫检查点阻断、肿瘤靶向的免疫调节等。

04

在研抗肿瘤双抗的靶点选择及适应症分布

目前,全球双抗靶点开发聚焦T细胞重定向,而中国侧重双免疫检查点阻断,开发主要以实体瘤治疗为主,包括胃、胃食管结合部癌、膀胱癌、胆道恶性肿瘤、鼻咽癌等。

PART 2 靶向双抗在肺癌中的研究进展

01

EGFR×MET

Amivantamab

埃万妥单抗(Amivantamab)是一种新型抗EGFR/c-MET双特异性抗体。早前首次人体、I期研究(CHRYSALIS研究、NCT02609776)结果证明了埃万妥单抗对于EGFR 20外显子插入突变、含铂化疗失败的NSCLC患者可表现出稳定、持久的缓解,同时安全性可耐受。基于该研究的ORR和DoR结果,2021年5月,FDA加速批准埃万妥单抗用于EGFR 20外显子插入突变、含铂化疗失败的NSCLC治疗。

随后,PAPILLON研究(NCT04538664)、MARIPOSA研究(NCT04487080)、MARIPOSA-2研究(NCT04988295)、PALOMA-3研究(NCT05388669)相继开展,分别证实了埃万妥单抗在EGFR 20外显子插入突变患者中疗效显著,联合化疗一线治疗可显著改善患者PFS,联合Lazertinib对比奥希替尼一线治疗也取得阳性结果,对于奥希替尼耐药EGFR敏感突变(ex19del/L858R)晚期NSCLC患者,埃万妥单抗+化疗±拉泽替尼显著改善了其PFS和颅内PFS,但毒性增加。

其皮下制剂显示出不劣于静脉注射的药代动力学和抗肿瘤活性,在保证疗效的同时提高耐受性、减少给药时间及IRR、延长了患者OS。

此外,王慧娟教授表示,EGFR×MET 双特异性抗体开发领域,CKD-702、EMB-01、MCLA-129等创新药物在早期临床研究中表现出临床治疗潜力,期待更多研究数据的公布。

02

MET×MET

REGN5093

一项开放标签、多中心、首次人体、I/II期研究,探索了REGN5093治疗既往接受过已批准的有效疗法治疗的MET突变晚期NSCLC患者的安全性、耐受性、PK和疗效(NCT04077099)。结果显示,REGN5093单药治疗安全性可耐受,在MET 14外显子突变和MET基因扩增、MET蛋白过表达患者中观察到初步疗效信号。

03

HER2×HER3

Zenocutuzumab

一项Ⅰ/Ⅱ期eNRGy研究(NCT02912949)评估了Zenocutuzumab单药治疗NRG1+非小细胞肺癌、胰腺癌和其他实体瘤的安全性和抗肿瘤活性。研究结果显示,Zenocutuzumab单药治疗晚期NRG1+非小细胞肺癌患者,ORR为37.2%,mDOR为14.9个月,且安全性和耐受性良好。基于该研究结果,Zenocutuzumab已被递交上市申请用于NRG1+ NSCLC和PDAC患者治疗,2024年5月,FDA已受理并优先审评。

04

EGFRxHER3

BL-B01D1

BL-B01D1是一款由EGFRxHER3双特异性抗体组成的首创ADC,在首次人体试验(BL-B01D1-101)中更新的BL-B01D1在实体瘤中的安全性和耐受性结果中,总人群cORR39.2%,EGFRm人群cORR为52.5%,PFS 均为5.6个月,表明了BL-B01D1在总人群和EGFRm人群均显示出良好的疗效,期待大样本数据发布。

Izalontamab(SI-B001)

一项多中心、开放标签II期研究(NCT05020457)评估了SI-B001联合化疗治疗局部晚期或转移性EGFR/ALK野生型非小细胞肺癌的安全性及有效性。结果显示,在 EGFR 突变耐药、免疫耐药的NSCLC患者中初步数据出色,已开展 III 期研究(NCT05943795)。

PART 3 免疫双抗在肺癌中的研究进展

2024 ASCO/WCLC/ESMO/ACLC 免疫双抗在肺癌领域的关键研究进展

01

PD-L1×VEGF

依沃西单抗

HARMONi-2(NCT05499390)是一项随机、双盲的Ⅲ期研究,旨在评估依沃西单抗单药对比帕博利珠单抗单药一线治疗PD-L1 表达阳性(PD-L1 TPS≥1%)的局部晚期或转移性NSCLC的疗效和安全性。研究结果显示,对比帕博利珠单抗,依沃西单抗单药一线治疗PD-L1+晚期NSCLC,显著延长PFS。这是首个证实相较于帕博利珠单抗显著改善晚期NSCLC疗效的III期研究,成为PD-L1>1%晚期NSCLC患者一线治疗的最佳选择。

HARMONi-A研究证实了依沃西单抗联合化疗能够显著延长EGFR-TKI经治NSCLC患者的PFS,同时初步显示出OS的获益趋势,且安全性可靠。

对于可切除NSCLC患者,AK112-205研究证实了依沃西单抗无论是作为单药还是与化疗联合使用,在可切除NSCLC的围手术期治疗中均是安全且有效的。

PM8002

一项Ⅱ期临床试验(NCT05756972)中,PM8002与化疗联用治疗EGFR突变的晚期非小细胞肺癌患者,不论PD-L1表达,均观察到抗肿瘤活性,且PD-L1表达水平与缓解率正相关。此外,其安全性可控,停药发生率低。基于这些结果,将在 NSCLC 患者中进行进一步的临床试验。

02

PD-1×CTLA-4

卡度尼利单抗

2024年世界肺癌大会(WCLC)公布了的卡度尼利单抗联合化疗一线治疗PD-L1阴性晚期非小细胞肺癌的Ⅱ期临床研究(LungCadX)结果,显示出其极具潜力的治疗效应,特别是在鳞癌患者中疗效优越,整体安全性良好。

此外,一项前瞻性、单臂、研究者发起的II期研究(NCT05377658)正在进行中,旨在评估卡度尼利单抗联合化疗围术期治疗可切除的NSCLC的安全性及有效性。初步结果表明,该治疗方案不影响手术可行性,安全性可耐受,可达到较好pCR率和MPR率。研究正在入组中,需要更长时间的随访以评估EFS获益。

AK104-IIT-018研究(NCT05816499)评估了卡度尼利单抗联合安罗替尼和多西他赛二线治疗免疫耐药的晚期NSCLC患者的疗效及安全性。结果同样表现出积极的抗肿瘤信号,同时安全性可控可管。

Volrustomig(MEDI5752)

2024 WCLC上更新的探索MEDI5752一线治疗非鳞状(Nsq)NSCLC疗效及安全性的Ib/II期研究(NCT03530397)结果显示,Volrustomig 联合化疗一线治疗晚期NSCLC,在PD-L1表达低于1%的患者中表现出活性,安全性可控。

艾帕洛利托沃瑞利单抗(QL1706)

一项关键Ⅱ期研究(DUBHE-L-201研究)探索了QL1706联合治疗方案治疗EGFR-TKI耐药NSCLC的临床疗效及安全性。研究结果显示,联合疗法的mPFS达到8.5个月,提示该新型免疫联合治疗模式有望为EGFR-TKI患者带来临床获益,期待更多研究数据的公布。

03

PD-L1×TGF-β

SHR-1701

TRAILBLAZER研究(NCT04580498)证实了SHR-1701用于 III 期不可切除 NSCLC 新辅助治疗,诱导治疗后 ORR 达 58%,手术转化率 25%,安全性可耐受。

04

PD-1×TIGIT

Rilvegostomig(AZD2936)

首次人体ARTEMIDE-01研究探索了AZD2936 在既往经历过CPI治疗的晚期/转移性 NSCLC 患者中的安全性、PK、PD 及初步疗效。研究结果显示,在PD -L1高表达、晚期初治NSCLC中表现出抗肿瘤活性,且安全性可控,III 期研究正在开展。

05

DLL3×CD3

Tarlatamab(AMG757)

Tarlatamab(AMG757)是一个靶向DLL3、半衰期延长的双特异性T细胞衔接器(HLE BiTE®)。

DeLLphi-301是一项评估Tarlatamab单药治疗二线以上ES-SCLC患者的Ⅱ期临床试验,旨在评估Tarlatamab 10mg/100mg两个剂量的有效性和安全性。研究结果显示,10mg剂量水平中显示出良好的抗肿瘤活性,确定为后续研究剂量,ORR为40%、mDoR为9.7个月。2024年5月16日,基于DeLLphi-301的ORR和DoR,FDA加速批准Tarlatamab上市用于含铂化疗进展ES-SCLC的治疗。

DeLLphi-303研究结果显示,Tarlatamab联合PD-L1抑制剂在ES - SCLC一线免疫(PD-L1单抗)联合化疗后维持治疗观察到积极效果,为正在进行的Tarlatamab联合度伐利尤单抗一线维持治疗的III期研究 (DeLLphi-305) 提供支持。

06

免疫双抗在肺癌的III期临床研究概览

PART 4 思考与展望

1.免疫双抗治疗实体瘤的三大障碍(以CD3×TAA为例)

2.双抗的优势和未来探索方向

总结

在肺癌治疗领域,双特异性抗体类药物的研发涵盖了靶向治疗、免疫治疗以及抗体偶联药物(ADC)治疗等方面,相关研究进展可以看出,双抗在不同治疗手段中均展现出了广阔的应用前景,期待未来随着研究探索不断深入,有更多的循证医学证据以支持双抗在肺癌领域的临床实践,突破当前肺癌治疗瓶颈。

(来源:《肿瘤瞭望》编辑部)

声 明

凡署名原创的文章版权属《肿瘤瞭望》所有,欢迎分享、转载。本文仅供医疗卫生专业人士了解最新医药资讯参考使用,不代表本平台观点。该等信息不能以任何方式取代专业的医疗指导,也不应被视为诊疗建议,如果该信息被用于资讯以外的目的,本站及作者不承担相关责任。

CSCO会议临床1期

2022-09-29

关注并星标CPHI制药在线文/忆9月24日,北京浦润奥生物科技有限责任公司递交的“伯瑞替尼肠溶胶囊”1类新药注册申请获CDE受理。9月14日,该药被CDE纳入优先审评,用于具有间质-上皮转化因子(MET)外显子14跳变的局部晚期或转移性非小细胞肺癌成人患者。伯瑞替尼(Bozitinib)是一款小分子选择性c-MET抑制剂,在多种临床前c-Met失调的人类胃癌、肝癌、胰腺癌和肺癌细胞移植动物模型(CDX)和人源肿瘤移植小鼠模型(PDX)中显示出强大的抑制肿瘤作用。目前,该药已在国内登记7项临床试验,适应症涉及NSCLC、神经胶质瘤等。2021年2月,伯瑞替尼被CDE纳入突破性治疗品种,用于治疗c-MET外显子14突变的NSCLC。2020年AACR会上已公布的该药治疗c-Met 异常晚期NSCLC的1期临床试验结果显示:在所有36例可评估疗效的患者中,伯瑞替尼的ORR为30.6%,DCR为94.4%。亚组分析中,在携带c-MET过表达、扩增或Ex14跳读变异的患者中,ORR分别为30.6%, 41.2%和66.7%;在携带c-MET过表达且伴随基因扩增的6例患者中的ORR为50%;在携带c-MET基因Ex14跳跃突变且伴随基因扩增的4例患者中,ORR达100%。伯瑞替尼最初由Crown Bioscience研发,后由其剥离出的公司CBT pharmaceuticals与浦润奥生物合作研发,其中浦润奥生物负责在中国的开发,CBT负责除中国外的其他地区的开发。2021年12月,鞍石生物完成对浦润奥生物100%股权收购,将伯瑞替尼纳入囊中。c-Met靶点介绍c-Met,即细胞间质上皮转换因子,也叫肝细胞生长因子受体(HGFR),是MET基因编码产生的具有自主磷酸化活性的跨膜受体,属于酪氨酸激酶受体超家族。当与配体——肝细胞生长因子(HGF)结合后,c-Met通过形成二聚体和近膜区域若干位点的磷酸化实现活化,激活下游的一系列信号通路,如PI3K-Akt、Ras-MAPK、STAT等,从而发挥促进细胞增殖、细胞生长、血管生成等效应。研究发现,c-Met通路异常激活可促进肿瘤细胞的增殖、侵袭和迁移,最终驱动恶性肿瘤的发生和发展。据报道,c-Met信号通路在多种类型的实体瘤,如肺癌 、胃癌 、肝癌 、 乳腺癌 、皮肤癌 、大肠癌等中均存在异常调节的现象,并且在结直肠癌肝转移,口腔鳞癌的形成、生长 、转移,乳腺癌、卵巢癌和胃癌的侵袭、转移,以及肝癌、肺癌和胰腺癌等发生发展中发挥重要的作用。c-MET通路异常激活主要包括MET14外显子跳跃突变、MET扩增和MET蛋白过表达3种类型,其中MET14外显子跳跃突变被认为是肺癌独立致癌驱动基因,在NSCLC患者中的发生率为1-3%,在肺肉瘤样癌患者中高达31.8% 。c-MET抑制剂研发现状据不完全统计,目前全球已经批准三款小分子c-MET抑制剂(即德国默克的Tepotinib(特泊替尼,商品名为Tepmetko)、诺华的capmatinib(卡马替尼,商品名为Tabrecta)、和黄医药的savolitinib(赛沃替尼,商品名为沃瑞沙/Orpathys))和一款c-MET靶向双抗(即强生的amivantamab(商品名为Rybrevant))。其中特泊替尼最早于2020年3月被日本厚生劳动省(MHLW)批准用于治疗携带MET14外显子跳跃突变的不可切除性、晚期或复发性NSCLC患者。卡马替尼于2020年5月被FDA批准用于治疗携带MET14外显子跳跃突变的转移性NSCLC成人患者,包括一线治疗(初治)患者和先前接受过治疗(经治)的患者。赛沃替尼于2021年6月被NMPA批准用于治疗含铂化疗后疾病进展或不耐受标准含铂化疗的、具有MET 14外显子跳跃突变的局部晚期或转移性NSCLC成人患者。Amivantamab是一款EGFR/c-Met靶向双特异性抗体,于2021年5月被FDA批准用于治疗在接受含铂化疗失败后病情进展、EGFR基因外显子20插入突变阳性的转移性NSCLC成人患者。此外,目前全球还有多款在研c-MET抑制剂,详见下表。在研c-MET抑制剂药物类型多样,涉及化药、单抗、双抗、三抗以及ADC,适应症主要为实体瘤。海和药业谷美替尼针对MET14外显子跳跃突变NSCLC的上市申请正在国内接受优先审查,据悉该药是一种新型、高效、高选择性口服MET抑制剂,其治疗MET14外显子跳跃突变的局部晚期或转移性NSCLC的ORR(客观缓解率)为60.9%,其中初治患者的ORR达66.7%,经治患者ORR达51.9%,而且该药对脑转移患者也有效。艾伯维开发的Telisotuzumab vedotin进展也较快,是全球首个进入3期临床的c-Met靶向 ADC,由抗c-Met人源化单抗ABT-700、连接子缬氨酸-瓜氨酸和细胞毒素单甲基澳瑞他汀E (MMAE)偶联而成,今年1月被FDA授予突破性疗法资格,用于治疗晚期/转移性EGFR野生型、c-Met过表达、疾病在铂类治疗期间或之后进展的非鳞状NSCLC患者。已公布的2期临床研究LUMINOSITY 结果显示:在EGFR WT非鳞状NSCLC患者中,c-Met表达高水平组ORR为53.8%,c-Met表达中等水平组ORR为25.0%。EMB-01和MCLA-129均是EGFR、c-Met靶向双抗。GB263T是一款针对EGFR和两个cMet不同表位的三特异性抗体,可同时抑制原发性及继发性EGFR突变和cMet信号通路,下调EGFR与cMet蛋白表达水平,并有效诱导EGFR及cMet的内吞,目前处于1期临床。2021 AACR上公布的体外试验数据显示:GB263T强烈抑制携带EGFR exon20ins的细胞系生长,并具有显著的ADCC效应,可以杀死携带有c-Met表达或扩增的EGFR突变的癌细胞。结 语整体来看,目前c-MET靶点已进入收获期,虽然已获批药物主要是小分子化药,但以c-MET为靶点的双抗、ADC也有望很快出线。而且,我国药企也积极深耕c-MET领域。期待随着企业的努力,越来越多元化的c-MET靶向药可以早日获批上市,造福更多患者。-END-智药研习社近期课程报名(线下+线上同步)来源:贝壳社声明:本文仅代表作者观点,并不代表制药在线立场。本网站内容仅出于传递更多信息之目的。如需转载,请务必注明文章来源和作者。投稿邮箱:Kelly.Xiao@imsinoexpo.com▼更多制药资讯,请关注CPhI制药在线▼点击阅读原文,进入智药研习社~

免疫疗法抗体抗体药物偶联物小分子药物创新药

2022-05-27

·药智网

近日,一篇题为《第三代EGFR和ALK抑制剂:耐药机制和管理》的综述发表于《Nature》子刊Nature Reviews Clinical Oncology上,该文详细介绍了第三代EGFR和ALK抑制剂耐药性的产生机制,并阐述了克服耐药性的多种策略。 截图来源:Nature Reviews Clinical Oncology官网值得注意的是,EGFR是近年来发现的一个新抗癌靶点,其单靶点抑制剂的临床疗效在很大程度上受到耐药性的限制,耐药机制主要包括EGFR点突变、旁路或下游通路异常激活以及肿瘤异质性等,而EGFR双靶点抑制剂的发现为克服耐药提供了新的方法,很好的与EGFR单靶点抑制剂形成优势互补。为此,为降低EGFR单靶点抑制剂的耐药风险、提高疗效、降低剂量和减少不良反应等,EGFR双靶点抑制剂越来越受到青睐。如EGFR/MET、EGFR/其他ErbB家族成员双靶点抑制剂等陆续走到前台。下面且随笔者一起详细了解几种EGFR双靶点抑制剂以及研发概况。EGFR/MET 双靶点抑制剂全球仅1款上市从第一代到第三代EGFR抑制剂,MET一直是令人头疼的耐药突变类型。而有意思的是,EGFR和MET这两个驱动基因在靶向药耐药方面刚好互补,换言之,EGFR靶向药失效的原因之一是MET通路激活导致,而MET靶向药失效的部分原因就在于EGFR通路激活。因此,能够同时抑制EGFR与MET,成为了非常重要的研发方向,而EGFR/MET“双抗”的问世,则给患者带来了新的希望。据公开资料显示,目前全球仅一款EGFR/MET“双抗”上市,为强生制药公司旗下杨森制药研发的amivantamab(中文名:埃万妥单抗),用于治疗铂类化疗后进展的EGFR外显子20插入突变(EGFR20ins)的转移性非小细胞肺癌(NSCLC),也是全球首款获批治疗NSCLC的“双抗”。2021年上市至今,强生并未公布其销售业绩,不过在Nature Reviews Drug Discovery上发表的一篇文章预测了到2027年amivantamab的销售额,估计会达到4.25亿美元。截图来源:Nature Reviews Drug Discovery官网“双抗”全球销量预测(图片来源:参考资料[4])再从近期公布的amivantamab一些研究成果来看,其更多可能性纷纷彰显。如今年AACR大会上公布的Ⅰ期的PALOMA研究结果显示,amivantamab皮下注射剂型的使用,具有很好的疗效和安全性;2022 ELCC大会上发布的CHRYSALIS研究D队列的亚组数据结果显示,amivantamab对于肿瘤原发灶的控制,可能延缓肺癌脑转移的发生发展。据ClinicalTrials.gov显示,目前amivantamab在进行的临床研究共11项,其中3项处于III期,5项处于II期,3项处于I期。表1 目前amivantamab的临床研究数据来源:ClinicalTrials.gov此外,据药智数据不完全统计,目前已进入临床的EGFR/MET双靶点抑制剂有三款:EMB-01、MCLA-129、CKD-702。表2 进入临床的EGFR/MET 双靶点抑制剂数据来源:药智数据(不完全统计)EGFR/其他ErbB家族成员双靶点抑制剂3款上市+18款进入临床EGFR、HER2和HER3同属于ErbB蛋白激酶家族。HER2通过增强亲和力和敏感周期,从而减少质膜上EGFR的解离、内吞或降解,促进其与EGFR的相互作用。长期使用吉非替尼(EGFR-TK抑制剂)能下调EGFR的表达,而上调HER2的表达,这一过程中,由EGFR主导的二聚化将逐渐倾向于HER2/HER3异源二聚化,且不影响丝裂原活化蛋白激酶(MAPK)的激活。这一模式易受到抗HER2抗体帕妥珠单抗的影响,但HER3在这种模式中的状态不会改变。因此,同时靶向EGFR、HER2/HER3可能是克服单药耐药的有效疗法。据药智数据不完全统计,目前已批准上市的EGFR/其他ErbB家族成员双靶点抑制剂均为EGFR/HER2(ERBB2)双靶点抑制剂,共有3款:尼妥珠单抗(nimotuzumab)、甲苯磺酸拉帕替尼(Lapatinib Ditosylate)、莫博赛替尼(mobocertinib)。已进入临床的EGFR/其他ErbB家族成员双靶点抑制剂包括18款,其中EGFR/ERBB2“双抗”15款,EGFR/ERBB3“双抗”3款。表3 进入临床的EGFR/其他ErbB家族成员双靶点抑制剂数据来源:药智数据(不完全统计)值得提及的是, 5月12日恒瑞医药官微发文表示,甲磺酸阿帕替尼片联合卡瑞利珠单抗的国际多中心III期临床研究达到主要研究终点,研究结果表明,作为一线治疗可以显著延长晚期肝细胞癌患者的无进展生存期和总生存期。结 语当然,除了靶点MET、ErbB家族,还有一些其他靶点也在参与EGFR这场“双抗”热潮,比如处于临床前的EGFR/4-1BB“双抗”HLX35、EGFR/CD3“双抗”GBR-1372等。EGFR一直是铁打的明星靶点,但是破解耐药难题道阻且长,而开发EGFR双靶点抑制剂有望提高癌症疗效,克服耐药。相信新药物新策略的不断涌现,定会改变肿瘤治疗的未来。注:全文数据皆为手动搜索,如有疏漏,欢迎留言指正~参考资料:[1] Cooper et al., (2022), Third-generation EGFR and ALK inhibitors: mechanisms of resistance and management. Nat Rev Clin Oncol, https://doi-org.libproxy1.nus.edu.sg/10.1038/s41571-022-00639-9[2] Köhler J, Jänne PA. Amivantamab: Treating EGFR Exon 20-Mutant Cancers With Bispecific Antibody-Mediated Receptor Degradation. J Clin Oncol. 2021 Oct 20;39(30):3403-3406. doi: 10.1200/JCO.21.01494. Epub 2021 Aug 2. PMID: 34339261.[3] Lun Tan, Jifa Zhang, Yuxi Wang, et al. Development of DualInhibitors Targeting Epidermal Growth Factor Receptor in Cancer Therapy. J. Med. Chem. 2022, 65, 7, 5149-5183.[4] Arman Esfandiari, Sorcha Cassidy & Rachel M. Webster. Bispecific antibodies in oncology. Nature Reviews Drug Discovery 2022[5] 【2022ELCC&AACR】破茧成蝶 向新而生| 赵军教授:EGFR exon 20ins NSCLC靶向治疗新突破https://mp.weixin.qq.com/s/1rYUCS82XuXpC3PShWUdBg[6]国际化再进一步!恒瑞医药“双艾”方案国际多中心III期临床研究达到主要研究终点https://mp.weixin.qq.com/s/Iy6gJ-U-Rii5wQpFhl0TCw[7]药智数据声明:本文观点仅代表作者本人,不代表药智网立场,欢迎在留言区交流补充;如需转载,请务必注明文章作者和来源。责任编辑 | 七 斤排版设计 | 惜 姌媒体合作 | 17316793441(微信号:18323856316)投稿爆料 | 18883189653(同微信)转载授权 | 18523380183(同微信)发现“分享”和“赞”了吗,戳我看看吧

免疫疗法抗体AACR会议

100 项与 美替拉酮/奥沙西泮 相关的药物交易

登录后查看更多信息

研发状态

10 条进展最快的记录, 后查看更多信息

登录

| 适应症 | 最高研发状态 | 国家/地区 | 公司 | 日期 |

|---|---|---|---|---|

| 尼古丁成瘾 | 临床3期 | 美国 | 2021-05-19 | |

| 尼古丁成瘾 | 临床3期 | 美国 | 2021-05-19 | |

| 烟草依赖 | 临床3期 | 美国 | 2021-05-19 | |

| 烟草依赖 | 临床3期 | 美国 | 2021-05-19 | |

| 可卡因相关疾病 | 临床2期 | 美国 | 2020-07-29 |

登录后查看更多信息

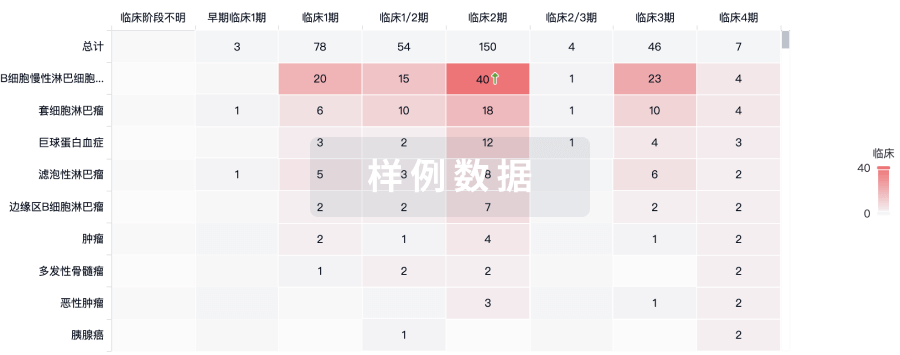

临床结果

临床结果

适应症

分期

评价

查看全部结果

| 研究 | 分期 | 人群特征 | 评价人数 | 分组 | 结果 | 评价 | 发布日期 |

|---|

No Data | |||||||

登录后查看更多信息

转化医学

使用我们的转化医学数据加速您的研究。

登录

或

药物交易

使用我们的药物交易数据加速您的研究。

登录

或

核心专利

使用我们的核心专利数据促进您的研究。

登录

或

临床分析

紧跟全球注册中心的最新临床试验。

登录

或

批准

利用最新的监管批准信息加速您的研究。

登录

或

特殊审评

只需点击几下即可了解关键药物信息。

登录

或

Eureka LS:

全新生物医药AI Agent 覆盖科研全链路,让突破性发现快人一步

立即开始免费试用!

智慧芽新药情报库是智慧芽专为生命科学人士构建的基于AI的创新药情报平台,助您全方位提升您的研发与决策效率。

立即开始数据试用!

智慧芽新药库数据也通过智慧芽数据服务平台,以API或者数据包形式对外开放,助您更加充分利用智慧芽新药情报信息。

生物序列数据库

生物药研发创新

免费使用

化学结构数据库

小分子化药研发创新

免费使用